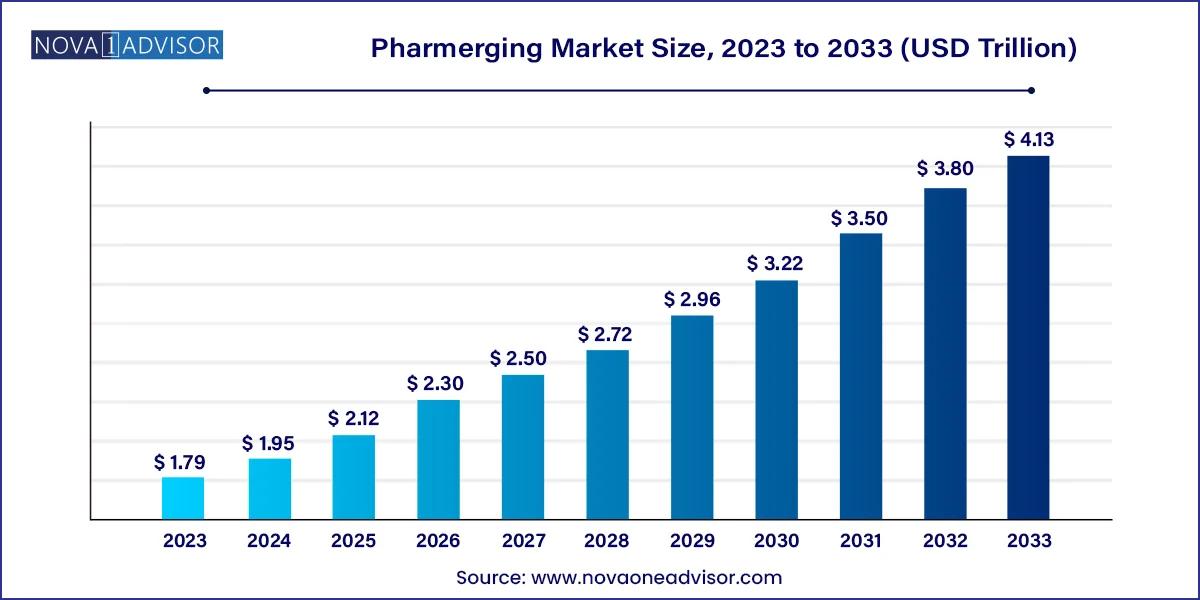

The global Pharmerging market size was valued at USD 1.79 trillion in 2023 and is anticipated to reach around USD 4.13 trillion by 2033, growing at a CAGR of 8.73% from 2024 to 2033.

