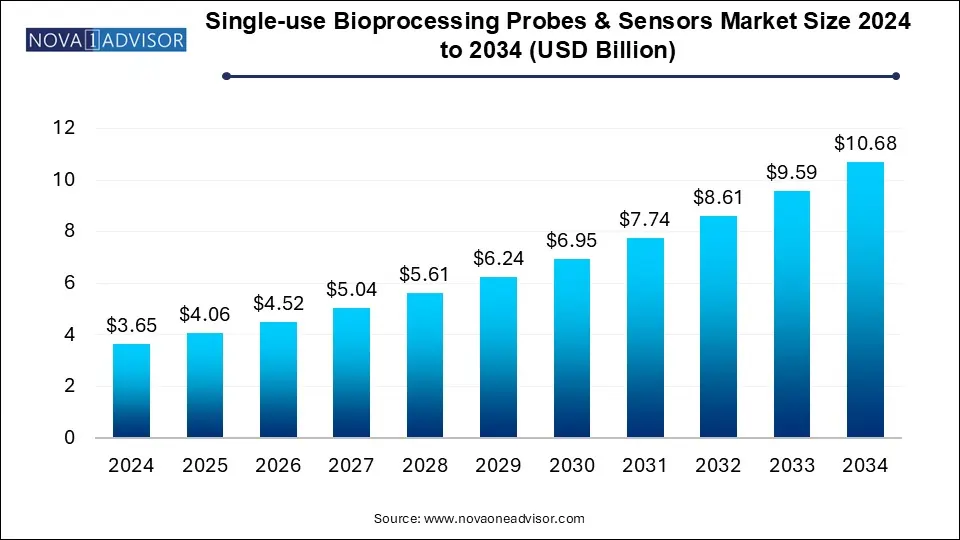

The single-use bioprocessing probes & sensors market size was exhibited at USD 3.65 billion in 2024 and is projected to hit around USD 10.68 billion by 2034, growing at a CAGR of 11.33% during the forecast period 2025 to 2034.

The single-use bioprocessing probes and sensors market has emerged as one of the most pivotal segments in the biomanufacturing landscape. As biopharmaceutical production becomes increasingly focused on flexibility, sterility, scalability, and speed, the industry is moving away from traditional stainless-steel equipment toward disposable, single-use systems (SUS). At the heart of this transformation lies the critical role of sensors and probes, which monitor and control essential process parameters in both upstream and downstream workflows.

Single-use sensors provide real-time, in-situ measurement of pH, dissolved oxygen (DO), pressure, temperature, flow rate, and conductivity, enabling tight control over bioprocess variables while reducing contamination risks. These sensors are embedded within disposable bioreactor bags, tubing systems, and purification units, ensuring seamless integration without requiring extensive cleaning validation or calibration. The market's growth is also supported by rising biopharmaceutical investments, increased demand for monoclonal antibodies, vaccines, and personalized medicines, as well as the expansion of contract development and manufacturing organizations (CDMOs).

As the global demand for biologics continues to surge, especially post-COVID-19, companies are under pressure to accelerate development timelines while maintaining regulatory compliance and product consistency. Single-use bioprocessing probes and sensors offer a solution to these dual demands. Their growing adoption is transforming how modern biomanufacturers design and execute production strategies, making this market not only essential but central to the evolution of bio-innovation.

Increased Integration with Smart Manufacturing Platforms: Sensors now offer data connectivity, enabling integration into automated process control and digital twins.

Growing Use of Multiparameter Sensors: Companies are demanding compact devices that simultaneously measure pH, DO, and temperature to reduce equipment footprint.

Adoption of Optical and Non-invasive Technologies: Optical sensors for pH and DO allow for contactless measurements, reducing risks of contamination.

Rising Customization for Single-use Systems: Sensor manufacturers are offering modular and customizable probes tailored for unique bioreactor designs.

Expansion in Continuous Bioprocessing Applications: Sensors compatible with perfusion and continuous bioreactor setups are gaining popularity.

Emphasis on Disposable Sensor Standardization: Industry bodies are collaborating to establish standards in accuracy, lifespan, and sterilization compatibility.

Increased Outsourcing to CDMOs: Contract manufacturers are rapidly adopting single-use technologies to handle diverse client needs and shorten project timelines.

