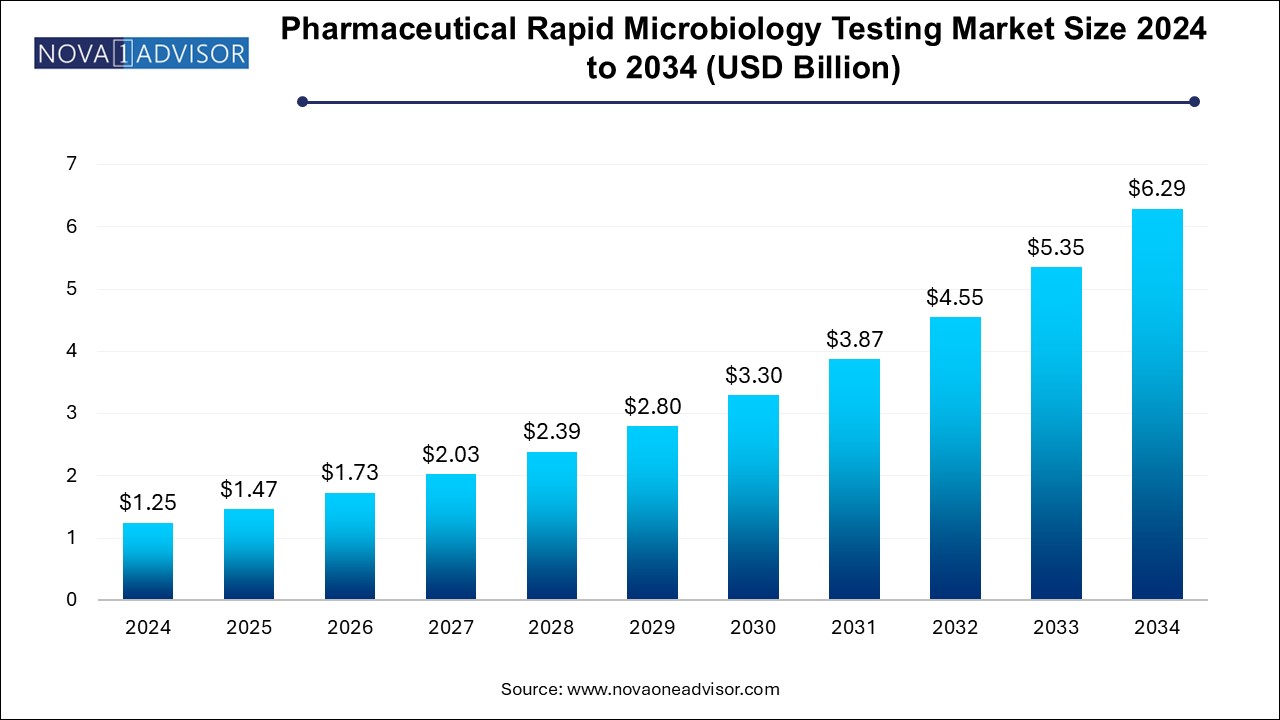

The pharmaceutical rapid microbiology testing market size was exhibited at USD 1.25 billion in 2024 and is projected to hit around USD 6.29 billion by 2034, growing at a CAGR of 17.54% during the forecast period 2025 to 2034.