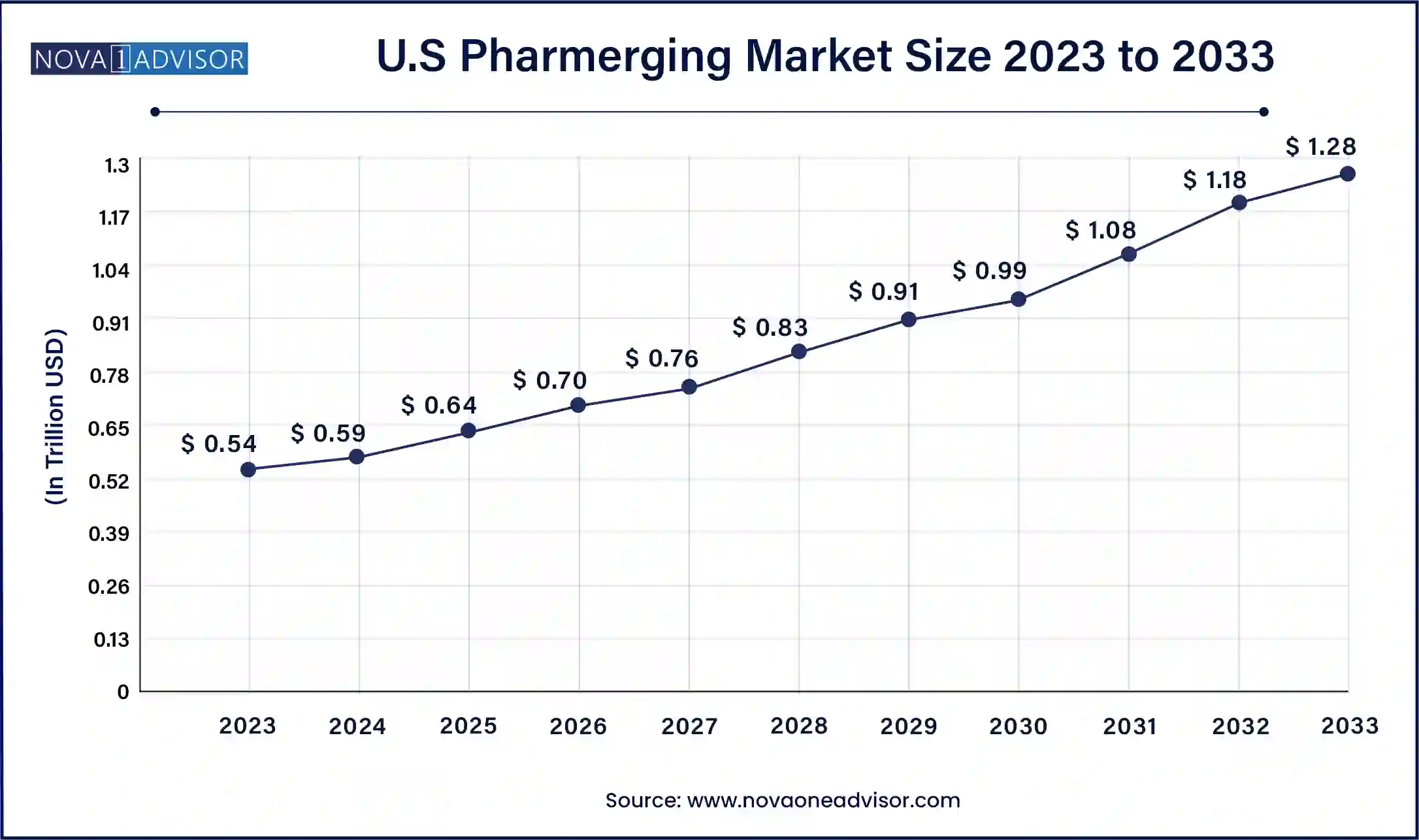

The U.S. Pharmerging market size was exhibited at USD 0.54 trillion in 2023 and is projected to be worth around USD 1.28 trillion by 2033, poised to grow at a CAGR of 9.0% from 2024 to 2033.

