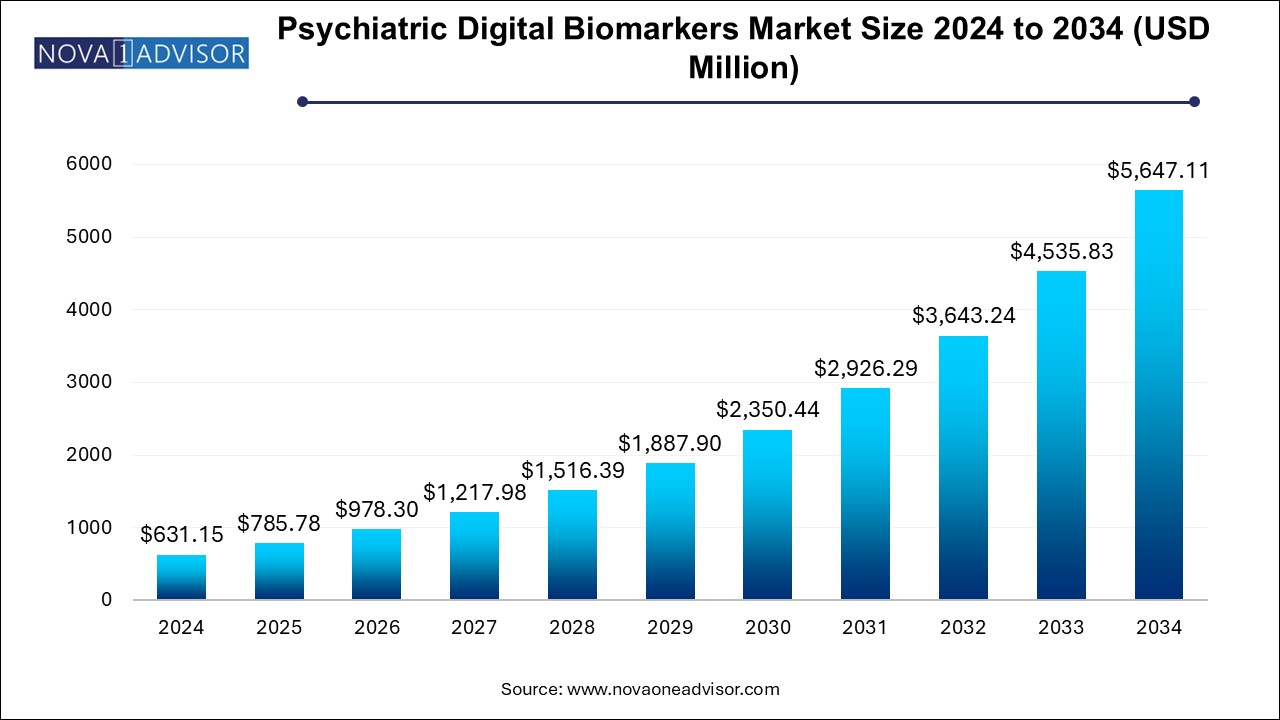

The psychiatric-digital-biomarkers-market size was exhibited at USD 631.15 million in 2024 and is projected to hit around USD 5647.11 million by 2034, growing at a CAGR of 24.5% during the forecast period 2025 to 2034.

