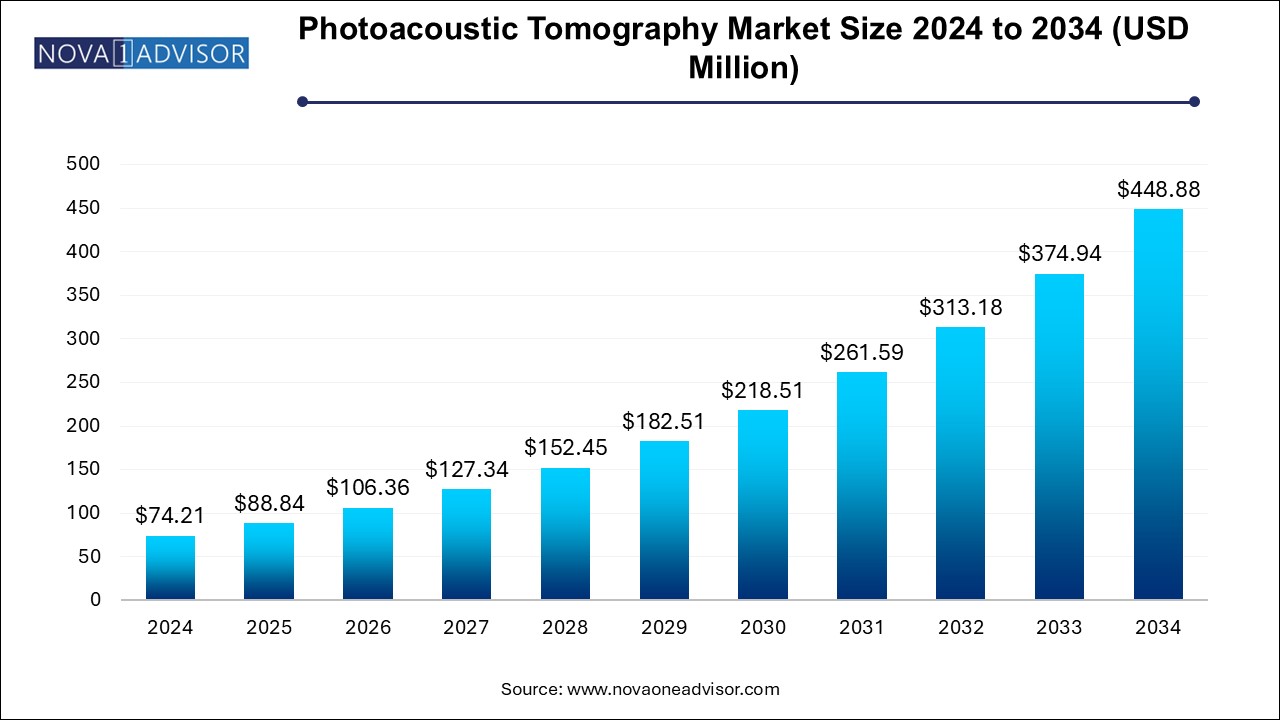

The photoacoustic tomography market size was exhibited at USD 74.21 million in 2024 and is projected to hit around USD 448.88 million by 2034, growing at a CAGR of 19.72% during the forecast period 2025 to 2034.