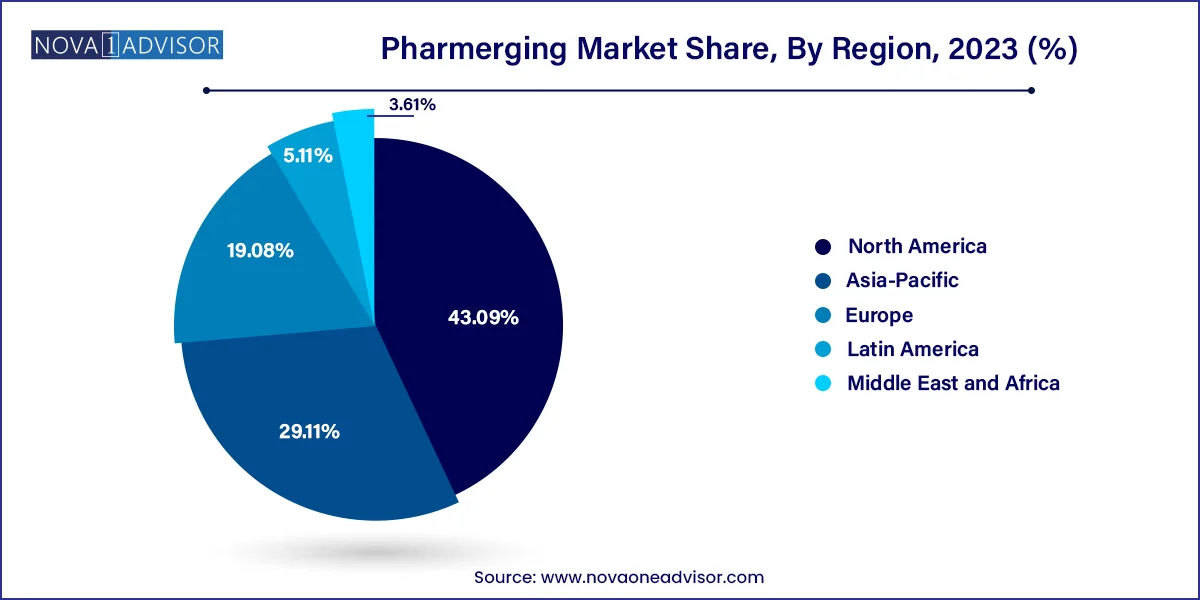

North America emerged as the dominant region in the global pharmerging market, accounting for the largest revenue share of 43.09%. This substantial market share is underpinned by a combination of robust healthcare infrastructure, increasing healthcare expenditure, and the expansion of private healthcare networks. Particularly in countries such as Mexico and select Caribbean nations—which fall under the pharmerging classification—significant investments are being made to improve hospital capacity, drug access, and medical technology adoption. The region also benefits from favorable public-private partnerships and international pharmaceutical collaborations that support market expansion.

Asia-Pacific leads the global pharmerging market, fueled by its demographic size, rising incomes, supportive government schemes, and world-class manufacturing ecosystems. China and India together account for nearly 40% of global generic drug volume. Southeast Asian nations like Indonesia, Thailand, and Vietnam are also scaling up healthcare infrastructure, medical tourism, and digital health programs. The region is home to top CROs, CDMOs, and API suppliers, making it critical to the global supply chain.

Latin America is the fastest-growing region, with countries like Brazil, Mexico, and Colombia seeing surges in pharmaceutical demand. These nations are focusing on strengthening universal healthcare, attracting foreign investments, and fostering biosimilar adoption. Brazil’s unified public system and Colombia’s regulatory improvements are expanding medicine access. The region’s growing middle class and aging population also contribute to greater chronic disease prevalence, which in turn boosts pharmaceutical sales.

The term “Pharmerging” has emerged as a defining classification in global pharmaceutical economics, referring to emerging pharmaceutical markets that are experiencing rapid growth in healthcare expenditure, medicine consumption, and access to advanced therapies. Unlike mature markets in North America and Western Europe, pharmerging countries—such as China, India, Brazil, Russia, Turkey, and select Southeast Asian and African nations—are characterized by expanding middle-class populations, increasing healthcare infrastructure investment, and shifting disease burdens from infectious to chronic and lifestyle-related conditions.

The pharmerging market is reshaping the global pharmaceutical value chain. These markets are forecasted to outpace growth in developed regions through 2034, offering tremendous commercial opportunities for global pharma companies and local manufacturers alike. While cost-sensitive, these markets are also increasingly innovation-driven, with rising demand for patented therapies, biologics, digital health integration, and localized manufacturing.

In recent years, global pharmaceutical giants such as Pfizer, Novartis, and Sanofi have adjusted their commercial strategies to tap into the vast potential of these markets—localizing supply chains, investing in regional R&D centers, and forging partnerships with local firms. Meanwhile, homegrown champions such as Sun Pharma (India), Fosun Pharma (China), and EMS Pharma (Brazil) have expanded into regional and global markets, bolstered by government policies that encourage generic production and price control.

In a world grappling with aging populations, epidemiological transitions, and rising healthcare costs, pharmerging countries are not just growth engines—they are innovation laboratories. The dynamics of affordability, accessibility, and adaptability make the pharmerging market a critical focus for long-term industry strategy and global health equity.

Shift toward generic drug dominance: As cost-efficiency becomes paramount, pharmerging nations continue to favor generic and biosimilar drugs to enhance access.

Digital health integration: Telemedicine, e-pharmacies, and AI-powered diagnostics are accelerating in these markets, especially in response to COVID-19.

Government-backed universal healthcare initiatives: Countries like India (Ayushman Bharat) and China (Healthy China 2030) are investing in healthcare access and infrastructure.

Local manufacturing and tech transfer incentives: Policies supporting domestic pharmaceutical production are strengthening supply chains and reducing import reliance.

Rising burden of non-communicable diseases (NCDs): Lifestyle disorders such as diabetes, hypertension, and cancer are now top health concerns, shifting treatment focus.

Growing medical tourism hubs: Nations like Thailand, India, and Turkey are becoming destinations for affordable yet high-quality medical care.

Emergence of Tier-2 and Tier-3 economies: Markets once overlooked are now showing strong pharmaceutical growth driven by urbanization and improving healthcare delivery systems.

