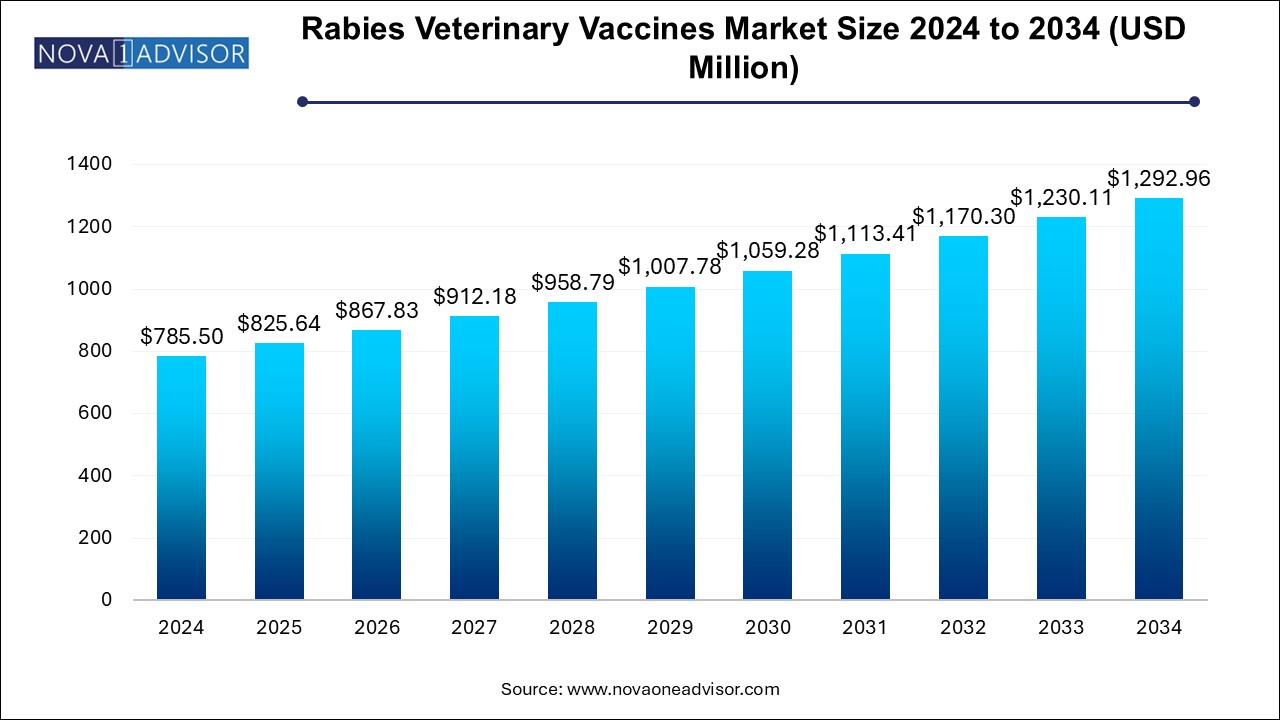

The rabies veterinary vaccines market size was exhibited at USD 785.5 million in 2024 and is projected to hit around USD 1292.96 million by 2034, growing at a CAGR of 5.11% during the forecast period 2025 to 2034.

Increasing government initiatives to eradicate animal rabies, rising awareness of zoonotic diseases, increased coverage of animal vaccinations in developing countries, nationwide implementation of mass dog vaccination campaigns, increased wildlife rabies-eradication bait programs, and a notable increase in pet ownership rates are some of the factors driving the market growth.

