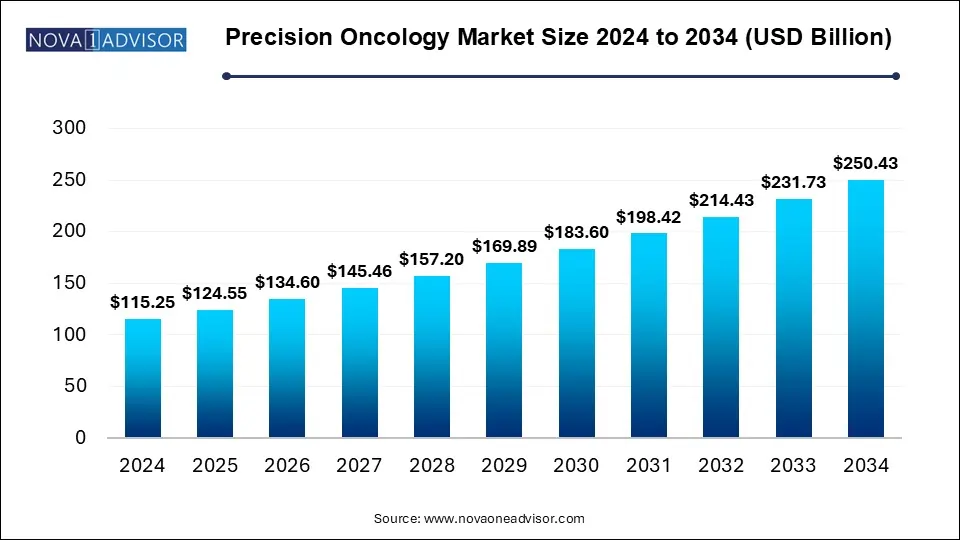

The precision oncology market accounted for USD 115.25 billion in 2024 and is expected to hits around USD 250.43 billion by 2034, growing with a CAGR of 8.07% from 2025 to 2034. This market is growing due to advancements in genomics and targeted therapies, enabling personalized cancer treatments with higher efficiency and fewer side effects.

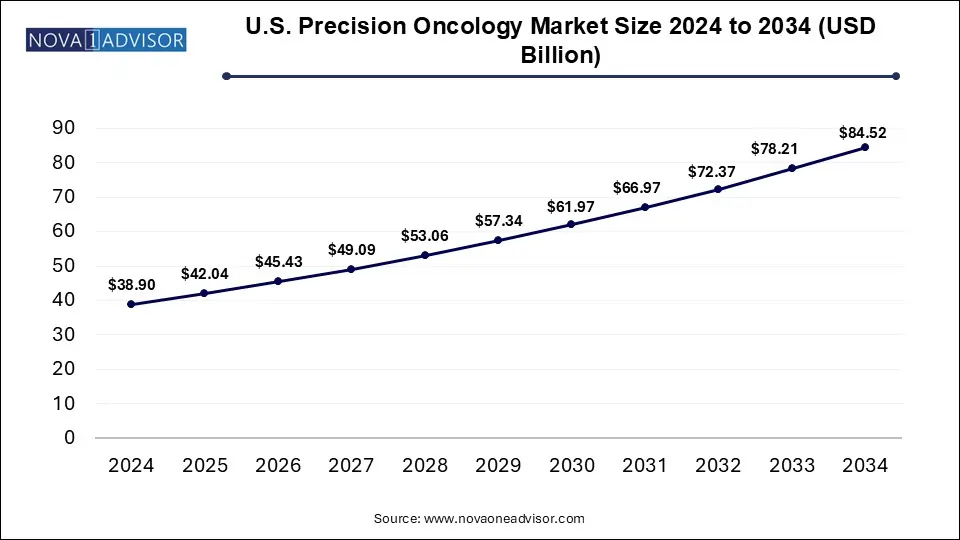

The U.S. precision oncology market size was valued at USD 38.9 billion in 2024 and is expected to hits around USD 84.52 billion by 2034, growing at a CAGR of 7.3% from 2025 to 2034.

