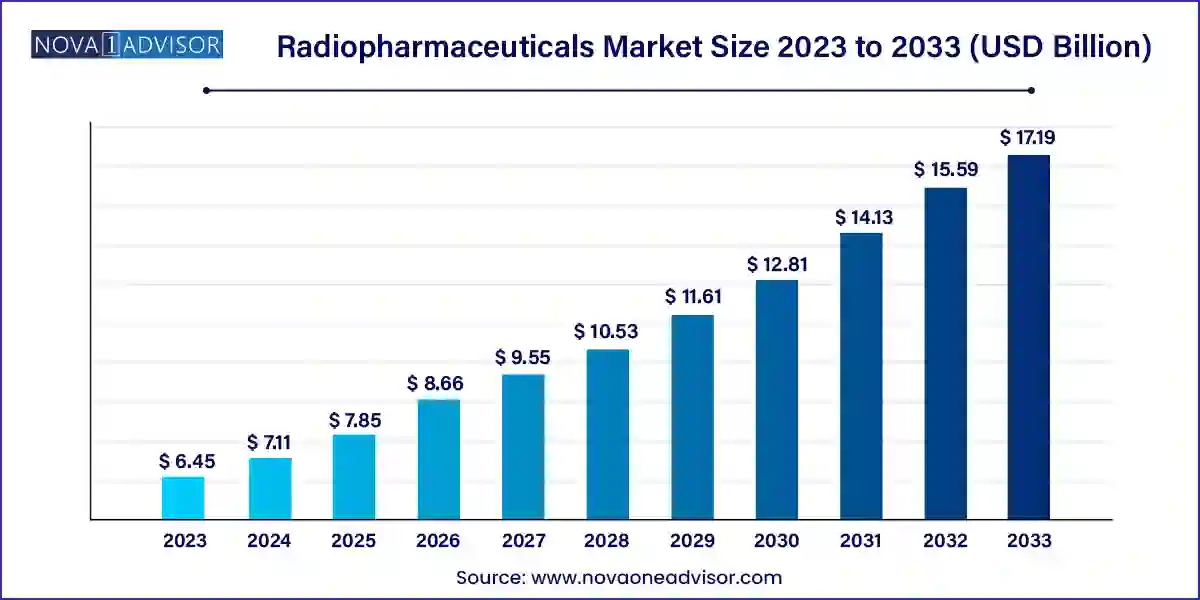

The radiopharmaceuticals market size was exhibited at USD 6.45 billion in 2023 and is projected to hit around USD 17.19 billion by 2033, growing at a CAGR of 10.3% during the forecast period 2024 to 2033.

The radiopharmaceuticals sector encompasses the realm of nuclear medicine pharmaceuticals. These substances contain radioactive elements, facilitating the diagnosis and treatment of a wide array of medical conditions. Radiopharmaceuticals emit radiation that can be detected through cutting-edge imaging devices like PET and SPECT scanners. This facilitates the visualization of internal physiological processes and the detection of diseases such as cancer, cardiac conditions, and neurological disorders.

The global radiopharmaceuticals market has expanded owing to breakthroughs in healthcare technology, an increasing prevalence of chronic illnesses, and a burgeoning elderly demographic. It plays a pivotal role in personalized medicine and the advancement of innovative medical therapeutics.

The radiopharmaceuticals sector, an integral component of nuclear medicine, has witnessed substantial expansion owing to its pivotal role in the diagnosis and treatment of diverse medical conditions. Radiopharmaceuticals consist of specialized drugs containing radioactive components that emit detectable radiation via sophisticated imaging instruments like PET and SPECT scanners. This technological advancement enables the visualization of internal bodily functions, aiding in the detection of ailments such as cancer, cardiovascular maladies, and neurological disorders.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.11 Billion |

| Market Size by 2033 | USD 17.19 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | By Radioisotope, By Application, By Type, and By End User |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Key Companies Profiled | Bayer AG, Iso-Tex Diagnostics, Inc, Jubilant Pharmova Limited, Novartis AG, General Electric Company, Lantheus Holdings, Inc., Eli Lilly and Company, Siemens AG, Curium Pharma, Cardinal Health Inc., and Others. |

The global radiopharmaceuticals market has experienced robust growth, underpinned by advancements in healthcare technology, the rising prevalence of chronic illnesses, and the burgeoning elderly population.