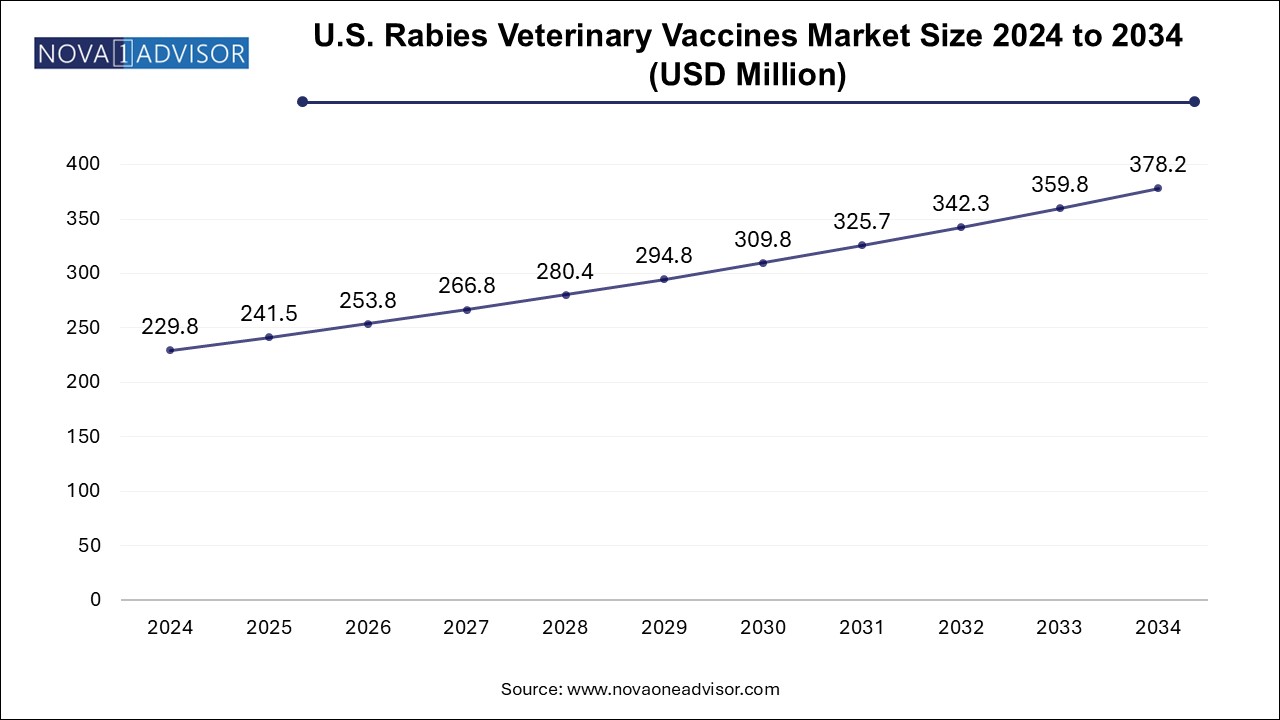

The U.S. rabies veterinary vaccines market size is evaluated at USD 229.8 million in 2024 and is projected to be worth around USD 378.2 million by 2034, growing at a CAGR of 4.6% from 2025 to 2034.

The North America rabies veterinary vaccines market dominated the global market and accounted more than 38% of the total revenue share in 2024. This can be ascribed to the region's high veterinary healthcare costs and large pet population. Government agencies and reputable veterinary pharmaceutical companies are also collaborating to expand the use of oral wildlife rabies bait-vaccine campaigns and mass vaccination programs to supplement eradication efforts, and growing pet humanization trends and pet owners' awareness of the need to protect their beloved animals from deadly diseases like rabies are also contributing to the region's improved vaccination coverage.

U.S. Rabies Veterinary Vaccines Market Trends

The U.S. rabies veterinary vaccines market held a significant share of the North America market in 2024, owing to a stringent Government regulation against vaccinations. For instance, according to the Texas Department of State Health Services, Texas mandates that dogs and cats undergo a vaccination by the time they are four months old. A licensed veterinarian is required to administer the immunization. Rabies is a zoonotic disease with high fatality rates, posing significant public health risks. Governments often implement rigorous vaccination mandates and monitoring systems to curb the spread of rabies, thus drives the market growth.

