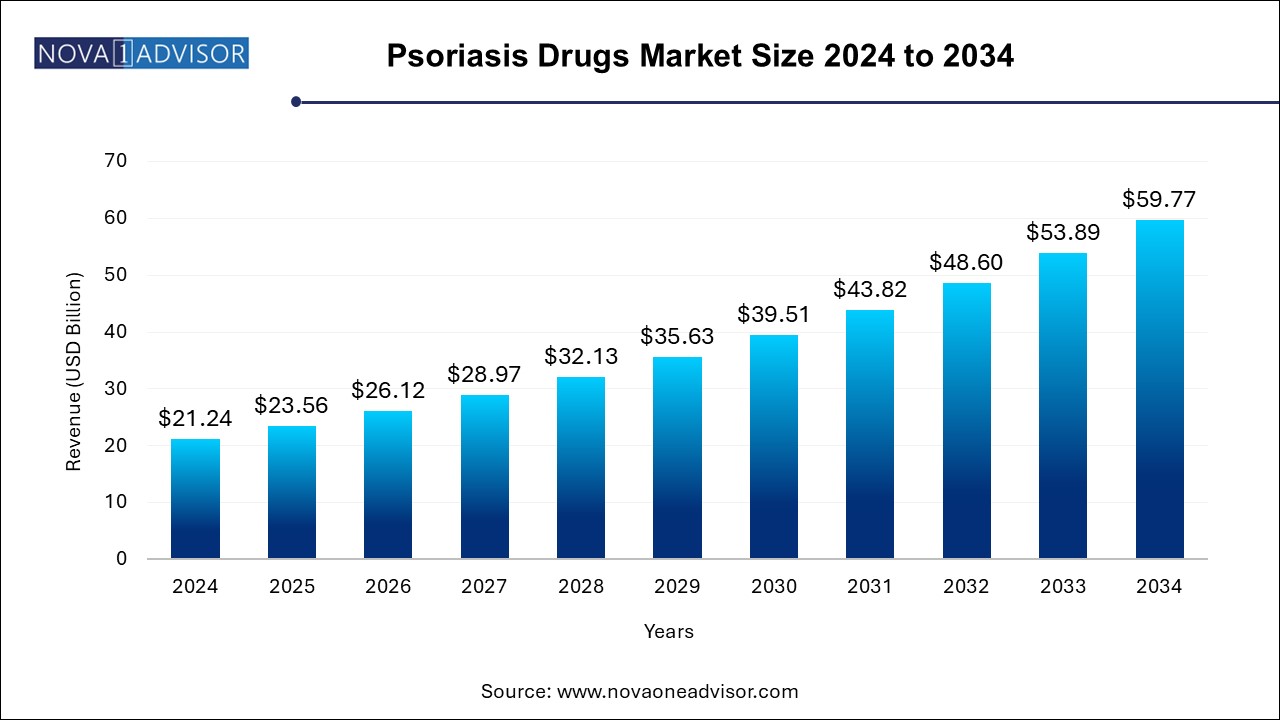

The psoriasis drugs market size was exhibited at USD 21.24 billion in 2024 and is projected to hit around USD 59.77 billion by 2034, growing at a CAGR of 10.9% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 23.56 Billion |

| Market Size by 2034 | USD 59.77 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 10.9% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Class, Treatment, Route, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | AbbVie Inc.; Amgen Inc.; Johnson & Johnson Services Inc.; Novartis AG; Eli Lilly and Company; AstraZeneca; Celgene Corporation; UCB S.A.; Merck; Boehringer Ingelheim International GmbH |

The increasing prevalence of psoriasis in various countries has led to a demand for psoriasis drugs for treatment. In addition, biotechnology advances and drug development, such as biologically targeted therapies enhance patient treatment outcomes. Moreover, stress is a major cause of the condition in adults. The global prevalence of psoriasis in young adults is approximately 10% and 2% in children.

Psoriasis is a chronic skin disorder triggered by environmental, immunological, and genetic factors. It is considered one of the systemic inflammatory conditions linked to metabolic syndrome, psychological issues, cardiovascular disease, and inflammatory bowel disease. Psoriasis drugs aim to prevent rapid growth in skin cells and remove scales. Topical treatments are advised in cases of mild to moderate psoriasis. The topical treatments comprise corticosteroids while the ointments containing salicylic acid, calcineurin inhibitors, and coal tar are prescribed most often.

