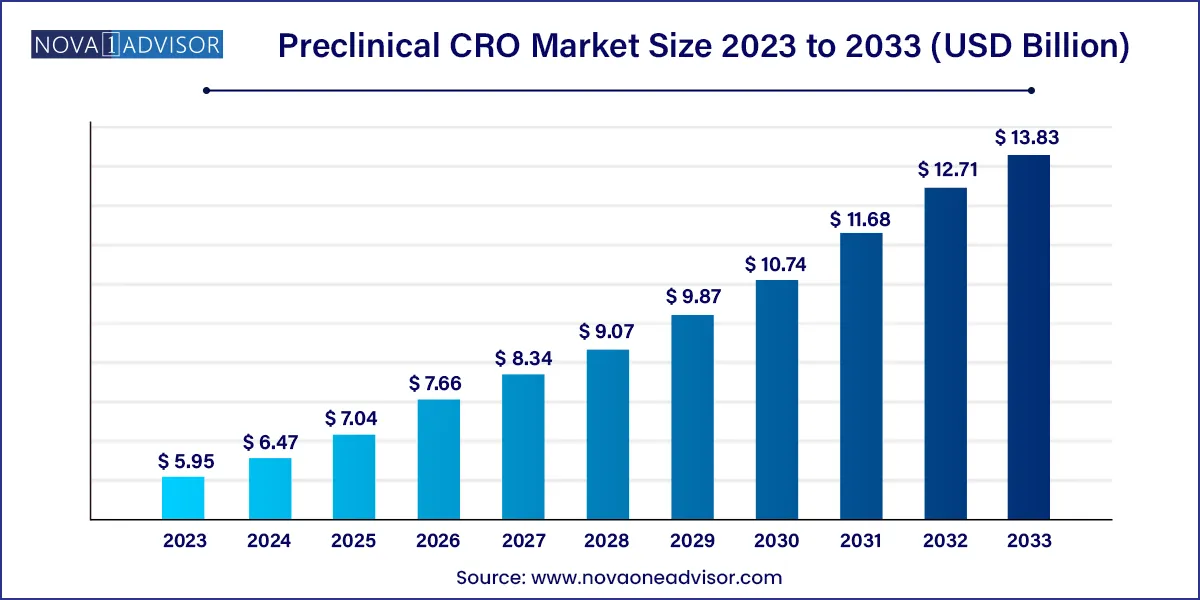

The global preclinical CRO market size was valued at USD 5.95 billion in 2023 and is projected to surpass around USD 13.83 billion by 2033, registering a CAGR of 8.8% over the forecast period of 2024 to 2033.

Increased R&D budgets for drug development are driving up demand for preclinical contract research organization (CRO) services, enhancing market growth over the forecast period. The increase in the number of preclinical trials involving big compounds, combined with the growing desire to reduce R&D costs, is projected to drive up demand for excellent preclinical CRO.

Preclinical investigations on the COVID-19 vaccine have been conducted at an exponential rate, indicating that CROs play a significant role. Increased spending on CRO services is likely to significantly increase market growth over the forecast period. The increasing demand for medications following COVID-19 is leading to market expansion. Following COVID-19, various organizations throughout the world have invested heavily in the development of treatments and medical devices. For example, from the start of the pandemic in 2020 to March 2022, the US federal government allocated around USD 2.3 billion on the research and development of mRNA COVID-19 vaccines.

The Food and medicine Administration's (FDA) medicine approval procedure has evolved significantly throughout the years. The United States recently approved the 21st Century Cures Act, which expedited the clearance process for breakthrough pharmaceuticals and medical devices. These improvements in regulatory processes are likely to spur innovation while also increasing demand for preclinical services, ultimately contributing to market expansion.

