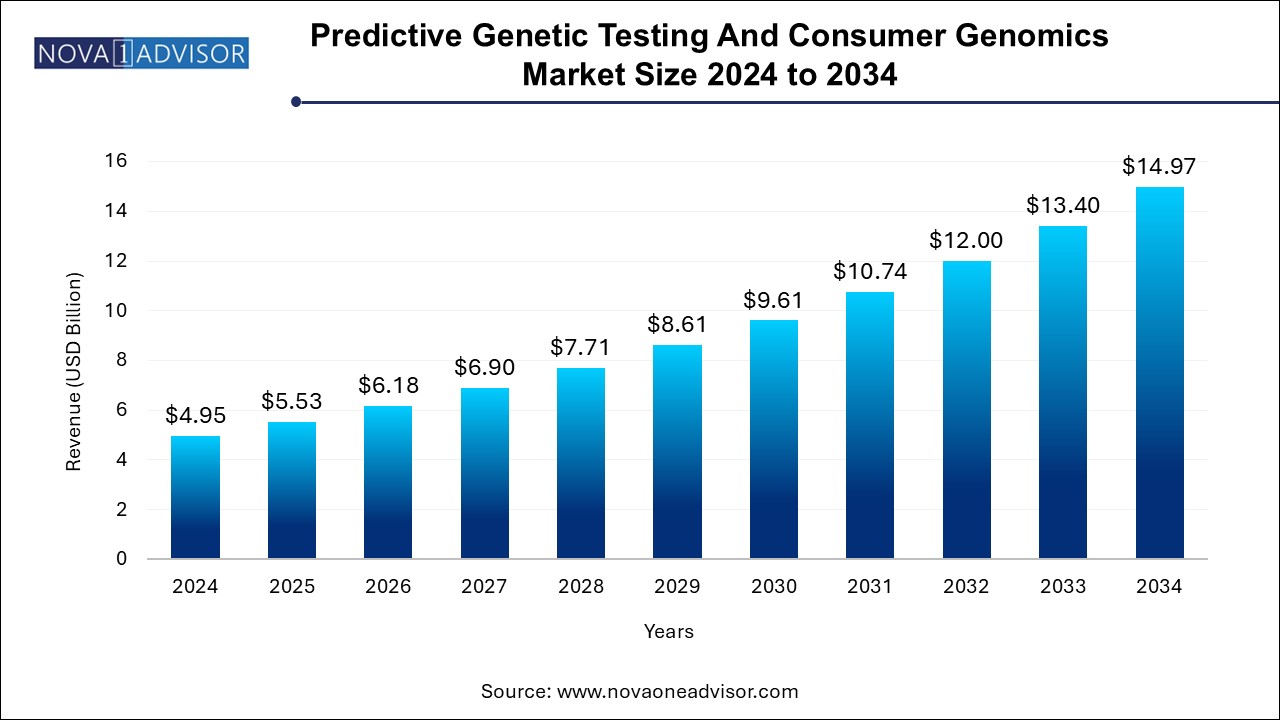

The predictive genetic testing and consumer genomics market size was exhibited at USD 4.95 billion in 2024 and is projected to hit around USD 14.97 billion by 2034, growing at a CAGR of 11.7% during the forecast period 2024 to 2034.

The Predictive Genetic Testing and Consumer Genomics Market represents a transformative frontier in personalized healthcare, intersecting genetics, biotechnology, digital health, and consumer empowerment. This market centers on tools and technologies that decode an individual’s genetic blueprint to forecast the likelihood of developing certain diseases or traits, or to identify potential health risks. Simultaneously, consumer genomics services cater to individuals interested in learning more about their ancestry, traits, and wellness profiles, including fitness and nutrition, without necessarily involving clinical settings.

Over the past decade, the advent of high-throughput sequencing technologies, decreasing costs of genome sequencing, rising awareness regarding preventive healthcare, and growing integration of genomics in public health initiatives have catalyzed the expansion of this market. Today, consumers can access direct-to-consumer (DTC) genetic tests from the comfort of their homes, while hospitals and research institutions are increasingly leveraging predictive genetic tools to personalize patient care, particularly in oncology, cardiology, and neurodegenerative disease management.

