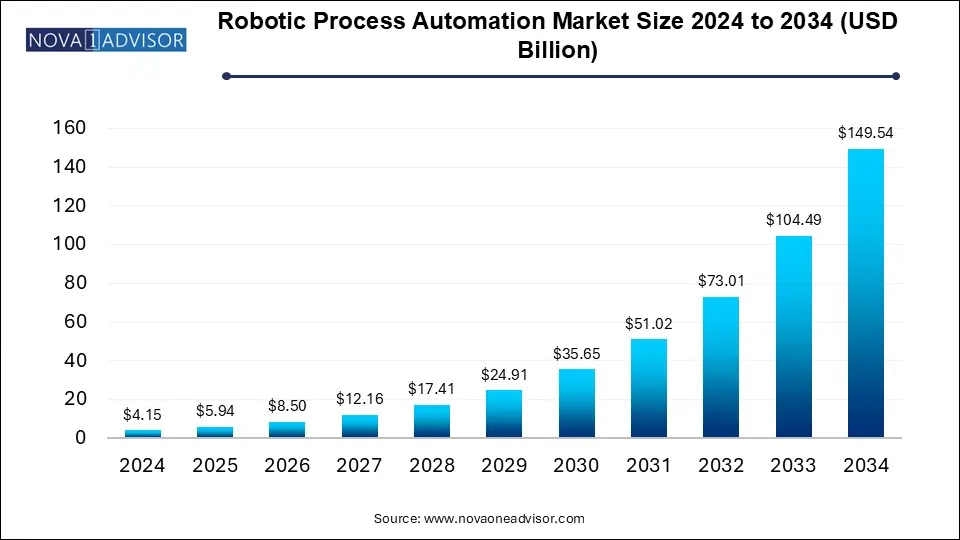

The robotic process automation market size was exhibited at USD 4.15 billion in 2024 and is projected to hit around USD 149.54 billion by 2034, growing at a CAGR of 43.11% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.94 Billion |

| Market Size by 2034 | USD 149.54 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 43.11% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Deployment, Enterprise Size, Operations, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Automation Anywhere Inc.; BlackLine Inc.; Blue Prism Limited; EdgeVerve Systems Limited; FPT Software; Microsoft; NICE; NTT Advanced Technology Corporation; OnviSource, Inc.; Pegasystems Inc.; SAP SE; Tungsten Automation Corporation; UiPath, Uniphore, WorkFusion, Inc. |

The growth of the market can be attributed to the increasing demand for operational efficiency and cost reduction in businesses. Enterprise Sizes across industries are adopting Robotic Process Automation (RPA) to automate repetitive, rule-based tasks, enabling them to streamline workflows, reduce human error, and allocate resources to higher-value activities.

Companies can unlock significant benefits from RPA, with reduced operational costs standing out as a key advantage. For instance, a 2024 survey by SMA Technologies revealed that 52% of financial services organizations reported saving at least USD 100,000 annually through automation. SMA Technologies is a provider of automation solutions for the financial services industry.

The adoption of new technologies is changing how corporate operations function inherently. Business processes are being reinvented across the field through automation, analytics, data, AI, robots, and many others. Businesses must continually assess and innovate their internal procedures to remain competitive. Earlier iterations of RPA were solely concerned with automating processes that required fewer than five decisions, five app accesses, and 500 clicks.

However, technical advancements in the RPA arena, such as machine learning, Optical Character Recognition (OCR), and analytics, may demand intelligent automation systems. As a result, by the end of 2025, intelligent automation is expected to eliminate more than 40% of service desk engagements. Integrating cognitive RPA and other chatbot technologies would allow for unsupervised automation modes at the service desk, eliminating human interventions and increasing operational productivity.

The integration of AI to enhance automation capabilities, combined with a strong focus on security and compliance, highlights the significant efficiency gains and ROI potential of RPA, reinforcing its value in high-volume, data-intensive industries. In October 2024, UiPath, a leading enterprise automation and AI software provider, announced its role in transforming operations for Omega Healthcare, a global company in clinical enablement services and revenue cycle management. By integrating AI-powered automation through the UiPath Platform, Omega Healthcare drives efficiency, enhances business value, and boosts client profitability. As part of its digital transformation strategy, Omega Healthcare leverages key features of the UiPath Platform, including the AI Trust Layer and advanced security governance tools, to securely optimize workflows. These capabilities ensure transparency, compliance, and ethical governance while harnessing the power of AI to deliver significant operational improvements and better service outcomes. The adoption of UiPath has revolutionized Omega Healthcare's internal processes, particularly in health documentation management, setting a new benchmark in the industry. Over the past four years, UiPath automations have successfully processed more than 60 million transactions, underscoring the platform's transformative impact on the company's operations.