Europe Rabies Veterinary Vaccines Market Trends

The Europe rabies veterinary vaccines market holds a second largest market share, due to increasing companion population, and pet care expenditure. With a larger companion animal population, there’s a greater risk of rabies transmission, increasing the demand for effective vaccination programs. Moreover, companion animals like dogs and cats are the primary targets for rabies vaccination campaigns, ensuring their protection and public safety. For instance, the number of pet owners is increasing, with 166 million out of Europe's 352 million pets being owned by 50% of European households.

The Germany rabies veterinary vaccines market is expected to grow significantly over the forecast period. Germany is among the European nations that have virtually eradicated rabies in both domestic and wild animals by meticulous management, especially oral immunization of foxes, the primary viral carriers. However, rabies in domestic and wild animals remains an issue in Eastern Europe and other parts of the world, according to an article published by Dr. Frühwein & Partner. Thus, a strict regulations and the importance of vaccination play a significant role in driving the market in Germany.

Asia Pacific Rabies Veterinary Vaccines Market Trends

The Asia Pacific rabies veterinary vaccines market is expected to grow at the fastest CAGR over the forecast period. Rabies is a major public health concern in Southeast Asian nations. According to reports, canine rabies is prevalent in China, India, and the majority of ASEAN nations, with a markedly increased annual number of cases. One of the main causes of Asia's high illness burden is the vast number of stray dogs. In order to eradicate rabies by 2030, the region has recently started a number of initiatives, including mass dog vaccination campaigns carried out in cooperation with important stakeholders and governmental agencies.. For instance, In April 2022, Boehringer Ingelheim and the Global Alliance for Rabies Control (GARC) launched a mass vaccination operation to vaccinate 12,000 animals in the Philippines, Indonesia, Vietnam, and Malaysia as part of the rabies control drive. These elements have a major impact on the market growth.

The Thailand rabies veterinary vaccines market is growing at a significant rate and held a significant share in 2024. Thailand has seen a rise in rabies infections during the last ten years, particularly among dogs. Even though Thailand imports 2.5 million doses of vaccine annually, the Thai National Vaccine Institute (Ministry of Public Health, MOPH) made the decision to start vaccine research and development in order to protect against viral strains that are active in Thailand and its neighboring countries. Vaccine manufacturers aim to provide a locally made product at a reasonable cost with the potential for international licensure.

Latin America Rabies Veterinary Vaccines Market Trends

The Latin American rabies veterinary vaccines market is anticipated to grow at a lucrative CAGR over the forecast period. Latin America includes countries like Argentina and Brazil. The market in this region is growing rapidly as a result of a shift in customer demographics and lifestyles that has led to greater demand for meat, eggs, and other animal products. Additionally, rising pet ownership have fueled market growth. In Argentina, for example, 86% of families own at least one pet, most often a dog or cat. Market participants continuously fund R&D initiatives to launch effective vaccines.

The Brazil rabies veterinary vaccines market exhibits high growth potential. This is mostly due to the large number of pet owners in this country. Among other countries in the world, Brazil is the only one with the greatest variety of animals. Because it is a global hub for meat production, the country consumes a lot of feed. A USDA research states that rising beef prices, rising global demand, and a general trend of sector expansion were the main drivers behind a 1% increase in cattle production in 2023. Hence, this trend is often linked to better nutritional management, which contributes to improved pet health and longevity, increasing the need for regular veterinary check-ups and preventive measures like vaccines.

Middle East and Africa (MEA) Rabies Veterinary Vaccines Market Trends

The MEA rabies veterinary vaccines market growth is driven by various factors such as increasing awareness of zoonotic diseases. In countries like South Africa, these circumstances increased the need for efficient management of these diseases. Moreover, expansion of veterinary services in the region is another factor contributing to the market growth. With more veterinary services, pet owners and livestock farmers can conveniently seek vaccinations and treatments, leading to higher vaccination rates and reduced incidence. Expanding veterinary infrastructure allows for the storage and distribution of vaccines, ensuring their availability in both urban and rural areas.

