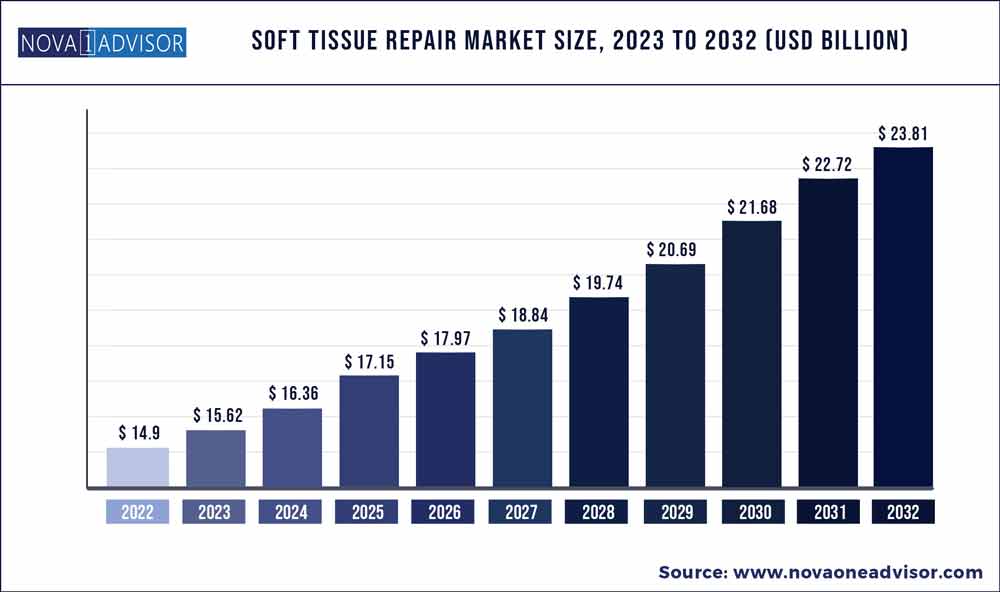

The global soft tissue repair market size was exhibited at USD 14.9 billion in 2022 and is projected to hit around USD 23.81 billion by 2032, growing at a CAGR of 4.8% during the forecast period 2023 to 2032.

Key Pointers:

Growth in this market is mainly driven by the growing incidence of sports injuries, the increasing age of the population and the obesity rate, a strong focus on R&D leading to the launch of technologically advanced products, etc. But the uncomplimentary reimbursement scenario for soft tissue repair products is one of the key factors restraining the growth of the market

Soft Tissue Repair Market Report Scope

|

Report Coverage |

Details |

|

Market Size in 2023 |

USD 15.62 Billion |

|

Market Size by 2032 |

USD 23.81 Billion |

|

Growth Rate From 2023 to 2032 |

CAGR of 4.8% |

|

Base Year |

2022 |

|

Forecast Period |

2023 to 2032 |

|

Segments Covered |

Product, Application, End user |

|

Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

|

Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

|

Key Companies Profiled |

Becton, Dickinson and Company (US), Smith & Nephew Plc. (UK), Stryker Corporation (US), Arthrex, Inc. (US), Johnson & Johnson (US), Medtronic Plc. (IE), LifeNet Health, Inc. (US), Zimmer Biomet (US), CryoLife, Inc. (US), Organogenesis Inc. (US), Baxter International, Inc. (US), ACell Inc. (US), Tissue Regenix Group Plc (UK) and Aroa Biosurgery Ltd. (NZ). |

Soft Tissue Repair Market Dynamics

Driver: increasing ageing population and obesity rate

Age-related physiological changes and metabolic inefficiencies often result in chronic diseases such as cystic fibrosis, hepatitis, cardiovascular disorders, and cancer. The elderly are more susceptible to various soft tissue injuries. For example, according to a register study from the United Kingdom, the prevalence of hernia increased with age, from 5% in the age group 25 to 34 years, through 10% in the age group 35 to 44 years, 18% in the age group 45 to 54 years, 24% in the age group 55 to 64 years, 31% in the age group 65 to 74 years, and 45% among men aged 75 and over. According to an article published in the Advances in Orthopedic Surgery journal, more than 40% of the population aged 60 years and older suffers from a rotator cuff tear.

