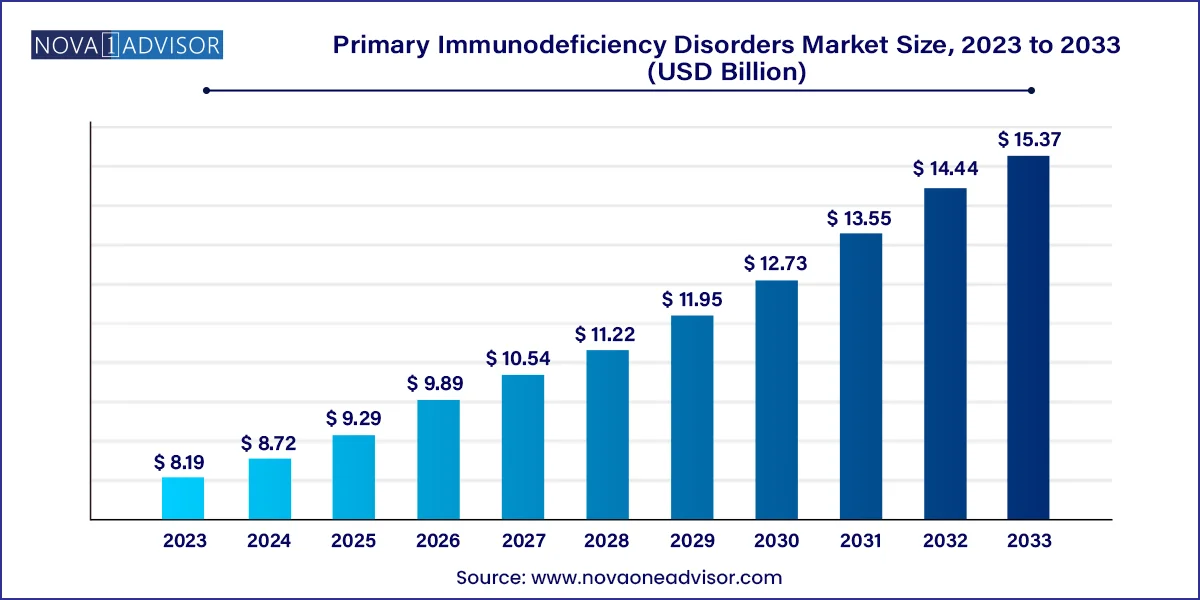

The global primary immunodeficiency disorders market size was valued at USD 8.19 billion in 2023 and is anticipated to reach around USD 15.37 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.

Primary immunodeficiency disorders (PIDDs) are a heterogeneous group of over 450 rare, chronic disorders characterized by an intrinsic defect in the immune system, resulting in increased susceptibility to infections, autoimmune complications, and malignancies. These conditions are typically inherited and manifest in early childhood, though some may not present until adolescence or adulthood. Due to the complex nature of these disorders, the global healthcare community has increasingly focused on advancing diagnostic tools, enhancing patient registries, and developing tailored therapies.

The global PIDD market is driven by advancements in genetic diagnostics, heightened awareness among clinicians and patients, and strong demand for immunoglobulin therapies and bone marrow transplants. The last decade has seen a remarkable shift from mere symptomatic management to precision-based treatment strategies, including the integration of gene therapy and personalized medicine. Moreover, improved newborn screening and genetic counseling have enabled early diagnosis, thereby facilitating prompt treatment and reducing disease-related complications.

The global burden of PIDDs, although relatively low in terms of prevalence, is significant in terms of healthcare costs, morbidity, and quality of life implications. According to Jeffrey Modell Foundation data, millions remain undiagnosed, particularly in low-to-middle income countries. This gap presents not only a public health concern but also a compelling opportunity for market expansion through diagnostics, therapeutics, and long-term care solutions. Major pharmaceutical firms and biotechnology startups are investing in PIDD-related R&D, signaling a promising trajectory for the market through 2034 and beyond.

Increasing use of gene sequencing technologies: Next-generation sequencing (NGS) has become a cornerstone in diagnosing rare immunodeficiency conditions, enabling clinicians to identify genetic mutations quickly and accurately.

Rising adoption of immunoglobulin replacement therapies (IRT): Intravenous and subcutaneous immunoglobulin therapies continue to be first-line treatments, especially for antibody deficiencies, and are witnessing increasing demand globally.