The South Africa rabies veterinary vaccines market growth is anticipated to grow over the forecast period. This growth is attributed to the presence of large number of veterinarians practicing in the country. For instance, There are over 4,000 registered veterinarians in the entire country, and the number is rising, according to the South African Veterinary Association. The veterinary sector in South Africa supports both the cattle and pet industries, which are both growing rapidly as a result of the nation's rising pet ownership rates.

| Report Coverage | Details |

| Market Size in 2025 | USD 825.64 Million |

| Market Size by 2034 | USD 1292.96 Million |

| Growth Rate From 2025 to 2034 | CAGR of 5.11% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Application, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Boehringer Ingelheim International GmbH; Zoetis Services LLC; Merck & Co., Inc.; Elanco; BroadChem Philippines Biopharma Corporation; Virbac; Ceva; BiogénesisBagó; Indian Immunologicals Ltd. |

The companion animals segment dominated the global market with a revenue share of over 70.0% in 2024. In certain parts of the world, the diseased dog population is responsible for nearly 98% of rabies transmission. Timely treatments are limited since the virus can incubate in any mammal for days to months without showing any clear clinical symptoms. This deadly virus infection causes the brain to become severely inflamed, which typically results in death. Regular vaccinations and booster shots are the only method to safeguard pet animals and their owners. Several countries have made vaccination for companion animals mandatory due to the significant impact of this zoonotic neuroinvasive virus, which supports the predicted revenue share.

The wild animals segment is anticipated to expand at the fastest CAGR of over 4% over the forecast period owing to the rising wildlife vaccination campaigns in developed regions. 90% of rabies cases reported in the United States in 2024 were caused by wild animals, according to the Centers for Disease Control & Prevention. Among the most often reported wild rabid species were feral cats (12.2%), skunks (8.9%), and raccoons (68%). Within the species to which they have been widely introduced, rabies virus variants continue to spread. In a similar vein, virus variants in raccoons, foxes, skunks, and mongooses are localized in particular geographic regions.

Hospital/Clinic Pharmacies dominated the market with the largest share of 46.0% in 2024. Hospital pharmacies indeed play a dominant role in the global vaccine market, primarily due to their critical function in ensuring vaccine availability and administration in both emergency and preventive scenarios. Hospital pharmacies are often the primary point of vaccine distribution, particularly in regions where rabies poses a significant public health threat. Moreover, rabies cases, especially those requiring post-exposure prophylaxis, are typically treated in hospitals. Hospital pharmacies ensure a steady supply of vaccines for immediate use in emergencies.

E-commerce segment is the fastest-growing segment and is expected to grow at a CAGR of over 8% over the forecast period. E-commerce platforms offer a broader range of vaccines, including advanced formulations and multi-dose packs, increasing their availability across regions. Online retailers often provide competitive pricing, discounts, and subscription models, making it cost-effective for consumers to purchase vaccines. In addition, many e-commerce platforms include detailed product descriptions, user reviews, and expert advice, which help in educating buyers about vaccine usage and benefits, driving demand.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the rabies veterinary vaccines market

By Application

By Distribution Channel

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Segment Definitions

1.2.1. Application

1.2.2. Vaccine Type

1.2.3. Disease type

1.2.4. Route of Administration

1.2.5. Distribution Channel

1.2.6. Regional Scope

1.2.7. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Regional outlook

2.4. Competitive Insights

Chapter 3. Rabies Veterinary Vaccines Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Rising animal rabies vaccination coverage in developing countries

3.2.1.2. Increasing concerns over zoonotic diseases

3.2.1.3. Implementation of mass dog vaccination campaigns in various countries

3.2.1.4. Initiatives by market participants

3.2.2. Market Restraint Analysis

3.2.2.1. Limited access to veterinary services in under developed countries

3.3. Rabies Veterinary Vaccines Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of suppliers

3.3.1.2. Bargaining power of buyers

3.3.1.3. Threat of substitutes

3.3.1.4. Threat of new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic landscape

3.3.2.3. Social landscape

3.3.2.4. Technological landscape

3.3.2.5. Environmental landscape

3.3.2.6. Legal landscape

3.3.2.7. Estimated Animal Population by key Species, key Country, 2018 - 2024

3.4. Regulatory Framework

3.5. Pricing Analysis

3.6. COVID-19 impact Analysis

Chapter 4. Rabies Veterinary Vaccines market: Application Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Rabies Veterinary Vaccines market: Application Movement Analysis