Furthermore, demand for CROs is increasing as R&D expenditure rises and pharmaceutical companies focus more on cost control. To decrease product development time and expenses, biopharmaceutical companies outsource their early-stage R&D tasks to CROs. This trend is projected to continue during the forecast period due to CROs' increasing ability to undertake complicated research, allowing life sciences organizations to cut R&D cost and focus on their core activities.

| Report Attribute | Details |

| Market Size in 2024 | USD 6.47Billion |

| Market Size by 2033 | USD 13.83 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.8% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Service, model type, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | WuXi AppTec, Inc. (WAI); LABCORP; Eurofins scientific se; Medpace holdings inc; Charles River Laboratories International, Inc.; Intertek group plc (igp); SGA SA; PPD (Thermo Fisher Scientific, Inc.); PRA Health Sciences, INC. (ICON plc); CROWN bioscience |

The toxicology testing segment accounted for the largest revenue share of 25.9% of the global preclinical CRO market in 2023, owing to a rise in outsourcing of noncore preclinical CRO studies and high adoption of toxicology tests. Toxicology is one of the key services, which is being outsourced to CROs owing to the improved capabilities of CROs to conduct toxicology tests. The growing rate of outsourcing noncore preclinical studies to the CROs and the growing capabilities of CROs to offer additional value-added services is expected to propel the growth of this segment during the forecast period.

The bioanalysis and DMPK studies segment is expected to register the fastest CAGR of 9.3% during the forecast period. The segment is expected to witness lucrative growth on account of a rise in the demand for pharmacokinetic services to support toxicology tests for IND-enabling studies. In addition, bioanalysis and DMPK studies are vital in the entire drug development process. They are performed in every stage of the drug development process and are not confined to the preclinical phase. These factors are further contributing to the segment growth.

The Patient Derived Organoid (PDO) Model segment held the largest share of 80.16% in 2023. The growing impact of the patient-derived organoid (PDO) model is due to the use of direct derived cells and tissues from the patient. This helps in personalized healthcare and the specimens can be cryopreserved. For these reasons, they are becoming an essential part of preclinical studies as they help in quicker diagnosis and prognosis of malignancy.

The Patient derived xenograft (PDX) model market has been analyzed to grow at a CAGR of 8.4% during the forecast period. This is attributed to the growing number of CROs maintaining an in-house inventory of immunodeficient mice with patient-derived xenografts (PDXs). Furthermore, this type of analysis allows researchers to co-relate the laboratory research with humans, owing to the maintenance of the original genetic makeup of the tumor cells. Also, the responses observed in clinical trials among patients have been found to correlate with the responses in these patient-derived xenografts, which in turn allows for a better safety profile and thus expedites the approval of New Drug Investigation (NDA).