The convergence of healthcare digitization, artificial intelligence (AI), cloud-based genetic data storage, and wearable technology further propels the predictive capabilities and consumer reach of genomic applications. For instance, partnerships between tech giants and genomics companies—such as Google's collaboration with DNAnexus or Apple’s ResearchKit integrating with genetic research—are setting new benchmarks in user-driven health intelligence.

Globally, the predictive genetic testing and consumer genomics market is witnessing robust investments from both private players and governmental bodies aiming to foster precision medicine. However, ethical concerns, regulatory challenges, and data privacy issues still remain prominent hurdles in widespread adoption.

Rising adoption of direct-to-consumer (DTC) genetic testing: Companies like 23andMe, AncestryDNA, and MyHeritage have seen a significant uptick in customers who seek insights into ancestry, health risks, and wellness traits without physician involvement.

Growing focus on population genomics initiatives: Programs like the UK’s Genomics England and the U.S. All of Us Research Program aim to genotype millions of people to inform public health and precision medicine strategies.

Integration of AI and machine learning in genetic data interpretation: Platforms are utilizing AI to deliver more accurate and personalized risk predictions for diseases.

Rising awareness about wellness genomics: The younger population is increasingly interested in nutrigenomics and fitness genetics to personalize lifestyle and diet choices.

Corporate wellness programs incorporating genetic testing: Employers are beginning to integrate wellness genomics into their corporate health benefits for early detection and personalized fitness planning.

Expansion of consumer genomics into emerging economies: With improving digital infrastructure, markets in Latin America, Southeast Asia, and parts of the Middle East are beginning to see growth in consumer-led genetic services.

Regulatory developments guiding test accuracy and data privacy: Authorities such as the FDA and EMA are focusing on frameworks that balance innovation with consumer protection.

Increased clinical adoption of predictive diagnostics for cancer and cardiology: Hospitals are adopting predictive genomics to assess hereditary cancer risks and cardiovascular conditions, improving early intervention.

Blockchain applications in genomics: Blockchain is being explored to secure genomic data sharing and ensure consumer control over their personal information.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.53 Billion |

| Market Size by 2034 | USD 14.97 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 11.7% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Test, Application, Setting, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | 23andMe, Inc.; Myriad Genetics, Inc.; F. Hoffmann-La Roche Ltd; Abbott; Agilent Technologies, Inc.; Thermo Fisher Scientific Inc.; BGI; Bio-Rad Laboratories, Inc.; Illumina, Inc.; ARUP Laboratories |

One of the pivotal drivers accelerating the predictive genetic testing and consumer genomics market is the surging demand for personalized medicine. Personalized medicine, which tailors treatment and prevention strategies to individual genetic profiles, is rapidly gaining traction among clinicians, healthcare providers, and pharmaceutical developers. The growing understanding that one-size-fits-all approaches are suboptimal—especially in oncology, cardiology, and neurology—has led to the integration of genetic risk assessment tools into clinical workflows.

For example, BRCA1/BRCA2 gene mutation testing is routinely used for women at risk of hereditary breast and ovarian cancers. Similarly, pharmacogenomic insights allow clinicians to prescribe drugs that match a patient’s metabolic profile, reducing the risk of adverse drug reactions. As research continues to uncover new gene-disease links, predictive tests are increasingly embedded into clinical protocols, insurance policies, and preventive care packages, creating a strong momentum for market expansion.

Despite technological advances, concerns over genetic data privacy and ethical implications continue to restrain market growth. Genetic information is uniquely sensitive—it not only reveals data about the individual but also about biological relatives, creating complex ethical considerations around consent and data use. Reports of data breaches or unauthorized data sharing—such as controversies involving DTC firms sharing information with third parties—have raised alarms among regulators and the public.

In 2020, for example, it was revealed that some consumer genomics firms had entered agreements with law enforcement and pharmaceutical companies without sufficiently clear consumer consent. This sparked debates on ethical boundaries and led to a reevaluation of data sharing policies across the industry. Moreover, the risk of genetic discrimination in insurance or employment contexts adds to public hesitation. Addressing these concerns through transparent consent practices, secure data encryption, and supportive legislation is crucial for unlocking the market’s full potential.

