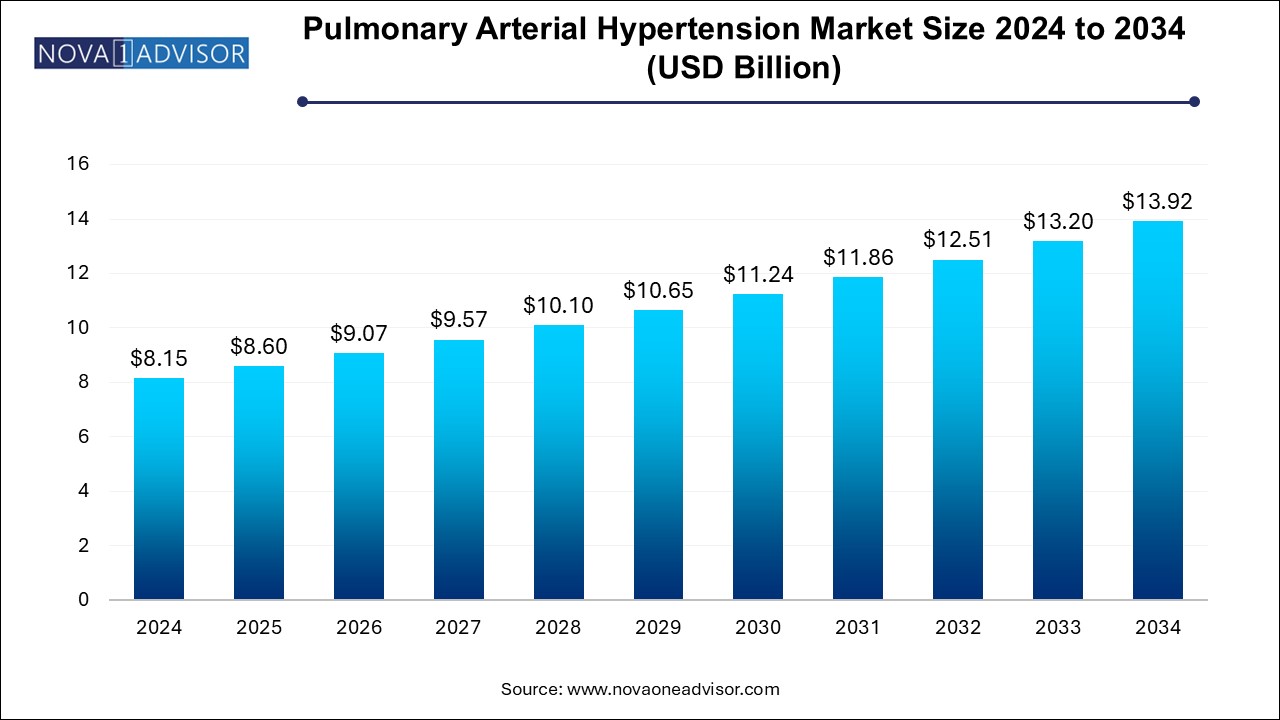

The pulmonary arterial hypertension market size was exhibited at USD 8.15 billion in 2024 and is projected to hit around USD 13.92 billion by 2034, growing at a CAGR of 5.5% during the forecast period 2024 to 2034.

The global Pulmonary Arterial Hypertension (PAH) market represents a critical frontier in rare disease management, combining targeted pharmacotherapy, diagnostic innovation, and multidisciplinary care. PAH is a progressive condition characterized by elevated blood pressure in the pulmonary arteries, which can lead to right heart failure and death if untreated. The disease is rare but severe, necessitating long-term pharmacological interventions and, in some cases, lung transplantation.

The market for PAH treatments has grown substantially in recent years, owing to improved diagnostic capabilities, heightened disease awareness, and a robust pharmaceutical pipeline. With more than 60 clinical trials ongoing globally, the focus is steadily shifting from merely managing symptoms to improving long-term outcomes and quality of life. Various drug classes are in use and under development, each targeting different molecular pathways associated with vascular remodeling, vasoconstriction, and endothelial dysfunction hallmarks of PAH pathology.

While orphan drug incentives have fueled innovation, pricing pressure, especially in developed markets, has raised access and affordability concerns. Moreover, the advent of combination therapies and transition to oral formulations has revolutionized treatment adherence and patient convenience. As the healthcare ecosystem increasingly embraces personalized medicine, the PAH market is poised to enter an era of precision treatment grounded in genomic profiling and biomarker diagnostics.

| Report Coverage | Details |

| Market Size in 2025 | USD 8.60 Billion |

| Market Size by 2034 | USD 13.92 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 5.5% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Drug Class, Type, Route Of Administration, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | United Therapeutics Corporation; Bayer; Gilead Sciences, Inc.; Johnson & Johnson; Viatris Inc.; GlaxoSmithKline; Sandoz Inc. (Novartis); Lupin Pharmaceuticals, Inc.; Sun Pharmaceutical Industries, Inc.; Teva Pharmaceuticals Inc. |

