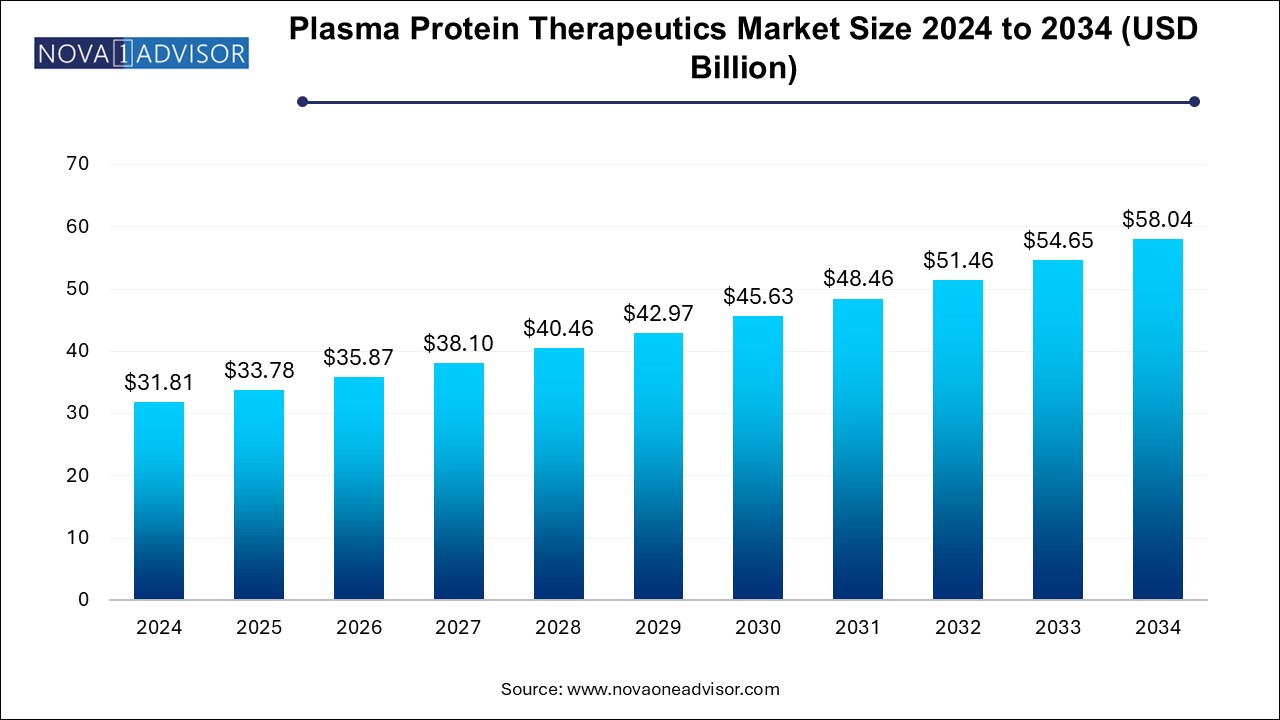

The plasma protein therapeutics market size was exhibited at USD 31.81 billion in 2024 and is projected to hit around USD 58.04 billion by 2034, growing at a CAGR of 6.2% during the forecast period 2025 to 2034.

