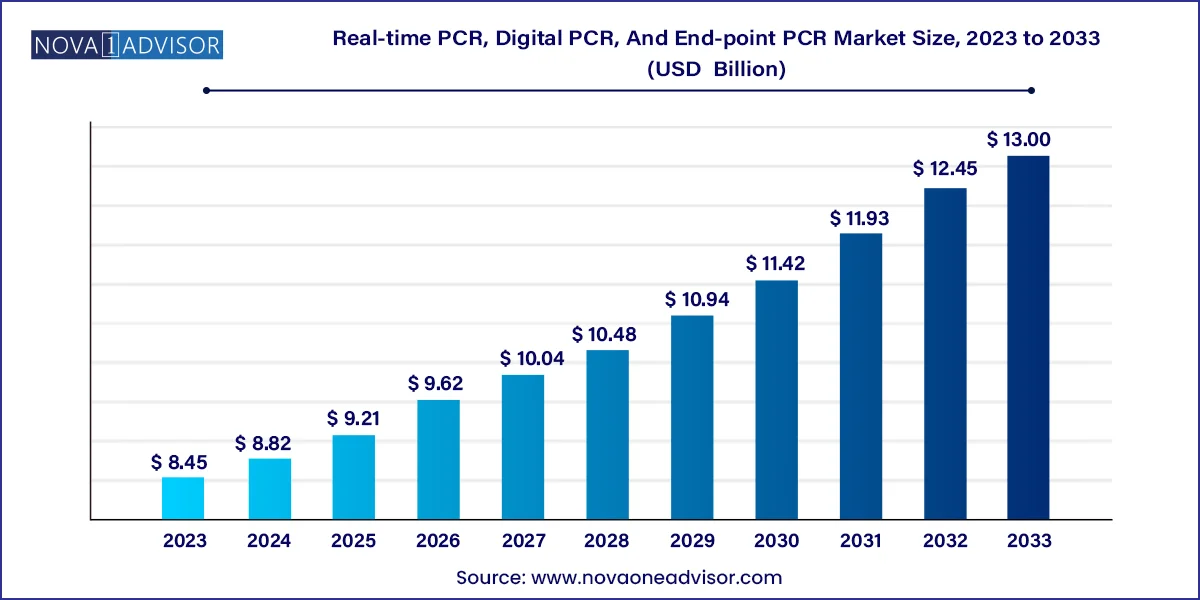

The global Real-time PCR, Digital PCR, And End-point PCR market size was valued at USD 8.45 billion in 2023 and is anticipated to reach around USD 13 billion by 2033, growing at a CAGR of 4.4% from 2024 to 2033.

Polymerase Chain Reaction (PCR) technologies have revolutionized molecular biology, enabling precise amplification and analysis of DNA and RNA sequences. Among these, Real-time PCR (qPCR), Digital PCR (dPCR), and End-point PCR stand out for their distinct methodologies and applications.

Real-time PCR (qPCR) allows for the monitoring of DNA amplification in real-time, providing quantitative data essential for diagnostics and research.

Digital PCR (dPCR) offers absolute quantification by partitioning the sample into numerous individual reactions, enhancing sensitivity and precision.

End-point PCR is the traditional method where the amplified product is analyzed at the end of the reaction, commonly used in genotyping and cloning.

The integration of these technologies into clinical diagnostics, research, and forensic applications has propelled market growth. The increasing prevalence of infectious diseases, genetic disorders, and the demand for personalized medicine are key drivers. Moreover, advancements in PCR technologies have led to the development of automated, high-throughput systems, further expanding their utility.

Integration with Next-Generation Sequencing (NGS): PCR technologies are increasingly being used in conjunction with NGS for library preparation and validation.

Point-of-Care Testing (POCT): Development of portable PCR devices enables rapid diagnostics at the patient's bedside or in remote locations.

Multiplex PCR: Simultaneous detection of multiple targets in a single reaction enhances efficiency and reduces costs.

Automation and High-Throughput Systems: Automation reduces manual errors and increases throughput, essential for large-scale studies.

Digital PCR Advancements: Enhanced sensitivity and precision of dPCR are making it a preferred choice for detecting rare mutations and low-abundance targets.

