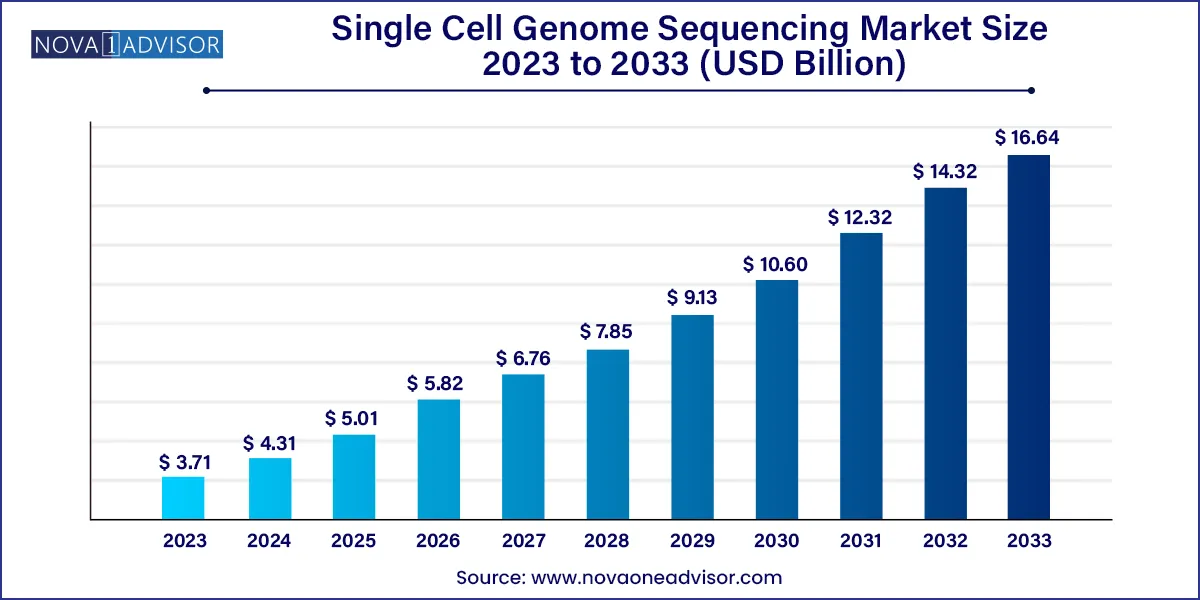

The global single cell genome sequencing market size was estimated at USD 3.71 billion in 2023 and is projected to hit around USD 16.64 billion by 2033, growing at a CAGR of 16.2% during the forecast period from 2024 to 2033.

The single cell genome sequencing market is rapidly evolving as a transformative segment within genomics and molecular biology. It enables researchers to uncover the complexities of individual cells, offering unprecedented insights into cell heterogeneity, lineage tracing, somatic mutations, and rare subpopulations within tissues. Unlike bulk sequencing that averages signals across a population of cells, single cell sequencing allows scientists to dissect the genomic architecture of each cell individually, thereby opening new frontiers in cancer biology, neurobiology, immunology, and developmental biology.

Over the past decade, single cell sequencing technologies have transitioned from experimental novelty to essential tools in translational research and precision medicine. With the cost of sequencing plummeting and high-throughput microfluidic platforms becoming widely accessible, adoption is accelerating across academic, clinical, and pharmaceutical sectors. Moreover, global investments in cell atlasing initiatives, such as the Human Cell Atlas, and rising emphasis on personalized therapies are further boosting the relevance of single cell sequencing in diagnostics and therapeutic development.

The convergence of droplet-based platforms, next-generation sequencing (NGS), and computational bioinformatics is reshaping how researchers analyze and interpret genomic variation at the resolution of individual cells. As a result, the single cell genome sequencing market is poised for robust growth over the next decade, with applications extending from oncology and immunotherapy to prenatal diagnostics and infectious disease monitoring.