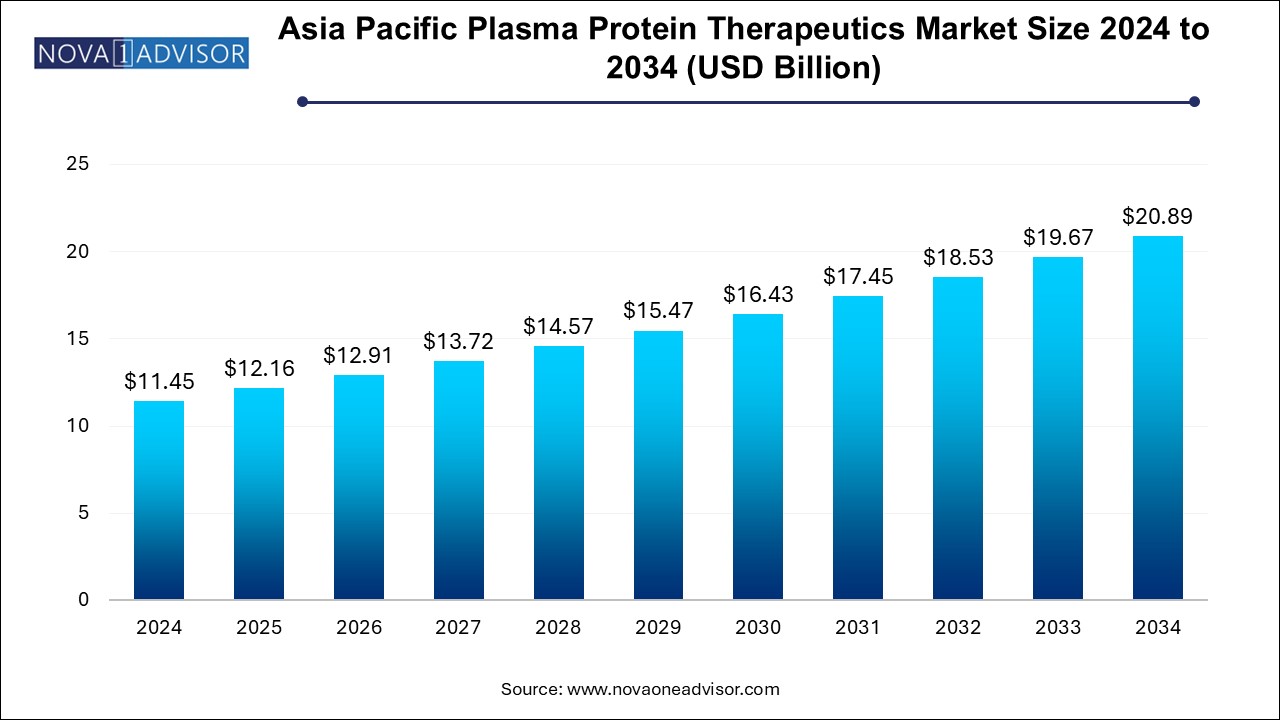

The Asia Pacific plasma protein therapeutics market size is evaluated at USD 11.45 billion in 2024 and is projected to be worth around USD 20.89 billion by 2034, growing at a CAGR of 5.61% from 2025 to 2034.