Additional therapies such as light therapy, and oral medications are also prescribed based on the severity of the condition. Besides, these drugs are called systemic drugs and are usually prescribed for moderate to severe psoriasis conditions. Oral medication is prescribed for a short period with alternative treatments as they have the potential for severe side effects. For instance, in cases of severe psoriasis steroids, retinoids, biologics, and cyclosporine are suggested. However, the associated side effects include increased weight, liver toxicity, and also increases the risk of non-alcoholic fatty liver disease.

The focus on personalized treatments is a significant factor driving the market growth. In addition, advanced phototherapy has enhanced the treatment options to result in positive outcomes in psoriasis patients. The growing demand for safe and effective treatment, rising awareness, and the emergence of clinical startups focusing on psoriasis research and drug development encourage market growth. The impact of psoriasis, eczema, and skin disorders on patients has resulted in an earlier diagnosis. The need for effective therapies and early consultation augments the demand for psoriasis drugs.

Tumor necrosis factor inhibitors dominated the market and accounted for a share of 41.0% in 2024 as they effectively target the inflammatory pathways crucial to the disease, resulting in major enhancements. In addition, their prolonged dominance has resulted in proven effectiveness, high safety, and a wider acceptance contributing to their overall success. Furthermore, continuous improvements in drug formulation and delivery methods have improved patient outcomes and expanded therapeutic uses.

Interleukin inhibitors are expected to register the fastest CAGR of 12.2% over the forecast period attributed to their targeted approach against specific cytokines in psoriasis development, resulting in better effectiveness and fewer side effects than conventional treatments. In addition, the higher demand and market penetration by introducing new and enhanced interleukin inhibitors, and the growing awareness and diagnosis of psoriasis are anticipated to drive market growth.

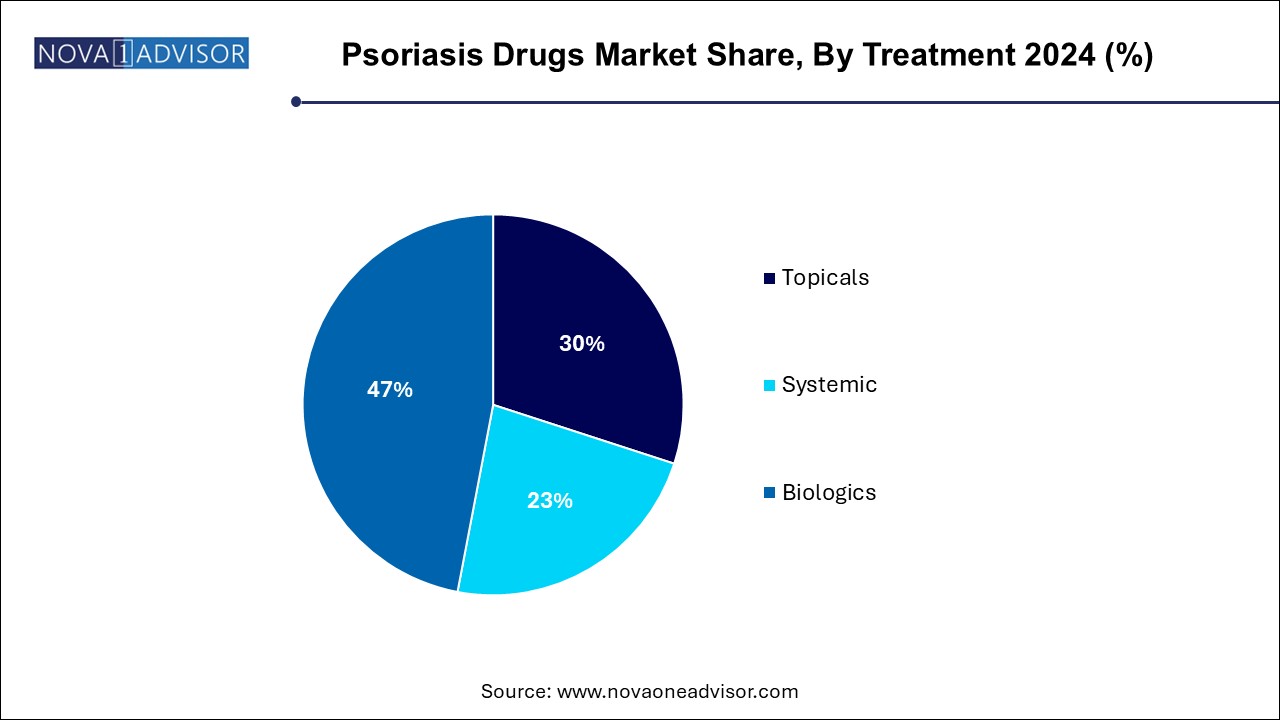

The biologics segment dominated the market in 2024 with a share of 47.0% as they are highly selective to certain immune pathways in connection to psoriasis and massive improvements in disease management compared to traditional medicines. Additionally, the progression of biological therapies has been significant to their dominance in developing safer therapies that are more efficient and endowed with long-lasting effects. Furthermore, the growth in patient awareness and availability of customized treatment methods have resulted in the acceptance of biologics.

