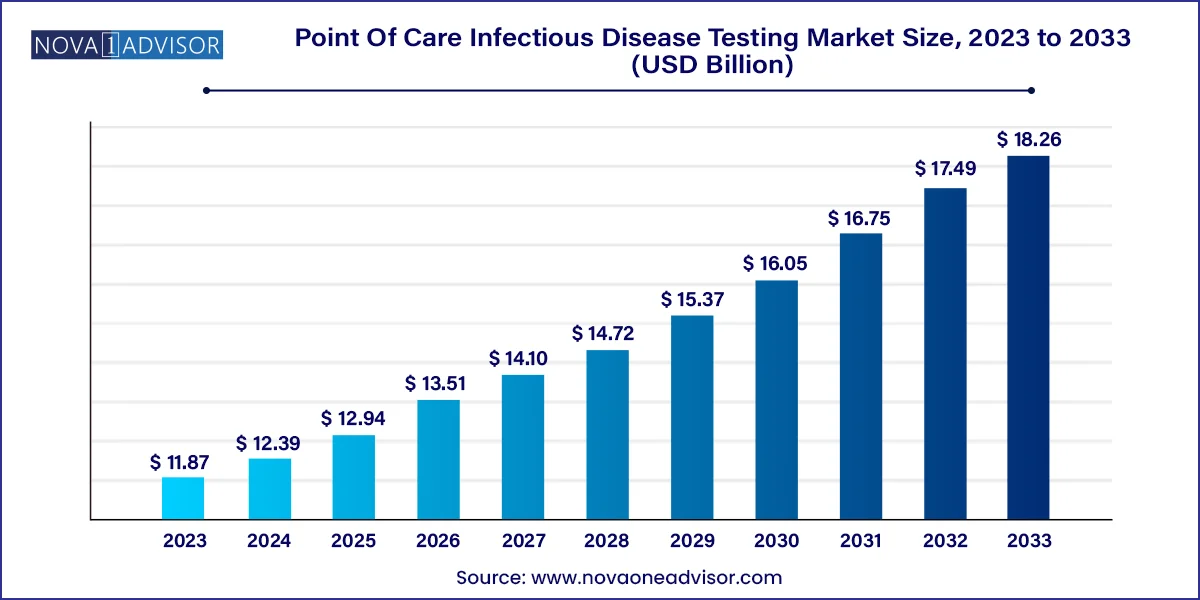

The global point of care infectious disease testing market size is expected to be worth around USD 18.26 Billion by 2033 from USD 11.87 Billion in 2023, growing at a Compound Annual Growth Rate (CAGR) of 4.4% during the forecast period from 2024 to 2033.

The Point-of-Care (POC) Infectious Disease Testing Market represents a rapidly growing and transformative segment of global healthcare diagnostics. Designed to deliver rapid, accurate, and actionable diagnostic results at or near the site of patient care, POC testing has become indispensable in the detection and management of infectious diseases. The urgency of early diagnosis for conditions such as HIV, tuberculosis (TB), influenza, COVID-19, and other viral and bacterial infections has made POC testing a frontline solution across diverse healthcare environments — from hospitals and clinics to remote rural settings and even home-based care.

One of the key differentiators of POC infectious disease testing is its ability to provide time-sensitive diagnostic information, often within minutes to an hour. This capability is crucial in containing disease outbreaks, initiating immediate treatment, and reducing transmission rates. The market has evolved significantly over the past decade, particularly in response to pandemics and endemic infections. The COVID-19 pandemic, for instance, exposed global diagnostic system vulnerabilities and prompted unprecedented investment in decentralized and rapid diagnostic testing technologies.

POC testing devices and kits employ a variety of technologies including lateral flow immunoassays, agglutination tests, and molecular diagnostic platforms such as RT-PCR and isothermal amplification. These are used to detect antigens, antibodies, and nucleic acids of pathogens causing diseases like HIV, hepatitis, influenza, human papillomavirus (HPV), and more. Advancements in microfluidics, biosensors, and mobile health integration have further fueled market innovation, enabling real-time data transmission, remote monitoring, and integration with electronic health records (EHRs).

Market participants range from established diagnostic powerhouses to agile biotech startups, all striving to address unmet diagnostic needs in both developed and low-resource settings. The increasing adoption of POC infectious disease tests by home users, ambulatory care providers, and assisted living facilities indicates a paradigm shift from centralized laboratory diagnostics to accessible, patient-centric healthcare models.

Decentralization of Diagnostic Services: Increasing preference for diagnostics closer to the patient, especially in rural or underserved areas, is boosting demand for portable POC devices.

Rise in Multiplex Testing Panels: Development of POC devices that can simultaneously test for multiple pathogens (e.g., respiratory panels) is improving efficiency in clinical decision-making.

