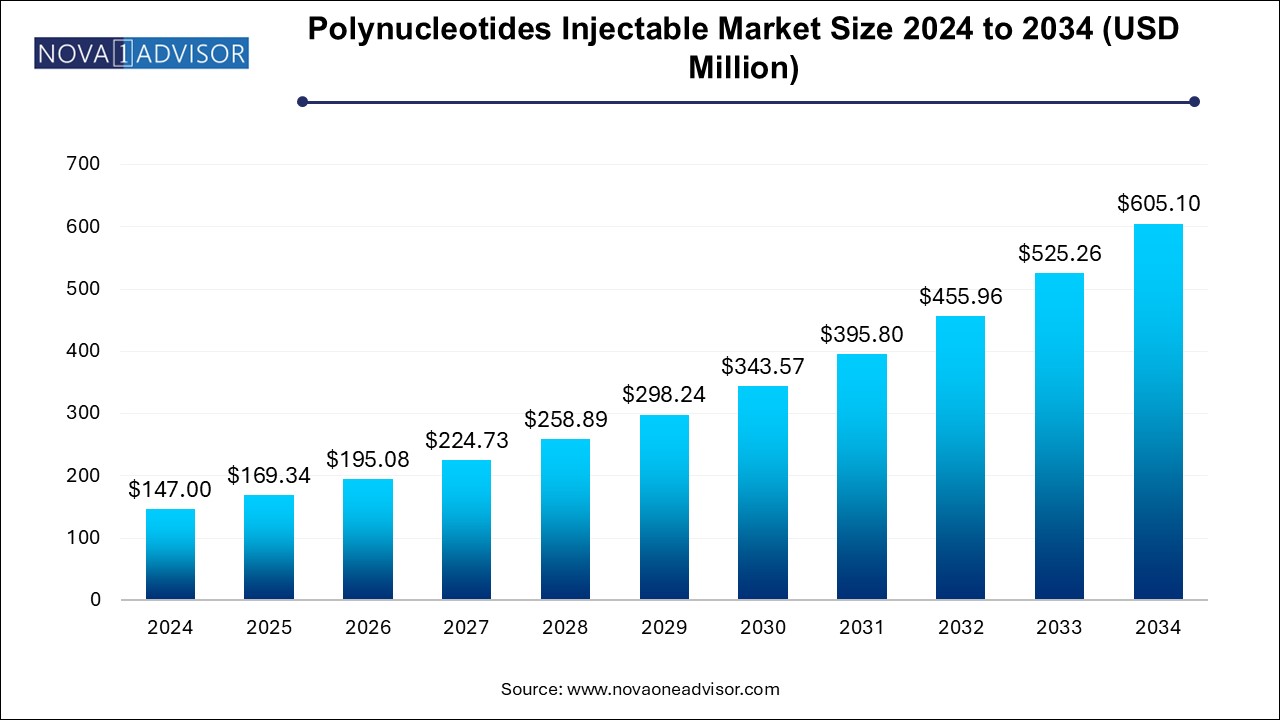

The polynucleotides injectable market size was exhibited at USD 147.0 million in 2024 and is projected to hit around USD 605.1 million by 2034, growing at a CAGR of 15.2% during the forecast period 2025 to 2034.