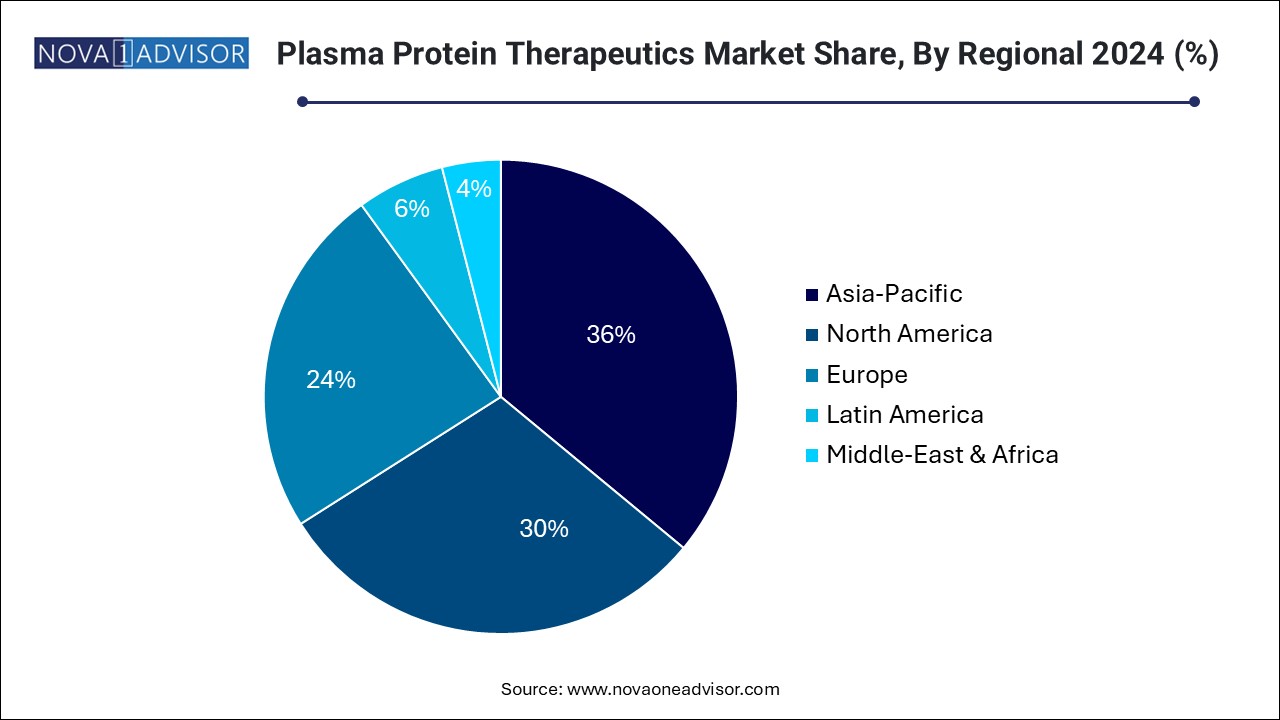

Asia Pacific accounted for the largest market share of 35.7% in 2024 and is expected to exhibit the fastest CAGR of 8.6% over the forecast period from 2025 to 2034. China ranks first in the global albumin market, supported by high demand and usage of albumin. In addition, factors like increasing demand for advanced treatment options, developing economies, and increasing per capita income are anticipated to create growth avenues for market players in emerging countries over the forecast period.

Approximately 50.0% of the market is concentrated in North America and Europe. The U.S. also accounted for a significant market share in 2024. The presence of a large patient base, a growing geriatric population, availability of well-developed infrastructure for storing and maintaining high-quality source plasma are some of the key regional drivers. Increased adoption of novel therapeutics and rising disease prevalence are other key factors contributing to regional growth.

| Report Coverage | Details |

| Market Size in 2025 | USD 31.81 Billion |

| Market Size by 2034 | USD 58.04 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.2% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | CSL; Grifols, S.A; Takeda; Octapharma AG; Biotest AG; Kedrion S.p.A |

Based on product, the market is segmented into albumin, Immunoglobulins (IG), plasma-derived factor VIII, and others. The immunoglobulin segment accounted for the largest revenue share of 51.0% in 2024. The large share can be attributed to the approval of biologics across multiple indications, ease of administration, and treatment cost.

The collaborations between key players and the launch of new and advanced products are further expected to boost market growth. For instance, in March 2024, Sanofi announced a partnership with IGM Bioscience to develop and commercialize six immunoglobulin M (IgM) antibody agonists against oncology and immunology.

The albumin segment is anticipated to grow at the fastest CAGR of 7.3% over the forecast period, driven by the improved diagnosis of hypoalbuminemia caused by liver cirrhosis and hepatitis B. High demand and usage in China, which is the largest market for albumin, is anticipated to fuel the growth further. Patients suffering from moderate to severe hemophilia A require clotting factor VIII as a preventive or on-demand therapy. However, approximately 70.0% of hemophilia patients receive none no or inadequate treatment. The factor VIII market is expected to witness a decline in sales due to increasing competition from recombinant and other long-term therapies.

The others segment includes alpha-1 antitrypsin, hyperimmune immunoglobulins, coagulation factors, fibrogammin, and c1 esterase inhibitors. Alpha-1 Antitrypsin (AAT) is a replacement therapy for treating rare hereditary emphysema. The deficiency causes conditions such as Chronic Obstructive Pulmonary Disease (COPD), bronchitis, and neonatal hepatitis. Currently, only about 10.0% to 15.0% of AAT-deficient patients receive treatment in the U.S. and Europe, thus creating room for market growth. The overall segment is anticipated to exhibit lucrative growth driven by improvement in diagnosis rate and product launches.

Based on application, the market for plasma protein therapeutics is segmented into Hemophilia, Primary Immunodeficiency Diseases (PID), Idiopathic Thrombocytopenic Purpura (ITP), and others. Primary immunodeficiency diseases include more than 200 rare, chronic diseases resulting from an immune system defect.

Globally, more than 6.0 million individuals live with a PID, of which less than 60,000 cases are reported annually. The PID segment captured the largest market share of 26.5% in 2024 and is expected to exhibit substantial growth with a CAGR of 6.2% through the forecast period from 2025 to 2034. Increasing expansion of clinical applications for immunoglobulins, approval of SCIGs, and high treatment costs are contributing to segment growth.