North America will dominate the proteomics market in 2024, due to its advanced healthcare infrastructure, significant R&D investments, and strong presence of key players like Roche, Illumina, and Pfizer. Government initiatives such as the Cancer Moonshot Initiative and the All of Us Research Program further drive innovation. The region leads in genomic sequencing, biomarker-based cancer treatments, and personalized medicine adoption, fueled by a high cancer prevalence and growing demand for targeted therapies. Additionally, the region benefits from a well-established regulatory framework that supports rapid approvals of precision oncology therapies. Increasing collaborations between pharmaceutical companies, research institutes, and technology firms further accelerate market growth.

Asia Pacific is experiencing rapid growth in the precision oncology market driven by substantial investments in R&D, robust healthcare infrastructure, and widespread use of cutting-edge cancer treatments. Top cancer research institutes and significant biotechnology and pharmaceutical firms like Pfizer Merck and Bristol Myers Squibb have reinforced the region's leadership. Additionally, factors contributing to the region's dominance include early regulatory approvals for precision therapies and government programs promoting cancer research. Furthermore, the integration of AI-driven diagnostics and advantageous reimbursement policies promote the uptake of targeted treatments.

The precision oncology market is experiencing rapid growth, driven by advancements in genomic sequencing, biomarker research, and targeted therapies that enhance personalized cancer treatment. The market is expanding due to factors like rising cancer prevalence, increased demand for customized treatments, and encouraging government policies. While AI and big data analytics are enhancing early diagnosis and treatment outcomes, pharmaceuticals and biotech companies are making significant investments in precision medicine. High expenses and difficult regulations, however, continue to be a major obstacle. All things considered, as innovations continue to transform cancer care the market is expected to grow steadily.

Market Driver

Growing Adoption of Targeted Therapies

Monoclonal antibodies are examples of targeted treatments (e.g.A. small molecule inhibitors) e.g. trastuzumab for HER2-positive breast cancer). G. Imatinib for CML) has become widely accepted. In contrast to chemotherapy targeted therapies reduce side effects by minimizing damage to healthy cells. Individualized treatment regimens are increasing patient quality of life and survival rates. Targeted therapy approvals from regulators are rising which accelerates market expansion. The goal of biomarker-driven drug development is to increase efficacy according to pharmaceutical companies.

Advancements in Genomic and Molecular Research

Accurate cancer profiling and more focused treatments are made possible by ongoing advancements in next-generation sequencing (NGS) CRISPR gene editing and biomarker discovery. As genomic databases grow scientists can find new mutations and potential therapeutic targets. Through the use of single-cell sequencing, tumor heterogeneity is being better understood which will enable more accurate interventions. Proteomic and transcriptomic developments are also helping to improve treatment response forecasting and patient stratification. Precision diagnostics is becoming more widely accessible which is increasing the rate of adoption of these technologies.

Expanding Use of Liquid Biopsy and Companion Diagnostics

Non-invasive diagnostic methods such as liquid biopsies are transforming cancer monitoring and detection by offering real-time information for treatment modifications. Liquid biopsies allow for ongoing tumor evolution monitoring without invasive procedures in contrast to traditional tissue biopsies. Developments in circulation tumor DNA analysis are enhancing resistance monitoring treatment selection and early detection. In oncology drug development companion diagnostics are becoming a crucial component as they assist in determining the most effective targeted therapies for specific patients. The demand for precision oncology solutions is being driven by the expanding pipeline of biomarker-based diagnostic tests.

| Report Coverage | Details |

| Market Size in 2025 | USD 124.55 Billion |

| Market Size by 2034 | USD 250.43 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.07% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product Type, Cancer Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; Invitae Corporation; Qiagen N.V.; Illumina, Inc.; Laboratory Corporation Of America Holding; Exact Sciences Corporation; Rain Oncology Inc.; Strata Oncology, Inc.; Xilis, Inc.; Variantyx, Inc.; Bioserve; Relay Therapeutics; Acrivon Therapeutics. |

Market Opportunities

Telemedicine and Digital Health Expansion

Access to precision oncology expertise is becoming easier due to the growing use of telemedicine and digital health platforms particularly in underserved and remote areas. Remote monitoring systems, AI-powered patient management tools, and virtual consultations are expanding access to individualized cancer treatment. There is a sizable market for businesses that create digital health solutions for precision oncology such as smartphone apps for tracking symptoms and AI-powered decision support tools.