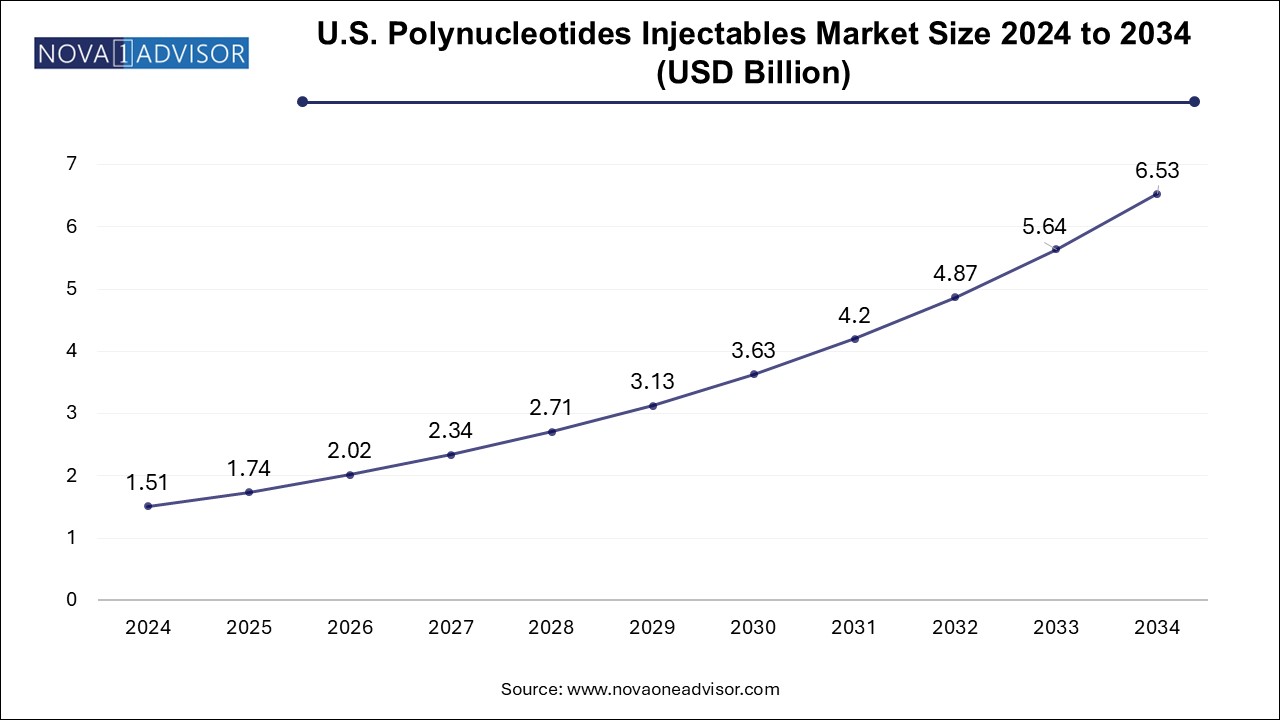

The U.S. polynucleotides injectable market size is evaluated at USD 1.51 billion in 2024 and is projected to be worth around USD 6.53 billion by 2034, growing at a CAGR of 15.8% from 2025 to 2034.

Europe dominates the global polynucleotides injectable market, backed by regulatory support, early product innovation, and a culture that favors natural beauty and holistic aesthetics. Italy, Germany, France, and Spain are key contributors, with several CE-marked PN injectables developed and launched by European biotech firms. European dermatology conferences have showcased PNs as a breakthrough in regenerative injectables, accelerating clinician adoption. Additionally, European consumers tend to opt for gradual, skin-improving procedures over aggressive cosmetic alterations, aligning perfectly with the benefits offered by polynucleotide therapies. The continent’s robust aesthetic infrastructure and medical training standards ensure safe and effective administration of these products.

Asia Pacific is the Fastest Growing Region

Asia Pacific is the fastest-growing regional market, driven by a deeply ingrained beauty culture, high skin consciousness, and rapid growth in the cosmetic dermatology industry. Countries like South Korea, Japan, and China are seeing explosive demand for injectables that deliver skin regeneration, especially among younger women and professionals. In South Korea, for instance, PNs have become a staple in beauty clinics, often marketed under the popular brand "Rejuran" as skin boosters for texture refinement and glow enhancement. Local biotech companies are also developing competitive formulations, lowering treatment costs and increasing access. The influence of K-beauty, combined with a proactive approach to skincare and innovation-friendly markets, places Asia Pacific at the forefront of market expansion.

The polynucleotides injectable market has witnessed a significant surge in recent years, primarily fueled by the rising consumer demand for regenerative aesthetics and biocompatible skin rejuvenation therapies. Polynucleotides (PNs) are natural biopolymers composed of nucleotide chains that have demonstrated remarkable therapeutic potential in promoting tissue regeneration, hydration, and collagen synthesis. Their application in aesthetic medicine has positioned them as a preferred alternative to conventional fillers such as hyaluronic acid, particularly for individuals seeking more natural and long-lasting results.

