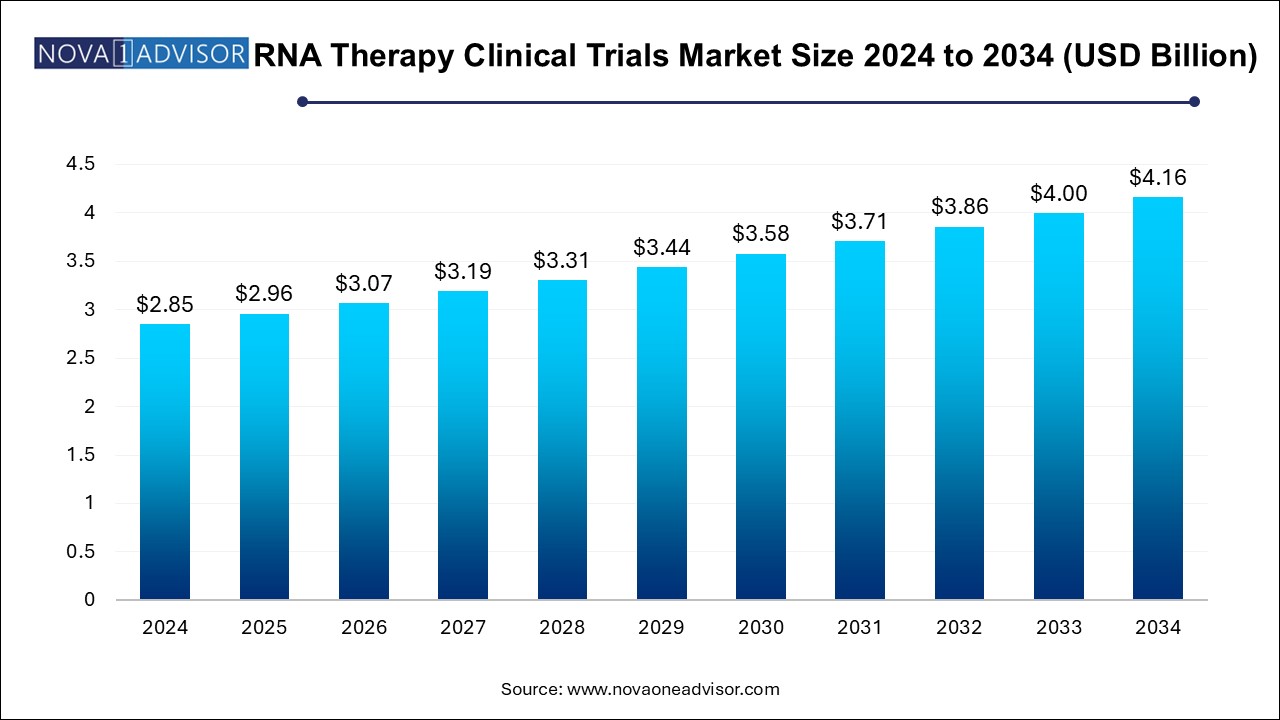

The RNA therapy clinical trials market size was exhibited at USD 2.85 billion in 2024 and is projected to hit around USD 4.16 billion by 2034, growing at a CAGR of 3.85% during the forecast period 2024 to 2034.

The RNA Therapy Clinical Trials Market is rapidly evolving into a cornerstone of next-generation therapeutics, driven by revolutionary breakthroughs in RNA biology and delivery platforms. RNA-based therapies—spanning messenger RNA (mRNA), RNA interference (RNAi), antisense oligonucleotides (ASOs), and other oligonucleotide-based modalities—are transforming the landscape of drug development. From personalized cancer treatment to rare genetic diseases and infectious disease management, RNA therapeutics are demonstrating exceptional potential in modulating previously "undruggable" targets.

Clinical trials in RNA therapy are proliferating globally, bolstered by the success of mRNA vaccines during the COVID-19 pandemic, which validated the therapeutic potential and scalability of RNA platforms. Additionally, RNA therapies are gaining traction in treating rare diseases like Duchenne muscular dystrophy, spinal muscular atrophy, and certain types of inherited blindness. Clinical trials are not just focusing on efficacy and safety but also optimizing delivery vectors, stability, and target specificity.

