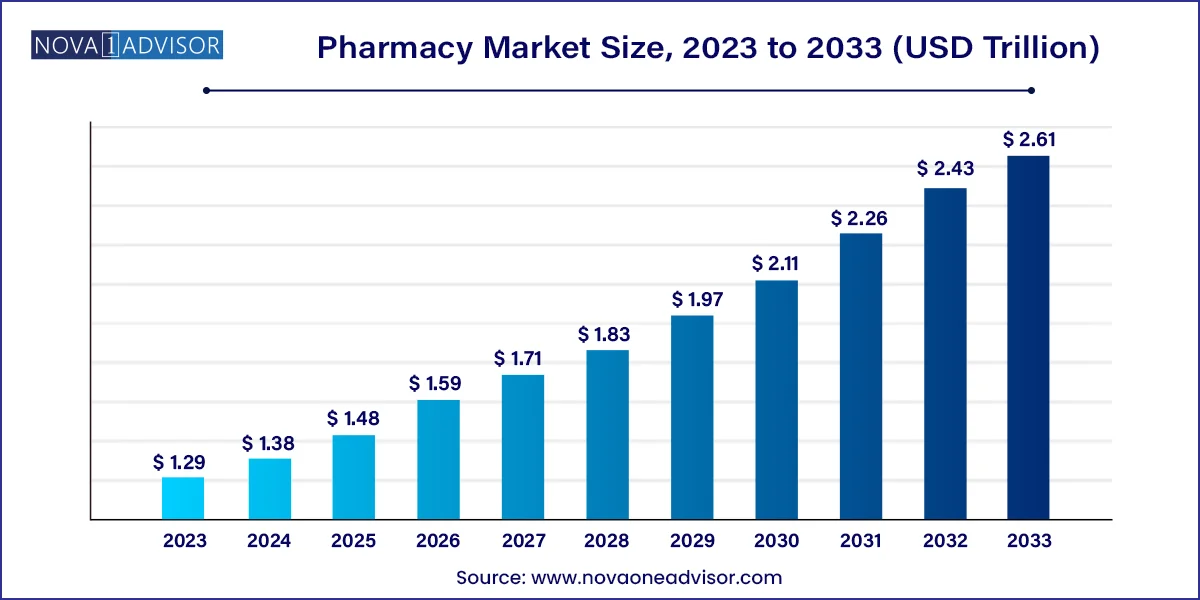

The global Pharmacy market size was valued at USD 1.29 trillion in 2023 and is anticipated to reach around USD 2.61 trillion by 2033, growing at a CAGR of 7.29% from 2024 to 2033.

The growing demand for specialty drugs globally and increasing prescription drug expenditure in developed countries are expected to drive the growth of the market over the forecast period. In addition, the growing prevalence of chronic diseases, majorly due to changes in lifestyle and a rapidly aging population, are supplementing the market growth.

The growing demand for prescription medications is contributing to the industry's growth. As the demand for prescription drugs increases, pharmacies experience a surge in business due to the need for dispensing these medications. According to the National Health Service the current cost of an NHS prescription in England for 2024-2025 is USD 12.65 per item, an increase of USD 0.51 from the previous year. Prescription charges are usually reviewed annually. The cost has increased steadily in recent years, from USD 8.80 in 2015 - 2016 to USD 10.47 in 2024 - 2025.

Moreover, pharmacies are adopting digitalization programs to cater to the growing demand from consumers and provide improved accessibility to patients. For instance, CVS Health introduced a Digital Transformation program to personalize the healthcare experience using artificial intelligence, machine learning, data, and analytics. Moreover, in December 2021, the company entered into a partnership with Microsoft to scale up retail personalization and loyalty programs using advanced machine learning, powered by Azure. Such digitalization and automation strategies are anticipated to drive the growth in the industry during the forecast period.

| Report Attribute | Details |

| Market Size in 2024 | USD 1.38 trillion |

| Market Size by 2033 | USD 2.61 trillion |

| Growth Rate From 2024 to 2033 | CAGR of 7.29% |

| Base Year |

2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, type, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | CVS Health; Boots Walgreens; Cigna; Walmart; Kroger; Rite Aid Corp.; Lloyd Pharmacy; Well Pharmacy; Humana Pharmacy Solutions; Matsumoto Kiyoshi; Apollo Pharmacy; MedPlusMart.com. |

Based on product type, the prescription segment dominated the pharmacy market with the largest revenue share of 81.18% in 2023. The increasing demand for prescription drugs for therapies, such as diabetes, cardiovascular disease, respiratory diseases, antibiotics, blood disorders, and oncology, is driving the growth of the prescription segment. Furthermore, the rising prevalence of long-term health conditions and the expanding elderly demographic are fueling the need for prescription drugs.

According to the IDF Diabetes Atlas, 537 million adults were suffering from diabetes in 2021 globally. The number of adults suffering from diabetes is estimated to increase to 783 million by 2045. Almost 90% of older adults regularly take at least one prescription drug, with many taking multiple medications to manage chronic conditions. This growing need for prescription drugs, especially among the aging population, is expected to significantly drive the growth of the industry in the coming years.

However, the OTC segment is estimated to witness the fastest growth rate during the forecast period. The high growth is due to better cost savings compared to prescription drugs, consumer empowerment in managing minor ailments, a shift toward preventive healthcare, an expanding product range, consumer awareness & education, and the influence of online sales and e-commerce platforms. In addition, the increasing trend of self-medication and conversion of prescription medicines to OTC medications is expected to contribute to the growth of the segment over the forecast period. For instance, in March 2023, the U.S. FDA approved Narcan (4 mg), a naloxone hydrochloride nasal spray, for OTC use. It is the first-ever naloxone product approved to be used OTC.