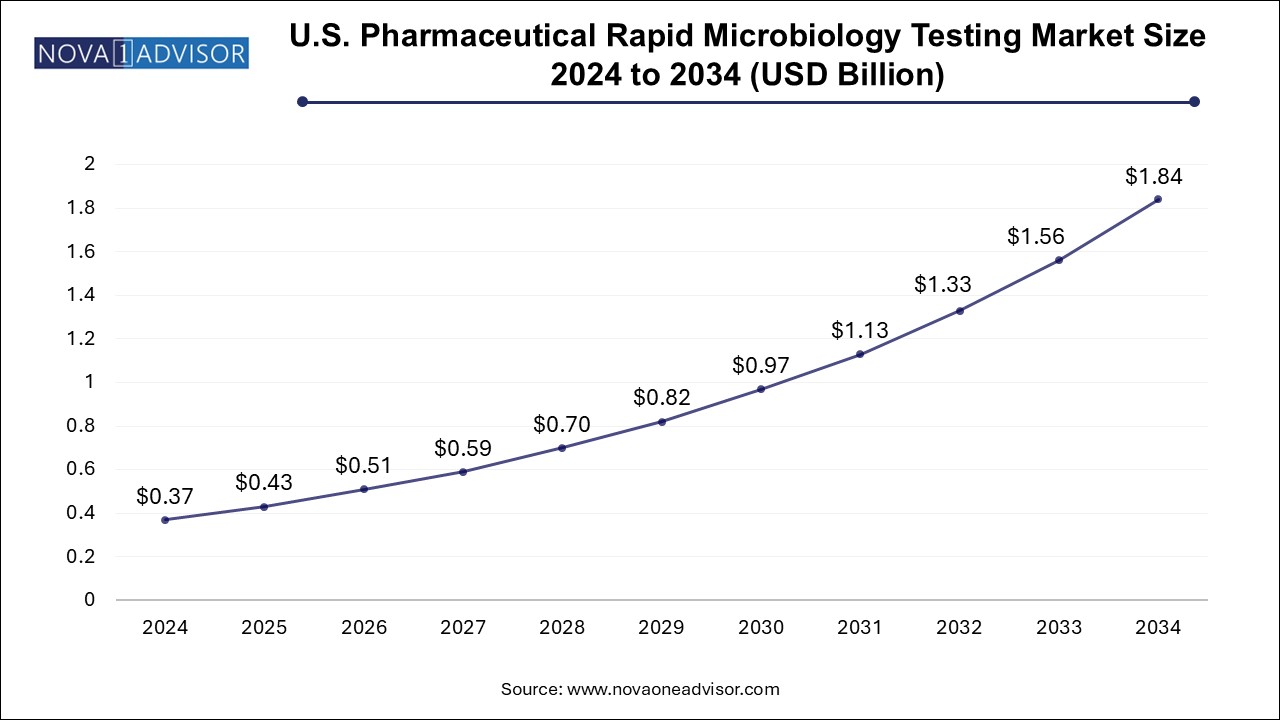

The U.S. pharmaceutical rapid microbiology testing market size is evaluated at USD 0.37 billion in 2024 and is projected to be worth around USD 1.84 billion by 2034, growing at a CAGR of 15.69% from 2025 to 2034.

North America leads the global pharmaceutical rapid microbiology testing market, primarily due to its mature pharmaceutical industry, regulatory openness to innovation, and high R&D investments. The U.S. FDA has been proactive in promoting rapid testing under its PAT initiative and continues to collaborate with industry players to validate and standardize new technologies. This has created a fertile environment for RMT adoption across both large pharmaceutical companies and emerging biotech firms.

The pharmaceutical rapid microbiology testing (RMT) market has become a crucial pillar in ensuring the microbiological safety, quality, and compliance of pharmaceutical products. As pharmaceutical manufacturing becomes increasingly complex, the demand for accurate, high-throughput, and real-time microbial detection has surged. Traditional microbiological techniques, though reliable, often require extended incubation periods and are prone to manual errors and subjective interpretation. In contrast, rapid microbiology methods offer a faster, more efficient alternative, helping pharmaceutical manufacturers meet stringent regulatory standards while maintaining operational agility.

Rapid microbiology testing encompasses a suite of modern technologies designed to detect, identify, and quantify microbial contamination in raw materials, in-process samples, and finished pharmaceutical products. These techniques are extensively used in sterile and non-sterile drug production, quality control, and environmental monitoring. With increasing pressure to shorten production cycles, accelerate product release, and enhance contamination control, the adoption of RMT methods has become a strategic imperative for pharmaceutical companies.

Technologies such as nucleic acid-based testing (e.g., PCR, qPCR), viability-based assays (e.g., flow cytometry), and cellular component-based techniques (e.g., endotoxin testing) are transforming microbial detection into a science of precision and speed. These tools not only reduce detection time from days to hours but also enable real-time decision-making—critical in environments where microbial excursions can halt entire production lines.