The services segment accounted for the largest revenue share of 64.0% in 2024. The growth of the segment can be attributed to a wide range of services offered by RPA companies, including assessment, deployment & support, strategy, and implementation. Moreover, the growing focus on digital transformation is a significant driver of the service segment. As companies strive to modernize operations and integrate advanced technologies, RPA serves as a foundational tool for automating legacy systems and bridging gaps between various digital platforms. Its ability to quickly deliver measurable results makes it an attractive option for businesses undergoing transformation.

The software segment is expected to grow at a significant rate from 2025 to 2034. The segment’s growth can be attributed to the increasing partnerships aimed at expanding sales channels, which has enabled wider adoption of RPA software. For instance, in November 2024, OnviSource and TForge, a South Africa-based Interaction Intelligence Technology provider, have launched a joint venture to revolutionize contact centers with AI-powered analytics and automation. Their innovative solutions are designed to enhance communication efficiency, improve workforce performance, elevate customer satisfaction, and boost overall business productivity.

The cloud segment accounted for the largest revenue share of over 54.0% in 2024. The growth of cloud RPA solutions can be attributed to the benefits of the cloud-based deployment of RPA solutions, which include lower infrastructure costs, ease of implementation, remote accessibility, ease of use, and scalability. This results in the increased demand for cloud-deployable RPA solutions, which solution providers are offering to cater to the demand for these solutions successfully. Moreover, the increasing adoption of Software-as-a-Service (SaaS) models is a significant driver of growth in the RPA market, particularly within the cloud segment. SaaS-based RPA solutions provide businesses with a subscription-based approach, enabling them to access automation tools without the need for heavy upfront investments in hardware or infrastructure.

The on-premise segment is expected to grow at a significant rate from 2025 to 2034. The segment’s growth can be attributed to the benefits of on-premises deployment, which include access policies as per in-house protocols governed by the organization, long-term cost savings, better alignment with corporate standards and policies, in-house ownership, ability to create and customize reports as needed, and access to all backend logs and databases. These benefits play a crucial role in driving the on-premises segment growth. The presence of major RPA market companies such as IBM and UiPath has also accelerated the growth of the on-premises segment.

The large enterprise segment accounted for the largest revenue share in 2024. The growth of the large enterprises segment can be attributed to the benefits of RPA, such as increased productivity, better efficiency, better security, and a boost in scalability. In a highly competitive business environment, large companies are trying to adopt different means for sustaining and developing their business, which has resulted in the wider adoption of RPA among large enterprises. Moreover, as budget constraints do not affect large enterprises compared to SMEs and large enterprises are aware of the benefits of implementing RPA, the enterprises segment is expected to witness significant growth in the coming years.

The small & medium enterprise (SME) segment is expected to grow at the 46.0% during the forecast period. The benefits offered by implementing RPA in SMEs have been driving the growth of the SME segment. Some major benefits include enabling staff to focus on priority tasks, better opportunities for expanding and scaling the business, enhanced customer satisfaction, better communication within the company, reduced operational costs and compliance risks, and expedited ROI and time to value on automation investment. Major companies in the RPA market have been able to cater to the demand for RPA solutions among SMEs, bridging the gap between demand and supply. This is further driving the growth of the small & medium enterprises segment.

The BFSI end use segment accounted for the largest revenue share in 2024. The use of RPA in the BFSI sector has been a major boost to businesses in improving customer experience, reducing everyday banking operations, lowering IT expenditures, increasing efficiency & productivity, enhancing scalability, and improving accuracy and reliability, among others. RPA is best suited for handling various functions in the BFSI sector, including mortgage lending, accounting, risk & compliance reporting, front office, cards and payments systems, and money laundering. These benefits of implementing RPA in the BFSI sector have resulted in widespread adoption of RPA among BFSI businesses, thereby driving the segment growth.

The pharma & healthcare segment is expected to grow at a 48.2% during the forecast period. The companies in the robotic automation market have been introducing solutions specifically targeting the healthcare sector, which has successfully attracted healthcare businesses and driven the growth of the pharma & healthcare segment in the RPA market. For instance, in May 2024, PathAI, a U.S.-based AI-powered pathology, launched an Early Access Program (EAP) to promote the adoption of its AISight Image Management System (IMS) in Continental Europe.

Following a program in 2023 that engaged over 50 laboratories in the U.S., many of which are now exploring long-term use of the system, the European EAP offers laboratories the opportunity to trial AISight, a GDPR-compliant, cloud-based pathology solution. Participants can also conduct and publish validation studies on PathAI’s AI-powered tools, including ArtifactDetect, TumorDetect, AIM-PD-L1, AIM-TumorCellularity, and AIM-HER2, further advancing applications of AI in pathology.

The rule based segment accounted for the largest revenue share in 2024. Many organizations rely on legacy systems that may not have the flexibility to support modern automation technologies. Rule-based RPA solutions can easily integrate with these existing systems without requiring extensive changes or updates. This makes RPA an attractive option for businesses looking to automate their processes without overhauling their entire IT infrastructure. The ability to work seamlessly with legacy systems accelerates the adoption of RPA in industries with older technological frameworks, such as banking and government. Moreover, rule-based RPA helps businesses adhere to regulatory requirements by ensuring that processes are executed consistently and in compliance with internal policies and industry regulations.

