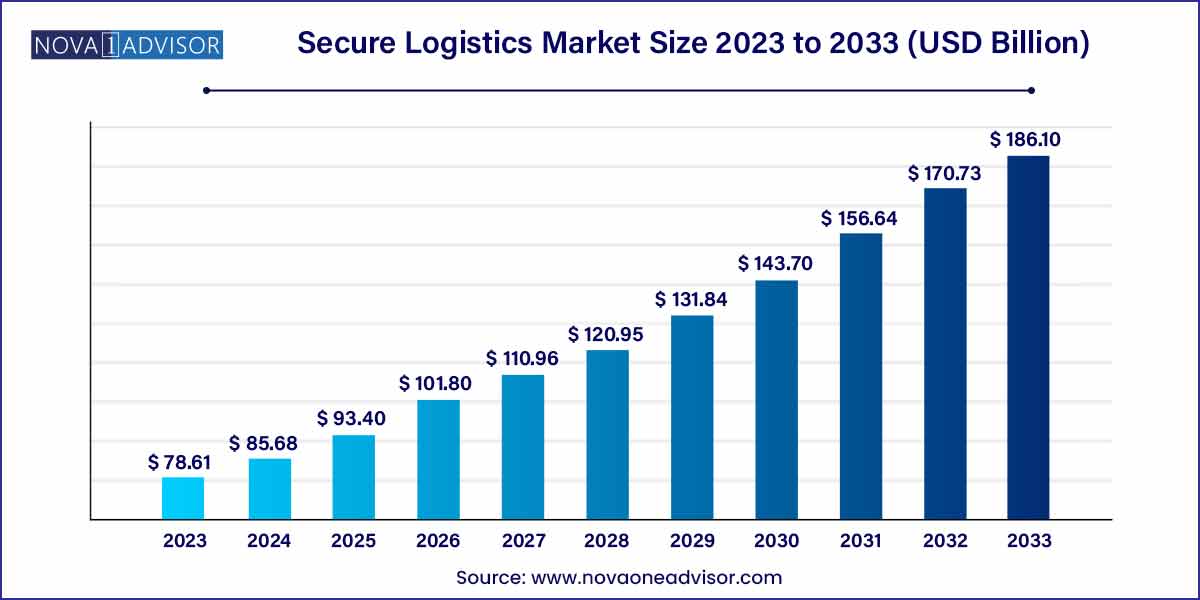

The global secure logistics market size was exhibited at USD 78.61 billion in 2023 and is projected to hit around USD 186.10 billion by 2033, growing at a CAGR of 9.0% during the forecast period of 2024 to 2033.

Key Takeaways:

Secure Logistics Market by Overview

The secure logistics market has witnessed significant growth in recent years, driven by the increasing emphasis on protecting valuable goods during transportation. This market primarily caters to industries such as banking, jewelry, pharmaceuticals, electronics, and others that require secure and reliable transportation of high-value assets.

Secure Logistics Market Growth

The robust growth of the secure logistics market is underpinned by several key factors. Escalating global security concerns, particularly those related to theft, tampering, and terrorism, have driven a heightened demand for advanced secure logistics services. Technological advancements, including the integration of GPS tracking, real-time monitoring, and biometric authentication, have revolutionized the landscape, enhancing the security of shipments and providing real-time visibility across the supply chain. The booming e-commerce sector has further propelled market expansion as companies seek to safeguard high-value products during transit. As a result, the secure logistics market continues to evolve, with the critical role it plays in protecting valuable goods positioning it for sustained growth in the foreseeable future.

Secure Logistics Market Report Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 78.61 Billion |

| Market Size by 2033 | USD 186.10 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.0% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, Type, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Brink’s Inc.; CargoGuard; CMS Info Systems (CMS); G4S plc; GardaWorld; Lemuir Group; Loomis AB; Maltacourt; PlanITROI, Inc.; Prosegur; Allied Universal; Securitas AB. |

Secure Logistics Market Dynamics

The secure logistics market is dynamically influenced by continuous technological advancements and their seamless integration into logistics solutions. Technologies such as GPS tracking, RFID systems, and real-time monitoring have become integral to secure logistics operations, providing enhanced visibility, control, and security. The ongoing pursuit of innovation in biometric authentication, blockchain, and artificial intelligence further amplifies the market dynamics, shaping a landscape where the adoption of cutting-edge technologies is not just a competitive advantage but a necessity for staying ahead in the evolving realm of secure logistics.

The dynamics of the secure logistics market are significantly impacted by the increasing globalization of trade and cross-border transactions. As businesses expand their reach across international markets, the need for secure transportation of high-value goods becomes paramount. The market witnesses fluctuations in demand based on geopolitical factors, trade policies, and the overall economic landscape. Moreover, the proliferation of e-commerce, with its reliance on efficient and secure logistics, fuels the dynamic nature of the market as companies adapt to the evolving demands of a globally interconnected supply chain.

