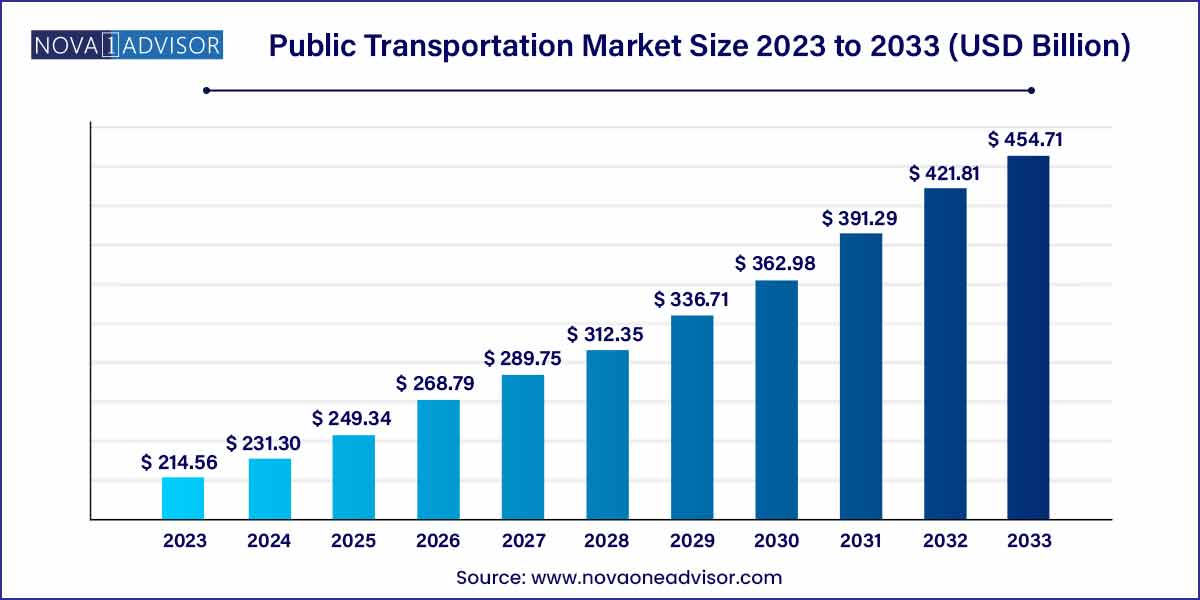

The global public transportation market size was estimated at USD 214.56 billion in 2023, is expected to surpass around USD 454.71 billion by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 7.8% during the forecast period of 2024 to 2033.

The global public transportation market serves as the backbone of urban and rural mobility networks, enabling billions of people daily to commute efficiently, cost-effectively, and sustainably. Public transportation encompasses a range of systems, including buses, trains, subways, trams, and ferries, all vital for economic development, social inclusion, and environmental preservation.

Driven by the twin imperatives of urbanization and climate change mitigation, public transportation has gained significant attention from policymakers, investors, and urban planners worldwide. Governments are increasingly investing in modernizing aging infrastructure, expanding networks, and integrating technology to enhance the user experience and operational efficiency. Simultaneously, a shift in public sentiment toward shared mobility and reduced car dependency is reinforcing the demand for well-structured public transportation systems.

Despite the disruption caused by the COVID-19 pandemic, which initially led to a dramatic decline in ridership, recovery is underway. As cities rebuild smarter and greener, public transport is poised to play an even more central role. The sector's future hinges on investments in electrification, digitalization, inclusivity, and resilience to emerging global challenges.

The growth of the public transportation market is propelled by a confluence of factors driving demand and innovation. Urbanization stands as a primary driver, with expanding urban populations necessitating efficient and sustainable mobility solutions. Concurrently, rising concerns over congestion, pollution, and carbon emissions are prompting governments and consumers alike to prioritize public transportation as a viable alternative to private vehicle usage. Moreover, advancements in technology, such as digital platforms, smart ticketing systems, and eco-friendly propulsion methods, are enhancing the attractiveness and accessibility of public transit options. Additionally, supportive government policies, subsidies, and investment initiatives are fueling infrastructure development and service expansion, further stimulating market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 214.56 Billion |

| Market Size by 2033 | USD 454.71 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Distribution Channel, Mode Type, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | BC Transit Corporation; Berliner Verkehrsbetriebe; Deutsche Bahn; East Japan Railway Company; Keolis; Mass Transit Railway (MTR); Metropolitan Transportation Authority; Southern California Regional Rail Authority (Metrolink); The Brussels Transport Company; Transport for London (TfL); Transport International Holding Limited; Trenitalia c2c Limited; TOBU RAILWAY Co. LTD; Toronto Transit Commission; Transdev. |