A key driver for the PAH market is the continuous innovation in drug development, especially around combination therapy. Traditionally, PAH was managed with monotherapy; however, newer guidelines and clinical evidence support the initiation of combination therapies that target multiple pathogenic pathways simultaneously. The AMBITION trial, for instance, demonstrated that an initial dual oral therapy with an endothelin receptor antagonist (ERA) and a PDE-5 inhibitor significantly reduced morbidity and hospitalization compared to monotherapy. This paradigm shift has encouraged physicians and patients to adopt aggressive early-stage intervention strategies, thereby fueling demand for multiple drug classes and new product approvals.

Despite advancements, the high cost of PAH therapies continues to be a major restraint. Most PAH drugs are classified as orphan drugs, resulting in limited competition and premium pricing. For instance, prostacyclin analogs and SGC stimulators can cost upwards of $100,000 per patient annually. These costs are often prohibitive, particularly in low- and middle-income countries where insurance penetration is minimal and public healthcare budgets are constrained. Furthermore, complex administration routes such as intravenous therapies require specialized centers and ongoing monitoring, further escalating the cost of care and limiting treatment accessibility for many patients globally.

An untapped opportunity lies in the expansion of the PAH market in emerging economies, particularly across Asia-Pacific and Latin America. These regions are witnessing improvements in healthcare infrastructure, a rise in specialist diagnostic centers, and increased government interest in rare disease treatment. The availability of generic versions and local manufacturing capabilities are making PAH therapies more affordable and accessible. Additionally, regional patient advocacy groups and public-private partnerships are playing a pivotal role in raising awareness and facilitating earlier diagnosis. These trends are expected to create significant opportunities for market players looking to scale their operations and enter high-potential markets.

Endothelin Receptor Antagonists (ERAs) currently dominate the PAH drug class segment due to their widespread adoption, proven efficacy, and favorable side effect profile. Drugs like bosentan, ambrisentan, and macitentan have become foundational treatments in PAH management. These medications help block the effects of endothelin-1, a potent vasoconstrictor implicated in PAH pathogenesis. Their oral administration and ability to be used in combination regimens make them a convenient choice for both patients and clinicians. ERAs are also well-integrated into international treatment guidelines and are supported by long-term clinical outcome data.

On the other hand, Soluble Guanylate Cyclase (SGC) stimulators, such as riociguat, are experiencing the fastest growth. These agents work by enhancing the nitric oxide signaling pathway, promoting vasodilation and inhibiting smooth muscle proliferation. Riociguat is particularly effective in patients who are non-responsive to PDE-5 inhibitors, offering a critical alternative. As research uncovers more about individualized patient response to therapy, SGC stimulators are becoming more prevalent, especially in patients with advanced disease. Ongoing trials aim to validate their role in combination therapies, which could accelerate their adoption globally.

Branded medications dominate the PAH market due to the innovative nature of the drugs, regulatory protection through orphan drug status, and limited alternatives. Most leading PAH treatments are developed by global pharmaceutical giants with significant R&D capabilities and marketing networks. The dominance of branded drugs is further strengthened by clinical trial data, specialist endorsements, and patient assistance programs. For instance, Uptravi (selexipag) and Opsumit (macitentan) have captured substantial market share due to their clinical advantages and brand recognition.

However, the generic segment is growing rapidly, particularly in regions where healthcare cost containment is a priority. Patent expirations of first-generation PAH drugs have opened the door for generic manufacturers, especially in Asia and Latin America. These versions offer significant cost savings and are being integrated into national treatment protocols to improve accessibility. Regulatory agencies like India’s CDSCO and Brazil’s ANVISA are expediting approvals for generics, making this segment a key area of opportunity for regional players.

