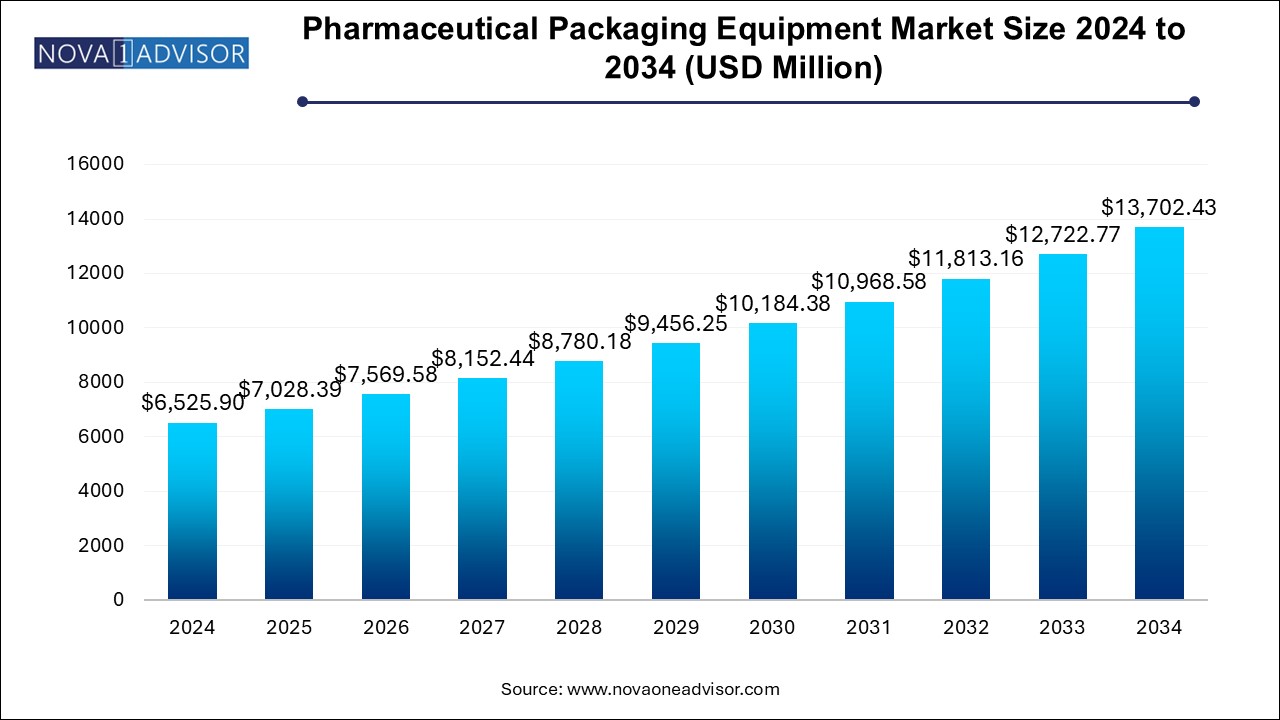

The pharmaceutical packaging equipment market size was exhibited at USD 6525.9 million in 2024 and is projected to hit around USD 13702.43 million by 2034, growing at a CAGR of 7.7% during the forecast period 2025 to 2034.

Filling machine type led the market and accounted for 36.0% of the global revenue in 2024.

The pharmaceutical packaging equipment market in North America accounted for a market share of 23.0% in 2024.