Unlike volumizing dermal fillers that primarily add mass or contour, polynucleotide injectables operate at the cellular level, stimulating fibroblast activity and enhancing extracellular matrix regeneration. This dual action—combining hydration with biological repair—makes them ideal for treating delicate or thin-skinned areas, including the eyes, lips, forehead, and jawline. In recent clinical studies, polynucleotides have shown superior efficacy in improving skin tone, elasticity, and radiance while minimizing post-procedural inflammation.

Globally, aesthetic dermatology has moved beyond merely addressing aging symptoms to promoting holistic skin health. As consumers become more educated and skincare-conscious, polynucleotides are gaining traction for their regenerative properties and minimal side effects. Their growing use across medspas, cosmetic clinics, and hospitals reflects the increasing integration of biologically active injectables into mainstream aesthetic practice. Moreover, the rise in non-invasive procedures, coupled with the influence of social media trends, has significantly enhanced market visibility for polynucleotide-based treatments.

The regulatory landscape is also gradually evolving to support innovation in injectable biotechnology. While Europe remains the primary hub for product launches and clinical validations, markets across Asia Pacific and North America are catching up swiftly. As more clinical trials confirm the safety and efficacy of these formulations, the global polynucleotides injectable market is poised to expand robustly through 2034, capturing both medical and aesthetic application domains.

Shift Toward Regenerative Aesthetics: Increasing demand for treatments that support natural healing and collagen stimulation over synthetic fillers.

Growing Preference for Natural-Looking Results: Consumers are moving away from exaggerated facial enhancements to subtle, refreshed appearances.

Integration of Polynucleotides in Combination Therapies: Often used alongside PRP, microneedling, and HA fillers to enhance outcomes and skin quality.

Rise in Preventive Aesthetics: Younger demographics in their 20s and 30s are seeking polynucleotide-based injectables as a preventive anti-aging solution.

Emergence of Asia Pacific as a Market Hotspot: South Korea, Japan, and China are witnessing a boom in demand, supported by beauty culture and local product innovation.

Product Differentiation Through Crosslinking and Hybrid Formulas: Brands are enhancing polynucleotide injectables with hyaluronic acid or peptide blends for multi-functional use.

MedSpa Segment Driving Volumes: The rising number of wellness centers and luxury medspas is expanding accessibility and adoption of polynucleotide injections.

| Report Coverage | Details |

| Market Size in 2025 | USD 169.34 Million |

| Market Size by 2034 | USD 605.1 Million |

| Growth Rate From 2025 to 2034 | CAGR of 15.2% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | PHARMA RESEARCH; BIOPLUS CO. LTD.; LG Chem; AMEELA; Mastelli; Pluryal; Promoitalia Laboratories; Fox Pharma; BR Pharm; DermaFocus |

A key driver fueling the growth of the polynucleotides injectable market is the growing consumer preference for natural, non-invasive, and regenerative cosmetic solutions. As awareness around skin biology and aging mechanisms increases, a significant portion of aesthetic consumers are moving away from traditional fillers that merely volumize or immobilize. Instead, they are seeking treatments that rejuvenate the skin from within, support tissue repair, and offer cumulative benefits without the risk of distortion or stiffness.

Polynucleotides, derived from purified DNA fragments (often sourced from salmon or other marine sources), are ideal for such regenerative therapies. They activate fibroblast proliferation, improve vascularization, and stimulate collagen and elastin production. For example, in clinical applications, PN injectables have shown superior results in under-eye rejuvenation, an area where traditional fillers often fall short due to sensitivity and risk of puffiness. This trend toward restorative aesthetics is particularly strong among Millennials and Gen Z, who view skincare as part of a broader wellness regimen, thereby bolstering market expansion.

One of the prominent restraints hindering market growth is the lack of clear regulatory guidelines and clinical standardization across geographies. Polynucleotide injectables, being biologically derived, often fall into regulatory gray areas, particularly in markets where classification between medical devices, biologics, and cosmetic injectables is still evolving. For instance, while the European Union has granted CE markings for several PN products under aesthetic applications, the U.S. FDA continues to classify most such formulations as investigational, thereby limiting their commercial availability.

Additionally, there is a shortage of long-term, large-scale clinical studies comparing polynucleotide injectables with traditional dermal fillers or autologous treatments. The absence of standardized treatment protocols, dosage guidelines, and consensus on ideal injection techniques creates variability in results, deterring some practitioners from full adoption. To address this challenge, greater collaboration between biotech manufacturers, dermatology societies, and regulators is essential to define clinical benchmarks and enhance practitioner confidence.