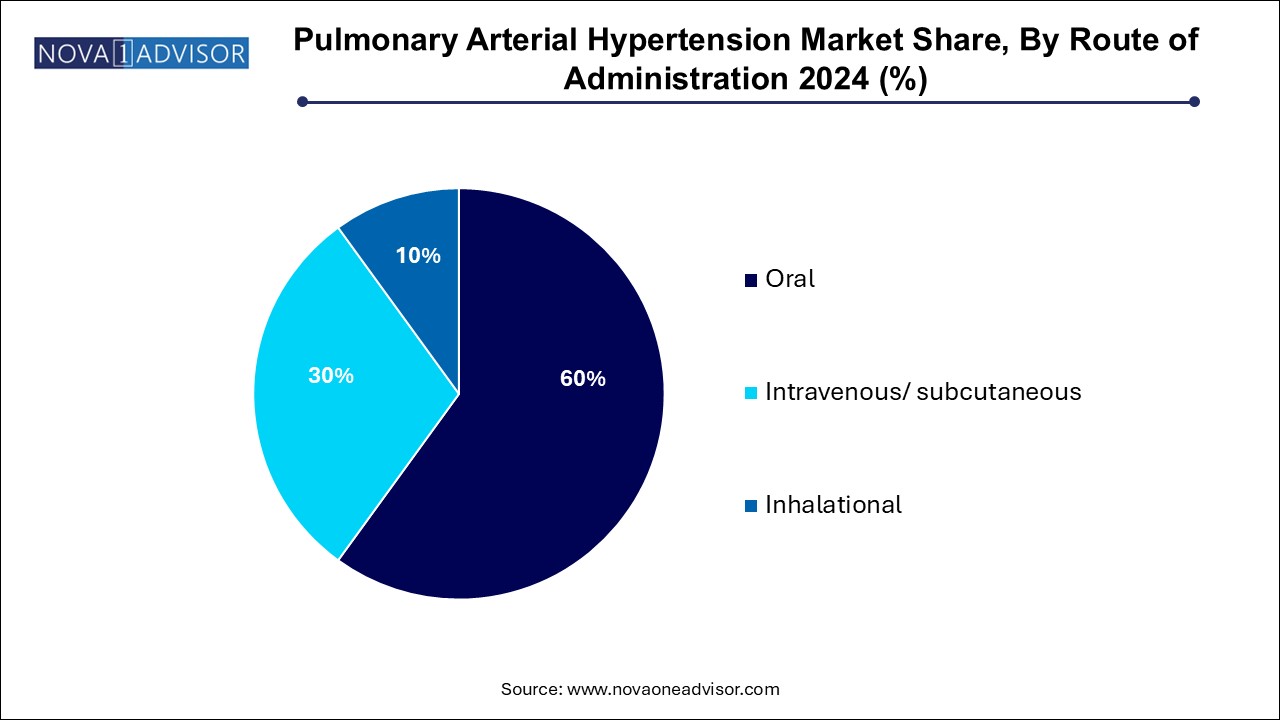

Oral administration dominates the PAH market, primarily due to its convenience, improved adherence, and suitability for long-term therapy. Many of the leading PAH medications including ERAs, PDE-5 inhibitors, and SGC stimulators are available in oral form. This route has become the first-line treatment choice, especially in outpatient settings where chronic disease management is paramount. The shift toward oral combination therapy has further solidified the dominance of this segment. Physicians prefer oral drugs for newly diagnosed patients or those in the early stages of the disease to ensure ease of use and continuity of care.

In contrast, inhalational therapies represent the fastest-growing segment. These therapies deliver targeted drug delivery directly to the lungs, offering rapid symptom relief with reduced systemic side effects. Treprostinil and iloprost are commonly used inhalational prostacyclin analogs, especially in patients who cannot tolerate systemic treatments. Advances in nebulizer and inhaler technologies are improving drug delivery and patient comfort. Furthermore, new inhalational formulations under development aim to expand the role of this route in combination regimens, especially for pediatric and elderly populations.

North America, led by the United States, remains the dominant region in the PAH market. Factors contributing to this include high disease awareness, strong healthcare infrastructure, favorable reimbursement mechanisms, and a concentration of pharmaceutical innovators. The U.S. Food and Drug Administration (FDA) has played a proactive role in fast-tracking orphan drug approvals, making North America a launchpad for new therapies. For instance, the approval of sotatercept in early 2025 has added a novel therapeutic mechanism to the existing arsenal, boosting market value. The region also boasts advanced diagnostic capabilities and patient advocacy networks that support early intervention and adherence.

Asia-Pacific is emerging as the fastest-growing region in the PAH market due to expanding healthcare access, economic growth, and increased public health investments. Countries like China, India, Japan, and South Korea are witnessing a rise in PAH diagnosis rates owing to improved medical training and awareness programs. In April 2025, a Japanese research consortium received government funding to investigate genetic markers associated with PAH susceptibility, highlighting regional research focus. The proliferation of local pharmaceutical companies, along with the entry of multinationals, is accelerating drug availability. Favorable regulatory reforms, such as China’s new rare disease policy, are further supporting market growth.

April 2025 – Acceleron Pharma (a Merck subsidiary) received FDA approval for sotatercept, a first-in-class activin signaling inhibitor for PAH.

March 2025 – United Therapeutics announced expanded distribution of its oral treprostinil formulation to European markets.

February 2025 – Janssen Pharmaceuticals launched a Phase 3 trial evaluating macitentan in pediatric PAH populations.

January 2025 – Gilead Sciences initiated a partnership with a Chinese biopharma company to develop biosimilar versions of PAH drugs.

December 2024 – Bayer AG reported positive Phase 2 results for its new SGC stimulator targeting intermediate-risk PAH patients.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pulmonary arterial hypertension market

By Drug Class

By Type

By Route of Administration

By Regional