An exciting opportunity lies in the integration of genetic testing into broader digital health ecosystems. As consumers increasingly adopt wearable devices, mobile health apps, and telemedicine services, there is a compelling case for embedding genetic insights into these platforms to offer holistic and personalized healthcare experiences.

Imagine a scenario where a smartwatch not only tracks your heart rate but also tailors your fitness regime based on your genetic predisposition to endurance or muscle fatigue. Or consider a nutrition app that adjusts your meal plans based on nutrigenomic test results indicating lactose intolerance or vitamin metabolism inefficiencies. Such integration enhances consumer engagement and enables continuous, proactive health management. Companies that create seamless, interoperable platforms combining genomics with digital health tools stand to gain a competitive edge in both clinical and consumer segments.

Predictive Testing dominated the market due to its critical role in early diagnosis and risk assessment across multiple diseases, especially hereditary cancers and cardiovascular conditions. Sub-segments such as genetic susceptibility testing and predictive diagnostics have been widely adopted by healthcare providers and at-risk patients. These tests help assess predisposition to diseases like BRCA-related cancers, Lynch syndrome, and familial hypercholesterolemia, thereby enabling timely intervention. Moreover, with the growing emphasis on preventive care in national health policies, population screening programs are being launched globally, bolstering the uptake of predictive testing.

On the other hand, Consumer Genomics is emerging as the fastest-growing test segment, fueled by the growing popularity of ancestry and wellness testing kits offered directly to consumers. Wellness genomics sub-segments like nutrigenetics and skin & metabolism genetics have gained particular momentum among the health-conscious millennial and Gen Z population. These consumers are not just looking to manage diseases but to optimize their health proactively. The gamification of genetic results, integration with mobile health apps, and increasing affordability of tests are driving this trend further. Companies like 23andMe, DNAfit, and Helix are pioneering this shift from disease management to health optimization.

Breast and ovarian cancer screening remains the dominant application, primarily due to the well-established correlation between BRCA gene mutations and cancer risk. With heightened awareness campaigns, media coverage (e.g., Angelina Jolie’s public disclosure of BRCA testing), and growing adoption of hereditary cancer testing among women with family history, this segment has maintained its stronghold. Additionally, insurers and healthcare providers are more likely to cover these tests, making them more accessible across developed markets.

In contrast, Parkinsonism and Alzheimer’s disease applications are witnessing the fastest growth, as aging populations drive demand for early detection of neurodegenerative conditions. As no definitive cure exists for these diseases, early identification of genetic risk factors (such as APOE-e4) is critical to initiate lifestyle interventions or participate in clinical trials. Companies are increasingly developing targeted panels for neurological diseases, and the integration of such tests into memory clinics and geriatric practices is expanding rapidly.