Growing use of droplet microfluidics for high-throughput single cell isolation and barcoding

Integration of machine learning for single cell data interpretation and clustering

Expansion of single cell applications into microbiology and environmental genomics

Emergence of spatial genomics to complement single cell sequencing

Increasing adoption of single cell multi-omics platforms (genomics, transcriptomics, epigenomics)

Development of commercial kits and reagents optimized for rare cell populations

Greater use of single cell data in drug target discovery and biomarker validation

Strategic collaborations between academic institutions and sequencing technology providers

| Report Attribute | Details |

| Market Size in 2024 | USD 4.31 Billion |

| Market Size by 2033 | USD 16.64 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 16.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product type, technology, workflow, disease area, application, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Bio-Rad Laboratories; 10x Genomics; Novogene; Fluidigm; BGI; Illumina, Inc.; Oxford Nanopore Technologies; Pacific Biosciences; Thermo Fisher Scientific, Inc.; QIAGEN; F Hoffmann-La Roche Ltd. |

The most significant driver of the single cell genome sequencing market is the increasing demand for precision insights in cancer and immunology research. Cancer is a heterogeneous disease where tumor evolution, therapy resistance, and metastasis are driven by rare cell populations that often go undetected in bulk sequencing. Single cell sequencing enables detection of tumor subclones, quantification of mutation loads, and mapping of tumor microenvironments, which is critical for designing personalized therapies.

In immunology, understanding the diverse repertoire of immune cells, particularly T cells and B cells, is vital for vaccine development, autoimmune disease studies, and immunotherapy optimization. Single cell platforms help identify clonal expansions, antigen-specific responses, and immune cell exhaustion states with granular precision. The ability to pair genomic data with cell surface markers and transcriptomic profiles further enhances the utility of single cell technologies in these domains.

Despite its potential, the market faces a major restraint in the form of high capital costs and the analytical complexity involved in single cell sequencing workflows. Specialized instruments for cell capture, reagent kits for low-input library preparation, and robust sequencing platforms are often prohibitively expensive for small labs and budget-constrained institutions.

Moreover, the data generated from single cell experiments is vast, sparse, and noisy, requiring advanced computational tools and expertise in bioinformatics for meaningful interpretation. Batch effects, dropout rates, and normalization challenges further complicate analysis pipelines. These factors not only hinder broader adoption but also introduce variability that can affect reproducibility across laboratories.

An emerging opportunity within the market lies in applying single cell genome sequencing to non-invasive prenatal diagnostics and reproductive medicine. Traditional methods such as amniocentesis are invasive and carry risks. With advancements in isolating fetal cells from maternal blood, single cell sequencing offers a promising alternative for early, non-invasive genetic screening.

By analyzing trophoblast or fetal nucleated red blood cells, researchers can detect chromosomal abnormalities, single-gene disorders, and de novo mutations at a resolution unmatched by conventional techniques. As ethical and regulatory pathways become clearer, and validation studies mature, this application is expected to expand in clinical settings, offering safer and more informative options for expecting parents.

Reagents dominate the product type segment, accounting for the largest share due to their recurring nature and indispensable role in library preparation, cell lysis, amplification, and sequencing reactions. Companies offer specialized reagent kits tailored for low-input DNA extraction, whole genome amplification (WGA), and barcoding, which are crucial for high-quality single cell sequencing workflows. The demand for reagents is expected to remain steady, especially with the growing adoption of droplet-based and plate-based platforms.

Instruments are the fastest-growing segment, owing to the increasing deployment of integrated platforms that combine single cell capture, sorting, and sequencing. Tools such as microfluidic droplet generators, robotic cell sorters, and real-time imaging systems are becoming essential in both research and clinical labs. The trend toward miniaturized, benchtop instruments with user-friendly interfaces is further driving accessibility and adoption among new entrants in the space.

Next-generation sequencing (NGS) remains the cornerstone technology, forming the backbone of nearly all single cell genome sequencing workflows. Its scalability, accuracy, and multiplexing capabilities make it ideal for analyzing thousands of single cells in parallel. NGS technologies are widely used across cancer, immunology, and stem cell research, with major vendors constantly innovating to improve read length, accuracy, and cost-efficiency.

Microarray and multiple displacement amplification (MDA) are niche yet growing technologies, especially in cases where targeted analysis or whole genome amplification is required. PCR and qPCR remain integral in pre-sequencing steps for target enrichment and mutation validation. However, their utility is more limited in genome-wide studies compared to NGS-based platforms.

Genomic analysis dominates the workflow segment, as the final interpretation of sequencing data provides insights into SNPs, CNVs, structural variants, and mutational signatures at the single cell level. This step often involves cloud-based platforms, machine learning algorithms, and statistical tools to handle high-dimensional data and draw biological conclusions.