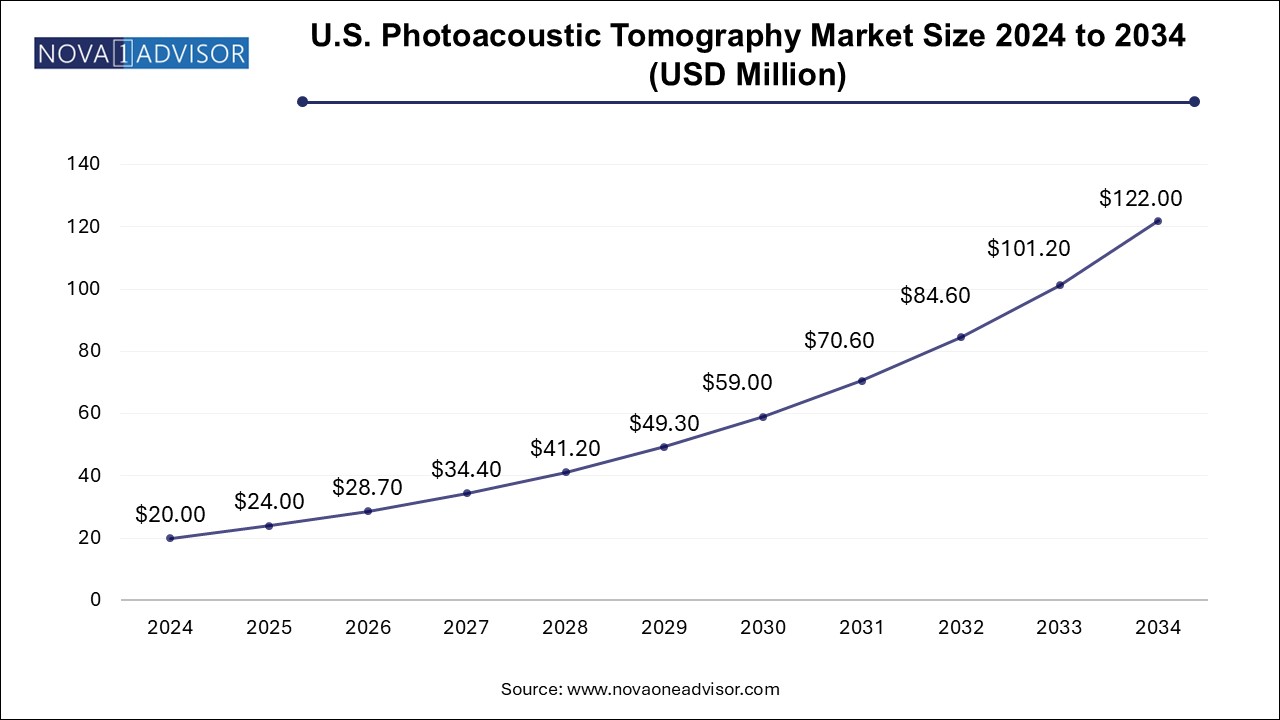

The U.S. photoacoustic tomography market size is evaluated at USD 20.0 million in 2024 and is projected to be worth around USD 122.0 million by 2034, growing at a CAGR of 17.86% from 2025 to 2034.

North America currently dominates the global photoacoustic tomography market, thanks to its robust healthcare infrastructure, high research funding, and early adoption of emerging medical technologies. The United States is home to several pioneering PAT developers, academic collaborators, and research grants that fuel market development. The presence of leading institutions such as Stanford University, MIT, and the NIH has propelled advancements in photoacoustic imaging techniques. Moreover, growing clinical adoption in top-tier hospitals and the FDA’s supportive stance toward non-invasive diagnostics contribute to regional leadership.

In contrast, Asia Pacific is the fastest-growing region in the PAT market. Countries such as China, Japan, and South Korea are investing heavily in biomedical innovation and research infrastructure. China, in particular, has emerged as a major hub for photoacoustic imaging research, with institutions like Tsinghua University and the Chinese Academy of Sciences conducting cutting-edge work in the field. The region's growing burden of chronic diseases, combined with increasing investments in healthcare modernization, positions it as a high-growth territory for both research and clinical applications of PAT.

The Photoacoustic Tomography (PAT) Market is emerging as one of the most promising and transformative segments within the biomedical imaging space. By combining the high contrast of optical imaging with the spatial resolution of ultrasound, PAT offers an innovative, non-invasive method for visualizing anatomical, functional, and molecular information in vivo. The unique advantage of PAT lies in its ability to probe deep into biological tissues with optical contrast, surpassing the penetration depth limitations of traditional optical imaging techniques.

The market for PAT is being propelled by technological innovations, a rising incidence of chronic and lifestyle-related diseases, and increasing applications in cancer detection, brain imaging, and vascular mapping. Researchers and clinicians are increasingly turning toward PAT to visualize microvascular structures, blood oxygenation levels, and tumor angiogenesis with high resolution and specificity. Hospitals, diagnostic centers, and academic institutions are showing growing interest in adopting PAT technologies for both clinical diagnostics and preclinical research.

