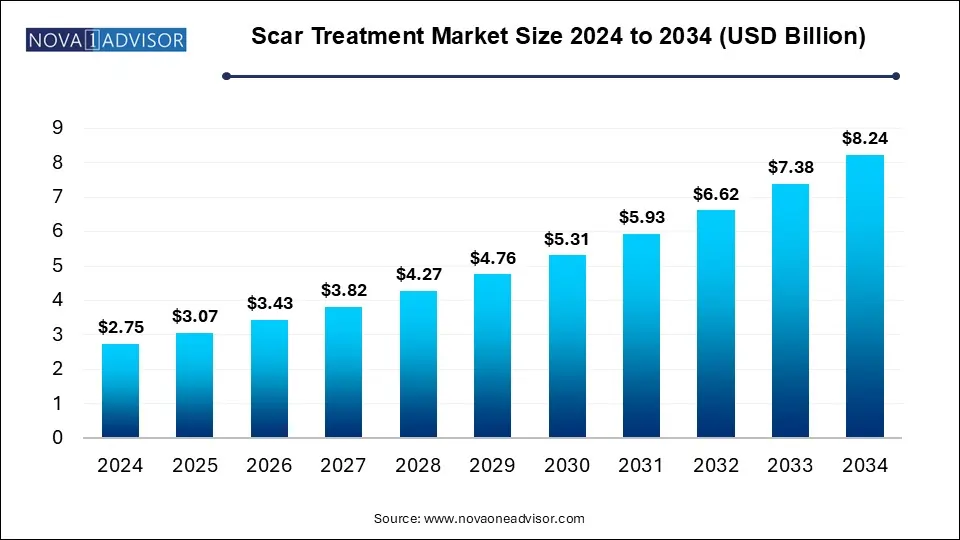

The scar treatment market size was exhibited at USD 2.75 billion in 2024 and is projected to hit around USD 8.24 billion by 2034, growing at a CAGR of 11.6% during the forecast period 2025 to 2034.

The U.S. scar treatment market size was valued at USD 0.52 million in 2024 and is expected to reach around USD 1.55 million by 2034, growing at a CAGR of 10.43% from 2025 to 2034.

In 2024, North America accounted for a substantial market share of 25.0%, driven by high aesthetic awareness and the swift adoption of advanced treatment solutions. The demand for cutting-edge laser scar treatment devices is particularly strong in the U.S. In 2022, the U.S. held the largest market share within the North American region. According to the American Burn Association (ABA), approximately 486,000 burn cases occur annually.

In the U.S., government reimbursement policies cover scar treatment for burn injuries. However, acne scar treatments may not be reimbursed unless a healthcare provider submits a Letter of Medical Necessity. Additionally, rising healthcare expenditures among patients serve as a key growth factor in the U.S. market.

Asia Pacific is projected to register the highest CAGR of 10.4% over the forecast period, primarily due to the high frequency of road accidents in countries like India. Major contributors to the Asia Pacific market include China and India. Many nations in this region are still developing and are increasingly embracing technological advancements at a rapid pace.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.07 Billion |

| Market Size by 2034 | USD 8.24 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 11.6% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Scar Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Smith & Nephew PLC; Lumenis; Merz Pharmaceuticals, LLC; Sonoma Pharmaceuticals, Inc.; Cynosure; CCA Industries, Inc.; Newmedical Technology Inc.; Mölnlycke Health Care AB; Suneva Medical |

In 2024, the topical products segment held the largest market share at 66.0%. The widespread availability of topical creams, gels, and silicone sheets as over-the-counter (OTC) products enables consumers to treat scars conveniently. Laser treatments are also highly popular due to their non-invasive and painless approach, offering effective scar treatment with minimal discomfort. Topical solutions, including silicone sheets, creams, and gels, are applied directly to the skin's surface and are frequently purchased due to their easy accessibility as OTC products.

Additionally, these treatments do not require medical prescriptions or physician visits, making them a more convenient option, further driving demand. Other topical solutions include oils, sprays, elastic bandages, pressure garments, and ointments. Pressure garments are commonly used in scar treatment, applying consistent pressure to the affected area. These non-invasive solutions can be used at home without medical supervision. However, topical treatments generally require continuous application for 6 to 12 months to show visible results, which may limit market growth during the forecast period.

The atrophic scars segment held the highest market share of 37.9% in 2024, primarily due to the increasing prevalence of acne scars. These scars are typically treated using topical creams and gels. Meanwhile, the keloid and hypertrophic scar segments are projected to witness significant growth over the forecast period, driven by a higher incidence of wound-related injuries.

Atrophic scars occur when the body experiences a loss of muscle or fat at an injury site. They form due to insufficient collagen production during the healing process and often appear as depressions or pits in the skin. Common causes include acne, chickenpox, staphylococcus infections, and surgical procedures.

Treatment for atrophic scars generally involves the application of topical creams, gels, and ointments that promote the skin’s natural healing process by replenishing collagen, elastin, and fibrous tissues. As these scars are most commonly linked to acne, topical solutions help in reducing their appearance. With growing consumer interest in aesthetic enhancement, the demand for topical products for atrophic scar treatment is expected to rise further.

The homecare segment led the market in 2024, accounting for a dominant share of 66.0%. This growth is attributed to the availability of advanced scar treatment products and sophisticated home-use technologies.

The retail pharmacies and e-commerce segment is projected to experience the fastest growth throughout the forecast period, fueled by the expansion of online shopping platforms and the easy accessibility of scar treatment products through these channels. OTC products are frequently purchased online without requiring a doctor's consultation. Additionally, consumers are increasingly opting for online purchases due to discounts, promotional offers, and the convenience of home delivery.

Hospitals also play a vital role in scar treatment, offering patients a variety of solutions to minimize or eliminate scars. In most cases, hospitals provide initial emergency care for cuts, burns, wounds, and other severe injuries, aiming to prevent excessive scar formation. Larger hospitals are equipped with advanced medical technologies and treatment procedures to enhance patient care. Non-invasive scar treatment methods such as creams, gels, silicone sheets, and laser therapies are widely used in hospital settings to improve scar management outcomes.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the scar treatment market

By Product

By Scar Type

By End-use

By Regional