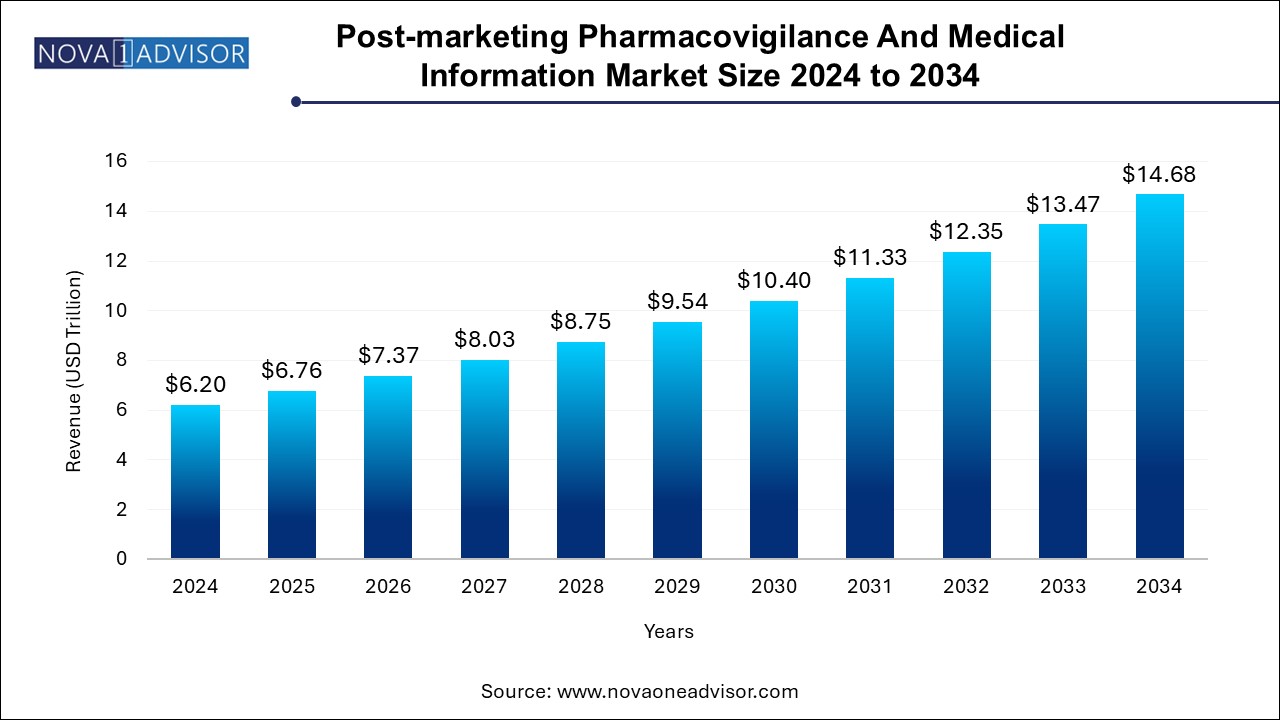

The post-marketing pharmacovigilance and medical information market size was exhibited at USD 6.20 trillion in 2024 and is projected to hit around USD 14.68 trillion by 2034, growing at a CAGR of 9.0% during the forecast period 2024 to 2034.

The Post-marketing Pharmacovigilance and Medical Information Market plays an indispensable role in ensuring the long-term safety, efficacy, and optimal use of pharmaceutical products once they have been approved for public consumption. Post-marketing surveillance, a cornerstone of pharmacovigilance, captures and analyzes real-world data from diverse populations over extended periods—offering insights that pre-approval clinical trials may not fully uncover. The inclusion of medical information services within this domain reflects the growing emphasis on patient education, transparency, and regulatory compliance.

With the rising complexity of drug therapies, especially biologics, gene therapies, and personalized medicines, post-marketing monitoring has become more nuanced and technologically driven. Adverse Drug Reactions (ADRs), drug interactions, and long-term complications are often detected after commercial launch, prompting regulatory authorities such as the FDA, EMA, and PMDA to mandate comprehensive post-marketing pharmacovigilance frameworks. Furthermore, growing patient engagement, social media monitoring, and the rise of health data from wearable devices and Electronic Health Records (EHRs) are influencing how safety data is collected and interpreted.