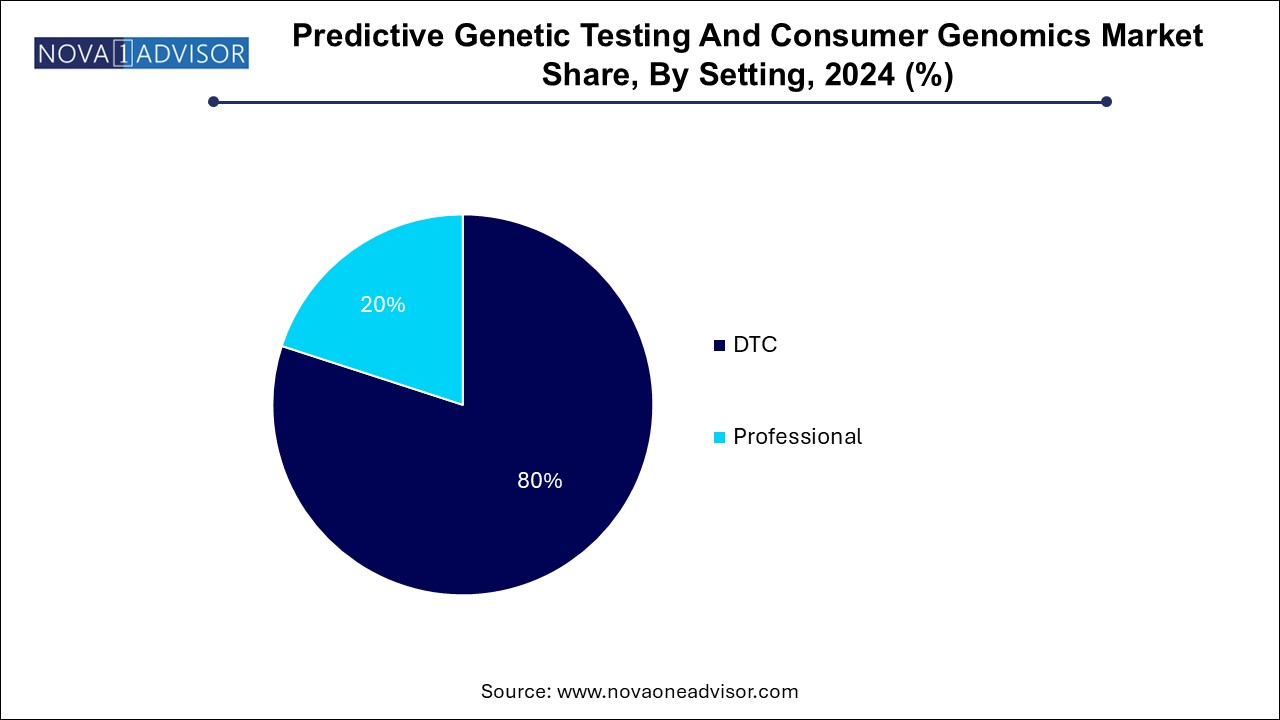

The DTC segment accounted for a dominant revenue share in the market revenue share 80.0% in 2024, Driven by technological democratization, changing consumer behavior, and increasing availability of at-home test kits. Consumers today are more health-aware, tech-savvy, and value the convenience of accessing health data without clinical intermediaries. This model also aligns with the growing interest in wellness, ancestry exploration, and biohacking, creating a booming space for DTC genomics firms.

The professional segment is anticipated to advance at a moderate growth rate during the forecast period. As hospitals, diagnostic centers, and specialty clinics use predictive testing for clinical decision-making. Tests in professional settings are often more comprehensive, regulated, and guided by genetic counselors or physicians, ensuring higher accuracy and informed patient management. These are particularly critical in oncogenomics and cardiogenomics, where the interpretation of complex variants requires expert input.

North America led the market in 2024, accounting for a 45.9% global revenue share. Owing to a combination of factors such as a highly developed healthcare infrastructure, strong presence of key market players, supportive regulatory landscape, and early adoption of innovative health technologies. The U.S., in particular, has a flourishing ecosystem of genetic testing labs, genomics startups, academic research institutions, and investor activity. For instance, the presence of companies like Invitae, Myriad Genetics, and Color Genomics—alongside initiatives like the NIH’s All of Us Research Program—solidifies the region’s leadership. Additionally, favorable reimbursement policies for certain tests and increasing physician adoption further drive market penetration.

Conversely, Asia Pacific is the fastest-growing region, driven by improving healthcare access, growing middle-class income, and rising government investment in genomics infrastructure. Countries such as China, India, South Korea, and Japan are experiencing a surge in both predictive diagnostics and consumer genomics due to their vast population base, increasing burden of chronic diseases, and growing public health awareness. In India, for example, startups like MapmyGenome and MedGenome are pioneering affordable DTC tests, while the Chinese government has announced plans to integrate genomics into national precision medicine strategies. As digital health adoption accelerates across Asia, the region is poised to outpace traditional markets in growth trajectory.

February 2025: 23andMe announced the launch of a new genetic wellness platform that integrates AI to deliver more personalized diet and fitness recommendations, expanding its offerings beyond traditional ancestry and disease risk tests.

November 2024: Color Health secured a $150 million funding round to expand its population genomics services in partnership with public health departments across the U.S.

August 2024: Myriad Genetics unveiled a partnership with Epic Systems to integrate its genetic test results directly into electronic health records (EHR), streamlining clinician workflows.

June 2024: Gene by Gene, the parent company of FamilyTreeDNA, launched a privacy-first testing kit targeting European markets, addressing increasing regulatory scrutiny under GDPR.

May 2024: MapmyGenome in India received regulatory clearance to launch its "SmartNutri" panel, combining genetic testing with AI-powered diet planning tailored for Indian genetic profiles.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the predictive genetic testing and consumer genomics market

Test

Application

Setting

Regional