4.3. Rabies Veterinary Vaccinesby Application Outlook (USD Million)

4.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

4.5. Companion Animals

4.5.1. Market Estimates And Forecast, 2021 - 2034 (USD Million)

4.6. Livestock Animals

4.6.1. Market Estimates And Forecast, 2021 - 2034 (USD Million)

4.7. Wildlife Animals

4.7.1. Market Estimates And Forecast, 2021 - 2034 (USD Million)

Chapter 5. Rabies Veterinary Vaccines market: Distribution Channel Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Rabies Veterinary Vaccines market: Distribution Channel Movement Analysis

5.3. Rabies Veterinary Vaccinesby Distribution Channel Outlook (USD Million)

5.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

5.5. Retail

5.5.1. Market Estimates And Forecast, 2021 - 2034 (USD Million)

5.6. E-Commerce

5.6.1. Market Estimates And Forecast, 2021 - 2034 (USD Million)

5.7. Hospital/Clinic Pharmacies

5.7.1. Market Estimates And Forecast, 2021 - 2034 (USD Million)

Chapter 6. Rabies Veterinary Vaccines market: Regional Estimates & Trend Analysis

6.1. Regional Dashboard

6.2. Market Size, & Forecasts Trend Analysis, 2021 to 2034:

6.3. North America

6.3.1. U.S.

6.3.1.1. Key country dynamics

6.3.1.2. U.S. market estimates and forecasts 2021 to 2034 (USD Million)

6.3.2. Canada

6.3.2.1. Key country dynamics

6.3.2.2. Canada market estimates and forecasts 2021 to 2034 (USD Million)

6.3.3. Mexico

6.3.3.1. Key country dynamics

6.3.3.2. Mexico market estimates and forecasts 2021 to 2034 (USD Million)

6.4. Europe

6.4.1. UK

6.4.1.1. Key country dynamics

6.4.1.2. UK market estimates and forecasts 2021 to 2034 (USD Million)

6.4.2. Germany

6.4.2.1. Key country dynamics

6.4.2.2. Germany market estimates and forecasts 2021 to 2034 (USD Million)

6.4.3. France

6.4.3.1. Key country dynamics

6.4.3.2. France market estimates and forecasts 2021 to 2034 (USD Million)

6.4.4. Italy

6.4.4.1. Key country dynamics

6.4.4.2. Italy market estimates and forecasts 2021 to 2034 (USD Million)

6.4.5. Spain

6.4.5.1. Key country dynamics

6.4.5.2. Spain market estimates and forecasts 2021 to 2034 (USD Million)

6.4.6. Sweden

6.4.6.1. Key country dynamics

6.4.6.2. Sweden market estimates and forecasts 2021 to 2034 (USD Million)

6.4.7. Denmark

6.4.7.1. Key country dynamics

6.4.7.2. Denmark market estimates and forecasts 2021 to 2034 (USD Million)

6.4.8. Norway

6.4.8.1. Key country dynamics

6.4.8.2. Norway market estimates and forecasts 2021 to 2034 (USD Million)

6.4.9. Rest of Europe

6.4.9.1. Key country dynamics

6.4.9.2. Rest of Europe market estimates and forecasts 2021 to 2034 (USD Million)

6.5. Asia Pacific

6.5.1. Japan

6.5.1.1. Key country dynamics

6.5.1.2. Japan market estimates and forecasts 2021 to 2034 (USD Million)

6.5.2. China

6.5.2.1. Key country dynamics

6.5.2.2. China market estimates and forecasts 2021 to 2034 (USD Million)

6.5.3. India

6.5.3.1. Key country dynamics

6.5.3.2. India market estimates and forecasts 2021 to 2034 (USD Million)

6.5.4. Australia

6.5.4.1. Key country dynamics

6.5.4.2. Australia market estimates and forecasts 2021 to 2034 (USD Million)