Secure Logistics Market Restraint

One significant restraint facing the secure logistics market is the complex web of regulatory constraints and compliance challenges. The stringent regulations governing the secure transportation of high-value goods vary across regions and industries, posing a considerable challenge for logistics providers. Adherence to diverse compliance standards, including customs regulations, security protocols, and international trade laws, requires significant resources and meticulous attention to detail.

The secure logistics market is constrained by the burden of high operational costs, encompassing expenses related to advanced security technologies, skilled personnel, and specialized equipment. The necessity for armored vehicles, state-of-the-art surveillance systems, and secure storage facilities contributes significantly to the overall operational expenditure. Economic volatility and fluctuations in fuel prices further exacerbate cost challenges, impacting the profitability of secure logistics providers.

Secure Logistics Market Opportunity

A notable opportunity within the secure logistics market lies in the continued exploration and integration of emerging technologies aimed at enhancing security measures. The adoption of innovations such as blockchain for secure and transparent transactions, advanced data analytics for predictive risk management, and the Internet of Things (IoT) for real-time tracking presents a significant growth avenue.

The evolving nature of goods requiring secure logistics, coupled with the diversification of industries relying on these services, presents an opportunity for providers to offer customized and specialized solutions. Tailoring services to meet the unique requirements of sectors such as pharmaceuticals, electronics, and high-end retail allows for a more targeted and value-added approach. This customization may involve specialized handling protocols, temperature-controlled transport for sensitive products, or additional layers of security based on the nature of the goods.

Secure Logistics Market Challenges

A paramount challenge confronting the secure logistics market is the need for continuous innovation to counteract the ever-evolving landscape of security threats. Criminal tactics, including cyber-attacks, theft methodologies, and counterfeiting techniques, continually adapt and become more sophisticated. Secure logistics providers must invest substantially in research and development to stay ahead of these threats, developing and implementing advanced security protocols, technologies, and training programs to safeguard shipments effectively.

The recruitment and training of skilled personnel for specialized, secure logistics operations pose a significant challenge for market players. The nature of transporting high-value goods demands a workforce with expertise in security protocols, risk management, and the operation of advanced technologies. Securing and retaining qualified professionals who can handle the intricacies of secure logistics becomes a critical factor in maintaining the integrity and effectiveness of services.

Segments Insights:

Application Insights

On the basis of applications, the global market has been further segmented into cash management, diamonds, jewelry & precious metals, manufacturing, and others. The other application segment includes retail and public infrastructure. The cash management segment led the industry in 2023 and accounted for the largest revenue share of more than 55.6%. The segment is expected to remain dominant even during the forecast period. This growth is attributed to the rapidly growing penetration of ATMs in emerging countries.The cash management segment includes cash-in-transit, cash processing, and ATM services.

Cash-in-transit involves picking up money from the banks and delivering it to the designated cash points, such as ATMs. The service providers utilize armored trucks to transport valuables, which reduces risks and increases security by reducing the opportunity for theft. The carriers offer Automated Teller Machine (ATM) services in conjunction with the traditional cash-in-transit service and are regulated by regional, national, and local legislation. The responsible authorities for the industry include the Ministry of Justice, the Ministry of Interior, and the Police. The development of innovative and efficient goods is the primary focus of the market players.

For instance, in 2023, Prosegur and Forética, a significant organization in corporate social responsibility and sustainability in Spain, signed a cooperation agreement to form alliances that will help speed the transition to a sustainable model. Furthermore, market players are focusing on partnerships and collaborations to gain competitive advantages. For instance, in February 2023, Brink’s Inc. signed a partnership agreement with Courtyard, which is a physically-backed NFT platform. In 2018, Brink’s Inc.’s Canadian subsidiary signed a multi-year collaboration with Canopy Growth Corp. Brink’s Inc. and Canopy Growth will build a cross-selling program that will allow Brink’s to provide solutions to Canopy Growth’s connected cultivators and retail clients.