Single cell isolation is the fastest-growing workflow, due to innovations in cell capture techniques such as fluorescence-activated cell sorting (FACS), microfluidics, magnetic-activated cell sorting (MACS), and laser capture microdissection. These technologies enable high-throughput and precise cell separation, which is a critical prerequisite for accurate genomic analysis.

Cancer leads the disease area segment, owing to the deep heterogeneity observed within tumor tissues and the growing need for clonal mapping in oncology. Single cell sequencing is revolutionizing our understanding of tumor evolution, minimal residual disease, and resistance mechanisms. It also supports the development of personalized immunotherapies based on tumor-infiltrating lymphocytes (TILs).

Prenatal diagnosis is the fastest-growing disease area, especially with the emergence of non-invasive cell capture methods and growing public interest in early, accurate fetal genetic screening. Neurobiology and immunology also represent promising segments, as researchers apply single cell tools to study complex systems like neural development and immune modulation at a cellular level.

Genomic variation analysis dominates the application segment, driven by the need to identify single nucleotide polymorphisms (SNPs), copy number variations (CNVs), and de novo mutations in individual cells. This application is central to both cancer and developmental biology studies and supports disease modeling and biomarker discovery.

Subpopulation characterization and cell differentiation/reprogramming are rapidly growing, supported by advances in lineage tracing, CRISPR-based perturbations, and induced pluripotent stem cell (iPSC) technologies. Researchers are increasingly using single cell platforms to define cell identities, reconstruct differentiation trajectories, and monitor cellular reprogramming in regenerative medicine.

Academic and research laboratories account for the largest end-use segment, due to their foundational role in developing and validating single cell sequencing methods. Publicly funded programs like NIH’s BRAIN Initiative or the European Human Cell Atlas project have significantly boosted investments in this segment.

Biotechnology and biopharmaceutical companies are the fastest-growing end-users, leveraging single cell genomics to discover novel drug targets, develop cell-based therapies, and enhance patient stratification in clinical trials. Clinics are gradually adopting single cell tools, particularly for preimplantation genetic diagnosis (PGD), hematological malignancy screening, and personalized oncology.

North America dominates the global single cell genome sequencing market, owing to its advanced healthcare infrastructure, well-funded research programs, and strong presence of genomic technology companies. The U.S. houses major sequencing platforms, reagent developers, and academic institutions that are actively driving innovation in single cell applications. Favorable reimbursement policies and regulatory clarity for genomic diagnostics further support market growth.

Asia Pacific is the fastest-growing region, propelled by increasing investments in precision medicine, growing adoption of sequencing in clinical settings, and the emergence of biotech startups in countries like China, India, and South Korea. Government-backed genomics initiatives, such as China’s precision health project and India’s GenomeIndia program, are fostering infrastructure and demand for cutting-edge single cell technologies.

Major companies are continually striving for progress to establish themselves as market leaders. Consequently, the market is witnessing numerous activities such as acquisitions, product launches, and the implementation of competitive strategies. Moreover, companies are actively expanding their research and development initiatives while introducing cutting-edge technological advancements in the industry.

For instance, in October 2022, Oxford Nanopore Technologies PLC announced a collaboration with 10x Genomics, aimed at streamlining the workflow to enable the sequencing of full length transcripts in single reads on Oxford Nanopore devices. This collaboration will facilitate single cell sequencing accessible to any laboratory, thereby increasing efficiency and cost reduction benefits. Some prominent players in the global single cell genome sequencing market include:

March 2025: 10x Genomics launched a new platform integrating spatial transcriptomics with single cell DNA sequencing to enable spatially resolved mutational mapping.

February 2025: Mission Bio partnered with a major oncology center to develop a multi-omics single cell platform for tumor evolution tracking in blood cancers.

January 2025: Illumina announced the expansion of its NovaSeq X platform with optimized protocols for high-throughput single cell whole genome sequencing.

October 2024: Bio-Rad Laboratories released a microfluidics-based single cell isolation chip with higher recovery rates for rare cell populations.

August 2024: Parse Biosciences secured a $60 million funding round to scale manufacturing of its single cell kits and expand its global reach.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Single Cell Genome Sequencing market.

By Product Type

By Technology

By Workflow

By Disease Area

By Application

By End-use

By Region