Regulatory agencies like the U.S. FDA, EMA, and WHO have been increasingly supportive of rapid methods, issuing guidance documents and fostering an environment that encourages innovation while upholding compliance. This alignment between regulation and technology is fueling robust market growth across all global regions.

Increased adoption of nucleic acid-based technologies such as real-time PCR for rapid pathogen detection.

Integration of automation and robotics to enhance consistency, speed, and throughput in microbiological workflows.

Rise in outsourcing of microbiological testing to contract research and manufacturing organizations (CROs and CMOs).

Growing demand for real-time environmental monitoring (RTEM) in sterile pharmaceutical manufacturing facilities.

Development of miniaturized, portable testing platforms for point-of-need microbial analysis in production lines.

Emergence of AI and machine learning for predictive microbial risk assessment and quality assurance analytics.

Shifting focus from growth-based to viability-based techniques, especially in biologics and personalized medicine manufacturing.

Regulatory harmonization and global pharmacopeia updates encouraging adoption of rapid methods as part of GMP validation.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.47 Billion |

| Market Size by 2034 | USD 6.29 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 17.54% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Technique, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; Merck KGaA; BD; bioMérieux; Danaher; Sartorius AG; Abbott; QuidelOrtho Corporation; Charles River Laboratories; Rapid Micro Biosystems, Inc. |

A critical driver propelling the pharmaceutical rapid microbiology testing market is the pressing need for faster, reliable, and regulatory-compliant quality control processes in pharmaceutical production. As drug development timelines shrink and the demand for sterile injectable, biologics, and complex therapeutics grows, the tolerance for delays in microbiological testing diminishes. Traditional microbial detection methods can take anywhere from 3 to 7 days for confirmation, which delays product release and adds to warehousing and operational costs.

Rapid microbiological methods provide results in a matter of hours, enabling pharmaceutical manufacturers to make real-time batch release decisions, minimize product hold times, and respond swiftly to contamination events. For instance, a leading biologics manufacturer using real-time PCR saw a 70% reduction in batch release time while maintaining full compliance with regulatory requirements.

Moreover, the introduction of the U.S. FDA’s Process Analytical Technology (PAT) initiative and continued support from EMA and MHRA have legitimized the use of rapid methods in GMP environments. This confluence of need, efficiency, and regulatory alignment is fostering widespread adoption and continued innovation in the RMT space.

Despite its benefits, the adoption of rapid microbiology testing is hampered by high upfront capital investment and integration complexity. Implementing RMT requires specialized equipment, extensive validation, and staff training, which can be cost-prohibitive for small- to mid-sized pharmaceutical companies or facilities operating on legacy systems.

For example, while automated PCR platforms or viability-based assays offer enhanced throughput and sensitivity, the cost of acquiring, installing, and validating these systems—often ranging in the hundreds of thousands of dollars—can act as a significant barrier. Furthermore, the transition from conventional to rapid methods demands compatibility with existing LIMS (Laboratory Information Management Systems) and SOPs, adding another layer of complexity to the integration process.

This challenge is particularly pronounced in emerging markets, where budget constraints and conservative regulatory environments slow down the pace of technology transition. Hence, while the long-term ROI of RMT is promising, the initial setup cost and operational disruptions remain key concerns.

A transformative opportunity for the RMT market lies in its integration into the rapidly expanding biologics and personalized medicine sectors. Biologic drugs, such as monoclonal antibodies, cell and gene therapies, and recombinant proteins, are inherently sensitive to microbial contamination due to their complexity and production environments. In such cases, traditional microbial detection methods are often too slow and incompatible with agile manufacturing models.

Rapid microbiology testing plays a pivotal role in ensuring real-time contamination monitoring and batch release, particularly in aseptic manufacturing conditions required for advanced therapies. For example, in CAR-T cell therapy production, sterility must be confirmed in real-time to ensure timely delivery to patients—something only possible through rapid detection methods like viability-based flow cytometry or PCR assays.