Strategic partnerships between global and regional players: Co-development, licensing, and joint ventures are common entry modes for multinationals.

| Report Attribute | Details |

| Market Size in 2024 | USD 1.95 Trillion |

| Market Size by 2033 | USD 4.13 Trillion |

| Growth Rate From 2024 to 2033 | CAGR of 8.73% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Indication, By Economy, and By Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Sanofi; Pfizer Inc.; AstraZeneca; GlaxoSmithKline; F. Hoffmann-La Roche Ltd.; GE Healthcare; Eli Lilly and Company; Medtronic; Abbott; Johnson and Johnson |

A key driver of the pharmerging market is the consistent rise in healthcare spending across emerging economies, underpinned by government reforms, income growth, urbanization, and public-private investment. Historically constrained by limited access and affordability, many of these nations are now prioritizing healthcare as a socio-economic pillar. For instance, China’s national health expenditure surpassed USD 1.2 trillion in 2023, with targets to expand insurance coverage and improve drug access across rural and urban regions alike.

In India, the Ayushman Bharat scheme—often referred to as the world's largest government-funded healthcare program—aims to provide coverage to over 500 million individuals. Brazil’s SUS (Sistema Único de Saúde) continues to provide universal healthcare while integrating biosimilars and generics. These expansive frameworks are improving drug penetration, hospital access, and diagnostic services. The growing middle class, now more health-conscious and willing to spend on preventive and curative services, is catalyzing the demand for pharmaceuticals, diagnostics, and medical devices. As these regions gain healthcare literacy and disposable income, demand for high-quality yet affordable medicines will continue to rise.

One of the most significant restraints hindering pharmerging market expansion is the regulatory diversity and unpredictability across regions. Unlike the harmonized protocols seen in mature markets governed by agencies like the FDA and EMA, pharmerging countries exhibit wide variation in approval timelines, patent law enforcement, price control mechanisms, and local content regulations. These inconsistencies can delay market entry and increase compliance costs for pharmaceutical firms.

For example, in countries such as Russia and Brazil, strict localization rules and pricing controls present obstacles for foreign entrants. In India, sudden price capping and policy reversals—such as the implementation of the National List of Essential Medicines (NLEM)—can significantly affect revenue streams. Additionally, clinical trial regulations, pharmacovigilance expectations, and product registration processes often lack transparency or capacity, leading to delays and uncertainties. These challenges necessitate region-specific strategies and risk management protocols, increasing the burden on companies attempting to scale across diverse markets.

While traditional focus in pharmerging markets has been on essential medicines and infectious diseases, a major opportunity lies in the expansion of specialty care, chronic disease management, and biologics. With aging populations and rapid urbanization, diseases like cancer, autoimmune disorders, diabetes, and cardiovascular conditions are reaching epidemic proportions. The demand for targeted therapies, monoclonal antibodies, insulin analogs, and advanced diagnostics is soaring.

For instance, oncology drug consumption in China grew by over 15% annually between 2020 and 2023, surpassing many Western nations in volume. Similarly, India has become a significant market for biosimilars targeting autoimmune conditions and diabetes. Pharmaceutical companies are investing in regional trials, physician training, and patient education programs to promote specialty care adoption. As more biosimilars and off-patent biologics gain approval, and infrastructure for cold-chain storage and specialty pharmacy services improves, the pharmerging market is primed to become a dominant force in chronic disease therapeutics.

