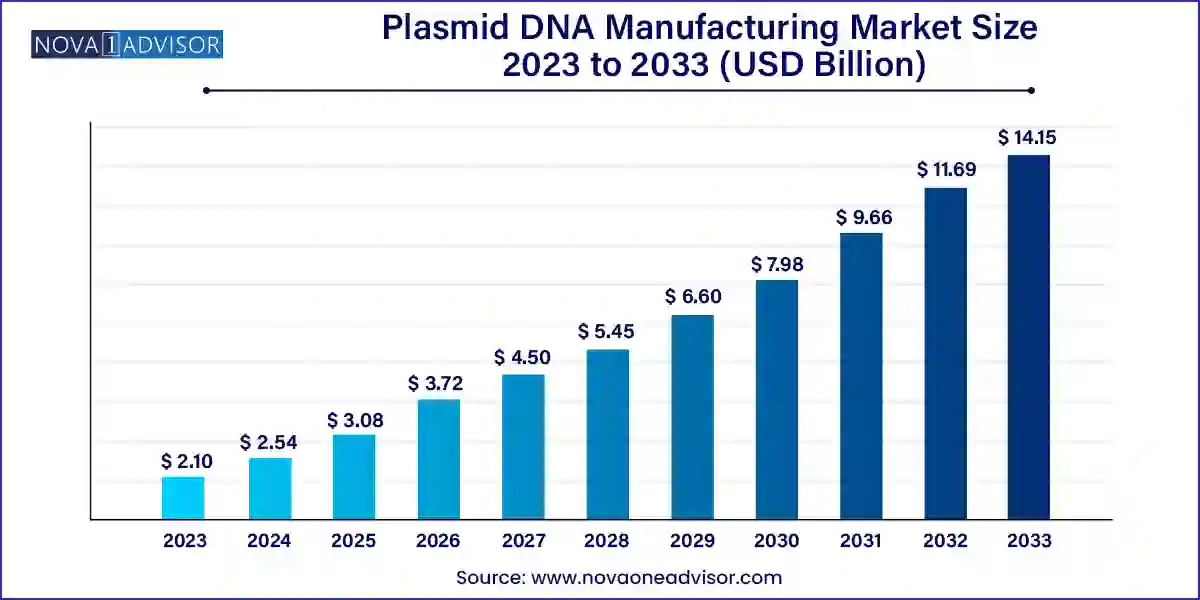

The global plasmid DNA manufacturing market size was valued at USD 2.10 billion in 2023 and is anticipated to reach around USD 14.15 billion by 2033, growing at a CAGR of 21.02% from 2024 to 2033.

Plasmid DNA plays an important role in the healthcare industry. Today, plasmid DNA is crucial for the development of vaccines and next-generation cell and gene therapies. New plasmid DNA vaccines are now being developed, leading to more efficient and clean manufacturing processes. In the production of vaccines and gene therapies, plasmids are more attractive than recombinant viruses as they can deliver significant amounts of DNA with a low risk of oncogenesis or immunogenicity. Such factors are expected to propel industry growth.

Increasing awareness about cell and gene therapy boosts industry growth. This is mainly due to growing acceptance of cell and gene therapy products to treat various diseases globally and the availability of approved gene therapy products. Plasmid DNA is the base for gene therapies and vaccines for several infectious, genetic, and acquired diseases, enteric pathogens, and influenza. With the rising demand for robust disease treatment therapies, various companies and research organizations are accelerating R&D efforts for advanced therapies that target the cause of disease at a genomic level, resulting in increased demand for plasmid DNA.

For instance, in October 2021, the National Institutes of Health, FDA, five nonprofit organizations, and ten pharmaceutical companies entered into a partnership to ramp up the development of gene therapies for 30 million individuals in the U.S. who suffer from rare disorders. The COVID-19 pandemic outbreak led to an increase in the use of plasmid DNA. The pandemic resulted in extensive research efforts for the development of vaccines against the infection. For instance, in November 2021, Enzychem entered into a manufacturing license and technology transfer agreement with Zydus Cadila to develop a COVID-19 plasmid DNA vaccine in South Korea.