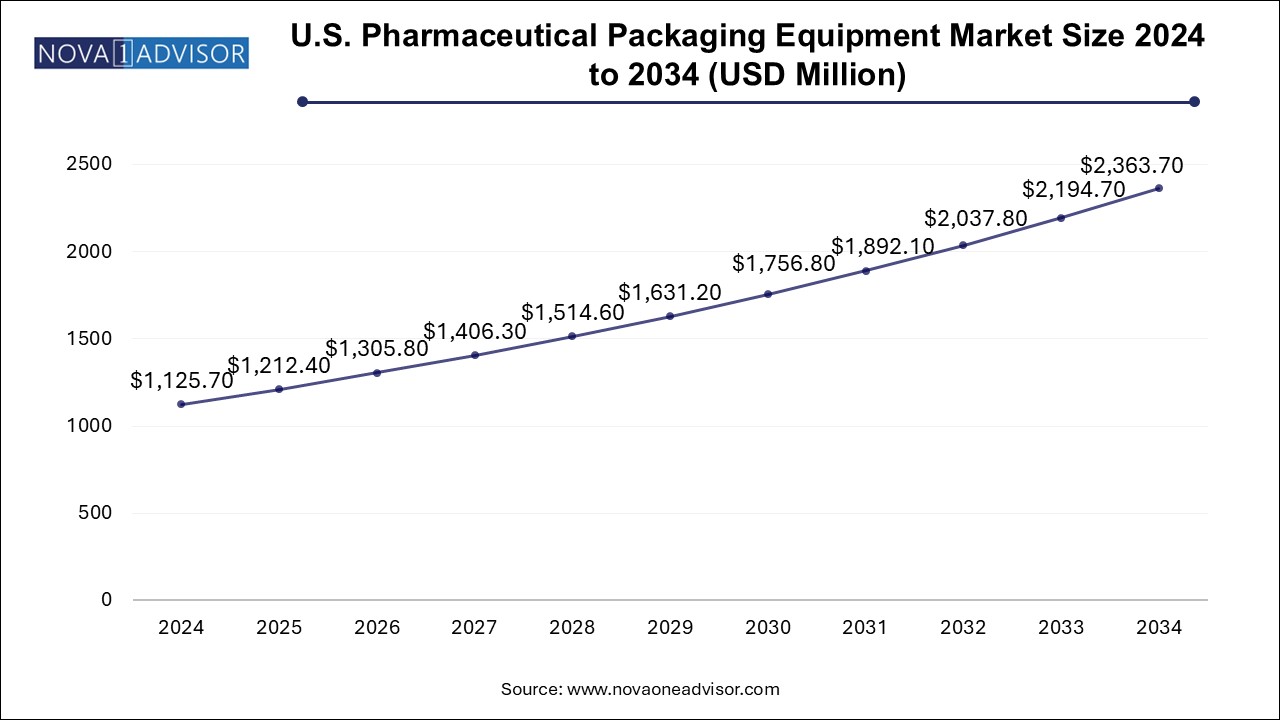

The U.S. pharmaceutical packaging equipment market size is evaluated at USD 1125.7 billion in 2024 and is projected to be worth around USD 2363.7 billion by 2034, growing at a CAGR of 6.97% from 2025 to 2034.

The pharmaceutical packaging equipment market in North America accounted for a market share of 23.0% in 2024. The North America pharmaceutical packaging equipment market is significantly driven by the increasing demand for advanced packaging equipment that ensure drug safety and efficacy. As the pharmaceutical sector continues to evolve, there's a growing need for packaging methods that comply with stringent regulatory requirements. Innovations such as smart packaging, which includes temperature control and tamper-evident features, are becoming essential in preserving product integrity and enhancing patient safety.

U.S. Pharmaceutical Packaging Equipment Market Trends

The pharmaceutical packaging equipment market in the U.S. held a significant share in 2024. The U.S. pharmaceutical packaging equipment market is experiencing robust growth, fueled by the increasing demand for efficient and automated packaging solutions to meet stringent regulatory standards. Innovations in technology, such as serialization and smart packaging, are driving advancements in equipment capabilities, enhancing safety and traceability. Additionally, the rising prevalence of chronic diseases and the corresponding need for pharmaceutical products are contributing to the expansion of packaging operations.

The pharmaceutical packaging equipment market in the Canada is expected to grow at a CAGR of 4.8% over the forecast period. This continuous rise in health expenditures directly correlates with the growing demand for pharmaceutical products and, subsequently, for pharmaceutical packaging equipment in Canada. As the healthcare system expands, the need for efficient, compliant, and innovative packaging solutions becomes increasingly critical.

The pharmaceutical packaging equipment market in the Mexico is expected to grow at a CAGR of 6.6% over the forecast period. According to the International Trade Administration, pharmaceutical sales in Mexico from 2020 to 2024 indicates some fluctuations over the years. In 2020, sales reached USD 11.10 billion, which slightly decreased to USD 11.00 billion in 2021. This decline might reflect challenges faced during the pandemic, including supply chain disruptions. However, in 2022, sales dropped significantly to USD 10.12 billion, suggesting a notable setback for the sector. Moreover, the market rebounded in 2024, with sales rising to USD 10.83 billion, indicating a recovery trend and renewed demand for pharmaceutical products, thereby driving the demand for market.