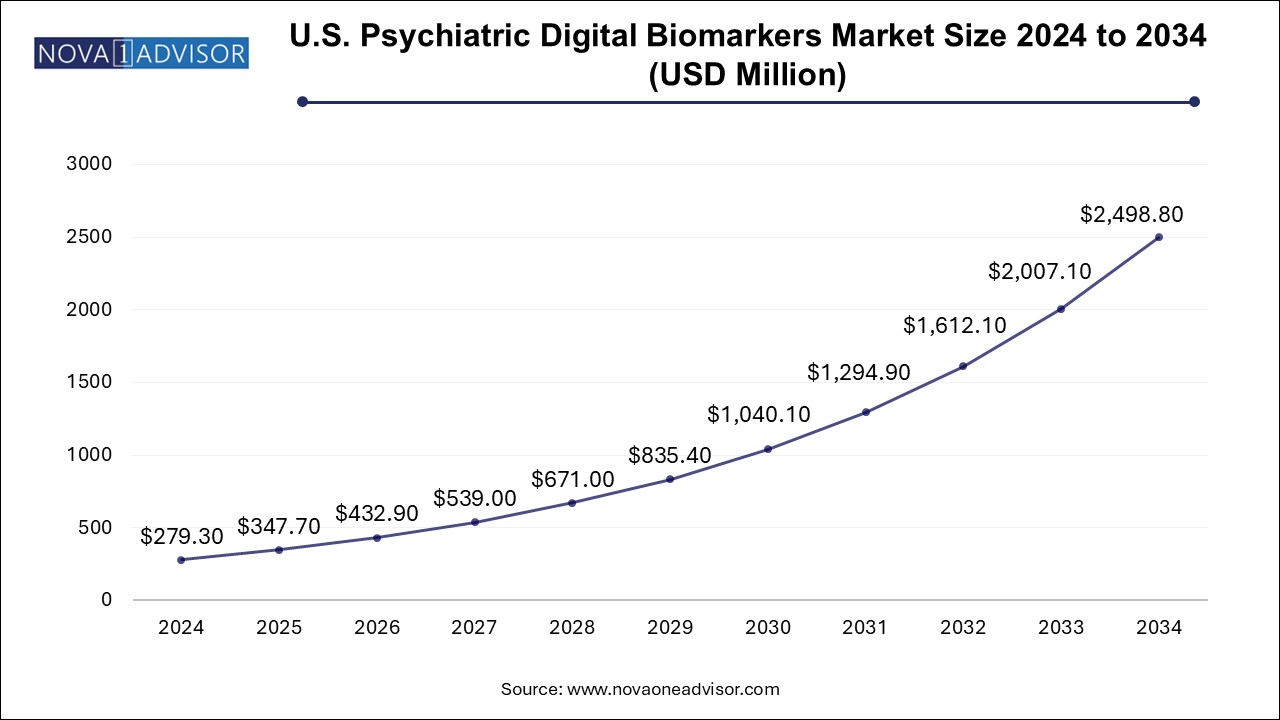

The U.S. psychiatric-digital-biomarkers-market size is evaluated at USD 279.3 million in 2024 and is projected to be worth around USD 2498.8 million by 2034, growing at a CAGR of 22.04% from 2025 to 2034.

North America led the global psychiatric digital biomarkers market, driven by a confluence of factors including advanced healthcare IT infrastructure, strong digital health innovation, and a high mental health disease burden. The U.S., in particular, has seen a surge in mental health app adoption, telepsychiatry platforms, and academic-industry partnerships aimed at validating new digital endpoints. Regulatory openness from the FDA towards Software as a Medical Device (SaMD) and digital biomarkers also supports product approvals and scaling.

Investment momentum from venture capital firms into mental health tech startups, such as Mindstrong, Akili Interactive, and Woebot Health, has further accelerated the development and deployment of digital psychiatric tools. Moreover, national focus on behavioral health reform and veteran mental health initiatives enhances the market's structural maturity and readiness for digital biomarker integration.

Asia Pacific is projected to be the fastest-growing market, fueled by increasing smartphone penetration, mental health stigma reduction, and a rising burden of untreated psychiatric conditions. Countries like China, India, Japan, and South Korea are investing in digital health as a means to overcome psychiatric care access gaps—especially in rural and underserved populations.

Government-backed health digitization programs, growing tech-savvy youth demographics, and mobile-first healthcare strategies are encouraging app-based monitoring solutions. Localized AI algorithms and language-adapted interfaces are enabling scalable deployment of psychiatric digital biomarkers. As mental health care becomes a national priority in emerging markets, APAC offers vast potential for biomarker adoption and innovation.

The psychiatric digital biomarkers market represents a rapidly emerging segment within the broader digital health and neurotechnology ecosystem. Psychiatric digital biomarkers refer to objectively measurable physiological, behavioral, or cognitive indicators collected through digital devices and technologies—such as smartphones, wearables, and sensors—that provide insight into mental health conditions. These biomarkers are revolutionizing how psychiatric disorders like depression, anxiety, schizophrenia, and bipolar disorder are diagnosed, monitored, and treated.

Unlike traditional biomarkers derived from blood tests or neuroimaging, digital biomarkers are passive or active data streams generated in real time from an individual’s interaction with technology. These may include voice tone, sleep patterns, heart rate variability, keystroke dynamics, facial expression tracking, mobility patterns, or social media behavior. The primary appeal of psychiatric digital biomarkers lies in their ability to provide continuous, remote, and non-invasive monitoring of mental health, significantly reducing subjectivity and latency in diagnosis and care.