Under this initiative, Zydus provided its technical assistance and manufacturing technology to Enzychem. Increased prevalence of cancer is anticipated to boost the production of plasmid DNA. Plasmid DNA is used in gene therapy to identify and treat illnesses in patients. According to the American Cancer Society estimate, the overall number of new cancer cases in 2023 is approximately 1,958,310 and the number of cancer deaths is 609,820 in the U.S. The most common cancers are lung, breast, prostate, colon, and rectum cancers. In 2020, around 2.26 million cases of breast cancer were reported.

| Report Attribute | Details |

| Market Size in 2024 | USD 2.54 Billion |

| Market Size by 2033 | USD 14.15 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 21.02% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Grade, development phase, application, disease, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Charles River Laboratories; VGXI, Inc.; Danaher (Aldevron); Kaneka Corp.; Nature Technology; Cell and Gene Therapy Catapult; Eurofins Genomics; Lonza; Luminous BioSciences, LLC; Akron Biotech |

Emerging companies are entering the industry with advanced technologies to meet the increasing demand and strengthen their position in the global market. For instance, in June 2021, Biotage launched a new automated solution for plasmid DNA purification, Biotage PhyPrep. A new automated solution for plasmid DNA purification saves lab technicians’ time by eliminating the need to perform repetitive, manual work. It also fully utilizes the dual flow chromatography technology of the PhyTip columns to produce supercoiled, endotoxin-free, transfection-grade pDNA.

Furthermore, increasing development and commercialization of novel vaccines is also expected to contribute to market growth. For instance, in January 2021, Advaccine Biopharmaceuticals Suzhou Co., Ltd and INOVIO signed a licensing agreement to commercialize INO-800, a COVID-19 DNA vaccine in greater China area including Taiwan, Hong Kong, Macao, and Mainland China. This vaccine was composed of optimized DNA plasmid, which is directly delivered into cells in the body through a smart device. This licensing agreement is anticipated to have a positive impact on the growth of the global market.

Moreover, the requirement for innovation in established manufacturing technologies to fulfill the demand for acceptable products and their volume is predicted to generate enormous growth prospects for industry players. For instance, in January 2020, GenScript announced the signing of a strategic cooperation agreement with Genopis, Inc., a firm that specializes in plasmid DNA-based research and offers contract development & manufacturing organization (CDMO) services, for the manufacturing of GMP Plasmids. Through this strategic collaboration agreement, GenScript & Genopis developed a revenue-sharing arrangement for the global promotion, sale, and manufacturing of GMP plasmids.

The clinical therapeutics segment held the largest market share of 55.19% in 2023. The importance of Plasmid DNA is currently increasing for clinical research applications in genetic vaccination and gene therapy. Particularly, plasmid DNA gene therapy is utilized for cardiovascular disorders as the transfer of plasmid DNA for skeletal or cardiac muscle is possible. Patients with peripheral artery disease have undergone clinical angiogenic gene therapy employing plasmid DNA gene transfer. Hence, propelling the segment growth.

The pre-clinical therapeutics segment is expected to witness the fastest CAGR of 23.60% from 2024 to 2033. The main drivers of market expansion are increased numbers of clinical trials with promising results, incidence of chronic diseases, and increased gene therapy development efforts. The clinical transformation and industrialization of gene therapy continue to steadily progress across Asian countries. For instance, in June 2021, Aldevron and Aruvant Sciences announced that Aldevron will contribute in developing ARU-1801, Aruvant's investigational gene therapies for sickle cell disease (SCD), including ARU-2801, gene therapies for hypophosphatasia (HPP). Furthermore, for Aruvant's planned ARU-1801 pivotal study, Aldevron will supply a plasmid that meets good manufacturing practice (GMP) standards.