The dynamics of the public transportation market are intricately woven into the fabric of global urbanization and demographic shifts. Across continents, rapid urbanization is driving the need for efficient and sustainable transportation solutions to accommodate burgeoning populations. This trend is particularly pronounced in emerging economies, where growing urban centers are grappling with escalating congestion and environmental concerns. Furthermore, the rise of megacities underscores the critical importance of robust public transportation networks in facilitating mobility, economic development, and social cohesion. In developed regions, aging infrastructure and evolving consumer preferences are prompting transit agencies to adapt and innovate to remain competitive in an increasingly dynamic landscape.

The public transportation market is underpinned by a myriad of drivers that shape its trajectory and growth prospects. Key among these drivers is the pressing need to address urban congestion and mitigate the environmental impact of transportation. With cities around the world grappling with gridlock and pollution, there is a growing recognition of the role that public transit plays in alleviating these challenges. Additionally, demographic trends, such as population growth and aging populations, are fueling demand for accessible and inclusive transportation options. Government initiatives and policies aimed at promoting sustainable mobility, coupled with advancements in technology and infrastructure, are further driving market expansion.

One of the primary restraints facing the public transportation market is the challenge posed by aging and inadequate infrastructure. Many cities around the world grapple with outdated transit systems that struggle to meet the demands of growing populations. Insufficient funding for infrastructure maintenance and expansion further exacerbates this issue, leading to delays, service disruptions, and suboptimal user experiences. Moreover, retrofitting existing infrastructure to accommodate emerging technologies, such as electric vehicles and autonomous buses, presents logistical and financial hurdles for transit agencies. These infrastructure limitations not only impede the efficiency and reliability of public transportation services but also hinder efforts to address urban congestion and environmental concerns effectively.

Funding constraints pose a significant restraint on the public transportation market, limiting investment in infrastructure upgrades, service improvements, and technological innovations. Public transit agencies often rely heavily on government subsidies and fare revenues to sustain operations, leaving them vulnerable to fluctuations in funding levels and economic downturns. Moreover, competing budget priorities and political considerations may divert resources away from public transportation projects, hindering progress and exacerbating existing infrastructure deficiencies. Private sector investment opportunities are also constrained by factors such as regulatory barriers, uncertain returns on investment, and perceived risks associated with the public transportation sector.

The shift towards sustainable mobility presents a significant opportunity for the public transportation market to expand and innovate. With growing concerns over climate change and air pollution, there is increasing pressure on governments and transit agencies to prioritize eco-friendly transportation solutions. This presents an opportunity for public transportation providers to invest in renewable energy sources, electrification, and zero-emission vehicles, such as electric buses and hydrogen fuel-cell trains. By embracing sustainable mobility initiatives, transit agencies can not only reduce their carbon footprint but also enhance their attractiveness to environmentally conscious consumers.

Technological advancements present a myriad of opportunities for innovation and growth within the public transportation market. The integration of digital platforms, smart sensors, and artificial intelligence has the potential to revolutionize the way public transit systems are managed, operated, and experienced by passengers. For instance, the adoption of real-time tracking systems and predictive analytics can improve service reliability, optimize route planning, and enhance the overall passenger experience. Similarly, the emergence of Mobility as a Service (MaaS) platforms offers an opportunity for public transportation providers to collaborate with ride-sharing, bike-sharing, and micro-mobility services to offer seamless, multimodal transportation solutions to consumers. Moreover, advancements in autonomous vehicle technology hold the promise of safer, more efficient transit operations, while the proliferation of electric and hydrogen-powered vehicles offers an opportunity to reduce greenhouse gas emissions and promote sustainable urban mobility.