The knowledge based segment is expected to grow at the fastest rate from 2025 to 2034. The integration of AI, Natural Language Processing (NLP), and machine learning (ML) into RPA significantly enhances its capabilities to manage complex tasks typically performed by humans. AI allows RPA systems to handle tasks that require advanced cognitive functions, such as understanding context, making informed decisions, and continuously learning from new data. NLP enables RPA to comprehend and process unstructured data, such as emails, documents, and customer queries, by extracting relevant information and interpreting the meaning behind natural language.

North America robotic process automation market held the major share of over 39% of the robotic process automation industry in 2024. In industries such as finance, healthcare, and pharmaceuticals, companies in North America face increasing regulatory pressures to comply with industry standards and government regulations. RPA helps organizations ensure compliance by automating the tracking, documentation, and reporting of regulatory requirements. With RPA, businesses can reduce the risk of human error in compliance processes, maintain up-to-date records, and meet deadlines more effectively. This need for reliable compliance solutions has contributed to the growth of the RPA market in North America.

U.S. Robotic Process Automation Market Trends

The robotic process automation industry in the U.S. is expected to grow significantly from 2025 to 2034. The market’s growth in the U.S. can be attributed to the increased capabilities and features of RPA solution with the integration of AI technology in terms of improved business results, educed wage costs, improved ROI, cand creating new positions, among others. RPA robots can also perform activities across different systems to get information on digital platforms. For instance, adopting RPA in the finance industry helps bank customers check account details online and process Know Your Customer (KYC) verification, along with other functions, through the internet. Such services have resulted in reduced manual involvement and enabled the offering of improved customer experience.

Europe Robotic Process Automation Market Trends

The Europe robotic process automation industry is growing significantly at a CAGR of over 41% from 2025 to 2034. The rising integration of RPA with advanced technologies like artificial intelligence (AI), machine learning (ML), and natural language processing (NLP). This convergence enables automation systems to handle unstructured data, make predictive decisions, and perform more complex tasks, expanding the scope of RPA applications. European companies, especially in countries like Germany, the UK, and France, are increasingly leveraging intelligent automation to enhance customer experiences and optimize resource utilization.

The robotic process automation industry in the UK is expected to grow rapidly in the coming years. The robotic automation process market is expected to witness a significant growth over the forecast period ascribed to the presence of several logistics and industrial companies in the region. The technology assists in rationalizing pickup and drop operations to achieve significant advancements in cycle time and improve the customer experience. Due to the growing demand for customer service in industries such as BFSI, IT & telecommunications, government, and insurance, which is expected to propel the adoption of robotic automation process in the UK.

Germany robotic process automation industry held a substantial market share in 2024. In Germany, the robotic automation process market growth can be attributed to the technological advancements and an increase in R&D activities in artificial intelligence, particularly machine learning and deep learning, will lead to more applications for traditional industrial robots and collaborative robots.

Asia Pacific Robotic Process Automation Market Trends

The robotic process automation industry in the Asia Pacific is growing significantly at a CAGR of over 46% from 2025 to 2034. The Asia Pacific RPA market is experiencing rapid growth, driven by several key factors such as the region’s increasing focus on digital transformation and automation. One major driver is the growing need for operational efficiency across industries such as BFSI, healthcare, telecommunications, and manufacturing. With the rising demand for cost optimization, businesses are turning to RPA solutions to automate repetitive tasks, reduce errors, and accelerate workflow processes, thereby enhancing productivity and profitability.

China robotic process automationindustry held a substantial share in 2024. The availability of a large pool of skilled IT professionals and China's rapid development of cloud infrastructure further augment the adoption of RPA. Cloud-based RPA solutions offer scalability, cost-effectiveness, and ease of deployment, making them particularly appealing to small and medium-sized enterprises (SMEs) looking to automate their operations.

The robotic process automation industry in Japan held a substantial share in 2024. The RPA market growth in Japan can be attributed to the increasing need to optimize operations to enhance efficiency and achieve maximum return in the business operations, growing integration of innovative technologies, and transformation of business process across organizations. RPA can help businesses in the region to reduce errors and increase speed by automating repetitive and routine tasks. The organizations in the region are keen on enhancing their business process using RPA to expedite day-to-day operation, which, in turn, helps them focus on more intensive business decisions.

India robotic process automation industry is expanding rapidly. Robotic process automation is underway in India and quickly changing the businesses functions and operations. Market players are increasingly acknowledging the fundamental role of automation in resolving their pain points, such as finding automation skills, developing business cases, and selecting an implementation partner, among others and accelerating growth across the region.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the robotic process automation market

By Type

By Deployment

By Enterprise Size

By Operations

By End Use

By Regional