Type Insights

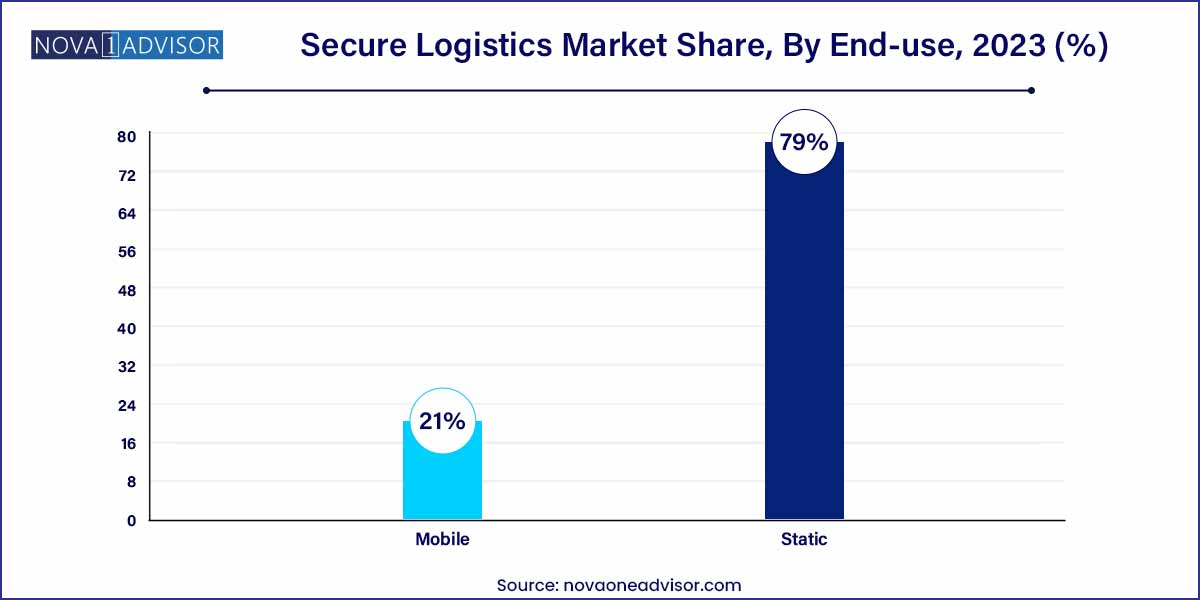

On the basis of types, the global market has been segmented into static and mobile. The static type segment registered the highest market share in 2023 and is expected to dominate over the forecast period. The segment is expected to remain dominant throughout the forecast period. For security purposes, manned guards are employed in the static type. The security guards stationed at various points aid in logistics transportation’s security. For the market, several players provide guarding services. These companies offer specialized logistics security solutions aimed at exposing security breaches, reducing shipment loss & damage, and preventing theft.

The mobile type segment, on the other hand, is expected to register the fastest growth rate during the forecast period. This growth can be attributed to the increasing advancements in secure journey management services. The providers offer vehicles with electronic countermeasures as well as radio and satellite communication systems. Electronic safes are primarily used by financial institutions to reduce management downtime. Service providers partner with several safe manufacturers to offer a wide scope of electronic safe services of various sizes.

Regional Insights

Europe held the largest share of more than 43.0% of the global market in 2023 and has become one of the most influential markets. The increasing penetration of ATMs, coupled with the growing use of ATMs in emerging economies, is expected to spur regional growth. The rising rate of cash circulation and trade investments among European countries opens up a whole range of secure logistics opportunities. In the future, trade policies among countries, as well as Brexit difficulties, will have a significant impact on market shares. An article published by ATM Marketplace in 2018 mentioned that few nations, such as Italy, the Netherlands, and Spain, are concentrating their efforts on limiting the number of ATMs and bank branches to reduce high operational costs and promote electronic payment systems.

The emerging markets, such as Brazil, Nigeria, and Iran, are expected to portray a high demand for new ATMs owing to the development of financial institutions in the region. The Australian Federal Police and Customs made a joint venture to form the Reduce Aviation Freight Theft (RAFT) project to investigate aviation theft in Australia. The Transported Asset Protection Association (TAPA) forum was formed, which unites global manufacturers, freight carriers, logistics providers, law enforcement agencies, and other stakeholders with the aim of reducing losses from international supply chains. In the European Union, the theft of high-risk, high-value products was estimated to cost over 8.2 billion euros a year.

The Asia-Pacific market is expected to register the fastest CAGR of 12.2% during the forecast period. Asia Pacific is expected to grow significantly owing to factors such as rising demand for ATMs, expansion of financial institutions, and increasing theft of freight. The North American region is expected to register a substantial market share in 2023 owing to the popularity of cash transactions and consumer preferences for modes of payment in North America. However, due to the high number of COVID-19 cases, especially in the U.S., the North American market sustained significant economic losses in the first two quarters of 2020. However, in order to cope with losses and maintain commercial operations, logistics and supply-chain industry participants place a strong emphasis on digital technologies. Several logistics firms are concentrating their efforts on capturing recruitment opportunities and investing in digital technologies. This is expected to drive the digitization of the logistics supply chain market in North America.

Some of the prominent players in the secure logistics market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global secure logistics market.