Growing prevalence of mental health disorders globally, alongside the limitations of conventional assessment tools such as clinician-administered surveys and patient-reported outcomes, has fueled the need for scalable and objective diagnostic alternatives. Psychiatric digital biomarkers offer a personalized and data-rich approach to understanding mental states, enabling clinicians and researchers to detect early signs, monitor treatment response, and even predict relapse before it becomes clinically apparent.

The COVID-19 pandemic further accelerated digital mental health adoption, compelling healthcare providers, researchers, and payers to embrace telepsychiatry, remote monitoring, and digital therapeutics. As digital health matures, psychiatric digital biomarkers are becoming integral to mental health management platforms, mobile apps, wearable solutions, and AI-driven behavioral analytics. With robust R&D investments, regulatory openness, and growing consumer comfort with health technology, this market is poised for substantial growth over the next decade.

Integration of Artificial Intelligence (AI): AI and machine learning models are increasingly used to analyze complex data patterns and predict mental health conditions.

Proliferation of Smartphone-based Monitoring: Mobile apps using phone sensors to track user behavior are becoming ubiquitous tools for digital psychiatry.

Wearables as Continuous Monitoring Tools: Devices like smartwatches and fitness bands are gaining traction in passive biometric and behavioral tracking.

Clinical Validation and FDA Breakthroughs: An increasing number of startups are pursuing regulatory pathways to establish the clinical utility of their digital biomarkers.

Growth in Predictive Analytics: Focus is shifting from retrospective analysis to predictive modeling for early detection of psychiatric episodes.

Rising Use of Natural Language Processing (NLP): NLP tools analyze speech and text data to detect emotional distress and cognitive disorders.

Expansion of Digital Therapeutics (DTx): Psychiatric biomarkers are being embedded in DTx platforms for real-time feedback and personalized therapy.

Partnerships with Pharma and Payers: Biopharma and insurance firms are collaborating with tech developers to integrate digital biomarkers in drug trials and reimbursement frameworks.

| Report Coverage | Details |

| Market Size in 2025 | USD 785.78 Million |

| Market Size by 2034 | USD 5647.11 Million |

| Growth Rate From 2025 to 2034 | CAGR of 24.5% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Clinical Practice, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Koneksa Health; Biogen; Empatica Inc.; VivoSense; IXICO plc; Sonde Health, Inc.; Clario |

The primary driver propelling the psychiatric digital biomarkers market is the rising prevalence and economic burden of psychiatric disorders. According to the World Health Organization (WHO), depression alone affects over 280 million people worldwide, while anxiety disorders impact over 300 million. In the U.S., nearly one in five adults lives with a mental illness, with depression, bipolar disorder, PTSD, and schizophrenia being the most prevalent.

These disorders contribute significantly to years lived with disability (YLDs) and productivity losses, creating immense pressure on healthcare systems. Traditional diagnostic methods, reliant on interviews and rating scales, often fail to capture early symptoms, leading to delayed interventions and suboptimal outcomes. Psychiatric digital biomarkers provide a way to bridge this gap by enabling objective, real-time tracking of mental health parameters.

By offering continuous behavioral monitoring and pattern recognition, digital biomarkers can enhance clinical decision-making, optimize treatment personalization, and detect subtle changes that precede acute episodes. Their potential to improve patient engagement and enable proactive care aligns with the broader shift towards value-based, preventive mental healthcare.

Despite their promise, psychiatric digital biomarkers face significant challenges regarding privacy, data security, and ethical compliance. These biomarkers often involve the collection of sensitive and deeply personal information—such as voice recordings, movement data, device usage, and even social media interactions—raising concerns about informed consent, data ownership, and surveillance.

Mental health data is particularly stigmatized, making individuals wary of sharing their biometric and behavioral information. Without strict protocols to anonymize, secure, and ethically manage data, trust between patients and digital health providers may erode. Additionally, the use of AI to interpret behavioral data can lead to biased outputs or misdiagnosis if not carefully calibrated across diverse populations.

Regulatory standards for digital biomarkers are still evolving, and there is a lack of globally harmonized frameworks governing data usage, cross-border storage, and interoperability. These concerns must be addressed to ensure equitable access, transparency, and long-term sustainability of digital psychiatry solutions.