A primary impetus propelling the radiopharmaceuticals market is the burgeoning realm of personalized medicine. Radiopharmaceuticals play a pivotal role in customizing medical treatments for individual patients, and enhancing therapeutic outcomes. Moreover, the escalating incidence of chronic ailments like cancer and cardiovascular diseases has stimulated demand for diagnostic and therapeutic solutions offered by radiopharmaceuticals. The industry has also benefited from ongoing research and development endeavors, ushering in novel radiopharmaceuticals that augment diagnostic precision and therapeutic effectiveness.

Despite its promising trajectory, the radiopharmaceuticals sector confronts several obstacles. Regulatory complexities can impede the approval process for new radiopharmaceuticals, leading to delays in their commercial rollout. There are also concerns surrounding the secure handling and disposal of radioactive materials, which can entail substantial expenses and logistical intricacies. Additionally, the substantial initial investments required for establishing radiopharmaceutical production facilities can pose a formidable entry barrier for smaller enterprises.

The radiopharmaceuticals market offers substantial business prospects, particularly in the sphere of pioneering diagnostic and therapeutic agents. Enterprises adept at navigating the regulatory landscape and committing resources to research and development for cutting-edge radiopharmaceuticals are well-poised for success. Moreover, collaborative ventures between pharmaceutical entities, healthcare providers, and research institutions can spur joint efforts in advancing the field. With healthcare systems globally emphasizing early disease detection and personalized treatment, the radiopharmaceuticals market stands poised to leverage these opportunities.

In summation, the radiopharmaceuticals domain is a dynamic sector that has witnessed significant expansion owing to its pivotal role in healthcare. While grappling with regulatory intricacies and logistical challenges, it presents substantial business opportunities for enterprises at the vanguard of research and innovation, driven by the surging demand for personalized medicine and the escalating prevalence of chronic diseases.

Driver

Personalized medicine

Personalized medicine stands as a distinctive driving force propelling the dynamic expansion of the radiopharmaceuticals market. This groundbreaking paradigm tailors medical interventions to individual patients, leveraging their distinct genetic, molecular, and clinical profiles, thus ushering in a transformative era in healthcare. Within the realm of radiopharmaceuticals, this approach empowers the creation of exceptionally precise diagnostic and therapeutic solutions. Through the application of cutting-edge imaging techniques and the development of radiopharmaceuticals engineered to selectively bind to disease-specific biomarkers, healthcare professionals can deliver pinpoint diagnoses and meticulously monitor ailments such as cancer, cardiovascular disorders, and neurodegenerative conditions.

Furthermore, personalized medicine fuels the innovation of radiopharmaceutical-based treatments meticulously crafted to effectively combat diseases while minimizing adverse effects. The art of matching patients with radiopharmaceuticals uniquely suited to their genetic constitution and disease attributes not only elevates treatment outcomes and safety but also stimulates market growth by igniting a surge in research and development endeavors aimed at engineering novel, highly specialized radiopharmaceuticals.

Moreover, it fosters increased acceptance and utilization of radiopharmaceuticals as healthcare providers increasingly grasp their pivotal role in achieving precise diagnoses and delivering laser-focused therapeutic interventions. With the continued ascent of personalized medicine, the radiopharmaceuticals market is poised to ascend to unprecedented heights, revolutionizing the landscape of disease management and patient-centric care.

Restraints

Short half-lives

The relatively short half-lives of many radiopharmaceuticals pose a significant restraint on the radiopharmaceuticals market's growth. These short half-lives, often measured in minutes to hours, limit the window of opportunity for both production and administration of these compounds. Firstly, from a production standpoint, it necessitates a highly efficient and streamlined manufacturing process, as delays can lead to significant radioactive decay, rendering the radiopharmaceutical ineffective or less potent. This requirement for precision and speed in production can increase operational costs and complexity.

Secondly, in terms of administration, the short half-lives demand well-established and well-coordinated distribution networks to ensure timely delivery to healthcare facilities. This can be particularly challenging in regions with limited infrastructure or remote areas. Additionally, the short half-lives restrict the use of radiopharmaceuticals to specific diagnostic and therapeutic applications, limiting their versatility and potentially reducing their market potential. Overcoming these challenges requires ongoing investment in research and development to create radiopharmaceuticals with longer half-lives and innovative solutions for efficient production and distribution, thus expanding their utility in healthcare.

Opportunities

Neurological applications

Neurological applications are etching distinctive contours in the radiopharmaceuticals market, sketching a vivid canvas of promising prospects. This metamorphosis is spurred by a myriad of forces reshaping the demand dynamics for radiopharmaceuticals. First and foremost, the surging prevalence of neurodegenerative ailments, exemplified by Alzheimer's and Parkinson's, compels a shift towards precise diagnostics, continuous surveillance, and deep-seated research. Radiopharmaceuticals, endowed with the knack for unveiling the intricacies of cerebral function and molecular-level disorders, have risen to become indispensable assets for neurologists and researchers alike.