Application

Type

By Region

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

1.3. List of Data Sources

Chapter 2. Executive Summary

Chapter 3. Market Variable, Trends & Scope

3.1. Market Segmentation & Scope

3.2. Secure Logistics Market Size and Growth Prospects

3.3. Secure Logistics- Value Chain Analysis

3.4. Penetration & Growth Prospect Mapping

3.5. Secure Logistics Market Dynamics

3.5.1. Market Driver Analysis

3.5.1.1. Expansion of banking and financial institutions in emerging economies

3.5.1.2. Growing cash circulation and increasing penetration of automated teller machines (ATMs)

3.5.1.3. Growing freight theft and cash-in-transit heists

3.5.2. Market Restraints Analysis

3.5.2.1. Increasing penetration of mobile payments

3.5.2.2. The growing emphasis on virtual banking

3.5.3. Market Opportunity Analysis

3.5.3.1. Unbanked Population

3.5.3.2. Technology integration and the advent of fully automated cash-in-transit vehicles

3.5.4. Market Challenge Analysis

3.5.4.1. Economic challenges faced by the companies

3.6. Secure Logistics Market Industry Analysis - Porter’s

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat of New Entrants

3.6.5. Competitive Rivalry

3.7. Secure Logistics Market Industry Analysis - PEST

3.7.1. Political & Legal Landscape

3.7.2. Environmental Landscape

3.7.3. Social Landscape

3.7.4. Technology Landscape

3.8. COVID-19 Impact on Secure Logistics Market

3.8.1. Gems and Jewelry

3.8.2. Cash Management

3.8.3. Manufacturing

3.9. Major Deals & Strategic Alliances Analysis

3.9.1. Joint Ventures

3.9.2. Mergers & Acquisitions

3.9.3. Licensing & Partnership

3.9.4. Technology Collaborations

Chapter 4. Secure Logistics Market: Application Estimates & Trend Analysis

4.1. Secure Logistics Market: Application Analysis

4.1.1. Cash Management

4.1.2. Diamonds, Jewelry & Precious Metals

4.1.3. Manufacturing

4.1.4. Others

Chapter 5. Secure Logistics Market: Type Estimates & Trend Analysis

5.1. Secure Logistics Market: End-User Analysis

5.1.1. Static

5.1.2. Mobile

Chapter 6. Secure Logistics Market: Regional Estimates & Trend Analysis

6.1. Secure Logistics Market Share By Region, 2024 & 2033

6.2. North America

6.2.1. U.S.

6.2.2. Canada

6.3. Europe

6.3.1. U.K.

6.3.2. Germany

6.4. Asia Pacific

6.4.1. China

6.4.2. India

6.4.3. Japan

6.5. Latin America

6.5.1. Brazil

6.5.2. Mexico

6.6. Middle East & Africa

Chapter 7. Competitive Analysis

7.1. Recent Developments & Impact Analysis, by Key Market Participants

7.2. Company/ Competition Categorization (Key Innovators, Market Leaders, Emerging Players)

7.3. Vendor Landscape

7.3.1. Key Company Analysis, 2024

7.4. Company Analysis

7.4.1. Company Market Position Analysis

7.4.2. Competitive Dashboard Analysis

Chapter 8. Competitive Landscape

8.1. Brink's Incorporated

8.1.1. Company Overview

8.1.2. Financial Performance

8.1.3. Product Benchmarking

8.1.4. Recent Developments

8.2. CargoGuard

8.2.1. Company Overview

8.2.2. Financial Performance

8.2.3. Product Benchmarking

8.2.4. Recent Developments

8.3. CMS Info Systems (CMS)

8.3.1. Company Overview

8.3.2. Financial Performance

8.3.3. Product Benchmarking

8.3.4. Recent Developments

8.4. G4S Limited

8.4.1. Company Overview

8.4.2. Financial Performance

8.4.3. Product Benchmarking

8.4.4. Recent Developments

8.5. GardaWorld

8.5.1. Company Overview

8.5.2. Financial Performance

8.5.3. Product Benchmarking

8.5.4. Recent Developments

8.6. Lemuir Group

8.6.1. Company Overview

8.6.2. Financial Performance

8.6.3. Product Benchmarking

8.6.4. Recent Developments

8.7. Loomis AB

8.7.1. Company Overview

8.7.2. Financial Performance

8.7.3. Product Benchmarking

8.7.4. Recent Developments

8.8. maltacourt

8.8.1. Company Overview

8.8.2. Financial Performance

8.8.3. Product Benchmarking

8.8.4. Recent Developments

8.9. PlanITROI, Inc.

8.9.1. Company Overview

8.9.2. Financial Performance

8.9.3. Product Benchmarking

8.9.4. Recent Developments

8.10. Prosegur

8.10.1. Company Overview

8.10.2. Financial Performance

8.10.3. Product Benchmarking

8.10.4. Recent Developments

8.11. Allied Universal

8.11.1. Company Overview

8.11.2. Financial Performance

8.11.3. Product Benchmarking

8.11.4. Recent Developments

8.12. Securitas AB

8.12.1. Company Overview

8.12.2. Financial Performance

8.12.3. Product Benchmarking

8.12.4. Recent Developments