6.5.5. South Korea

6.5.5.1. Key country dynamics

6.5.5.2. South Korea market estimates and forecasts 2021 to 2034 (USD Million)

6.5.6. Thailand

6.5.6.1. Key country dynamics

6.5.6.2. Thailand market estimates and forecasts 2021 to 2034 (USD Million)

6.5.7. Rest of Asia-Pacific

6.5.7.1. Key country dynamics

6.5.7.2. Rest of Asia-Pacific market estimates and forecasts 2021 to 2034 (USD Million)

6.6. Latin America

6.6.1. Brazil

6.6.1.1. Key country dynamics

6.6.1.2. Brazil market estimates and forecasts 2021 to 2034 (USD Million)

6.6.2. Argentina

6.6.2.1. Key country dynamics

6.6.2.2. Argentina market estimates and forecasts 2021 to 2034 (USD Million)

6.6.3. Rest of LA

6.6.3.1. Key country dynamics

6.6.3.2. Rest of LA market estimates and forecasts 2021 to 2034 (USD Million)

6.7. MEA

6.7.1. South Africa

6.7.1.1. Key country dynamics

6.7.1.2. South Africa market estimates and forecasts 2021 to 2034 (USD Million)

6.7.2. Saudi Arabia

6.7.2.1. Key country dynamics

6.7.2.2. Saudi Arabia market estimates and forecasts 2021 to 2034 (USD Million)

6.7.3. UAE

6.7.3.1. Key country dynamics

6.7.3.2. UAE market estimates and forecasts 2021 to 2034 (USD Million)

6.7.4. Kuwait

6.7.4.1. Key country dynamics

6.7.4.2. Kuwait market estimates and forecasts 2021 to 2034 (USD Million)

6.7.5. Rest of MEA

6.7.5.1. Key country dynamics

6.7.5.2. Rest of MEA market estimates and forecasts 2021 to 2034 (USD Million)

Chapter 7. Competitive Landscape

7.1. Company Categorization

7.2. Recent Developments & Impact Analysis by Key Market Participants

7.3. Company Market Share Analysis, 2024

7.4. Company overview

7.4.1. Boehringer Ingelheim International GmbH

7.4.1.1. Company Overview

7.4.1.2. Financial performance

7.4.1.3. Product benchmarking

7.4.1.4. Strategic initiatives

7.4.2. Zoetis Services LLC

7.4.2.1. Company Overview

7.4.2.2. Financial performance

7.4.2.3. Product benchmarking

7.4.2.4. Strategic initiatives

7.4.3. Indian Immunologicals Ltd.

7.4.3.1. Company Overview

7.4.3.2. Financial performance

7.4.3.3. Product benchmarking

7.4.3.4. Strategic initiatives

7.4.4. Merck & Co., Inc.

7.4.4.1. Company Overview

7.4.4.2. Financial performance

7.4.4.3. Product benchmarking

7.4.4.4. Strategic initiatives

7.4.5. Virbac

7.4.5.1. Company Overview

7.4.5.2. Financial performance

7.4.5.3. Product benchmarking

7.4.5.4. Strategic initiatives

7.4.6. BiogénesisBagó

7.4.6.1. Company Overview

7.4.6.2. Financial performance

7.4.6.3. Product benchmarking

7.4.6.4. Strategic initiatives

7.4.7. Elanco

7.4.7.1. Company Overview

7.4.7.2. Financial performance

7.4.7.3. Product benchmarking

7.4.7.4. Strategic initiatives

7.4.8. Ceva

7.4.8.1. Company Overview

7.4.8.2. Financial performance

7.4.8.3. Product benchmarking

7.4.8.4. Strategic initiatives

7.4.9. BroadChem Philippines Biopharma Corporation

7.4.9.1. Company Overview

7.4.9.2. Financial performance

7.4.9.3. Product benchmarking

7.4.9.4. Strategic initiatives

7.5. Strategy Mapping

7.5.1. Mergers & Acquisitions

7.5.2. Partnerships & Collaborations

7.5.3. Expansions

7.5.4. Others

7.6. List of Other Key Players