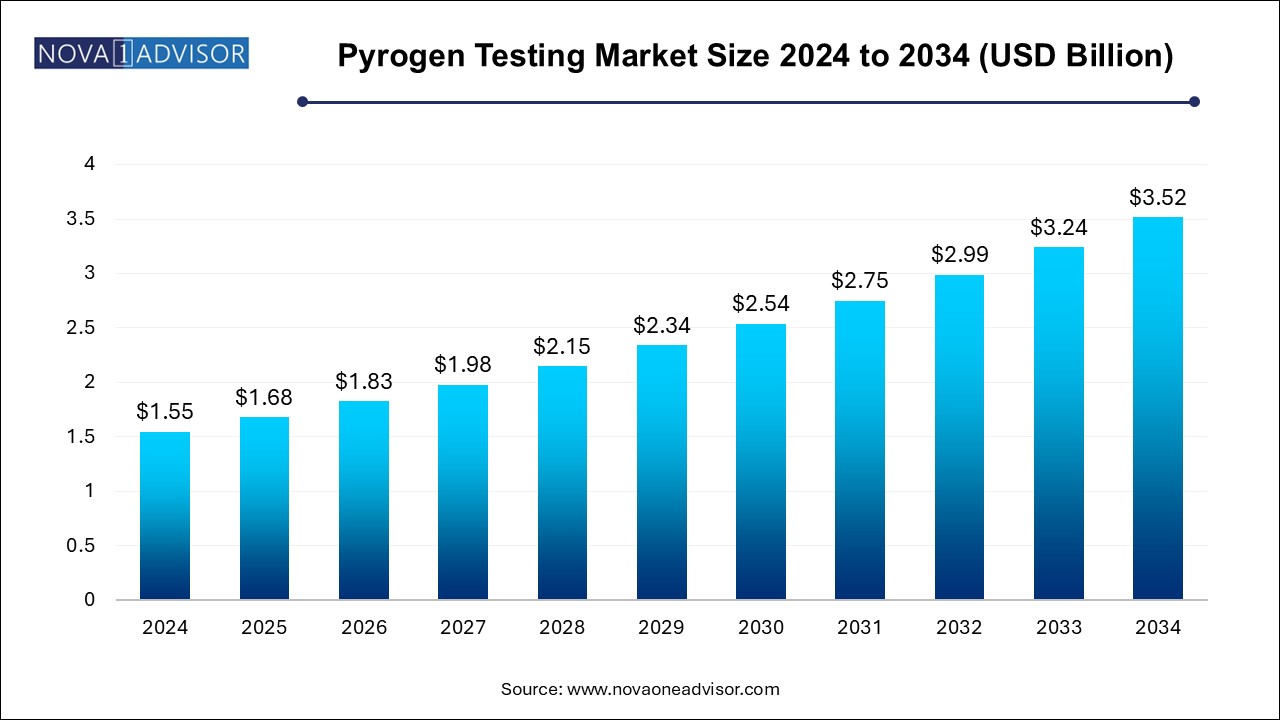

The pyrogen testing market size was exhibited at USD 1.55 billion in 2024 and is projected to hit around USD 3.52 billion by 2034, growing at a CAGR of 8.55% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.68 Billion |

| Market Size by 2034 | USD 3.52 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 8.55% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Test Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Charles River Laboratories; Ellab A/S; Merck KGaA; GenScript; bioMérieux SA; Lonza; Thermo Fisher Scientific, Inc.; Associates of Cape Cod, Inc.; FUJIFILM Wako Chemicals U.S.A. Corporation (Pyrostar) |

Increasing demand for pyrogen testing products in the pharmaceutical and biotechnology industry is a major factor contributing to the growth of the market. Rapidly growing pharmaceutical and biotechnology industries and the escalating number of new therapeutics launches are expected to boost the demand for pyrogen testing products.

Increasing investment in R&D by the government and manufacturing companies for product development is one of the major factors contributing to the market's growth. New product development and launch is a key strategy acquired by manufacturers to maintain their dominance and to get a maximum revenue share in the sector. As stated by the European Federation of Pharmaceutical Industries and Associations (EFPIA), in 2024, the research-based pharmaceutical industry invested around USD 48.65 billion in R&D in Europe in 2022. Hence, the need for pyrogen testing products is anticipated to upsurge during the forecast period.