Expansion of newborn screening programs: Countries like the U.S., Australia, and several European nations are expanding neonatal screening for severe combined immunodeficiency (SCID), leading to earlier intervention and better outcomes.

Emergence of gene therapy as a curative option: Breakthroughs in gene editing tools, such as CRISPR-Cas9 and lentiviral vectors, are offering curative prospects for PIDDs, particularly SCID and Wiskott-Aldrich Syndrome.

Global collaborations and patient advocacy movements: Organizations like the International Patient Organisation for Primary Immunodeficiencies (IPOPI) are playing a pivotal role in shaping policy, access, and treatment guidelines.

Biologics pipeline diversification: Biopharmaceutical firms are exploring monoclonal antibodies and targeted biologics to manage autoimmune complications arising from PIDDs.

Increased FDA approvals and orphan drug designations: Regulatory bodies are accelerating approval timelines for PIDD therapies through priority review and orphan drug incentives, particularly in the U.S. and EU.

| Report Attribute | Details |

| Market Size in 2024 | USD 8.72 Billion |

| Market Size by 2033 | USD 15.37 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.5% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Disease, treatment |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Baxter International; CSL Behring; Takeda Pharmaceutical; Octapharma; Biotest; Grifols; Kedrion Biopharma; Bio Products Laboratory; LFB; ADMA Biologics; Astellas Pharma; Abbott Laboratories. |

One of the most potent drivers of the PIDD market is the rapid advancement in genetic diagnostics, particularly whole exome sequencing (WES) and targeted gene panels. Historically, diagnosing PIDDs involved a trial-and-error approach, often leading to delays and misdiagnosis. However, modern genetic tools now enable clinicians to pinpoint specific molecular defects, sometimes within days. These technologies are especially useful in identifying atypical cases and guiding personalized treatments.

For example, early diagnosis of severe combined immunodeficiency (SCID) via T-cell receptor excision circle (TREC) screening has allowed for curative stem cell transplantation before the onset of serious infections. Institutions like the National Institute of Allergy and Infectious Diseases (NIAID) have also developed large-scale patient registries to match phenotypes with genotypes. As diagnostic tools become more affordable and accessible, particularly in middle-income countries, the overall treatment pipeline for PIDDs becomes significantly more effective and cost-efficient.

Despite medical advances, the high cost of PIDD therapies remains a major restraint in market expansion, particularly in developing economies. Treatments such as immunoglobulin replacement therapy, stem cell transplants, and gene therapies can cost tens to hundreds of thousands of dollars annually. For instance, the annual cost of subcutaneous immunoglobulin therapy in the U.S. can exceed $70,000 per patient.

Access disparities are further compounded by reimbursement challenges, limited insurance coverage, and under-resourced healthcare systems. In regions such as Africa, Latin America, and parts of Asia-Pacific, many PIDD patients go undiagnosed or receive inadequate treatment due to a lack of specialized immunology services and therapeutic infrastructure. This inequity significantly hinders the market’s full potential and poses ethical and economic dilemmas for global health policymakers.

The emergence of gene therapy offers a revolutionary opportunity to transform the PIDD treatment landscape from lifelong symptom management to potential cures. Disorders like ADA-SCID, X-linked SCID, and Wiskott-Aldrich Syndrome are now being addressed through gene transfer techniques using viral vectors to correct faulty genes in hematopoietic stem cells. Bluebird Bio and Orchard Therapeutics have already achieved promising clinical results, with some patients demonstrating long-term immune reconstitution post-treatment.

As gene therapy platforms mature and receive regulatory approvals, their application is expected to expand across multiple PIDD subtypes. The U.S. FDA and European Medicines Agency (EMA) have been supportive, granting several therapies orphan drug status and fast-track designations. Furthermore, the growing trend of in vivo gene editing using CRISPR technology indicates that the future of PIDD care may involve single-dose, outpatient procedures. This shift would not only improve patient outcomes but also reduce long-term healthcare costs, making gene therapy a game-changer in this market.