A transformative opportunity lies in the development of hybrid injectable formulas that combine polynucleotides with other bioactive agents such as hyaluronic acid (HA), peptides, antioxidants, or amino acids. These multifunctional injectables provide synergistic effects, enabling hydration, volume restoration, and cellular repair in a single application. For example, certain European and Korean brands have introduced dual-chamber syringes containing PNs and HA to target both superficial wrinkles and deeper dermal laxity in one session.

Furthermore, the rising popularity of "functional aesthetics"—where treatments aim to improve not just appearance but also skin health—is reshaping treatment protocols. Practitioners are increasingly incorporating polynucleotide injectables in post-laser recovery, scar repair, and rosacea treatment plans due to their anti-inflammatory and reparative properties. This multidimensional approach opens new market avenues beyond anti-aging, extending into therapeutic dermatology and post-operative care. As scientific backing grows, these hybrid applications are expected to attract wider practitioner adoption and drive product innovation.

The Jawline and cheekbone enhancement dominates the application segment, primarily due to the increasing demand for facial contouring and structure refinement. While traditional dermal fillers have long served this purpose, polynucleotide injectables are now being used to provide subtle volume while enhancing skin firmness and elasticity. This dual-action appeal—lifting and regenerating—makes PNs ideal for improving mid-face aesthetics without the risk of overfilling or creating unnatural contours. Clinical outcomes suggest that repeated sessions lead to sustained collagen remodeling, making the jawline and cheekbones one of the most requested treatment areas, especially among consumers aged 30–50.

On the other hand, under-eye and periorbital areas represent the fastest-growing application segment, driven by the demand for delicate and safe rejuvenation treatments. The thin skin under the eyes makes it highly susceptible to aging signs, yet also challenging to treat due to the risk of bruising, puffiness, or product migration. Polynucleotide injectables offer a safe, biologically compatible alternative, stimulating microcirculation, reducing pigmentation, and enhancing skin tone. Clinics across South Korea and Europe report high satisfaction rates with PNs for dark circles and eye bags, fueling a surge in procedures tailored for this region. With rising demand for "tear trough" and under-eye rejuvenation treatments, this segment is set for rapid expansion.

The MedSpas dominate the end-use segment, accounting for a substantial share of polynucleotide injectable procedures. The growth of medical spas has coincided with the trend toward minimally invasive and luxury wellness treatments. These settings offer an ideal platform for aesthetic injections due to their ambiance, personalized service, and bundled skincare offerings. MedSpas often operate under medical oversight while providing high-volume services in urban and high-income neighborhoods. Their marketing strategies, social media presence, and influencer collaborations also contribute significantly to consumer education and treatment uptake.

The Aesthetic and cosmetic centers are the fastest-growing end-users, especially in emerging markets and Tier 2 cities. These specialized clinics focus solely on cosmetic dermatology and are expanding their service portfolios to include polynucleotide injectables as demand grows. Many clinics have begun offering signature protocols incorporating PNs with microneedling or laser treatments to improve skin tone, texture, and resilience. Moreover, these centers are often the early adopters of new injectable technologies, providing a testbed for clinical protocols and consumer feedback. Their expertise and agility position them to be key growth drivers in the coming years.

March 2025: Italian company Mastelli Aesthetic announced a new generation of polynucleotide-based injectables, combining salmon DNA with growth factors for enhanced tissue regeneration, launched across European aesthetic clinics.

January 2025: South Korea’s Caregen Inc. unveiled its patented PN+HA hybrid filler line “RejuNate,” targeting mid-face volume restoration and periorbital rejuvenation, receiving positive clinical feedback.

December 2024: Aesthetic physician-led startup in Japan raised over $12 million in Series A funding to develop AI-assisted injection planning systems for PN-based aesthetic treatments.

November 2024: German biotech firm BioRegen partnered with a Dubai-based distributor to expand PN product reach across the Middle East and Africa, citing growing demand in luxury medspas.

September 2024: U.S. FDA granted investigational device exemption (IDE) status to a new injectable polynucleotide formulation under evaluation for atrophic acne scar repair in clinical trials.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the polynucleotides injectable market

By Application

By End-use

By Regional