The RNA therapy clinical trial market spans early-stage discovery (Phase I) to post-marketing surveillance (Phase IV), with numerous biotech startups, academic institutions, and pharmaceutical giants actively pursuing new indications. North America and Europe dominate the landscape in terms of trial volume and funding, but emerging markets are gaining momentum with increasing regulatory support and investment in translational medicine.

Regulatory frameworks are also adapting, with agencies such as the FDA, EMA, and PMDA creating fast-track and orphan drug designations for RNA therapeutics. These factors collectively point toward a rapidly expanding and technologically sophisticated RNA therapy clinical trial ecosystem, poised to reshape drug development pipelines across multiple therapeutic domains.

Rising number of mRNA clinical trials beyond vaccines, targeting oncology, cardiovascular, and autoimmune conditions.

Increased venture capital funding and strategic partnerships between biotech startups and Big Pharma to co-develop RNA assets.

Surge in antisense and RNAi trials for rare genetic disorders, driven by orphan drug incentives and accelerated approval pathways.

Integration of lipid nanoparticles (LNPs) and exosomes as RNA delivery vehicles for targeted tissue and organ delivery.

Growing interest in intrathecal and inhalation delivery routes for RNA drugs targeting the CNS and pulmonary systems.

Adoption of AI in trial design and patient recruitment to enhance precision and reduce cost.

Expansion of decentralized and hybrid clinical trials using telemedicine, e-consent, and remote monitoring technologies.

Cross-border regulatory harmonization aimed at streamlining RNA trial approvals and accelerating global study deployment.

Development of multi-omics biomarkers to assess RNA therapy efficacy and patient stratification in early-phase studies.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.96 Billion |

| Market Size by 2034 | USD 4.16 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 3.85% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Modality, Clinical Trials Phase, Therapeutic Areas, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | IQVIA; ICON Plc; Laboratory Corporation of America Holdings; Charles River Laboratories International, Inc.; PAREXEL International Corp.; Syneos Health; Medpace Holdings, Inc.; PPD Inc.; Novotech; Veristat, LLC. |

A pivotal driver of the RNA therapy clinical trials market is the success and scalability of mRNA platforms, which gained global validation during the COVID-19 pandemic. The rapid development and emergency use authorization of mRNA vaccines such as Pfizer-BioNTech’s BNT162b2 and Moderna’s mRNA-1273 showcased the platform's ability to respond to global health crises. These vaccines were developed, trialed, and commercialized in record time, proving that RNA technology could meet real-world medical needs efficiently.

This success story has catalyzed a surge in mRNA clinical trials targeting non-infectious indications such as pancreatic cancer, melanoma, and myocardial infarction. The flexibility of mRNA allows for rapid customization, making it ideal for personalized medicine and oncology applications. Companies are now investing in therapeutic mRNA applications, including those encoding monoclonal antibodies and immunomodulators. The ability of mRNA therapies to be produced synthetically and at scale also reduces manufacturing bottlenecks, further propelling interest and investment in this modality.

Despite the promising trajectory, delivery and immunogenicity remain significant challenges restraining the RNA therapy clinical trials market. RNA molecules are inherently unstable and susceptible to enzymatic degradation, which necessitates encapsulation in delivery systems such as lipid nanoparticles (LNPs), polymers, or viral vectors. However, each delivery method carries potential drawbacks, including systemic toxicity, limited tissue targeting, or immune activation.

For example, while LNPs are widely used, they can trigger innate immune responses, particularly in patients with pre-existing conditions. Moreover, intramuscular or systemic administration routes may not be ideal for targeting hard-to-reach tissues such as the brain or retina. These complexities can lead to adverse events or limited therapeutic efficacy in clinical trials, resulting in delays or attrition. Addressing these issues through the development of safe, targeted delivery vectors is critical for translating RNA therapies from bench to bedside.

A transformative opportunity in the RNA therapy clinical trials market lies in the expanding application of RNA-based modalities for rare genetic diseases, many of which currently lack effective treatment options. RNA therapeutics offer the ability to target disease at the genetic level—through exon skipping, mRNA replacement, or gene silencing—making them ideal candidates for treating monogenic disorders.

Antisense oligonucleotides (ASOs) and RNA interference (RNAi) platforms have already demonstrated success in rare diseases such as spinal muscular atrophy (SMA) and hereditary transthyretin-mediated amyloidosis. Clinical trials targeting diseases like Duchenne muscular dystrophy, Batten disease, and Huntington’s disease are gaining momentum, supported by orphan drug designations and regulatory incentives. As genetic screening and diagnostic tools become more accessible, patient identification and trial recruitment are improving, further accelerating this high-impact opportunity.