Regulatory Advancements and Policy Support

Initiatives in precision medicine are receiving more and more support from governments and regulatory bodies through funding initiatives and policy changes. The market is becoming more favorable due to accelerated drug approvals, standardized genetic testing protocols, and incentives for precision oncology research. In this growing industry businesses can obtain a competitive advantage by investing in compliance strategies and adapting to changing regulatory frameworks.

Market Challenge

High Cost of Precision Oncology Treatment

The high expense of genomic testing targeted medications and precision oncology treatments is one of the main obstacles. The high cost of advanced therapies like CAR-T cell therapy and customized cancer vaccines prevents many patients from accessing them. The expense of companion diagnostics and next-generation sequencing further increases like financial strain. Precision medicine adoption is further limited by a lack of insurance coverage especially in developing nations where access to affordable healthcare is a concern.

Therapeutics segment held the largest share in 2024 driven by the growing use of biologics immunotherapies and targeted therapies that are adapted to genetic mutations. When compared to conventional chemotherapy these treatments are more effective and have fewer side effects. Precision oncology medications like Kisqali (for breast cancer) Opdivo (for multiple cancer types) and Tagrisso (for long-term cancer) have been heavily invested in by companies like AstraZeneca Bristol Myers Squibb and Novartis. The dominance of this market segment is further reinforced by the expanding pipeline of precision medications and rising regulatory approvals.

Diagnostics segment is expected to grow at the fastest rate because of developments in liquid biopsy technology next-generation sequencing (NGS) and genetic testing. Early cancer detection and improved treatment selection based on each patient's distinct genetic profile are made possible by these advancements. Innovative diagnostic solutions such as thorough genomics profiling and AI-driven pathology tools are offered by industry leaders like Illumina Thermo Fisher Scientific and Guardant Health. The rapid growth of this market is largely driven by the growing emphasis on companion diagnostics or tests that inform the choice of individualized treatment.

Breast cancer segment held the largest share in 2024, driven by a high prevalence of the disease and a great deal of research into individualized treatment options. Targeted therapies such as Ibrance from Pfizer Herceptin from Roche and Enhertu from AstraZeneca have transformed treatment by concentrating on molecular subtypes such as hormone receptor-positive and HER-2-positive breast cancers. This segment continues to dominate due to increased awareness, better screening programs, and the introduction of innovative therapeutics.

Cervical cancer segment is expected to grow at the fastest rate, driven mostly by gynecological cancer precision medicine. The increase in HPV-related cervical cancer cases has sparked a boom in immunotherapies and biomarker-driven therapies. Targeted therapies like Tivdak and Keytruda which have demonstrated notable efficacy in treating advanced and recurrent cervical cancer cases are being developed by companies such as Merch GSK and Seagen. The emphasis on early-edge molecular diagnostics is also propelling this market's expansion.

The hospitals and diagnostic laboratories segment held the largest share in 2024 driven by being involved in the detection diagnosis and treatment of cancer. These organizations offer direct access to genomic-guided treatments and house cutting-edge molecular testing facilities. Prominent cancer facilities leading the charge to incorporate precision medicine into standard clinical practice include MD Anderson Cancer Center Mayo Clinic and Memorial Sloan Kettering Cancer Center.

The pharmaceutical & biotechnology companies segment is expected to grow at the fastest rate, driven by substantial R&D expenditures on innovative cancer medications and diagnostics. Companies like Moderna Eli Lilly and Roche are using cutting-edge technologies like CRISPR gene editing and AI-based drug discovery to create next-generation cancer treatments. Additionally propelling this segment's growth are partnerships between academic research institutions and biotech companies which guarantee ongoing innovation in precision oncology.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Precision Oncology Market

By Product Type

By Cancer Type

By End-use

By Regional