The topicals segment is expected to register a CAGR of 11.4% during the forecast period due to their effectiveness, ease of use, and economical nature compared to other more complicated therapies. Additionally, advancements in formulation technology have made topical products more effective. Furthermore, the rising prevalence of psoriasis and the increasing trend towards less invasive treatment choices contribute to the acceptance of topical treatments.

The parenteral segment dominated the market in 2024 as injectable biologics and systemics are more effective in treating moderate to severe psoriasis than topical and oral medications. In addition, the development of new drug delivery systems such as auto-injectors boost the market growth. The clinical data has upheld their safety and efficacy as a preferred treatment option for patients and healthcare professionals.

The topical segment is projected to grow at a CAGR of 10.4% over the forecast period as many people opt for non-surgical procedures and formulations are designed to enhance the efficacy of topical remedies. Additionally, the availability of these topical treatments is also driving the growth as these agents can be made accessible to patients suffering from mild to moderate psoriasis.

The hospital pharmacies segment accounted for a leading share of 41.5% in 2024 owing to hospitals offering expensive, specialized treatments such as biologics and advanced systemic therapies. In addition, the hospitals provide essential care and management options for patients with severe or complex psoriasis contributing to their further growth through close monitoring and individualized treatment plans. Furthermore, factors such as the growing cases of severe psoriasis cases and cutting-edge treatments contribute to the demand for hospital pharmacies in the industry.

The retail pharmacies segment is projected fastest growth at a CAGR of 11.3% over the forecast period attributed to the increasing demand for convenient psoriasis treatment, enabling patients to purchase over-the-counter and prescription products from nearby pharmacies. Innovations in topical formulations and new product launches cater to a wider range of psoriasis patients. Furthermore, the growing trend towards self-managing mild to moderate psoriasis and the expansion of retail pharmacy chains offering a wide range of dermatological products are driving strong growth in this sector.

North America psoriasis drugs market dominated the global market with a share of 38.4% in 2024 due to its advanced healthcare system that enables patients to receive early diagnosis and complete treatment. The region's dominance can be attributed to the significant presence of leading pharmaceutical companies and ongoing advancements in psoriasis treatments, such as biologics and novel drug options.

U.S. Psoriasis Drugs Market Trends

The U.S. psoriasis drugs market dominated in the North American region with a share of 83.1% in 2024 due to its advanced healthcare system that enables the population to have easy access to advanced therapies for psoriasis. The market is also influenced by huge patient influx, large investments in research and development by major pharmaceutical companies, and healthcare policies centering around psoriasis for introducing novel treatments.

Europe Psoriasis Drugs Market Trends

Europe psoriasis drugs market is expected to witness the fastest CAGR of 10.1% over the forecast period attributed to increasing awareness and early diagnosis, which has resulted in enhanced treatment across the region. In addition, there has been a progression in psoriasis treatment driven by enhancement in therapies and the availability of new drugs due to supportive health policies.

Asia Pacific Psoriasis Drugs Market Trends

Asia Pacific psoriasis drugs market is anticipated to witness significant growth in the forecast period. Increased awareness and diagnosis of psoriasis in the Asia Pacific region are expected to drive demand for effective treatment options, leading to a significant growth in the psoriasis drugs market. Furthermore, the market's strong growth is fueled by greater investments in healthcare, broadening the availability of cutting-edge treatments, and the rise of the middle-income population with increased healthcare expenditures.

China psoriasis drugs market held a substantial share in 2024 owing to the large patient population and diagnosis leading to an increased demand for effective treatments. Furthermore, the Chinese market has experienced substantial growth due to the growing importance of psoriasis medication in the region, increased investments in medical research, and a focus on advanced therapies.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the psoriasis drugs market

By Class

By Treatment

By Route of Administration

By Distribution Channel

By Regional