In parallel, as the annals of neurobiology unfurl, radiopharmaceuticals are emerging as keystone elements in the realm of pharmaceutical development and clinical experimentation, sparking intricate collaborations between pharmaceutical juggernauts and radiopharmaceutical maestros. This burgeoning panorama not only fans the flames of innovation but also diversifies the utility of radiopharmaceuticals, transcending the precincts of oncology and elevating their pertinence and economic feasibility. This expansive trajectory is poised to spark heightened investments, transformative research endeavors, and fervent developmental pursuits in the radiopharmaceutical domain, promising an era rife with burgeoning opportunities and metamorphic growth.

The COVID-19 pandemic had a mixed impact on the radiopharmaceuticals market. While disruptions in the supply chain and reduced patient access to healthcare facilities initially posed challenges, the crisis also underscored the importance of diagnostic imaging and therapeutic radiopharmaceuticals in disease management and research. Increased focus on vaccine development and tracking the virus using radiopharmaceuticals, such as PET tracers, drove innovation.

The market adapted to new safety protocols, telemedicine integration, and collaborations to ensure continued production and supply. In the long term, the pandemic's emphasis on healthcare resilience and advanced diagnostics is expected to bolster the radiopharmaceuticals market's growth.

According to the Radioisotopes, the Technetium-99m sector has held 45% revenue share in 2023. Technetium-99m (Tc-99m) holds a major share in the radiopharmaceutical market due to its unique properties. It's the most widely used isotope for diagnostic imaging, offering excellent imaging characteristics with a relatively short half-life, minimizing patient radiation exposure. Tc-99m is versatile, compatible with various radiopharmaceutical compounds, making it suitable for a wide range of diagnostic applications, from cardiology to oncology. Additionally, it is readily available from technetium generators, ensuring a stable supply chain. These factors, coupled with its established safety and efficacy, contribute to Tc-99m's dominant position in the radiopharmaceutical market.

The Gallium-68 sector is anticipated to expand at a significant CAGR of 13.1% during the projected period. The prominence growth of Gallium-68 (Ga-68) in the radiopharmaceuticals market is attributed to its substantial market share, driven by its adaptability and clinical significance. Ga-68 primarily finds its niche in positron emission tomography (PET) imaging, a modality that has gained increasing importance in the diagnosis, staging, and monitoring of cancer treatments. Radiopharmaceuticals labeled with Ga-68, such as Ga-68 DOTATATE for neuroendocrine tumors, offer exceptional precision and enhanced imaging quality. Furthermore, Ga-68 boasts a relatively brief half-life, facilitating the production of readily deployable radiopharmaceuticals within imaging centers. This convenience, combined with the expanding spectrum of Ga-68's applications in personalized medicine, firmly establishes its dominance growth in the radiopharmaceuticals market.

Based on the application, cancer is anticipated to hold the largest market share of 53% in 2023. This commanding presence results from several influential factors. Firstly, radiopharmaceuticals play a pivotal role in the multifaceted domain of cancer care, spanning diagnosis, staging, and treatment monitoring, thus elevating the precision of therapeutic interventions. Secondly, their indispensability extends to therapeutic modalities like radioimmunotherapy and targeted alpha-particle therapy, contributing significantly to the arsenal of effective cancer treatments. Furthermore, the relentless global burden of cancer, coupled with progressive strides in radiopharmaceutical technology, has considerably broadened their scope and application. The synergy of diagnostic and therapeutic utility, coupled with the escalating incidence of cancer, establishes the cancer segment as a formidable driver of market dominance.

On the other hand, the cardiology sector is projected to grow at the fastest rate over the projected period. The ascendancy of the cardiology domain within the radiopharmaceuticals market can be attributed to its pivotal and central role in unraveling the mysteries of cardiovascular diseases, which endure as a leading global cause of mortality. Radiopharmaceuticals, particularly those harnessed in single photon emission computed tomography (SPECT) and positron emission tomography (PET) imaging, bestow the gift of precision in deciphering cardiac dynamics, blood circulation, and tissue vitality, thereby empowering early ailment detection and vigilant treatment tracking.