Integration with Digital Health Platforms: POC devices embedded with connectivity features for data sharing, remote monitoring, and telemedicine applications are growing in popularity.

Post-COVID Diagnostic Expansion: Continued testing demand for SARS-CoV-2 and related respiratory viruses is expanding the scope and use cases of POC solutions.

Growing Adoption in Home Settings: Rising patient preference for convenience and quicker results is leading to higher adoption of home-based POC infectious disease tests.

Government & NGO Support in LMICs: International health agencies are funding POC testing for HIV, TB, and malaria in low- and middle-income countries to improve disease surveillance.

Shift Toward Molecular POC Testing: Advanced POC molecular diagnostics are gaining traction due to their high sensitivity and specificity, even in low pathogen load conditions.

Expansion of Disease Coverage: POC testing is expanding to include emerging infections such as monkeypox, Zika virus, and antimicrobial resistance (AMR) markers.

| Report Attribute | Details |

| Market Size in 2024 | USD 12.39 Billion |

| Market Size by 2033 | USD 18.26 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.4% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, disease, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Abbott; Thermo Fisher Scientific Inc; F. Hoffmann-La Roche Ltd; Siemens Healthineers; Becton, Dickinson & Company; Chembio Diagnostics Inc.; Trinity Biotech; Cardinal Health; Quest Diagnostics Incorporated; Bio-Rad Laboratories Inc.; bioMérieux SA; Sight Diagnostics Ltd.; Gene POC; Trivitron Healthcare; OJ-Bio Ltd.; Ortho-Clinical Diagnostics.; |

One of the strongest market drivers is the critical need for rapid diagnostic tools to control the spread of infectious diseases. In clinical and non-clinical settings alike, the ability to detect infections swiftly and initiate treatment is essential for patient outcomes and public health safety. Traditional diagnostic methods, often reliant on centralized laboratories, involve long turnaround times, transport logistics, and delays in care — all of which can lead to higher transmission rates, poorer health outcomes, and increased healthcare costs.

POC infectious disease tests address these issues by offering real-time or near-real-time results, enabling immediate clinical decision-making. This capability was particularly evident during the COVID-19 pandemic, where rapid antigen and molecular tests were deployed globally to manage outbreaks. Similarly, POC HIV tests allow at-risk individuals to receive status confirmation in a single visit, improving linkage to care and treatment adherence. The growing awareness of asymptomatic carriers in diseases like influenza and COVID-19 has further emphasized the need for quick, reliable diagnostics. Governments, hospitals, and private players are now investing heavily in POC infrastructure as part of epidemic preparedness and response strategies.

Despite their rapidity and convenience, point-of-care tests often face scrutiny over variability in sensitivity and specificity, especially in comparison to centralized laboratory-based methods. The diagnostic accuracy of some antigen-based lateral flow tests may decline in the early or late phases of infection, or in the presence of low pathogen loads. This issue can lead to false negatives or positives, undermining clinician confidence and patient safety.

Additionally, regulatory approval processes for new POC infectious disease tests can be complex and time-consuming, particularly in multi-jurisdictional markets. Ensuring compliance with FDA, CE, WHO Prequalification, and other standards often requires extensive clinical validation studies, robust manufacturing protocols, and post-market surveillance. These requirements, while essential for quality assurance, can pose entry barriers for smaller manufacturers and delay market availability of innovative products. As a result, test developers must navigate a delicate balance between speed, accuracy, and regulatory compliance.

One of the most transformative opportunities lies in scaling POC infectious disease testing in low- and middle-income countries (LMICs), where access to laboratory infrastructure is limited or non-existent. In these regions, infectious diseases such as HIV, TB, malaria, hepatitis, and respiratory infections remain major causes of morbidity and mortality. Conventional diagnostic pathways are often hampered by long travel distances, lack of trained personnel, and cost barriers.

POC testing offers a game-changing solution by bringing accurate, affordable, and user-friendly diagnostics to primary care centers, mobile clinics, and community health workers. Programs by organizations such as the Global Fund, UNICEF, and the Gates Foundation are already funding the deployment of POC HIV and TB diagnostics in sub-Saharan Africa, Southeast Asia, and Latin America. The development of battery-operated, solar-powered, and instrument-free devices further enhances feasibility in remote settings. Expanding public-private partnerships and tech transfer programs can significantly accelerate the availability and adoption of POC infectious disease tests in these high-burden areas.