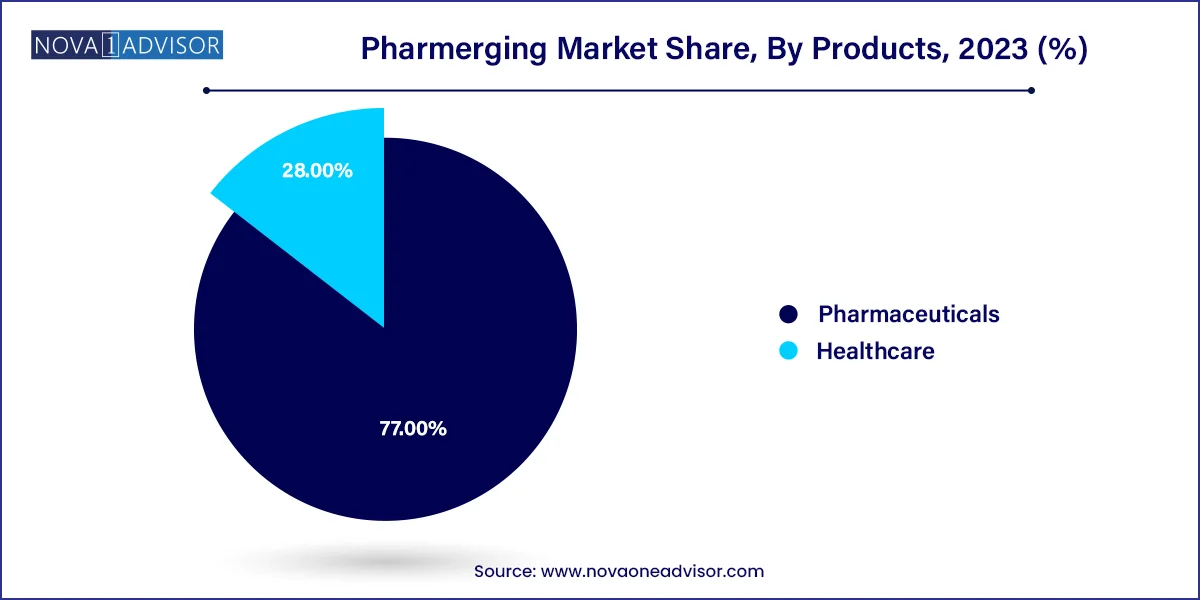

The pharmaceutical product segment dominated the market and accounted for the largest revenue share of 77.00% in 2023. Within this category, generic prescription drugs hold the lion’s share, driven by affordability, high volume demand, and favorable government policies. For instance, India's pharmaceutical exports, which are 80% generic, reached over USD 25 billion in 2023. Similarly, China’s emphasis on generic substitution through its “4+7” centralized procurement policy has increased uptake of low-cost alternatives. OTC drugs, including antipyretics, analgesics, and nutraceuticals, are also gaining ground, fueled by rising self-medication trends and e-pharmacy growth.

Other healthcare verticals such as clinical diagnostics and medical devices are the fastest-growing, propelled by infrastructure upgrades, increased disease awareness, and health tech innovation. Clinical diagnostics have become indispensable in managing chronic diseases and infectious outbreaks, with rapid diagnostics, point-of-care testing, and molecular assays finding strong uptake. Medical devices—from basic surgical tools to sophisticated imaging equipment—are also seeing increased procurement by both public and private hospitals. These verticals are benefiting from regional manufacturing incentives and international partnerships aimed at improving access to high-quality tools.

The tier-1 economy led the market, accounting for the largest market share at 61.5% in 2023. owing to their population size, industrial scale, and robust policy backing. These nations have developed advanced pharmaceutical ecosystems supported by academic research, manufacturing capacity, and international engagement. China, for example, has more than 5,000 pharmaceutical companies and a strong presence in APIs and finished formulations. India’s prominence as the "pharmacy of the world" reflects its dominance in generics and vaccine production. These countries serve as anchors for pharmerging growth and innovation.

Tier-2 and Tier-3 economies, including nations such as Vietnam, Nigeria, Kenya, and the Philippines, represent the fastest-growing segment, characterized by emerging infrastructure, rising healthcare investments, and large underserved populations. While their markets are currently smaller, they offer immense long-term growth potential. Governments in these regions are actively reforming healthcare systems, partnering with multilateral agencies, and adopting digital platforms to accelerate access. Pharmaceutical companies that enter early and tailor their approaches to local needs stand to gain significantly in these next-frontier economies.