As the prevalence of cardiovascular afflictions continues its unwavering ascent, the demand for these state-of-the-art diagnostic instruments steadfastly rises. Furthermore, concurrent endeavors in research and development, laser-focused on augmenting the effectiveness of cardiac radiopharmaceuticals, combined with the shifting demographic landscape characterized by aging, serve as cornerstones reinforcing the ascendancy and prominence of the cardiology segment within the radiopharmaceuticals market.

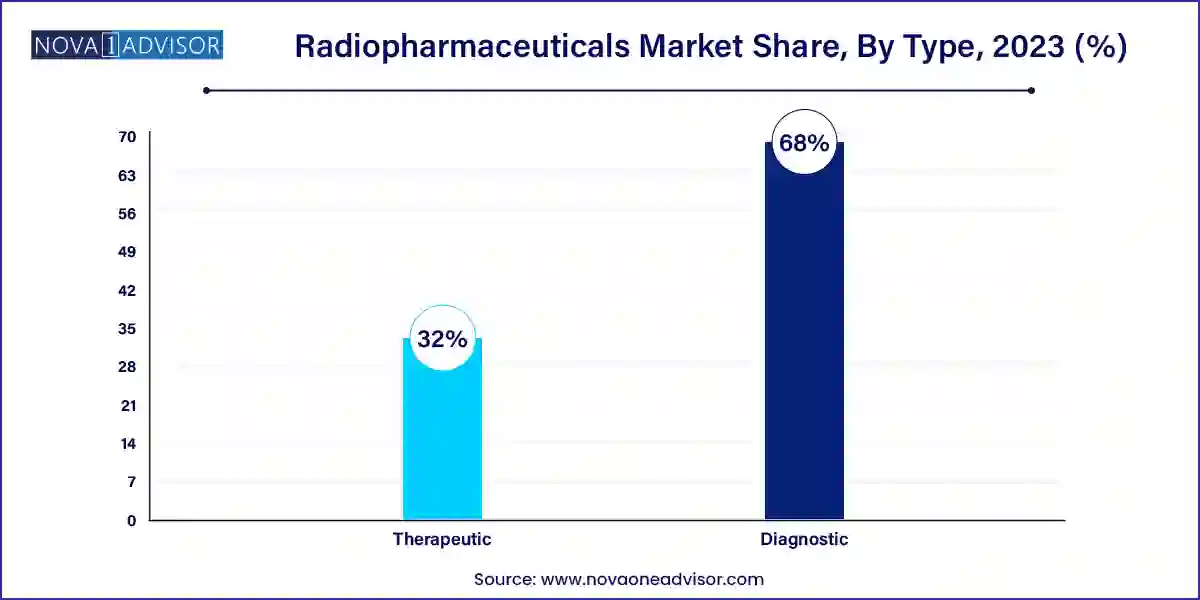

Based on the type, diagnostic is anticipated to hold the largest market share of 68% in 2023. The diagnostic segment holds a significant share in the radiopharmaceuticals market primarily because of its critical role in disease detection and management. Radiopharmaceuticals, such as PET and SPECT tracers, provide precise and non-invasive imaging of various medical conditions, including cancer, cardiovascular diseases, and neurological disorders. They enable early diagnosis, accurate staging, and treatment planning, driving their widespread use. Additionally, the increasing prevalence of chronic diseases and the growing adoption of nuclear medicine techniques contribute to the sustained demand for radiopharmaceuticals in diagnostics, making it a major revenue-generating segment in the market.

On the other hand, the therapeutics sector is projected to grow at the fastest rate over the projected period. The dominance growth of the therapeutics segment in the radiopharmaceuticals market is attributed to its central role in the treatment landscape for a range of medical conditions, notably cancer. Radiopharmaceuticals, including targeted radionuclide therapies, offer highly precise and efficacious treatment modalities, reducing collateral damage to healthy tissues.

As the global incidence of cancer and chronic ailments continues to surge, the demand for therapeutic radiopharmaceuticals escalates. Furthermore, ongoing research and developmental endeavors are broadening the therapeutic spectrum of radiopharmaceuticals, reinforcing their prominence growth in contemporary healthcare and solidifying their commanding presence within the market

The hospitals and clinics sector has generated a revenue share of 52 % in 2023. Hospitals and clinics hold a significant share in the radiopharmaceuticals market primarily due to their role as central hubs for patient care and medical imaging services. These healthcare facilities extensively utilize radiopharmaceuticals for diagnostic procedures like PET and SPECT scans, enabling accurate disease detection and treatment planning.

Moreover, hospitals and clinics often have the specialized equipment and expertise required for radiopharmaceutical administration and patient monitoring. As a result, they are key consumers, driving demand and revenue in the radiopharmaceuticals market, making them major stakeholders in this sector.