The global market landscape reflects a dynamic mix of early-stage companies, established medical device manufacturers, and academic institutions driving innovation through strategic collaborations and product development. With imaging playing a crucial role in precision medicine and personalized treatment plans, the demand for high-resolution, functional, and safe imaging modalities is growing — positioning PAT as a valuable tool in the medical imaging toolkit.

Moreover, increasing government funding for biomedical research and the inclusion of photoacoustic systems in multimodal imaging platforms have accelerated the commercialization trajectory of this technology. The rising demand for safer, non-ionizing imaging tools further bolsters PAT's market potential. As awareness spreads about its capabilities and applications diversify beyond oncology into dermatology, neurology, and cardiovascular diagnostics, the market is expected to gain significant momentum over the next decade.

| Report Coverage | Details |

| Market Size in 2025 | USD 88.84 Million |

| Market Size by 2034 | USD 448.88 Million |

| Growth Rate From 2025 to 2034 | CAGR of 19.72% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Application, End Use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Advantest Corp.; TomoWave; Kibero GmbH; FUJIFILM VisualSonics Inc.; Seno Medical Instruments; iThera Medical GmbH; Aspectus GmbH; Vibronix Inc. |

Market Driver: Increasing Need for Non-Invasive, High-Resolution Imaging

A primary driver fueling the growth of the photoacoustic tomography market is the rising demand for non-invasive and high-resolution imaging technologies, especially for applications requiring deep tissue visualization without compromising safety. Conventional imaging tools such as CT and PET scans, while effective, expose patients to ionizing radiation and often lack the specificity needed for functional and molecular imaging.

PAT bridges this gap by leveraging the photoacoustic effect—where pulsed laser light absorbed by tissue generates ultrasonic waves that can be reconstructed into detailed images. This dual approach enables high-resolution imaging of vascular structures, oxygen saturation levels, and tumor morphology in real time. Clinical applications such as breast cancer detection, monitoring tumor angiogenesis, or mapping blood oxygenation in ischemic tissues greatly benefit from PAT’s capabilities.

For instance, in functional brain imaging, PAT allows researchers to visualize cerebral hemodynamics and oxygen metabolism with high spatial and temporal resolution, aiding in early detection of neurological disorders. The growing prevalence of diseases such as cancer, stroke, and diabetes-related complications makes PAT an essential diagnostic tool for advanced, non-invasive clinical care.

Market Restraint: High Cost and Limited Commercial Availability

One of the most notable restraints limiting the market growth of photoacoustic tomography is the high cost of equipment and limited commercial penetration in mainstream healthcare settings. PAT systems involve advanced components, including tunable lasers, high-frequency ultrasound detectors, and sophisticated image processing software—all of which contribute to elevated costs. This pricing makes it difficult for smaller healthcare facilities and diagnostic centers to justify investment, especially when reimbursement pathways are not clearly established.

Furthermore, the market is still in a relatively nascent phase compared to well-established imaging modalities like MRI or CT, which benefit from robust clinical validation, insurance coverage, and broader physician familiarity. In contrast, PAT systems are often limited to research settings or specialized diagnostic labs, slowing the pace of clinical adoption. Manufacturers must also invest in clinician training and awareness programs to facilitate the broader rollout of PAT systems.

Market Opportunity: Expanding Role in Oncology and Personalized Medicine

One of the most promising opportunities for the PAT market lies in its expanding role in oncology and the growing trend toward personalized medicine. Tumor diagnosis, staging, and treatment monitoring require imaging technologies that offer detailed insights into vascular growth, tissue oxygenation, and metabolic activity—areas where PAT excels. Unlike traditional imaging, PAT can distinguish between malignant and benign tissues by assessing vascular density and oxygen consumption levels.

As cancer therapies become more targeted and treatment plans more individualized, imaging tools that offer functional and molecular insights—without invasive biopsies—are gaining traction. For instance, PAT can help oncologists visualize how tumors respond to chemotherapy by monitoring changes in blood vessel formation and tissue hypoxia over time. This real-time feedback supports treatment adjustments tailored to patient response, improving outcomes.