The rare diseases segment dominated the global market with a revenue share of more than 21.0% in 2024. ASO and RNAi platforms are proving especially useful in treating monogenic disorders where traditional small molecules and biologics fall short. Many of these trials benefit from orphan drug status, fast-track approval, and rare disease grants. Moreover, patient advocacy groups and registries are supporting trial awareness and enrollment, further accelerating growth.

The anticancer segment is anticipated to grow at the fastest CAGR during the forecast period. for RNA therapy clinical trials, due to the high unmet need and promising preliminary data from RNA-based interventions. Immunotherapies using siRNA, ASOs, and mRNA are being tested in both solid and hematologic malignancies. Key targets include KRAS, PD-L1, and BCL2, and trials span monotherapy as well as combination approaches with checkpoint inhibitors. Personalized cancer vaccines utilizing tumor-specific neoantigens encoded by mRNA are also reshaping immuno-oncology paradigms.

RNA interference (RNAi) remains the dominant modality in terms of clinical trial volume, driven by its robust silencing mechanisms and therapeutic relevance in genetic and metabolic disorders. Small interfering RNAs (siRNAs) and short hairpin RNAs (shRNAs) are being used extensively to downregulate disease-causing genes in hepatic, neurological, and oncological indications. Alnylam Pharmaceuticals, for instance, has pioneered RNAi-based therapies such as patisiran and givosiran, which have advanced through multiple clinical phases and received regulatory approvals, validating the modality’s clinical viability.

Messenger RNA (mRNA) is the fastest growing segment, propelled by its successful use in vaccines and increasing interest in therapeutic applications. Beyond infectious diseases, mRNA is now being explored in cancer immunotherapy, rare disease protein replacement, and regenerative medicine. Trials like Moderna’s personalized cancer vaccine for melanoma and BioNTech’s solid tumor mRNA program are rapidly progressing through Phases I and II. The ability of mRNA to encode virtually any protein, coupled with advancements in delivery and immunogenicity modulation, positions this modality as a cornerstone of future clinical innovation.