The medical imaging centers sector is anticipated to grow at a significantly faster rate, registering a CAGR of 14.8% over the predicted period. Medical imaging centers hold a substantial share in the radiopharmaceutical market primarily because they are critical consumers of radiopharmaceutical products for diagnostic purposes. These centers, equipped with advanced imaging technologies like PET and SPECT, heavily rely on radiopharmaceuticals to conduct precise scans for disease detection and treatment monitoring.

The increasing incidence of conditions like cancer, cardiac diseases, and neurological disorders drives the demand for these diagnostic services. Additionally, medical imaging centers play a central role in the expansion of theranostic approaches, where radiopharmaceuticals are used for both diagnosis and therapy, further solidifying their significance in the market.

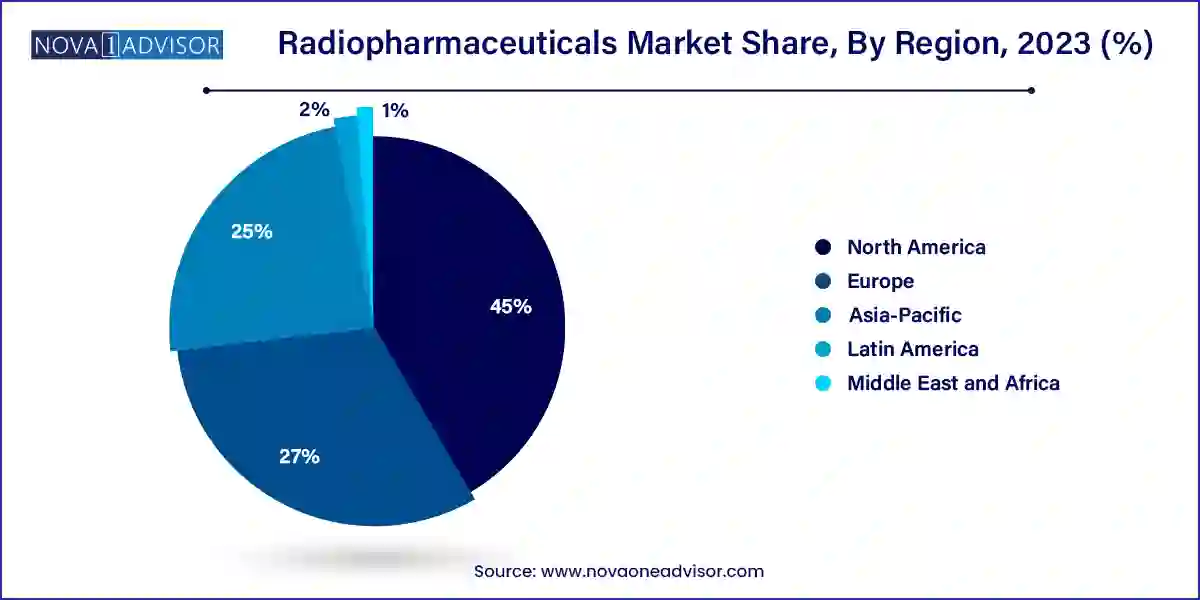

North America has held the largest revenue share 45% in 2023. North America's dominance in the radiopharmaceuticals market can be attributed to several pivotal factors. The region possesses a robust healthcare ecosystem, extensive research and development initiatives, and a high incidence of chronic ailments, fueling the demand for radiopharmaceuticals in diagnostics and treatment.

Furthermore, North America benefits from a well-established regulatory landscape, favorable reimbursement structures, and a significant presence of leading pharmaceutical and radiopharmaceutical enterprises, enhancing its market leadership. Additionally, the region's dedication to technological innovation and the embrace of cutting-edge imaging modalities solidify its preeminent position in the global radiopharmaceutical arena.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region has asserted its prominence in the radiopharmaceuticals market due to distinct factors. Its substantial and aging populace is encountering a surge in chronic ailments, compelling escalated employment of radiopharmaceuticals for diagnostic and therapeutic purposes. Furthermore, an upswing in healthcare infrastructure, wider accessibility to advanced medical technologies, and heightened awareness of nuclear medicine's advantages are propelling market expansion.

Additionally, the region's augmented investments in research and development, coupled with favorable shifts in regulatory landscapes, are fostering innovation and the creation of novel radiopharmaceuticals, thereby substantiating the significant market share held by Asia-Pacific.

Recent Developments

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the radiopharmaceuticals market

By Radioisotope

By Application

By Type

By End User

Regional