Eco-friendly Product Innovations: Development of biodegradable materials for sensor housing and packaging is gaining traction amid sustainability goals.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.06 Billion |

| Market Size by 2034 | USD 10.68 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 11.33% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Workflow, End use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Hamilton Company; Thermo Fisher Scientific Inc.; Parker-Hannifin Corporation; Danaher Corporation; Mettler-Toledo International Inc. (PendoTECH); PreSens Precision Sensing GmbH; Sartorius AG; Broadley-James Corporation; Saint-Gobain (Equflow); Dover Corporation |

A dominant driver propelling the global single-use bioprocessing probes and sensors market is the rapid expansion of biologic drug development, including monoclonal antibodies (mAbs), recombinant proteins, gene therapies, and vaccines. Unlike traditional small-molecule drugs, biologics require highly controlled environments for cell culture, fermentation, and purification. The ability to tightly monitor process parameters is non-negotiable, as even minor deviations can impact product yield and efficacy.

Single-use sensors address this need by providing accurate, real-time monitoring of critical variables like pH, DO, and temperature throughout the bioproduction process. Moreover, the flexibility offered by disposable sensors enables quick changeovers, batch flexibility, and reduced cross-contamination—features essential for multi-product facilities and clinical trial manufacturing. As more biopharma pipelines shift toward complex biologics, the demand for fast, safe, and cost-effective bioprocessing tools—anchored by single-use sensors—is expected to grow exponentially.

While the market is flourishing, one of the major restraints is the inherent limitation in the accuracy and long-term stability of single-use sensors compared to their reusable, stainless-steel counterparts. Disposable sensors are often pre-calibrated and cannot be adjusted mid-process, which can lead to discrepancies in readings during extended or high-volume runs. In continuous manufacturing or long-batch processes, degradation of sensor reliability can result in process deviations and quality concerns.

Further, many single-use sensors struggle to match the precision and robustness of traditional probes in highly complex or high-pressure applications. This creates hesitancy among manufacturers working on high-value or regulatory-critical biopharmaceuticals. Additionally, the inability to perform real-time recalibration and the limited compatibility of some sensors with harsh sterilization processes restrict their usage across broader workflows.

A transformative opportunity lies in the emergence of real-time bioprocessing platforms connected via cloud and edge computing, creating a data-rich environment for predictive analytics, automated controls, and remote process management. Single-use sensors that are integrated with digital biomanufacturing software platforms offer the ability to monitor, adjust, and optimize processes in real-time. This digital transformation reduces manual errors, improves batch reproducibility, and streamlines regulatory compliance through automated documentation.

As regulatory bodies increasingly favor QbD (Quality by Design) frameworks and continuous process verification (CPV), the integration of real-time data collection through smart single-use probes and sensors becomes a critical enabler. Companies that develop plug-and-play sensors with wireless communication, AI-assisted diagnostics, and advanced calibration intelligence will be best positioned to lead in the next phase of biomanufacturing innovation.

pH sensors held the largest share in the global single-use bioprocessing probes and sensors market in 2024. Their critical role in cell viability, enzyme kinetics, and bioreactor control systems makes them indispensable in both upstream and downstream processes. Maintaining optimal pH is essential for maximizing product yield and preventing cellular stress. These sensors are widely used in bioreactors, buffer preparation units, and filtration systems. Pre-calibrated and gamma-stable pH sensors specifically designed for single-use bioreactors have become mainstream, driven by their reliability and low risk of contamination.

Flow meters and sensors are expected to be the fastest-growing type, particularly due to their increasing utility in perfusion bioreactor setups, tangential flow filtration (TFF), and chromatography skids. As single-use systems shift from batch to continuous bioprocessing models, the need for accurate, disposable flow sensors that provide real-time volumetric data becomes more pronounced. These devices are being miniaturized, embedded into tubing lines, and integrated with software for dose monitoring, buffer exchange, and flow rate consistency—critical in high-yield biologics manufacturing.

Upstream processing dominated the market, especially in cell culture and fermentation phases where conditions must be precisely controlled for cell viability and protein expression. Single-use pH, DO, and temperature sensors play a crucial role in maintaining ideal environments for mammalian and microbial cell lines. These probes are often built directly into disposable bioreactor bags, allowing for real-time feedback without compromising sterility. Upstream processes benefit the most from sensor-enabled automation, as they set the foundation for successful downstream yield.

Downstream processing is the fastest-growing workflow, particularly in ultrafiltration, diafiltration, and chromatography processes. In this phase, flow, pressure, and conductivity sensors are vital for ensuring that the product is separated, concentrated, and purified effectively. The need for rapid batch turnovers and regulatory compliance in viral vector purification and mAb polishing is pushing manufacturers to adopt modular, sensor-equipped single-use platforms. As downstream steps increasingly embrace automation, disposable sensors are essential for minimizing manual input and improving product consistency.