A compelling opportunity in the psychiatric digital biomarkers market is the integration of these biomarkers into personalized psychiatry and decentralized clinical trials. Mental health disorders are heterogeneous in nature, with varied symptom presentations and treatment responses. Digital biomarkers enable the tailoring of psychiatric care by continuously capturing how individual patients respond to different treatments, environments, or life events.

This capability can be extended to optimize digital therapeutics, adaptive cognitive behavioral therapy (CBT) programs, and medication management apps. Moreover, pharmaceutical companies are increasingly using digital biomarkers to enhance the efficiency of clinical trials—identifying digital endpoints, reducing reliance on in-person visits, and stratifying patient populations more effectively.

As precision medicine continues to gain momentum, psychiatric digital biomarkers can serve as dynamic tools to link phenotypes with genotypes, aid in early drug response detection, and support remote mental health assessments. This evolution opens new revenue streams across diagnostics, therapeutics, and research collaborations.

Mobile-based applications dominated the psychiatric digital biomarkers market in 2024, as smartphones are the most accessible digital platform for collecting behavioral and biometric data. Numerous mental health apps now integrate passive sensing (screen time, typing speed, location) and active input (mood surveys, cognitive tasks) to derive biomarkers for depression, anxiety, and cognitive disorders. Their user-friendliness, scalability, and integration with telehealth platforms make them a preferred choice among both clinicians and consumers.

Wearables are the fastest-growing segment, owing to their increasing use in capturing physiological markers such as heart rate variability, sleep quality, movement patterns, and electrodermal activity. Smartwatches and fitness bands, equipped with biosensors, are being used to correlate physical signals with psychological states, offering a 24/7 window into mental well-being. As wearable accuracy and user adoption increase, their utility as digital psychiatric tools will expand significantly.

Monitoring psychiatric digital biomarkers held the largest market share, as continuous behavioral monitoring is increasingly embedded in mental health management solutions. These biomarkers allow clinicians and researchers to observe longitudinal changes in mood, cognition, and stress levels—crucial for conditions like bipolar disorder or PTSD. Remote monitoring also supports adherence tracking and timely interventions, especially in outpatient and chronic care settings.

Predictive and prognostic biomarkers are expected to be the fastest-growing segment, as AI models become more sophisticated in anticipating mental health events before they occur. Early-warning systems based on digital phenotyping can predict relapse or suicidal ideation, enabling preemptive outreach and care escalation. Predictive biomarkers hold particular value in high-risk populations such as adolescents, veterans, or individuals with comorbidities.

Healthcare providers were the leading end-users, as psychiatric clinics, hospitals, and integrated behavioral health systems increasingly adopt digital biomarkers to enhance diagnostic precision and streamline care delivery. Providers benefit from objective insights that complement clinical judgment, reduce diagnostic delays, and support personalized treatment planning. These tools also integrate with electronic health records (EHRs) for holistic mental health profiling.

Payers are anticipated to be the fastest-growing end-use segment, as insurers and employers explore psychiatric digital biomarkers to enable value-based reimbursement models. Real-time monitoring tools offer evidence of treatment adherence, symptom improvement, and relapse avoidance—allowing payers to fund only effective, outcomes-driven interventions. As mental health parity laws expand coverage, digital biomarkers will play a key role in cost justification and care optimization.

In February 2025, Mindstrong Health launched an AI-powered tool using smartphone typing and scrolling behavior as digital biomarkers for major depressive disorder in a national pilot with U.S. veterans.

In December 2024, Pear Therapeutics announced the integration of real-time digital biomarkers into its FDA-approved prescription digital therapeutic for schizophrenia, expanding functionality for continuous monitoring.

In October 2024, Apple Health partnered with researchers at UCLA and Biogen to study sensor-based behavioral biomarkers of anxiety and depression using Apple Watch and iPhone data.

In August 2024, Happify Health secured $75 million to develop personalized digital therapeutics using predictive biomarkers derived from user engagement and sentiment tracking.

In June 2024, Japanese startup Xenovision announced a wearable EEG headband embedded with machine learning algorithms to identify early cognitive decline and mood disturbances.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the psychiatric-digital-biomarkers-market

By Type

By Clinical Practice

By End-use

By Regional