The immunoglobulin replacement therapy segment held the largest share of 63.78% in 2023. IRT is the gold standard for managing antibody deficiencies and involves the regular infusion of pooled immunoglobulins from healthy donors. Both intravenous (IVIG) and subcutaneous (SCIG) forms are widely used, with SCIG gaining popularity for home-based administration. Key players like Takeda (Gammagard), CSL Behring (Privigen), and Grifols (Gamunex) dominate this space. The chronic nature of PIDDs necessitates lifelong IRT for many patients, thereby ensuring steady revenue streams for manufacturers.

On the other hand, gene therapy is emerging as the fastest-growing treatment segment due to its curative potential and the entry of biotech firms into this innovative space. Recent clinical trials using lentiviral vectors for ADA-SCID and X-linked SCID have demonstrated impressive long-term efficacy. Companies like Orchard Therapeutics and Mustang Bio are leading the charge with robust pipelines. As regulatory frameworks become more favorable and cost barriers decline, gene therapy is likely to transition from experimental to mainstream care, especially for patients without matched bone marrow donors.

The antibody deficiencies segment held the largest share of 53.02% in 2023, These conditions, including common variable immunodeficiency (CVID), X-linked agammaglobulinemia (XLA), and selective IgA deficiency, account for the majority of diagnosed PIDD cases globally. Patients with antibody deficiencies often suffer from recurrent bacterial infections, particularly of the respiratory tract, requiring consistent administration of immunoglobulin therapies. Because these disorders are more prevalent and relatively easier to diagnose, treatment protocols are well-established, driving a steady demand for therapies and diagnostic tools.

Conversely, innate immune disorders represent the fastest-growing disease segment in the market. These include conditions like chronic granulomatous disease (CGD) and leukocyte adhesion deficiency, which involve defects in the non-specific immune system. Recent advancements in genetic testing and newborn screening have improved early detection, while targeted therapies, including interferon-gamma and bone marrow transplantation, have shown success in managing symptoms. The increased awareness and funding for research into rare innate immune disorders are expected to fuel this segment's growth trajectory in the coming decade.

North America primary immunodeficiency disorders market dominated the overall global market and accounted for the 45.89% revenue share in 2023 owing to advanced healthcare infrastructure, supportive reimbursement policies, and a high level of disease awareness. The United States, in particular, has pioneered several PIDD programs, including the expansion of SCID newborn screening across all 50 states. Additionally, the presence of leading players such as Takeda, CSL Behring, and Grifols ensures ready availability of treatments and diagnostics. The FDA's active role in fast-tracking orphan drugs has further stimulated innovation and market access. The U.S. immunology research ecosystem, supported by institutions like the NIH, continues to attract investments in new therapeutic approaches, including gene therapy and biologics.

Asia-Pacific is the fastest-growing regional market, fueled by rising awareness, improving healthcare infrastructure, and increasing healthcare expenditure. Countries such as China, India, Japan, and South Korea are witnessing a surge in PIDD diagnoses due to expanded use of genetic testing and improved physician education. While access to therapies has historically been limited, the landscape is changing with more pharmaceutical companies entering the region and governments incorporating rare disease policies. Furthermore, collaborations between international PIDD organizations and local healthcare systems are helping establish diagnostic laboratories and immunology clinics, laying the foundation for long-term market growth.

The following are the leading companies in the primary immunodeficiency disorders market. These companies collectively hold the largest market share and dictate industry trends.

January 2024: Orchard Therapeutics announced the successful completion of a Phase III trial for its ex vivo gene therapy for ADA-SCID, with long-term immune recovery observed in over 90% of treated patients.

November 2023: CSL Behring launched a new subcutaneous immunoglobulin therapy formulation with a shorter infusion time in the U.S., improving patient convenience and treatment compliance.

October 2023: Grifols entered into a strategic partnership with a leading Asian healthcare group to expand access to its immunoglobulin therapies across Southeast Asia, including PIDD patient registries and training programs.

September 2023: Takeda Pharmaceutical Company received FDA Breakthrough Therapy Designation for a next-generation IVIG therapy aimed at reducing treatment frequency and enhancing immune protection in patients with CVID.

August 2023: X4 Pharmaceuticals reported positive interim data for mavorixafor, an oral CXCR4 antagonist, in patients with WHIM syndrome, a rare congenital immunodeficiency, paving the way for potential label expansion.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Primary Immunodeficiency Disorders market.

By Disease

By Treatment

By Region