Furthermore, the market is driven by the increasing demand for therapeutic drugs. Several companies are actively involved in developing new drug therapies. For instance, in 2024, the FDA approved 55 new drugs. Pyrogen testing in drug development specifies the absence or presence of pyrogens in parenteral pharmaceutical products. Moreover, the sterility of any drug does not indicate that it is pyrogen-free. Therefore, drugs that are expected to be sterile must be tested for the presence of pyrogens to control fevered reactions in patients.

In addition, several regulatory bodies and governments are taking various initiatives to train and create awareness about pyrogen testing. For instance, in February 2024, the European Directorate for the Quality of Medicines & Healthcare (EDQM) and the European Partnership for Alternative Approaches to Animal Testing (EPAA - European Commission) conducted an online training session to discuss the future of pyrogenicity testing by eliminating the rabbit pyrogen test.

Based on product, the pyrogen testing industry is segmented into consumables, instruments, and services. In 2024, the consumables segment was the largest segment with a share of 55.1%, and is estimated to maintain its dominance during the forecast period. The rising prevalence of chronic diseases boosts the production of pharmaceuticals, biologics, and medical device products. For instance, according to the WHO article published in September 2024, approximately 4.0 million deaths occur due to chronic respiratory diseases. Hence, the increasing production of drugs to cure these diseases drives the application of pyrogen testing consumables, including kits and reagents.

Instruments segment is expected to show significant growth during the forecast period owing to the technological advancement in products. For instance, the PyroDetect System is a verified non-animal substitute to replace the rabbit test that quality high-quality in vitro detection of both non-endotoxin and endotoxin contamination.

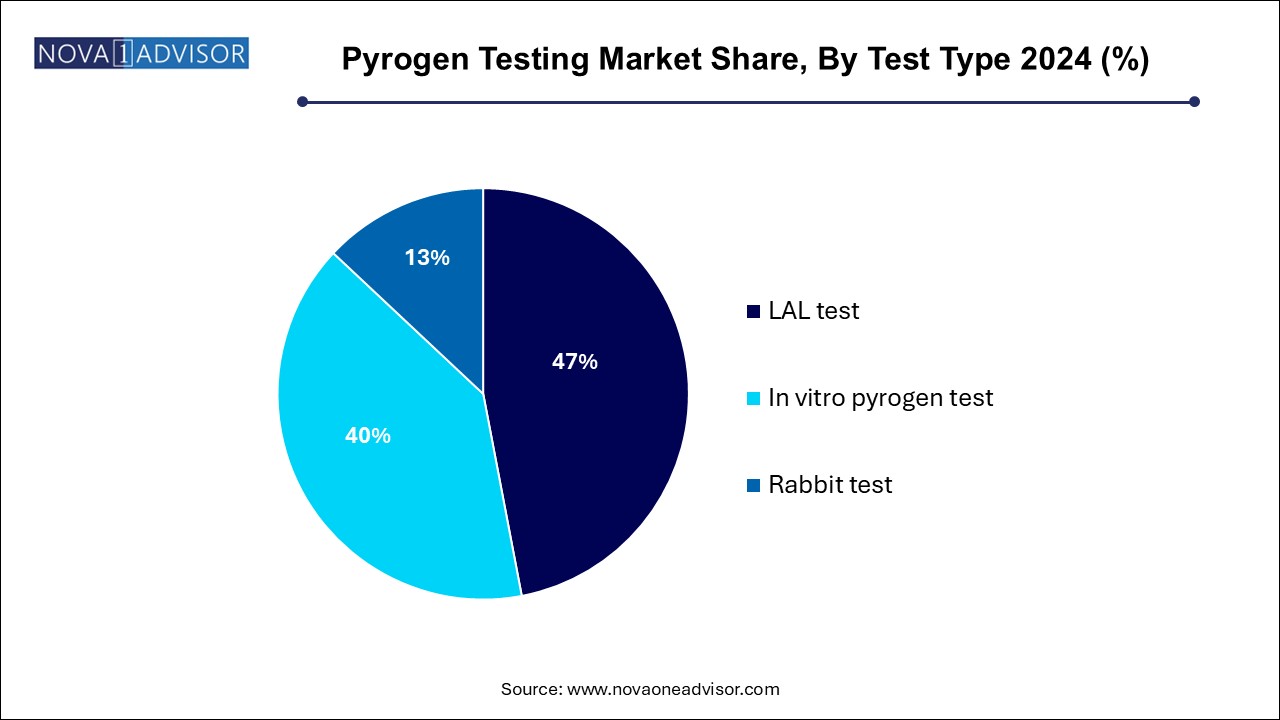

Based on test type, the pyrogen testing industry has been segmented into LAL tests, in vitro tests, and rabbit tests. The LAL test segment dominated the market with a share of 47.0% in 2024. The growth is attributed to the rising demand for animal-free detection tests and their high reproducibility and reliability during detection. For instance, In February 2024, the European Pharmacopoeia (Ph. Eur.) published 59 texts involving the rabbit pyrogen test replacement approach for public consultation in Pharmeuropa 35.1. LAL test is further categorized into turbidimetric, chromogenic, and gel clot tests.