Europe Pharmaceutical Packaging Equipment Market Trends

The European pharmaceutical packaging equipment market is experiencing robust growth driven by several key factors, including stringent regulatory requirements and a rising emphasis on patient safety. The implementation of regulations such as the Current Good Manufacturing Practice (CGMP) and EU Falsified Medicines Directive (FMD) has mandated enhanced packaging solutions, including serialization and tamper-evident features. This regulatory model not only ensures the integrity of pharmaceuticals but also fosters innovation among manufacturers who are investing in advanced packaging technologies.

Germany pharmaceutical packaging equipment market held 11.9% share in the European market. In 2024, pharmaceutical sales in Germany rose by 5.7%, reaching USD 64.58 billion. As Germany continues to be a leading exporter and producer of medicinal products and biopharmaceuticals, manufacturers require advanced packaging solutions to ensure compliance with stringent EU regulations and maintain product integrity. The emphasis on personalized medicine further necessitates specialized packaging that can accommodate diverse formulations and smaller batch sizes.

UK pharmaceutical packaging equipment market held 8.8% share in the European market. According to the Association of the British Pharmaceutical Industry, the UK is regarded as a life sciences powerhouse that is driven by the solid scientific foundation, a growing attitude towards foreign pharmaceutical investments, a skilled manufacturing workforce, and a strong emphasis on safeguarding innovation through intellectual property rights. The UK's regulatory bodies are also considered among the most experienced and sophisticated worldwide.

Asia Pacific Pharmaceutical Packaging Equipment Market Trends

The Asia Pacific region dominated the market and accounted for 40.2% share in 2024. The region has seen a significant rise in pharmaceutical production, fueled by population growth, increasing healthcare demands, and higher investments in the pharmaceutical industry. Countries such as Japan, Australia, and Singapore have traditionally aligned well with global industry standards, while others are progressing in that direction. As a result, there is a growing need for advanced and efficient packaging equipment to accommodate the rising production levels.

China pharmaceutical packaging equipment market held 11.9% share in the Asia Pacific market. The demand for pharmaceutical packaging equipment in China is driven by several key factors such as the rapid growth of the pharmaceutical industry. This is fueled by increasing investment in healthcare and a rising prevalence of chronic diseases, which has created a need for efficient packaging solutions.

India pharmaceutical packaging equipment market held 8.8% share in the Asia Pacific market. The demand for pharmaceutical packaging equipment in India is driven by several specific factors related to the country's unique landscape. The expansion of the pharmaceutical sector, supported by government initiatives like the Pharma Vision 2020, aims to make India a global manufacturing hub and a leader in end-to-end drug innovation and discovery. This growth necessitates advanced packaging solutions to ensure product integrity and compliance with international standards.

Central & South Pharmaceutical Packaging Equipment Market Trends

The pharmaceutical packaging equipment market in Central & South America is experiencing significant growth, fueled by increasing healthcare investments and a rising demand for pharmaceuticals across the region. The pharmaceutical market in Central & South America is driven by factors such as a growing middle class, improved access to healthcare, and heightened awareness of health issues.

Brazil is one of the dominant markets for pharmaceutical packaging in Central & South America owing to the presence of big pharmaceutical manufacturing companies and a large population base. Leading pharmaceutical manufacturers operating in the country include Ache, EMS Pharma, Eurofarma, NEO Quimica, Mantecorp Farmasa, and others. Presence of such prominent pharmaceutical manufacturing companies makes Brazil an attractive market for manufacturers of pharmaceutical packaging equipment.

Middle East & Africa Pharmaceutical Packaging Equipment Market Trends

The Middle East & Africa pharmaceutical packaging equipment market is witnessing significant growth, driven by increasing healthcare investments and a rising demand for pharmaceutical products. This growth is bolstered by governments in the region prioritizing healthcare infrastructure development, such as the Saudi Vision 2030 initiative, which aims to enhance healthcare services and boost local pharmaceutical manufacturing capabilities.