Pharmaceutical companies, Contract Research Organizations (CROs), and healthcare providers are investing in advanced signal detection systems, artificial intelligence (AI), and data mining tools to streamline adverse event reporting and improve data accuracy. Medical information services now go beyond simply handling inquiries—they are part of an integrated safety ecosystem that supports healthcare professionals and patients with evidence-based, product-specific information in real time.

Artificial Intelligence in Signal Detection: AI and machine learning are increasingly deployed for early identification of safety signals by analyzing large volumes of structured and unstructured data.

Integration with Real-World Data (RWD): Pharmacovigilance systems are now incorporating data from EHRs, claims databases, and patient registries to supplement traditional reporting.

Cloud-based Pharmacovigilance Platforms: Companies are adopting cloud-based PV systems for real-time access, scalability, and streamlined collaboration between global teams.

Outsourcing of Medical Information Services: Many pharmaceutical firms are outsourcing post-marketing surveillance and medical information operations to CROs and specialized vendors to reduce cost and improve efficiency.

Rising Use of Social Media Monitoring: Spontaneous ADRs and safety concerns are increasingly being tracked through sentiment analysis and data mining of patient feedback on platforms like Twitter, forums, and health-focused communities.

Personalized Medicine Demands Tailored Monitoring: Drugs designed for specific genetic or phenotypic profiles require specialized post-marketing safety protocols to detect niche ADRs.

Mobile Applications and Chatbots: Mobile platforms are being used to collect real-time ADR data from patients and to provide instant medical information via AI-powered chatbots.

Regulatory Push for Transparency: Agencies such as the FDA and EMA are enforcing stricter post-marketing obligations, including Risk Evaluation and Mitigation Strategies (REMS) and Risk Management Plans (RMPs).

| Report Coverage | Details |

| Market Size in 2025 | USD 6.76 Trillion |

| Market Size by 2034 | USD 14.68 Trillion |

| Growth Rate From 2024 to 2034 | CAGR of 9.0% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Service, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | IQVIA Inc; Parexel International (MA) Corporation; Laboratory Corporation of America Holdings; ICON plc; Syneos Health; Accenture; Cognizant; F. Hoffmann-La Roche Ltd; Sanofi; ArisGlobal; Ergomed Group; Medpace; IBM Corporation; Wipro; Capgemini |

A major driver of growth in the post-marketing pharmacovigilance and medical information market is increasingly stringent global regulatory mandates aimed at ensuring drug safety and public health. Regulatory bodies such as the U.S. FDA, European Medicines Agency (EMA), Japan’s PMDA, and India’s CDSCO have enhanced their pharmacovigilance frameworks to require not only spontaneous ADR reporting but also proactive, structured safety data collection methods.

For instance, the FDA mandates REMS for drugs with serious safety concerns post-approval, compelling manufacturers to continuously assess benefit-risk ratios. Similarly, the EMA's EudraVigilance database is one of the largest ADR repositories in the world, requiring marketing authorization holders to conduct periodic safety update reports (PSURs). These evolving mandates are encouraging pharmaceutical companies to build or outsource robust pharmacovigilance and medical information infrastructures, thus driving market demand.

One of the most pressing challenges for the market is data standardization and interoperability issues across pharmacovigilance systems. Given the diverse sources of safety data—ranging from EHRs and mobile applications to social media and wearable devices—there is a lack of unified frameworks for data harmonization.

Disparate data formats and terminologies make it difficult to perform consistent signal detection and trend analysis. Additionally, cross-border regulatory submissions often involve varying data compliance requirements (such as MedDRA vs. WHO-ART coding), leading to delays and inefficiencies. Smaller companies and institutions with limited IT infrastructure face significant barriers in upgrading to compatible systems, thus slowing market growth.

A prominent opportunity in the market lies in the expanding application of EHR mining for post-marketing surveillance. EHRs house a goldmine of longitudinal patient data that, when mined using advanced analytics, can reveal important trends in drug efficacy, safety, and off-label usage. This method allows pharmaceutical companies and regulators to detect subtle ADR patterns that may not be reported through traditional channels.