The retail pharmacy segment held the highest revenue share of 55.13% in 2023. The increasing presence of chain pharmacies & independent pharmacies and the availability of medications in supermarkets & mass retailers in countries such as the UK & the U.S., is driving the growth of the segment. Large chains such as Boots, Walgreens, CVS Health, Lloyd, Shoppers Drug Mart, and Well Pharmacy have a significant presence in countries such as Canada, the U.S., Australia, the U.K., and Russia. This concentration of major retailers is promoting the growth of the segment.

ePharmacy is estimated to be the fastest-growing segment during the forecast period. In 2020, numerous Innovations such as telepharmacy, mobile apps for prescription ordering, medication reminders, and online consultations have improved efficiency and accessibility, enhanced the customer experience, and expected to drive the growth of the segment. ePharmacies experienced a rise in revenue growth due to the COVID-19 pandemic. For instance, during pandemic CVS Health has seen a significant increase in digital refills for specialty medications through its mobile apps. Online sales of Walgreen Boots Alliance U.K. increased by 15.2% in 2022. Moreover, increasing penetration of smartphones, the high adoption of digital technologies by the healthcare industry, and growing number of retailers introducing online channels are projected to contribute to the growth of the industry.

North America dominated the market with a share of 53.62% in 2023. Growth can be attributed to the presence of large-scale multinational chains, such as Boots Walgreens, CVS Health, UnitedHealth Group, Cigna, Kroger, Walmart, and Rite Aid Corp. These players are leveraging diverse strategies and advance technologies to expand their presence and dominance. For instance, in March 2022, Rite Aid Corp. launched its Wellness + loyalty program, providing substantial savings and incentives to its valued customers.

U.S. Pharmacy Market Trends

The U.S. held the largest market share in 2023. Innovations in delivery methods and digital health technologies are enabling access to new and improved OTC and prescription drugs, further driving the growth. Furthermore, increasing demand for specialty drugs has influenced growth in drug utilization management services, such are prior authorization, step therapy, and quantity limits.

Europe Pharmacy Market Trends

Europe held a significant share in 2023. This growth is attributed to the increasing number of people with chronic diseases turning to online pharmacies for convenience and accessibility to medications, especially in rural areas.

The UK pharmacy market held a substantial revenue share in 2023. The imbalance of supply and demand, demographic changes, consolidation in the market, and a backlog of medical treatments are driving the demand for pharmacies in the UK. According to the Hutchings Consultants, the number of new buyers seeking to buy their own pharmacy increased by around 56.9% from March 2019/2020 to March 2020/2021.

The Germany pharmacy market held the largest share in Europe, in 2023. An aging population, increased demand for prescription drugs, and government regulations are expected to drive the growth of the market. ePharmacy has significantly impacted the market, making it easier for consumers to access a wider range of medications and healthcare products online. ePharmacies have gained a significant share, especially for non-urgent products such as weight loss or habit control.

Asia Pacific Pharmacy Market Trends

The Asia Pacific market is expected to experience the fastest growth in the coming years. The Asia-Pacific region is experiencing an aging population and a rise in chronic diseases such as diabetes, cancer, and cardiovascular diseases. This demographic shift is driving increased demand for the market.

The pharmacy market in China dominated the Asia Pacific market in 2023 and is expected to sustain dominance during the forecast period. Regulations such as allowing medicines on the National Reimbursement Drug List to be sold and reimbursed at both hospitals and retail pharmacies, and the recent deregulation of online prescription drug sales, are contributing to the growth of the industry in the country.

India pharmacy market is expected to exhibit the fastest growth rate during the forecast period. Key pharmacies are rapidly expanding their service lines to include ePharmacies, which is expected to boost the demand for pharmacies in the country. For instance, in March 2021, Generic Aadhar, an Indian pharmacy retail chain, launched a mobile app to enable customers to purchase generic medications and have them delivered to their local store.

Latin America Pharmacy Market Trends

Latin America market growth can be attributed to the growing dominance of pharmacy chains in many countries, with a handful of retailers now operating over three-quarters of pharmacies in markets such as Chile, Colombia, and Peru. This consolidation has been driven by strategies such as wholly owned outlets, franchises, and cooperatives.

The pharmacy market in Brazil is expected to grow at significant rate over the forecast period, owing to the demographic changes, the expansion of retail chains, and government efforts to improve healthcare access.

MEA Pharmacy Market Trends

The MEA market is expected to witness lucrative growth due to the use of advanced technologies such as AI and mobile apps enhancing efficiency, security, and user engagement in the ePharmacy ecosystem. The launch of ePharmacy platforms, leveraging digital transformation and increased internet penetration to provide convenient access to healthcare products and services is expected to drive the growth of the industry over the forecast period.

Saudi Arabia pharmacy market is expected to experience the fastest growth rate over the forecast period. The adoption of technologies such as Electronic Health Records (EHRs), pharmacy automation devices, medication dispensing technologies, and ePharmacy platforms is improving the efficiency and accessibility of services contributing to the growth of the market.

The following are the leading companies in the pharmacy market. These companies collectively hold the largest market share and dictate industry trends.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Pharmacy market.

By Product

By Type

By Region