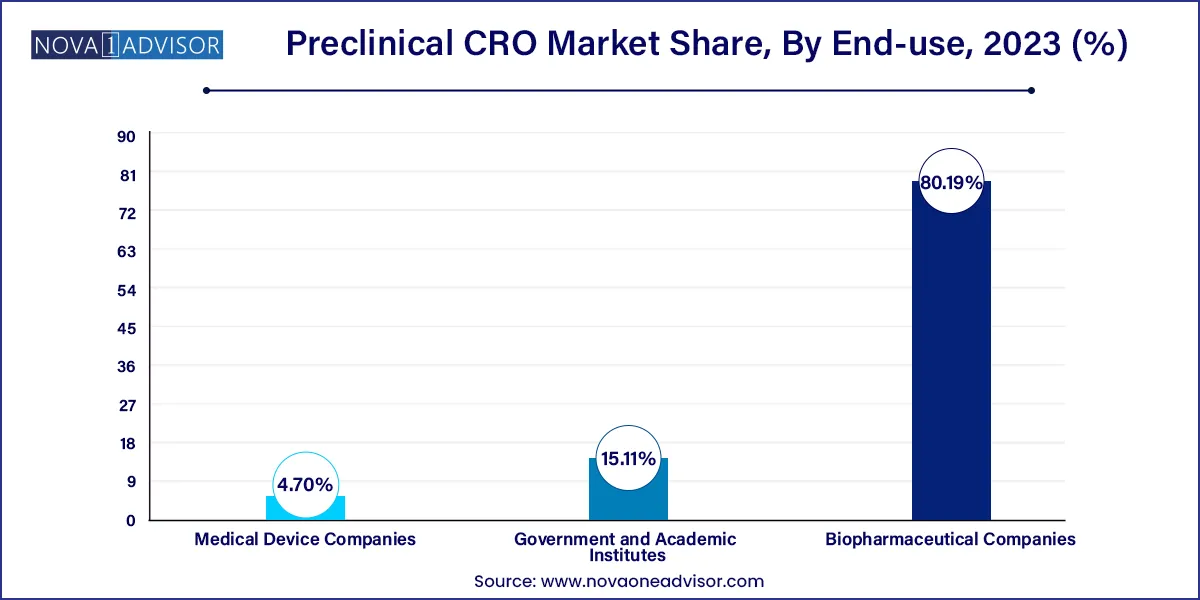

The biopharmaceutical companies segment is expected to hold the largest market share of 80.19% in 2023. The increasing trend of outsourcing end-to-end services among biopharmaceutical companies, especially amongst the small- and mid-size companies that lack sufficient expertise in the preclinical phase of drug development, is expected to boost the demand for preclinical CRO services in the future.

The government and academic institutes segment are estimated to register the fastest growth of 9.1% during the forecast period. Academia and government bodies play a crucial role in the preclinical phase of discovery and development. In addition, an increasing number of academic organizations and government bodies outsourcing preclinical services to CROs will boost the segment growth. Academic institutes are one of the major sources of revenue for big CROs, such as Charles River Laboratories and LabCorp.

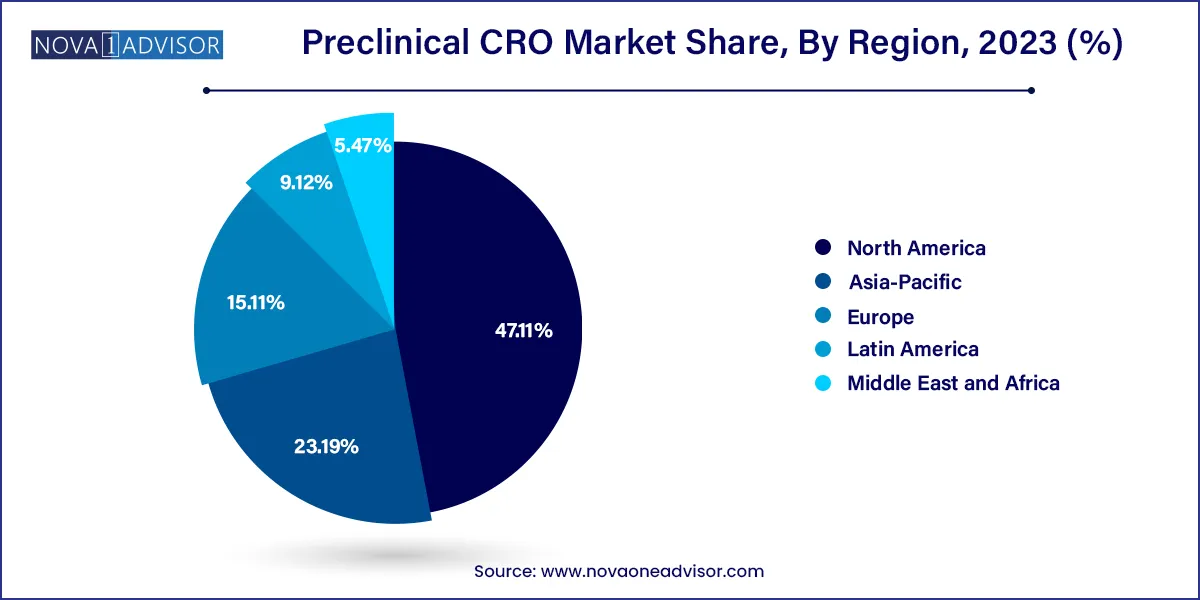

North America accounted for the largest share of 47.11% in 2023 owing to the presence of established CROs specializing in early drug discovery, such as Charles River Laboratories and LabCorp. The U.S. is the biggest market for preclinical trial outsourcing, as several biopharmaceutical companies prefer outsourcing their preclinical trials to CROs based in the U.S., to seek benefit from the Investigational New Drug (IND) application, approved by the FDA.