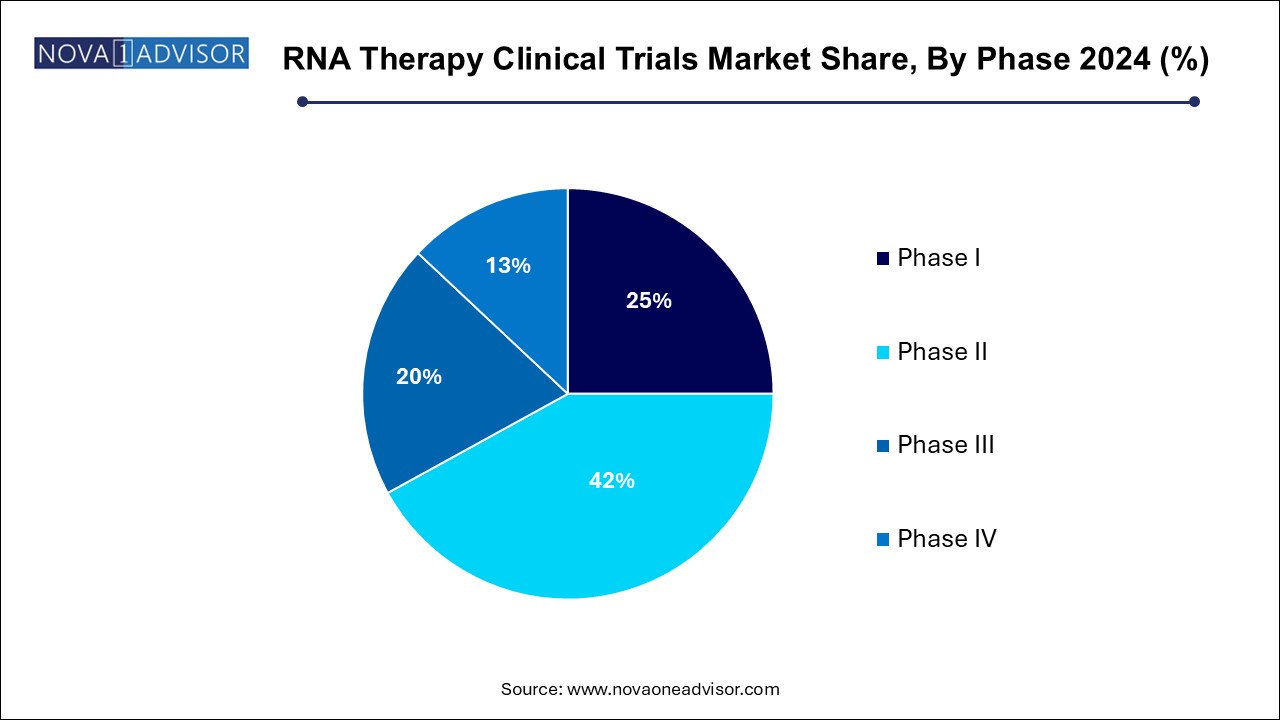

Based on phases, the RNA therapy clinical trial market has been further categorized into phase I, phase II, phase III, and phase IV. The phase II segment held a major revenue share of over 42.0% in 2024. These trials focus on determining dose efficacy and establishing therapeutic impact across diverse indications. Given the experimental nature of RNA therapies, sponsors prioritize rigorous biomarker-driven designs and adaptive protocols to maximize outcome relevance. In oncology and rare disease indications, Phase II trials often benefit from accelerated approval mechanisms, especially when surrogate endpoints demonstrate significant improvements.

The phase I clinical trials segment is expected to hold a significant market share in the coming years. As the RNA innovation pipeline continues to grow with early-stage candidates entering human testing. These studies are increasingly incorporating healthy volunteers and patient cohorts, with emphasis on pharmacokinetics, biodistribution, and immune responses. Companies are utilizing AI and digital tools to enhance trial recruitment and monitoring. As novel delivery platforms and RNA constructs are developed, the volume of Phase I trials is expected to surge over the next decade.

North America dominated the RNA therapy clinical trials market with a share of 36.58% in 2024. Owing to its strong biotech ecosystem, advanced regulatory frameworks, and significant R&D funding. The United States is home to many of the world’s leading RNA therapy developers, including Moderna, Alnylam Pharmaceuticals, Ionis Pharmaceuticals, and Arrowhead Pharmaceuticals. The region benefits from an efficient FDA pathway that accommodates fast-track, breakthrough, and orphan drug designations for RNA-based products.

Major academic institutions like Harvard, MIT, and the University of Pennsylvania are engaged in translational RNA research, often in collaboration with pharmaceutical firms. Additionally, a well-developed clinical trial infrastructure, including CROs and genomic testing facilities, supports high-throughput and multi-center studies. The abundance of venture capital and government grants further strengthens the region’s leadership position.

Asia Pacific is the fastest growing region, driven by increasing biotech innovation, favorable government policies, and rising investment in translational medicine. Countries like China, South Korea, and Japan are expanding their genomic research capabilities and streamlining clinical trial approvals for advanced therapies. China, in particular, has seen a surge in domestic RNA biotech startups, many of which are now entering clinical phases with oncology and genetic disease targets.

In parallel, academic partnerships and government funding in countries like India and Australia are fostering early-stage RNA research and trial deployment. The region’s large patient population and improving clinical infrastructure make it an attractive site for multinational trials. As regulatory agencies align with international standards, the Asia Pacific RNA therapy trials market is expected to grow exponentially.

March 2025 – Moderna Inc. initiated a Phase II trial of its mRNA-based personalized cancer vaccine (mRNA-4157/V940) in combination with pembrolizumab for high-risk melanoma patients.

January 2025 – Alnylam Pharmaceuticals announced positive Phase III results for its RNAi therapeutic vutrisiran for the treatment of ATTR amyloidosis, aiming for global regulatory submission by Q3 2025.

November 2024 – BioNTech SE began a Phase I trial of its inhaled mRNA vaccine targeting tuberculosis, marking the first respiratory infectious disease target outside COVID-19 for the company.

September 2024 – Wave Life Sciences launched a new ASO clinical program for the treatment of Huntington’s disease, incorporating allele-selective technology to minimize off-target effects.

July 2024 – Silence Therapeutics partnered with AstraZeneca to co-develop RNAi-based cardiovascular therapies, with multiple candidates set to enter Phase I by 2025.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the RNA therapy clinical trials market

Modality

Clinical Trials Phase

Therapeutic Areas

Regional