COVID-19 segment dominated the market and accounted for a share of 67.22% in 2023. Owing to the sudden and unprecedented need for large-scale rapid testing. The development of antigen and molecular COVID-19 POC tests in response to the global pandemic dramatically expanded the reach of this segment. Even post-pandemic, ongoing surveillance for SARS-CoV-2 variants and future respiratory virus outbreaks ensures sustained demand. Lessons learned from COVID-19 have also laid the foundation for expanding respiratory virus testing, paving the way for combination panels that can test for flu, RSV, and COVID-19 in one go.

HIV POC tests dominate the disease segment, reflecting longstanding public health efforts to control the global HIV epidemic. Rapid HIV tests allow same-day diagnosis and are crucial in reaching key populations, including in mobile testing campaigns and antenatal clinics. Initiatives such as PEPFAR (President’s Emergency Plan for AIDS Relief) and UNAIDS' “90-90-90” targets have driven widespread deployment of HIV POC diagnostics globally. These tests are often bundled with counseling services, enabling holistic care and reducing stigma.

Molecular diagnostics accounted for the largest market revenue share of 43.18% in 2023, due to its superior sensitivity and specificity, particularly in detecting low viral or bacterial loads. Technologies such as real-time PCR and isothermal amplification are increasingly being adapted for use in portable POC formats. Platforms like Cepheid’s GeneXpert and Abbott’s ID NOW have demonstrated the viability of molecular testing in emergency rooms, rural clinics, and even drive-through testing setups. As innovation reduces device footprint and cost, molecular POC testing is becoming more accessible for routine diagnostics, especially in sexually transmitted infections, drug-resistant TB, and HPV screening.

Lateral flow immunoassay is expected to register the fastest CAGR of 5.7% during the forecast period. driven by its simplicity, low cost, and ability to deliver results within minutes. These tests are widely used for conditions such as influenza, COVID-19, RSV, and HIV. Their ease of use without the need for laboratory equipment or extensive training makes them ideal for both clinical and at-home applications. In recent years, improvements in antibody specificity and test design have enhanced the reliability of these assays. The high-volume production and scalability of lateral flow tests also supported global diagnostic needs during the pandemic, cementing their position in the POC testing landscape.

Hospitals represent the dominant end-use segment, driven by the need for rapid decision-making in emergency departments, intensive care units, and inpatient settings. POC infectious disease tests help triage patients, guide antimicrobial therapy, and reduce unnecessary hospital admissions. Institutions prefer integrated diagnostic platforms that support multiple tests with minimal operator dependency. Moreover, the inclusion of POC results in electronic health records streamlines clinical workflows and enhances care coordination.

The home segment is projected to grow at the fastest CAGR of 5.5% over the forecast period, Consumers now actively seek over-the-counter rapid tests for influenza, COVID-19, and STDs, reflecting a shift toward self-care and health autonomy. Diagnostic companies are increasingly designing user-friendly, app-integrated kits with video instructions, teleconsultation features, and auto-reporting capabilities. Regulatory bodies like the U.S. FDA and the European Medicines Agency are also expanding approvals for at-home use, accelerating this growth trend..

North America point of care infectious disease testing market dominated the market with the revenue share of 51.33% in 2023 Factors such as advanced healthcare infrastructure, high awareness levels, favorable reimbursement policies, and rapid adoption of diagnostic technologies contribute to its dominance. The region is home to major diagnostic companies like Abbott, Becton Dickinson, and QuidelOrtho, which continue to launch innovative products for both professional and home use. Additionally, pandemic preparedness initiatives and government-backed surveillance programs have ensured consistent investment in POC testing infrastructure.

Asia-Pacific is witnessing the fastest growth, driven by expanding healthcare access, rising infectious disease burden, and supportive public health programs. Countries like India, China, Indonesia, and Vietnam are implementing POC diagnostic solutions for diseases like TB, dengue, hepatitis, and malaria. Government and NGO initiatives, combined with an increasingly tech-savvy population, are promoting widespread use of mobile-linked diagnostic tools. Local companies are also emerging with cost-effective, ruggedized devices suited for diverse geographies, further enhancing adoption across urban and rural areas.

March 2024: Abbott launched its dual COVID-19/flu antigen test for at-home use in the U.S., expanding its consumer testing portfolio.

February 2024: Qiagen received CE-IVD approval for its syndromic POC panel detecting respiratory pathogens including RSV, COVID-19, and influenza.

January 2024: Roche Diagnostics expanded distribution of its Cobas Liat POC platform into Asia-Pacific to support influenza and SARS-CoV-2 testing.

December 2023: LumiraDx partnered with the U.K. NHS to provide community health centers with portable molecular diagnostic units for TB and HIV.

October 2023: BioSure Global introduced an app-connected HIV self-test kit in South Africa, offering guidance, tracking, and telemedicine follow-up.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Point Of Care Infectious Disease Testing market.

By Technology

By Disease

By End Use

By Region