One of the foremost challenges confronting the public transportation market is the pervasive issue of urban congestion and increasing demand for mobility in densely populated areas. As cities continue to grow and urban populations expand, the strain on existing transportation infrastructure becomes increasingly apparent. Congested roadways, overcrowded public transit systems, and limited parking availability contribute to inefficiencies and delays, diminishing the overall effectiveness of public transportation services. Moreover, the rise of ride-sharing and micro-mobility options has introduced additional competition for passengers, further exacerbating congestion and complicating efforts to promote sustainable urban mobility. Addressing these challenges requires comprehensive planning, investment in infrastructure upgrades, and the development of integrated, multimodal transportation networks that prioritize accessibility, efficiency, and convenience for all users.

Another significant challenge facing the public transportation market revolves around funding constraints and financial sustainability. Public transit agencies often struggle to secure adequate funding to support operations, maintenance, and infrastructure upgrades, leading to service cutbacks, fare increases, and deferred maintenance. Furthermore, reliance on government subsidies and volatile revenue streams makes transit agencies vulnerable to budgetary constraints and economic downturns. Private sector investment opportunities are limited by factors such as uncertain returns on investment, regulatory barriers, and perceived risks associated with the public transportation sector. Without sufficient funding and financial stability, transit agencies may struggle to meet growing demand for services, maintain service quality, and invest in the technological innovations necessary to remain competitive in a rapidly evolving mobility landscape.

Offline distribution dominated the public transportation market's distribution channel segment. Historically, passengers have accessed public transport through traditional ticketing counters, vending machines, and pass systems. Despite the rise of online channels, offline methods remain predominant, particularly in developing regions and among older demographics. Offline ticketing systems are often complemented by physical information desks and customer service centers, essential for passengers unfamiliar with digital platforms or those requiring special assistance. Offline distribution ensures inclusivity, especially in rural and underserved areas.

However, Online distribution is witnessing the fastest growth within this segment. With smartphone penetration soaring and digital literacy improving globally, many commuters now prefer mobile apps and online platforms for ticket purchases, journey planning, and real-time updates. Cities like New York, Berlin, and Singapore have introduced comprehensive transit apps enabling seamless journey planning and contactless fare payments. Post-pandemic hygiene concerns have further accelerated the adoption of contactless ticketing solutions, setting the stage for online distribution channels to overtake traditional methods in the coming years.

Road transport dominated the mode type segment of the public transportation market. Buses, coaches, and minibuses account for a substantial portion of global public transit usage due to their flexibility, lower infrastructure requirements, and extensive network coverage. Urban bus rapid transit (BRT) systems like those in Bogota and Istanbul showcase how efficient road-based systems can transform urban mobility. Additionally, investments in low-emission and electric bus fleets, such as London's commitment to a fully zero-emission bus fleet by 2037, highlight the continuing relevance of road-based public transport.

In contrast, Rail transport is emerging as the fastest-growing mode within public transportation. Rail systems—including subways, commuter trains, and high-speed rail—are increasingly recognized for their ability to move large numbers of passengers quickly and sustainably. Major investments in high-speed rail networks across Europe and Asia, such as China's Beijing-Shanghai HSR line, demonstrate the segment's growth momentum. Furthermore, light rail systems are gaining popularity in mid-sized cities seeking to balance cost-efficiency with service quality.

Asia-Pacific dominated the global public transportation market in terms of ridership and network expansion. Home to populous countries like China, India, and Japan, the region accounts for a significant share of global public transport usage. Chinese cities like Beijing and Shanghai boast some of the world’s largest metro networks, while India continues to expand its metro systems aggressively across cities like Delhi, Bangalore, and Mumbai. Government support through initiatives such as "Smart Cities Mission" in India and China's "Urban Rail Transit Development" plan has reinforced the growth of public transportation across the region.

Middle East & Africa (MEA) is emerging as the fastest-growing region in the public transportation market. Mega infrastructure projects, supported by national visions such as "Saudi Vision 2030" and the "UAE's Urban Mobility Strategy," are transforming public transportation in the Gulf Cooperation Council (GCC) countries. Projects like the Riyadh Metro, Doha Metro, and Egypt's Cairo Monorail are establishing modern, sustainable public transportation networks in traditionally car-centric regions. In Africa, increasing urbanization and international funding are driving the development of BRT systems and light rail projects in cities like Lagos, Nairobi, and Addis Ababa.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global public transportation market.

Distribution Channel

Mode Type

By Region