Eco-friendly Reagents: Development of environmentally friendly reagents aligns with global sustainability goals.

| Report Attribute | Details |

| Market Size in 2024 | USD 8.82 Billion |

| Market Size by 2033 | USD 13.00 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.4% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, application, product, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Abbott; Qiagen; Bio-Rad Laboratories Inc.; Agilent Technologies, Inc.; Thermo Fisher Scientific, Inc.; GE Healthcare; bioMérieux; F. Hoffmann-La Roche Ltd; Fluidigm Corporation |

The shift towards precision medicine, which tailors treatment based on individual genetic profiles, has significantly increased the demand for accurate and sensitive diagnostic tools. PCR technologies, especially qPCR and dPCR, are pivotal in detecting genetic mutations, quantifying gene expression, and monitoring treatment responses. For instance, in oncology, PCR-based assays are used to identify specific mutations that guide targeted therapies. The ability of PCR to provide rapid and precise results makes it indispensable in the era of personalized healthcare.

While PCR technologies offer numerous advantages, the high cost associated with advanced instruments and reagents poses a significant barrier, especially for small laboratories and institutions in developing regions. The initial investment, coupled with maintenance and operational costs, can be prohibitive. Additionally, the need for skilled personnel to operate complex systems further escalates expenses. These financial constraints can limit the adoption of PCR technologies, particularly in resource-limited settings.

Emerging economies present a substantial opportunity for market expansion. Increasing healthcare expenditure, rising awareness of molecular diagnostics, and government initiatives to improve healthcare infrastructure are driving the adoption of PCR technologies in countries like India, China, and Brazil. For example, during the COVID-19 pandemic, many of these countries rapidly scaled up PCR testing capabilities, highlighting the potential for broader applications. Collaborations between global companies and local entities can facilitate technology transfer and market penetration in these regions.

Clinical Diagnostics Dominate the Application Segment

Clinical diagnostics represent the largest application area, encompassing pathogen detection, oncology testing, blood screening, and prenatal diagnostics. The rapid and accurate results provided by PCR technologies are vital for timely clinical decision-making. For instance, during the COVID-19 pandemic, qPCR became the gold standard for SARS-CoV-2 detection.

Research Applications are Expanding Rapidly

Research applications are witnessing significant growth, driven by advancements in genomics, transcriptomics, and personalized medicine. PCR technologies are integral in gene expression studies, mutation analysis, and cloning. The rise in academic and industrial research activities, supported by funding initiatives, contributes to this expansion.

Consumables & Reagents Lead the Market

Consumables and reagents, including primers, probes, enzymes, and buffers, constitute the largest product segment. The recurring nature of these products, essential for each PCR reaction, ensures consistent demand. The development of specialized reagents for specific applications, such as high-fidelity enzymes for cloning, further drives this segment.

Software & Services are Gaining Traction

With the increasing complexity of PCR data, software solutions for data analysis, interpretation, and storage are becoming crucial. Additionally, services like instrument calibration, maintenance, and training are in demand to ensure optimal performance and compliance with regulatory standards.