The cell & gene therapy segment held the largest market share of 55.33% in 2023. This high share can be attributed to the fact that gene therapy is broadly applied in the treatment of several inherited and genetic diseases. Moreover, continuous technological improvements in developing a safe and reliable treatment for various disorders are propelling the segment growth.

The DNA vaccines segment is expected to witness the fastest CAGR of 23.66% from 2024 to 2033. The high prevalence of chronic diseases and COVID-19 pandemic have led to an increase in R&D activities for the development of novel therapies and vaccines, thus creating a high demand for pDNA manufacturing solutions for research purposes. For instance, in May 2020, Takara Bio contracted AGC Biologics to produce an intermediate COVID-19 DNA vaccine (a circular DNA (plasmid DNA) that included the target pathogen's protein). Osaka University & AnGes Inc. developed this vaccination by combining their findings from producing DNA plasmid products. This is expected to increase the revenue share of DNA vaccine in the plasmid DNA manufacturing industry.

The cancer segment held the largest market share of 42.55% in 2023 and is expected to witness the fastest CAGR of 22.78% from 2024 to 2033. The rising use of DNA plasmids for the development of cancer treatment therapies is propelling the growth of this segment. Various gene therapy strategies have been used for cancer, such as genetic manipulation of apoptotic, gene therapy-based immune modulation, and oncolytic virotherapy, thus, increasing the demand for plasmid DNA and further boosting the segment growth.

The growing prevalence of cancer is expected to positively influence the regional market throughout the forecast period. Furthermore, as vaccine production expands & technology progresses, the requirement for plasmid DNA manufacturing will rise. According to the American Cancer Society estimate, the overall number of new cancer cases in 2023 is approximately 1,958,310, along with 609,820 cancer deaths in the U.S., and is thereby, boosting the market growth.

The GMP grade segment held the largest market share of 86.19% in 2023. The high share of this segment can be attributed to its wide applications in preclinical studies, such as animal testing for drug safety and metabolism. Moreover, it can be utilized for direct injection as vaccines, or ex-vivo applications, such as cell and gene therapy. Plasmid DNA that meets GMP standards is required for direct gene transfer into humans.

This process complies with important GMP requirements, such as a comparable production method and comparable quality standards. Furthermore, several manufacturers of therapeutics prefer GMP-grade plasmid DNA to meet the demand for volume as well as the quality required for use in therapeutics. Plasmids are a crucial component of material since they can impact the quality and safety of the final product. Therefore, it is strongly advised to start utilizing GMP-compliant plasmids when developing clinical batches

North America held the largest market share of 42.22% of the global market in 2023. Some of the major factors that have contributed to the large share of this region are the presence of a substantial number of centers and institutes that are engaged in the R&D of advanced therapies. Moreover, the establishment of the Recombinant DNA Advisory Committee by NIH to monitor scientific, ethical, and legal issues pertaining to the use of rDNA techniques is playing a significant role in driving the adoption of these techniques. The major role of the body is to review human gene transfer research.

Asia Pacific is anticipated to register the fastest CAGR of 22.57% from 2024 to 2033. Key factors such as the presence of untapped opportunities, economic development, improving healthcare infrastructure, and favorable initiatives by the government and manufacturers in the biotechnology sector are responsible for this rapid growth. Moreover, this region offers relatively inexpensive operating and manufacturing units for conducting research. Japan is leading the Asian market as it is considered a hub for regenerative medicine research. Moreover, according to the Japanese prime minister, regenerative medicine and cell therapy are key to the economic growth of the country. The country is geared to establish a global leader in the development and marketing of stem cells. Thus, driving the market growth in the Asia Pacific region.

The continuous demand for plasmid DNA manufacturing products by multiple applications has created numerous market opportunities for major players to capitalize on.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Plasmid DNA Manufacturing market.

By Grade

By Development Phase

By Application

By Disease

By Regional