For instance, mining EHR data from large hospital networks can uncover correlations between long-term statin use and rare muscular or cognitive effects. Companies like IBM Watson and Oracle Cerner are already partnering with pharmacovigilance teams to offer intelligent EHR data mining capabilities. The ability to extract real-world insights from anonymized EHRs can significantly enhance signal detection, particularly in rare disease populations and post-biologic therapy scenarios.

The spontaneous reporting service segment dominated the post-marketing pharmacovigilance and medical information market with a revenue share of 35.0% in 2024. Spontaneous reporting, where healthcare professionals or patients voluntarily report adverse events, forms the foundation of global safety databases like FAERS (U.S.) and VigiBase (WHO). These systems are often the first source of information about emerging safety issues, particularly during the early post-approval phase.

Pharmaceutical companies are required to implement robust spontaneous reporting mechanisms, including call centers, online forms, and automated tools. With the advent of mobile apps and social listening technologies, this method is being enhanced to capture real-time feedback. Its continued dominance is also driven by increasing patient awareness and the push for patient-centric drug monitoring practices.

Conversely, EHR mining has emerged as the fastest growing service segment, propelled by the surge in health data digitization and advances in natural language processing (NLP). EHR mining involves extracting meaningful safety and usage data from clinical records, laboratory notes, prescriptions, and follow-up visits—providing a richer context for evaluating a drug's real-world performance.

The growing adoption of interoperable EHR platforms, especially in North America and Europe, has enabled large-scale data mining projects. For instance, the Sentinel Initiative by the FDA leverages EHR data to proactively identify adverse events. The integration of machine learning in EHR analysis is accelerating the growth of this segment, offering opportunities to uncover subtle patterns and rare ADRs not visible through conventional reporting.

The hospital segment dominated the post-marketing pharmacovigilance and medical information market with a revenue share of 60.0% in 2024. Hospitals are increasingly incorporating pharmacovigilance protocols as part of their medication safety and quality assurance programs. Dedicated Drug Safety Units (DSUs) in tertiary care hospitals often function as formal reporting centers to national PV databases.

Moreover, academic medical centers and teaching hospitals serve as hubs for pharmacovigilance research and pilot programs for ADR detection technologies. With the increased digitization of hospital records, many facilities are now using clinical decision support systems (CDSS) to flag potential drug interactions, which also contributes to better post-marketing surveillance.

Research organizations—including Contract Research Organizations (CROs), academic institutes, and non-profits—are emerging as the fastest growing end users of post-marketing pharmacovigilance services. With rising R&D outsourcing, CROs are increasingly responsible for end-to-end safety monitoring, from clinical trials to post-market follow-up. These organizations are adopting cutting-edge pharmacovigilance tools to manage multi-region safety reporting obligations.

Furthermore, the push toward evidence-based medicine and real-world evidence generation is creating demand for robust post-marketing data analytics capabilities in research environments. Institutions are partnering with pharma companies to co-develop safety monitoring platforms or contribute to public-private surveillance networks, making this segment highly dynamic and innovative.

North America dominated the global post-marketing pharmacovigilance and medical information market due to its advanced healthcare infrastructure, well-established regulatory frameworks, and technological readiness. The U.S., in particular, boasts sophisticated surveillance systems like the FDA’s Sentinel Initiative and MedWatch, which support continuous safety evaluation even after drug approval.

Moreover, the region is home to major pharmaceutical companies, CROs, and IT vendors that have invested in cloud platforms, AI tools, and big data analytics for pharmacovigilance. The prevalence of electronic health records and the integration of CDSS across healthcare facilities enhance real-time ADR detection and reporting. In Canada, Health Canada's MedEffect program also actively encourages public participation in post-marketing reporting, reinforcing the safety net.

Asia Pacific is witnessing the fastest growth in the market, driven by expanding pharmaceutical manufacturing, increasing clinical trial activity, and regulatory reforms across countries like India, China, and South Korea. Governments in these nations are implementing national pharmacovigilance programs and encouraging local pharma companies to establish strong PV frameworks to align with global standards.

India’s Pharmacovigilance Programme of India (PvPI) and China’s National Medical Products Administration (NMPA) have significantly scaled up post-marketing monitoring. Additionally, as Asia becomes a hub for drug trials and generic production, regional regulators are demanding stronger post-market surveillance mechanisms. The proliferation of EHR systems in urban hospitals and growing

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the post-marketing pharmacovigilance and medical information market

Service

End Use

Regional