The others segmented is expected to grow at the fastest CAGR of 6.6% over the forecast period from 2025 to 2034. The increasing use of plasma protein therapeutics in the treatment of various diseases and their increasing prevalence are expected to add to the growth of this segment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the plasma protein therapeutics market

By Product

By Application

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Product

1.1.2. Application

1.1.3. Regional scope

1.1.4. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. Application outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Plasma Protein Therapeutics Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Market Dynamics

3.3.1. Market driver analysis

3.3.2. Market restraint analysis

3.4. Plasma Protein Therapeutics market Analysis Tools

3.4.1. Industry Analysis - Porter’s

3.4.1.1. Supplier power

3.4.1.2. Buyer power

3.4.1.3. Substitution threat

3.4.1.4. Threat of new entrant

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Technological landscape

3.4.2.3. Economic landscape

Chapter 4. Plasma Protein Therapeutics market: Product Estimates & Trend Analysis

4.1. Plasma Protein Therapeutics market: Key Takeaways

4.2. Plasma Protein Therapeutics market: Movement & Market Share Analysis, 2024 & 2034

4.3. Albumin

4.3.1. Albumin market estimates and forecasts, 2021 to 2034 (USD Million)

4.4. Immunoglobulin

4.4.1. Immunoglobulin market estimates and forecasts, 2021 to 2034 (USD Million)

4.5. Plasma-derived Factor VIII

4.5.1. Plasma-derived factor VIII market estimates and forecasts, 2021 to 2034 (USD Million)

4.6. Others

4.6.1. Others market estimates and forecasts, 2021 to 2034 (USD Million)

Chapter 5. Plasma Protein Therapeutics market: Application Estimates & Trend Analysis

5.1. Plasma Protein Therapeutics market: Key Takeaways

5.2. Plasma Protein Therapeutics market: Movement & Market Share Analysis, 2024 & 2034

5.3. Hemophilia

5.3.1. Hemophilia market estimates and forecasts, 2021 to 2034 (USD Million)

5.4. Primary Immunodeficiency Disorder (PID)

5.4.1. Primary immunodeficiency disorder (PIDD) market estimates and forecasts, 2021 to 2034 (USD Million)

5.5. Idiopathic Thrombocytopenic Purpura (ITP)

5.5.1. Idiopathic thrombocytopenic purpura (ITP) market estimates and forecasts, 2021 to 2034 (USD Million)

5.6. Others

5.6.1. Others market estimates and forecasts, 2021 to 2034 (USD Million)

Chapter 6. Plasma Protein Therapeutics market: Regional Estimates & Trend Analysis

6.1. Regional Outlook

6.2. Plasma Protein Therapeutics market by Region: Key Takeaways

6.3. North America

6.3.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.3.2. U.S.

6.3.2.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.3.3. Canada

6.3.3.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.4. Europe

6.4.1. UK

6.4.1.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.4.2. Germany

6.4.2.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.4.3. France

6.4.3.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.4.4. Italy

6.4.4.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.4.5. Spain

6.4.5.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.4.6. Denmark

6.4.6.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.4.7. Sweden

6.4.7.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.4.8. Norway

6.4.8.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.5. Asia Pacific

6.5.1. Japan

6.5.1.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.5.2. China

6.5.2.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.5.3. India

6.5.3.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.5.4. Australia

6.5.4.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.5.5. Thailand

6.5.5.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.5.6. South Korea

6.5.6.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.6. Latin America

6.6.1. Brazil

6.6.1.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.6.2. Mexico

6.6.2.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.6.3. Argentina

6.6.3.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.7. MEA

6.7.1. South Africa

6.7.1.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.7.2. Saudi Arabia

6.7.2.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.7.3. UAE

6.7.3.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

6.7.4. Kuwait

6.7.4.1. Market estimates and forecasts, 2024 - 2034 (Revenue, USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Market Participant Categorization

7.2.1. CSL

7.2.1.1. Company overview

7.2.1.2. Financial performance

7.2.1.3. Product benchmarking

7.2.1.4. Strategic initiatives

7.2.2. Grifols, S.A.

7.2.2.1. Company overview

7.2.2.2. Financial performance

7.2.2.3. Product benchmarking

7.2.2.4. Strategic initiatives

7.2.3. Takeda

7.2.3.1. Company overview

7.2.3.2. Financial performance

7.2.3.3. Product benchmarking

7.2.3.4. Strategic initiatives

7.2.4. Octapharma AG

7.2.4.1. Company overview

7.2.4.2. Financial performance

7.2.4.3. Product benchmarking

7.2.4.4. Strategic initiatives

7.2.5. Biotest AG

7.2.5.1. Company overview

7.2.5.2. Financial performance

7.2.5.3. Product benchmarking

7.2.5.4. Strategic initiatives

7.2.6. Kedrion S.p.A

7.2.6.1. Company overview

7.2.6.2. Financial performance

7.2.6.3. Product benchmarking

7.2.6.4. Strategic initiatives