This robust push for local production and innovation is significantly driving demand for pharmaceutical packaging equipment in Saudi Arabia. As the country enhances its manufacturing capabilities and expands its range of pharmaceutical products, there will be a heightened need for advanced packaging solutions that ensure compliance with regulatory standards and maintain product integrity.

| Report Coverage | Details |

| Market Size in 2025 | USD 7028.39 Million |

| Market Size by 2034 | USD 13702.43 Million |

| Growth Rate From 2025 to 2034 | CAGR of 7.7% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Machine, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Robert Bosch; Romaco Holding; Marchesini Group; Korber AG; I.M.A. Industria Macchine Automatiche S.p.A.; Uhlmann Group; Accutek Packaging Equipment Companies; Bausch + Ströbel; Coesia; Vanguard Pharmaceuticals Equipment; MULTIVAC Group; OPTIMA Packaging Group; ACG Worldwide; BREVETTI CEA S.P.A |

Filling machine type led the market and accounted for 36.0% of the global revenue in 2024. Filling machines in the pharmaceutical industry play a pivotal role in ensuring the precise and sterile dispensing of pharmaceutical products into various containers such as vials, bottles, and syringes. Moreover, advanced filling machines employ state-of-the-art technologies, including peristaltic pumps or volumetric fillers, to handle a diverse range of liquid or powder medications. Additionally, these machines often feature automated controls and monitoring systems to enhance efficiency, reduce human error, and ensure compliance with pharmaceutical quality standards. The flexibility of modern filling machines allows pharmaceutical companies to accommodate various container sizes and formulations, contributing to streamlined production processes and the delivery of high-quality, precisely dosed medications to meet the dynamic demands of the pharmaceutical industry.

Wrapping machines are integral to the pharmaceutical industry, serving the crucial function of securely packaging pharmaceutical products for protection and preservation. These machines are designed to handle a variety of packaging materials, including blister packs, strip packs, and sachets. Employing advanced technology, pharmaceutical wrapping machines ensure the aseptic and tamper-evident sealing of medicines, maintaining their integrity and compliance with regulatory standards. With capabilities for high-speed and precision, these machines contribute to the efficient packaging of pharmaceuticals in standardized formats, enabling convenient distribution and use.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pharmaceutical packaging equipment market

By Machine

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Pharmaceutical Packaging Equipment Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.2. Concentration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Raw Material/Component Outlook

3.3.2. Manufacture Outlook

3.3.3. Distribution Outlook

3.4. Technology Overview

3.5. Regulatory Framework

3.6. Market Dynamics

3.6.1. Market Drivers Analysis

3.6.2. Market Restraints Analysis

3.6.3. Market Opportunity Analysis

3.6.4. Market Challenge Analysis

3.7. Pharmaceutical Packaging Equipment Market Analysis Tools

3.7.1. Porter’s Analysis

3.7.1.1. Bargaining power of the suppliers

3.7.1.2. Bargaining power of the buyers

3.7.1.3. Threats of substitution

3.7.1.4. Threats from new entrants

3.7.1.5. Competitive rivalry

3.7.2. PESTEL Analysis

3.7.2.1. Political landscape

3.7.2.2. Economic and Social landscape

3.7.2.3. Technological landscape

3.7.2.4. Environmental landscape

3.7.2.5. Legal landscape

3.8. Economic Mega Trend Analysis

Chapter 4. Pharmaceutical Packaging Equipment Market: Machine Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Pharmaceutical Packaging Equipment Market: Machine Movement Analysis, USD Million, 2024 & 2034

4.3. Filling

4.3.1. Filling Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.4. Labelling

4.4.1. Labelling Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.5. Form Fill & Seal

4.5.1. Form Fill & Seal Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.6. Cartoning

4.6.1. Cartoning Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.7. Wrapping

4.7.1. Wrapping Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.8. Palletizing

4.8.1. Palletizing Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.9. Cleaning

4.9.1. Cleaning Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.10. Others

4.10.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. Pharmaceutical Packaging Equipment Market: Region Estimates & Trend Analysis

5.1. Pharmaceutical Packaging Equipment Market Share, By Region, 2024 & 2034, USD Million

5.2. North America

5.2.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.2.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.2.3. U.S.