Moreover, as more pharmaceutical companies establish modular or decentralized production units for personalized medicine, the demand for compact, rapid, and integrated microbial detection solutions is expected to grow exponentially. This shift positions RMT as a foundational tool in the next era of pharmaceutical manufacturing.

The reagents & kits segment dominates the pharmaceutical rapid microbiology testing market, accounting for the largest share due to the recurring nature of their use across various assays. These include PCR reagents, nucleic acid extraction kits, fluorescence markers, viability dyes, and microbial growth indicators. Given the high volume of daily tests conducted in pharmaceutical QC labs, consumables drive a continuous revenue stream and are central to the testing workflow.

Reagent kits are often tailored for specific applications, such as sterility testing in injectable drugs or bioburden analysis in raw materials. Their versatility and application-specific design make them essential for high-throughput testing. Furthermore, regulatory-certified kits from established players help streamline validation processes in GMP environments, adding to their widespread adoption.

While instruments represent the fastest-growing segment, they benefit from increasing demand for automated, high-precision systems that reduce human error and accelerate detection timelines. Advanced platforms incorporating real-time PCR, spectrophotometry, or impedance-based measurements are being installed in new manufacturing facilities and QC labs. As pharmaceutical firms modernize their operations, capital investment in instruments is expected to grow, especially in North America and Europe.

Nucleic acid-based testing dominates the market due to its high specificity, sensitivity, and compatibility with a wide range of microorganisms. Techniques such as qPCR, multiplex PCR, and isothermal amplification allow rapid identification of bacterial and fungal DNA, often in less than four hours. These methods are extensively used in both raw material testing and sterility assessments. Major companies have developed validated kits that comply with pharmacopeial standards, making adoption easier for regulated manufacturers.

In contrast, viability-based testing is the fastest-growing segment, driven by its ability to distinguish between live and dead cells—an essential distinction in biopharmaceuticals and vaccine production. Techniques like flow cytometry, ATP bioluminescence, and membrane integrity assays offer real-time viability insights and are especially suited for cleanroom monitoring, WFI (Water for Injection) testing, and cell culture processes. The appeal of obtaining actionable results in minutes rather than days is accelerating the adoption of viability-based platforms across sterile manufacturing lines.

Sterility testing is the dominant application in the RMT market, driven by its critical role in ensuring the microbiological safety of parenteral products, ophthalmics, and other sterile pharmaceuticals. Regulatory guidelines across regions require mandatory sterility testing before product release, and rapid alternatives to 14-day conventional tests are now widely accepted under GMP frameworks. Technologies like closed system real-time PCR and direct inoculation systems are gaining popularity due to their reduced risk of contamination and faster turnaround.

Meanwhile, bioburden assessment is emerging as the fastest-growing application, particularly in upstream and downstream processes of biologics manufacturing. Rapid bioburden methods help in monitoring raw materials, intermediate stages, and final products, offering critical insights into contamination control. Real-time bioburden detection reduces production delays, supports continuous manufacturing, and minimizes batch failure risks—making it invaluable in high-value biologics and vaccine production.

March 2025 – Charles River Laboratories announced the launch of AccuPRO™, a new rapid sterility testing system utilizing real-time PCR, aimed at improving batch release efficiency.

January 2025 – Merck KGaA expanded its Milli-Q Lab Water business to include a suite of bioburden and endotoxin detection kits designed for use in continuous manufacturing environments.

November 2024 – Rapid Micro Biosystems introduced its latest version of Growth Direct® system with enhanced AI-driven analytics and 21 CFR Part 11 compliance updates.

October 2024 – bioMérieux launched VITEK® MS PRIME, a next-gen MALDI-TOF system for microbial identification, now integrated with their rapid microbial monitoring software.

August 2024 – Thermo Fisher Scientific entered a partnership with Indian CMOs to deploy rapid endotoxin testing solutions across multiple sterile manufacturing sites.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pharmaceutical rapid microbiology testing market

By Product

By Technique

By Application

By Regional