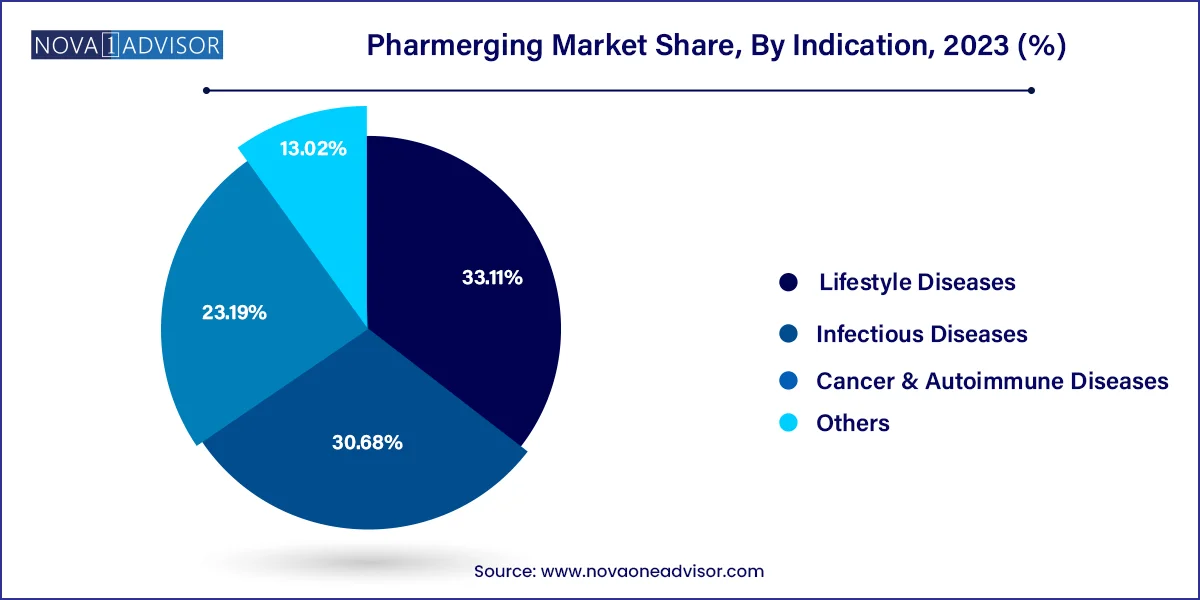

Infectious diseases dominated the market and held a revenue share of 30.68% in 2023. Sedentary lifestyles, dietary shifts, and increasing life expectancy have led to a surge in cardiovascular conditions, obesity, type 2 diabetes, and hypertension. These conditions are now major public health concerns, leading to continuous prescription of chronic care medications, often for life. As governments implement preventive care and screening programs, pharmaceutical demand for antihypertensives, lipid-lowering agents, and glucose regulators continues to rise.

Cancer and autoimmune diseases are the fastest-growing indications, supported by increased diagnosis rates, better health awareness, and access to specialty treatments. Biologic drugs, chemotherapy agents, and immunotherapies are gaining traction in urban centers with tertiary care facilities. For example, China's NRDL (National Reimbursement Drug List) is increasingly adding targeted oncology drugs, enabling broader access. Biosimilars are also expanding treatment access in cost-sensitive populations, creating a robust growth curve for this indication.

Retail pharmacies dominate the distribution landscape, particularly in densely populated urban and semi-urban areas. These outlets are the first point of contact for millions of consumers, offering both prescription and OTC medicines. Chain pharmacy models are emerging in countries like India (e.g., Apollo Pharmacy) and Brazil (e.g., Raia Drogasil), while traditional stores still dominate in rural areas. Governments are also regulating pharmacy operations to improve drug quality, traceability, and affordability.

Online stores represent the fastest-growing distribution channel, catalyzed by COVID-19, rising smartphone penetration, and digital payment adoption. Platforms like India’s 1mg, Brazil’s Farmácias APP, and China’s JD Health are disrupting the supply chain by enabling home delivery, teleconsultation integration, and real-time inventory management. E-pharmacy regulation is also becoming more favorable, ensuring growth with compliance.

The following are the leading companies in the pharmerging market. These companies collectively hold the largest market share and dictate industry trends.

March 2024 – Sun Pharma announced its expansion into the Latin American biosimilars market through a strategic partnership with a Colombian drug manufacturer, aiming to improve biologics access in Tier-2 economies.

February 2024 – Roche unveiled its mobile diagnostic testing vans in India and Indonesia, delivering point-of-care testing in rural areas as part of a regional health equity initiative.

January 2024 – Sanofi launched a manufacturing hub in Vietnam focused on diabetes and cardiovascular drugs to meet increasing regional demand and reduce dependency on imports.

December 2023 – Cipla launched a direct-to-patient digital platform in South Africa, providing chronic disease medicines through subscription models and pharmacist chat features.

November 2023 – Novartis received regulatory clearance for its biosimilar rituximab in Brazil, expanding its oncology and autoimmune disease portfolio across Latin America.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Pharmerging market.

By Product

By Economy

By Indication

By Distribution Channel

By Region