5.2.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.2.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.2.4. Canada

5.2.4.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.2.4.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.2.5. Mexico

5.2.5.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.2.5.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.3. Europe

5.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.3.3. Germany

5.3.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.3.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.3.4. UK

5.3.4.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.3.4.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.3.5. Russia

5.3.5.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.3.5.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.3.6. Spain

5.3.6.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.3.6.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.3.7. Italy

5.3.7.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.3.7.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.4. Asia Pacific

5.4.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.4.3. China

5.4.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.4.4. India

5.4.4.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4.4.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.4.5. Japan

5.4.5.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4.5.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.4.6. South Korea

5.4.6.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4.6.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.4.7. Australia

5.4.7.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4.7.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.5. Central & South America

5.5.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.5.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.5.3. Brazil

5.5.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.5.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.6. Middle East & Africa

5.6.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.6.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.6.3. Saudi Arabia

5.6.3.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.6.3.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

5.6.4. UAE

5.6.4.1. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, 2021 - 2034 (USD Million)

5.6.4.2. Pharmaceutical Packaging Equipment Market Estimates and Forecasts, By Machine, 2021 - 2034 (USD Million)

Chapter 6. Competitive Landscape

6.1. Recent Developments & Impact Analysis by Key Market Participants

6.2. Company Categorization

6.3. Company Market Positioning

6.4. Company Market Share Analysis

6.5. Company Heat Map Analysis

6.6. Strategy Mapping

6.7. Company Profiles

6.7.1. Robert Bosch

6.7.1.1. Participant’s Overview

6.7.1.2. Financial Performance

6.7.1.3. Product Benchmarking

6.7.1.4. Recent Developments

6.7.2. Romaco Holding

6.7.2.1. Participant’s Overview

6.7.2.2. Financial Performance

6.7.2.3. Product Benchmarking

6.7.2.4. Recent Developments

6.7.3. Marchesini Group

6.7.3.1. Participant’s Overview

6.7.3.2. Financial Performance

6.7.3.3. Product Benchmarking

6.7.3.4. Recent Developments

6.7.4. Korber AG

6.7.4.1. Participant’s Overview

6.7.4.2. Financial Performance

6.7.4.3. Product Benchmarking

6.7.4.4. Recent Developments

6.7.5. I.M.A. Industria Macchine Automatiche S.p.A.

6.7.5.1. Participant’s Overview

6.7.5.2. Financial Performance

6.7.5.3. Product Benchmarking

6.7.5.4. Recent Developments

6.7.6. Uhlmann Group

6.7.6.1. Participant’s Overview

6.7.6.2. Financial Performance

6.7.6.3. Product Benchmarking

6.7.6.4. Recent Developments

6.7.7. Accutek Packaging Equipment Companies

6.7.7.1. Participant’s Overview

6.7.7.2. Financial Performance

6.7.7.3. Product Benchmarking

6.7.7.4. Recent Developments

6.7.8. Bausch + Ströbel

6.7.8.1. Participant’s Overview

6.7.8.2. Financial Performance

6.7.8.3. Product Benchmarking

6.7.8.4. Recent Developments

6.7.9. Coesia

6.7.9.1. Participant’s Overview

6.7.9.2. Financial Performance

6.7.9.3. Product Benchmarking

6.7.9.4. Recent Developments

6.7.10. Vanguard Pharmaceuticals Equipment

6.7.10.1. Participant’s Overview

6.7.10.2. Financial Performance

6.7.10.3. Product Benchmarking

6.7.10.4. Recent Developments

6.7.11. MULTIVAC Group

6.7.11.1. Participant’s Overview

6.7.11.2. Financial Performance

6.7.11.3. Product Benchmarking

6.7.11.4. Recent Developments

6.7.12. OPTIMA Packaging Group

6.7.12.1. Participant’s Overview

6.7.12.2. Financial Performance

6.7.12.3. Product Benchmarking

6.7.12.4. Recent Developments

6.7.13. ACG Worldwide

6.7.13.1. Participant’s Overview

6.7.13.2. Financial Performance

6.7.13.3. Product Benchmarking

6.7.13.4. Recent Developments

6.7.14. BREVETTI CEA S.P.A

6.7.14.1. Participant’s Overview

6.7.14.2. Financial Performance

6.7.14.3. Product Benchmarking

6.7.14.4. Recent Developments