Additionally, with immunotherapy and targeted therapies reshaping cancer treatment, there’s a growing need for tools like PAT that can track microenvironmental changes at the tumor site. Integrating PAT into routine oncology diagnostics or therapy planning could unlock a significant market opportunity in the years to come.

Photoacoustic Microscopy dominates the PAT market by type, largely due to its widespread use in research and preclinical imaging applications. Photoacoustic microscopy (PAM) provides ultra-high-resolution images, making it ideal for visualizing capillary networks, single-cell imaging, and tissue microstructures. Academic and research institutions prefer PAM for studying biological processes at the microvascular level, such as in tumor angiogenesis or ocular research. The demand for high-resolution data in life sciences research has firmly established PAM as a core segment within the broader PAT ecosystem.

However, intravascular photoacoustic tomography is emerging as the fastest-growing type, especially in cardiovascular diagnostics. This technique is capable of providing both structural and chemical composition data about arterial plaques, aiding in the diagnosis of atherosclerosis. The growing global burden of cardiovascular disease, particularly in aging populations, is fostering demand for real-time, high-resolution intravascular imaging. Intravascular PAT’s ability to visualize lipid-rich plaques and inflammation could redefine how interventional cardiology approaches early-stage heart disease diagnostics and treatment planning.

Tumor angiogenesis imaging is currently the leading application segment for photoacoustic tomography, accounting for a substantial market share. Cancer research has consistently utilized PAT to investigate tumor growth patterns, monitor the effectiveness of anti-angiogenic therapies, and explore new diagnostic biomarkers. The ability to non-invasively visualize vascular architecture and oxygen saturation provides critical insights into tumor microenvironments. This capability makes PAT invaluable for both clinical research and pharmaceutical development, particularly in oncology drug trials.

Meanwhile, functional brain imaging is growing rapidly as a high-potential application, fueled by increased interest in neurological disorders such as Alzheimer’s, Parkinson’s, and epilepsy. PAT is uniquely suited for capturing cerebral hemodynamic responses to stimuli or pathology, without the need for contrast agents or radiation. As neuroimaging evolves to support earlier diagnosis and brain-computer interface research, functional PAT systems are seeing increased adoption in neuroscience labs and translational research programs.

Academic and research institutes dominate the market by end use, accounting for the largest share of installations and procurement. Given PAT’s current maturity level and strong foundation in experimental imaging, universities and medical research centers remain the primary adopters. These institutions utilize PAT systems to study vascular biology, cellular interactions, and disease pathophysiology in animal models. The growing emphasis on translational research and interdisciplinary imaging technologies ensures a steady demand for advanced PAT platforms in academic settings.

On the other hand, hospitals and diagnostic imaging centers represent the fastest-growing end-use segment, as PAT transitions from the lab to the clinic. With a growing number of clinical trials and regulatory approvals for diagnostic applications, hospitals are beginning to integrate PAT systems into their imaging suites. Early adopters in oncology and dermatology are using PAT for non-invasive diagnostics and therapy monitoring. As clinical workflows adapt to incorporate functional and molecular imaging tools, hospital-based adoption is expected to accelerate.

March 2024 – iThera Medical GmbH announced a successful clinical trial of its MSOT (Multispectral Optoacoustic Tomography) system in breast cancer patients, demonstrating improved detection of tumor oxygenation changes during therapy.

February 2024 – Verasonics Inc. introduced a new programmable ultrasound system integrated with photoacoustic capabilities aimed at preclinical research and translational imaging.

January 2024 – FUJIFILM VisualSonics launched a next-generation Vevo system combining photoacoustic and high-frequency ultrasound imaging for real-time molecular imaging in animal models.

November 2023 – TomoWave Laboratories received CE certification for its photoacoustic imaging system designed for dermatology applications, expanding its reach into the European clinical market.

October 2023 – Endra Life Sciences expanded its commercialization strategy by partnering with regional imaging centers in Europe for pilot deployment of its TAEUS (Thermo Acoustic Enhanced Ultrasound) system.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the photoacoustic tomography market

By Type

By Application

By End Use

By Regional