Furthermore, the rabbit pyrogen test segment had a significant market share in the market in 2024. However, the growing use of animal-free tests is a dominant characteristic that could restrict the use of this test type to some degree in near future. The demand for animal-free tests is rising due to their capability to evaluate the product without damaging any living organisms.

The pharmaceutical and biotechnology companies dominated the overall market with a share of 59.96% in 2024. The growth is attributed to the rising production of pharmaceuticals, biopharmaceuticals, and other biologic products. Pyrogen testing is crucial in confirming parenteral pharmaceutical product safety. It is a mandatory test to prevent serious fever reactions caused by pyrogenic substances. Hence, the increasing need for pyrogen testing consumables and instruments in these companies propels the growth of the pyrogen testing market.

The medical devices companies' segment is expected to grow significantly over the forecast period. The consideration of applying pyrogen testing for medical devices arises from their potential indirect or direct exposure to human blood cells. Pyrogenicity tests are imperative to assess the safety of products that come into direct or indirect contact with blood circulation, cerebrospinal fluid (CSF), the lymphatic system, and those that interact systemically with the human body. Official methods for assessing the medical devices' pyrogenicity and materials include the in vitro bacterial endotoxin test and the in vivo rabbit pyrogenicity test.

North America dominated the pyrogen testing market with the largest revenue share of 40.9% in 2024. The growth is attributed to the rising number of chronic diseases needing developments in drug therapy. Also, North America's highly developed healthcare & research infrastructure and a large focus on new drug development have fueled the regional market growth.

U.S. Pyrogen Testing Market Trends

The market in the U.S. is expected to grow over the forecast period. The country’s growth is attributed to key players, such as Pfizer Inc., F. Hoffmann-La Roche AG, Merck Group, Celgene Corp., and Amgen Inc. who operate in the pyrogen testing market. Furthermore, several companies in the U.S. manufacture pharmaceuticals, which further boosts the application of pyrogen tests in the country.

Europe's pyrogen testing market was identified as a lucrative region in this industry. The growth is attributed to the exponentially growing biotechnology and pharmaceutical industries. Furthermore, in 2021, the European Pharmacopoeia Commission (EPC), announced an undertaking of process to eliminate rabbit pyrogen test (RPT) in the next five years.

UK Pyrogen Testing Market Trends

The market in the UK is anticipated to expand over the forecast period due to a significant approval of drugs. For instance, in 2021, according to the MHRA , 35 new drugs were approved from the UK.

France Pyrogen Testing Market Trends

The market in France is projected to grow over the forecast period. The growth is attributed to the growing initiatives in the therapeutic drugs field. The country is undertaking several initiatives to increase the access of drugs to the targeted patients in France.

Germany Pyrogen Testing Market Trends

The market in Germany is anticipated to grow over the forecast period due to the presence of several key players. Moreover, Merck KGaA, a well-known player in the pyrogen testing industry, has its headquarters in Darmstadt, Germany.

Asia Pacific is projected to exhibit the significant growth rate during the forecast period, owing to untapped opportunities in this region. Many manufacturers target Asian countries, such as China & India, for drug discovery, development, and production. In addition, clinical research organizations are focusing on Asian countries for clinical trials. The availability of less stringent government regulations for drug development, the vast genome pool, and the rapidly developing healthcare infrastructure are some of the major factors responsible for the growth of the sector in this region.

China Pyrogen Testing Market Trends

The market in China is expected to grow over the forecast period. The growth is attributed to the increasing presence of key players in the country, owing to the reasonable manufacturing cost. For instance, in March 2022, Lonza , one of the market players, expanded its manufacturing plant of active pharmaceutical ingredients (API) in China.

Japan Pyrogen Testing Market Trends

The market in Japan is expected to grow over the forecast period due increasing number of drug approvals, favorable regulations, and several key players operating in the country. Japan focuses on introducing favorable regulations for new drugs developed in other countries. It will increase the number of foreign drug approvals in Japan, thereby increasing the application of pyrogen testing in the country.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pyrogen testing market

By Product

By Test Type

By End-use

By Regional