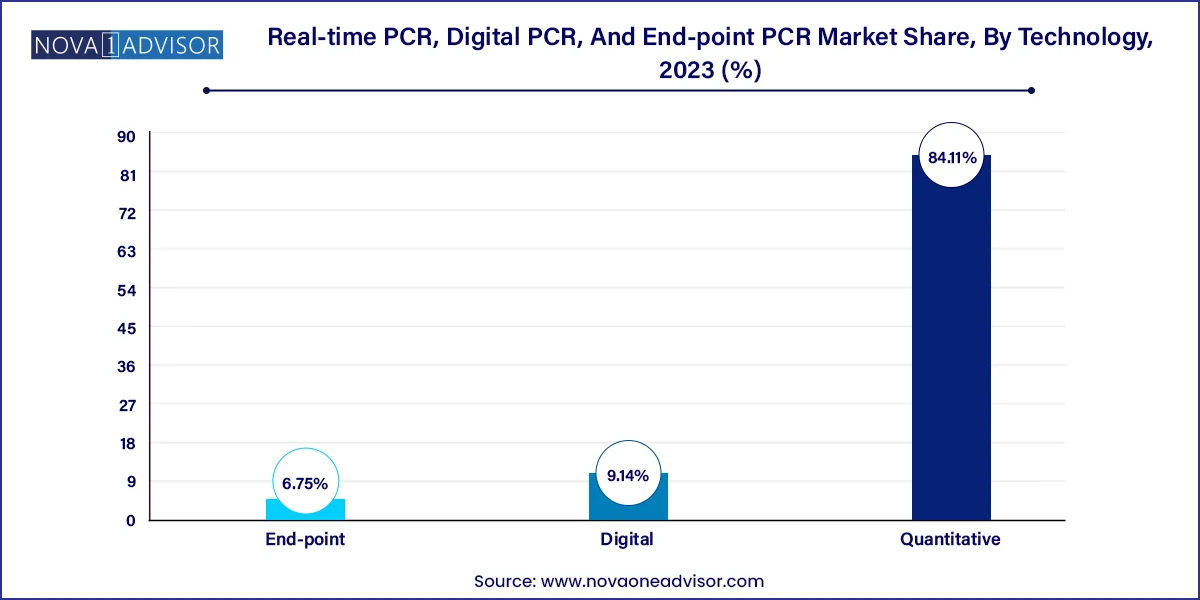

Quantitative PCR holds the largest market share due to its widespread application in clinical diagnostics and research. Its ability to provide real-time data on DNA amplification makes it invaluable for detecting pathogens, monitoring gene expression, and quantifying nucleic acids. The integration of qPCR in routine diagnostic workflows, such as viral load testing and cancer biomarker detection, underscores its dominance.

Digital PCR is experiencing rapid growth, attributed to its superior sensitivity and precision. It is particularly effective in detecting rare mutations, copy number variations, and low-abundance targets. The technology's ability to provide absolute quantification without the need for standard curves makes it increasingly popular in oncology, prenatal testing, and infectious disease diagnostics.

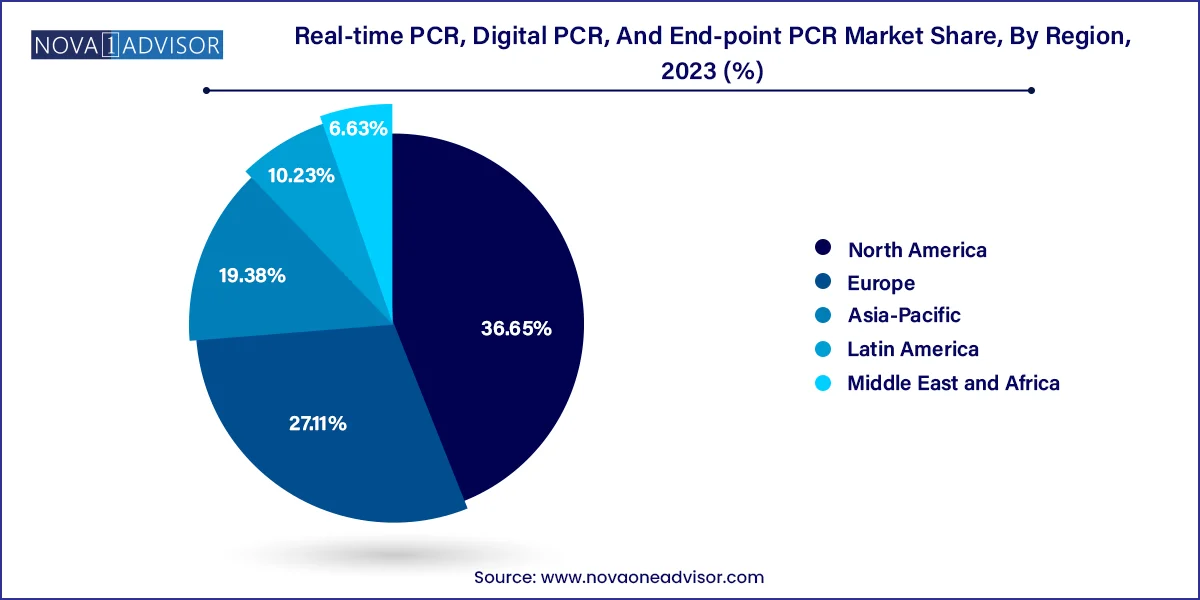

North America holds the largest market share, attributed to advanced healthcare infrastructure, high adoption of molecular diagnostics, and significant R&D investments. The presence of major market players and favorable reimbursement policies further bolster the region's dominance.

Asia-Pacific is the Fastest-Growing Region

The Asia-Pacific region is experiencing rapid growth due to increasing healthcare awareness, rising prevalence of infectious diseases, and government initiatives to enhance diagnostic capabilities. Countries like China and India are investing heavily in healthcare infrastructure, creating opportunities for PCR market expansion.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Real-time PCR, Digital PCR, And End-point PCR market.

By Technology

By Product

By Application

By Region