The U.S. accounted for the highest share in the global preclinical trial outsourcing market as a large number of pharmaceutical and life sciences companies are present in this region. CROs in the country possess various capabilities such as genotoxicity and immunotoxicity testing services, which are majorly carried out in the U.S. Along with this, rapid growth in emerging areas of medicine such as personalized medicines, orphan drugs, and biosimilar is expected to propel growth of the preclinical trial outsourcing market in the U.S.

Asia Pacific is also anticipated to grow at the fastest rate of 11.6% during the forecast period. The changing business model of MNC outsourcing and the rising cost of R&D is expected to increase preclinical outsourcing in the Asia Pacific, owing to the cost efficiency offered by CROs in countries such as India and China. Established companies located in Western Europe and the U.S. pursue analytical services, site research development, and clinical activities in the Asia Pacific region in order to reduce the cost associated with research.

Japan is considered to be one of the largest pharmaceutical markets across the globe. The growing pharmaceutical industry in Japan is contributing to the increasing demand for preclinical trial outsourcing. There has been a significant increase in the number of clinical trials being conducted in the country as the Japanese government is undertaking steps to offer regulatory support and promote clinical trials in the country. This is expected to stimulate the market for preclinical services as preclinical testing requires to be conducted in proximity to central development centers.

Preclinical CRO in India:The preclinical CRO market in India has experienced significant growth, driven by its cost advantage, a skilled workforce, and a favorable regulatory environment. Indian CROs offer competitive pricing, attracting international pharmaceutical and biotech companies seeking to outsource preclinical research. Some of the key players operating in the Indian preclinical CRO market are as follows:

In March 2023, Crown Bioscience & JSR Life Sciences Company announced starting a new site in Singapore, which will support the company in expanding its capacity for local and global biotech & pharma companies. The site will support companies that engage in preclinical & translational oncology drug discovery and development.

In February 2023, Apax Partners acquired Porsolt, a recognized Global CRO. This partnership will enhance Porsolt’s service offering while expanding its product portfolio & capabilities for drug screening, safety, and efficacy for worldwide consumers.

The preclinical CRO market has both large, multinational CROs and smaller, specialized CROs. These include Labcorp, Charles River Labs, Eurofins Scientific, and Intertek Group. Preclinical CRO market share depends on several factors such as number of players in the market, service portfolio, therapeutic expertise, geographic reach, innovation & investments, as well as partnerships & collaborations. For instance, key companies such as Covance— Labcorp’s drug development business,provide a comprehensive suite of preclinical services, including pharmacology & safety assessment, vector & cell characterization & qualification, and biodistribution testing & services. These market players also have expertise in specific therapeutic areas or in emerging fields (e.g., immuno-oncology, gene therapy). Combined with a broad geographic reach these companies can offer clients access to diverse patient populations, regulatory environments, and research expertise.

This enables key players to hold a notable share of the market.

The demand for preclinical CRO services is influenced by the overall pharmaceutical and biotechnology industry's research and development pipeline. Increased investments in drug discovery and development are expected to drive demand for preclinical research services.The market dynamics and competition is also influenced by trends in emerging therapeutic areas, such as immuno-oncology, gene therapy, and precision medicine, which may require specialized expertise from CROs. Between 2016 to 2020 for example, Labcorp’s Covancehas conducted 300+ preclinical studies and over 40 clinical trials for cell and gene therapies across the globe.

Preclinical CRO Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Preclinical CRO market.

By Service

By Model Type

By End-use

By Region