Biopharmaceutical and pharmaceutical companies accounted for the largest market share due to their substantial investments in biologic drug pipelines, vaccine development, and biosimilar manufacturing. These companies operate both pilot and commercial-scale facilities, where the need for scalable, sterile, and precise bioprocess control is paramount. Leading players are actively upgrading existing systems to incorporate modular single-use bioreactors and advanced sensor kits that meet GMP and international regulatory standards.

CROs and CMOs are the fastest-growing end users, propelled by increased outsourcing from small and mid-sized biotech firms. Contract organizations prioritize flexibility, speed, and low-cost production, making single-use technologies ideal for their operations. Since CMOs work on multiple client projects, quick turnaround and minimal cross-contamination are vital—benefits directly offered by disposable probes and sensors. As the CDMO market expands to accommodate gene therapies and advanced biologics, demand for integrated single-use sensor systems is expected to skyrocket.

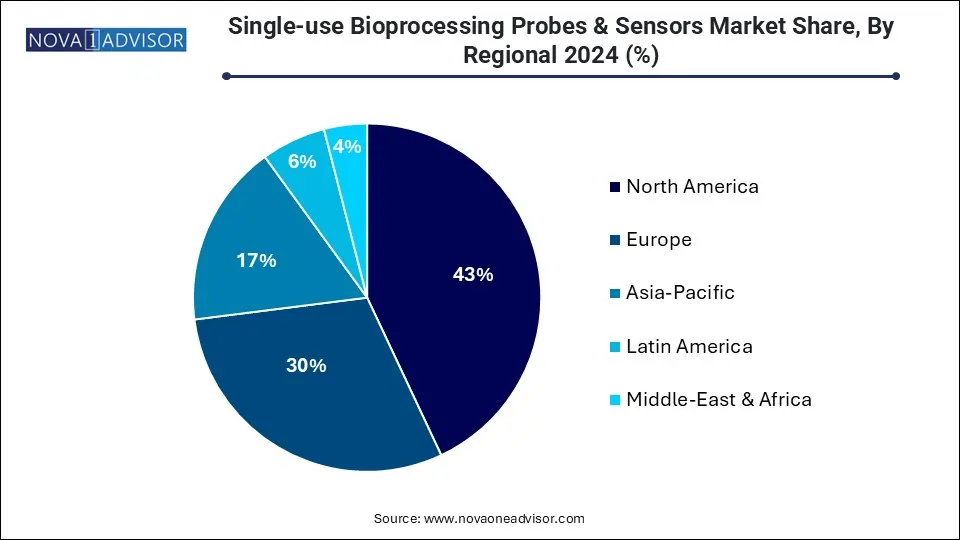

North America held the largest share in 2024, driven by robust biopharmaceutical manufacturing activity in the U.S. and Canada. The presence of leading biomanufacturers such as Pfizer, Amgen, and Bristol Myers Squibb, coupled with a mature CDMO ecosystem, fuels demand for advanced single-use sensor systems. Additionally, the FDA’s QbD and PAT (Process Analytical Technology) guidelines encourage widespread adoption of real-time monitoring solutions. Well-established supply chains, high R&D investment, and the rapid commercialization of biologics ensure North America remains the innovation hub of the industry.

Asia Pacific is the fastest-growing region, led by rapid biopharma industrialization in China, India, South Korea, and Singapore. Governments across the region are supporting domestic biologics production and building local capacity for biosimilars and vaccines. These initiatives are driving demand for low-cost, flexible, and regulatory-compliant single-use systems. Local players and global suppliers alike are setting up manufacturing and distribution bases to cater to regional needs. The availability of skilled labor, growing clinical trials, and increasing adoption of continuous bioprocessing are transforming Asia Pacific into a high-growth zone for disposable bioprocessing sensors.

March 2025 – Sartorius AG announced the launch of a next-gen multi-sensor probe that integrates pH, DO, and temperature sensors in a compact single-use design optimized for perfusion bioreactors.

February 2025 – Thermo Fisher Scientific completed its acquisition of a bioprocess sensor startup focused on optical pressure and conductivity sensors for cell therapy manufacturing.

January 2025 – Hamilton Company released an expanded range of gamma-stable pH and DO sensors for single-use bioreactor bags, targeting early-phase biologics manufacturing.

December 2024 – Parker Hannifin Corporation partnered with a leading CDMO in Singapore to develop customized flow and pressure sensors integrated within filtration skids.

November 2024 – PreSens Precision Sensing introduced a non-invasive optical sensor system with real-time data integration for downstream filtration processes.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the single-use bioprocessing probes & sensors market

By Type

By Workflow

By End Use

By Regional