In 2020, there will be 900 million people aged 65 and up worldwide. Women outlive men on average, so they make up the majority of the elderly, particularly at advanced ages. Over the next three decades, the number of older people worldwide is projected to more than double, reaching over 2 billion in 2050. All regions will see an increase in the size of the older population between 2020 and 2050. Globally, the share of the population aged 65 or over is expected to increase from 9.3 percent in 2020 to around 16.0 percent in 2050.

As per the FDA, more than one million hernia repairs are performed each year in the U.S. Approximately 800,000 are to repair inguinal hernias, and the rest are for other types of hernias. Similar trends are observed in other developed and developing countries as well. Thus, the increasing ageing population, coupled with rising disposable income and greater per capita healthcare expenditure, is expected to drive the demand for soft tissue repair surgeries in the forecast period of 2022–2025.

growing incidence of sports injuries

Globally, there is increasing awareness about the benefits of sports and physical activities on health. This has increased the popularity of sports among the youth. Due to this, the number of people participating in various sports has also increased significantly over the years. For instance, according to the National Basketball League of the United States, in 2020, the number of participants (aged six years and older) in basketball will amount to approximately 24.23 million.

These sports are also becoming popular in Asian countries such as China, Korea, India, and the Eastern Bloc countries. According to the annual High School Athletics Participation Survey conducted by the National Federation of State High School Associations (NFHS), the number of participants in high school sports increased for the 25th consecutive year in 2020–2021.

Research by the Sports Medicine Research Institute shows a significant rise in soft tissue injuries in a younger generation involved in athletic activities. Sports and many recreational activities for children can lead to a number of accidents and soft tissue injuries, as well as more serious injuries such as fractures. With the increasing sports participation across the globe, the number of sports-related soft tissue injuries is estimated to increase, which will drive the soft tissue repair market.

According to the American Academy of Orthopaedic Surgeons (AAOS), an estimated 200,000 anterior cruciate ligament (ACL) injuries are reported annually in the U.S., with around 100,000 ACL reconstructions performed each year. According to papers published by the IEEE Journal of Biomedical and Health Informatics, the number of Americans suffering from ACL injury disease and knee joint osteoarthritis is estimated to reach 60 million by 2025. This significant increase in soft tissue injuries is expected to drive the market for soft tissue repair in the next decade.

A strong emphasis on R&D results in the release of technologically advanced products.

Over the last few decades, there has been a steady increase in R&D investments, particularly among established players. This has led to the development of soft tissue repair products for various applications. Smith & Nephew invested approximately USD 496 million in R&D in fiscal 2020, a 16.3% increase over fiscal 2019. Similarly, Baxter International spent approximately USD 525 million on R&D.

Regulatory bodies in several countries have approved various products, such as grafts and adhesion barriers, for use in a number of medical applications. A rising number of products are also getting approved for additional indications, which is increasing the application and use of these products and also helping companies enter additional markets with their existing products.

In September 2019, Medtronic launched several new procedural solutions, including Fibercel Viable Bone Matrix, to reinforce its product portfolio for spine surgeries.

increasing volume of surgeries and growing prevalence of severe trauma injuries

Over the years, there has been a significant rise in the number of surgical procedures across the globe. According to 2019 WHO estimations, approximately 235 million major surgical procedures are undertaken worldwide every year. This is attributed to the growing prevalence of obesity and other lifestyle diseases, the rising geriatric population, the increasing prevalence of orthopaedic conditions, and the increasing incidence of spinal injuries and sports-related injuries.

Soft tissue repair products are finding substantial application in severe trauma injuries, including traumatic brain injuries (TBIs), spinal cord injuries, spine fractures, collapsed lungs, and subarachnoid hemorrhage. According to the Centers for Disease Control and Prevention (CDC), in 2019, TBIs accounted for about 61,000 injury-related deaths in the US, which is about 166 deaths due to TBIs every day. The growing prevalence of trauma injuries such as TBIs and injuries caused by falls and accidents is expected to increase the number of trauma surgeries performed across the globe. This is a key indicator of market growth during the forecast period.

Soft tissue repair products such as tissue, grafts, and suture anchors play a key role in cosmetic surgeries and reconstructive plastic surgeries. The American Society of Plastic Surgeons (ASPS) released its annual plastic surgery procedural statistics, reporting that 1.8 million surgical cosmetic procedures and 15.9 million minimally invasive cosmetic procedures were performed in the US in 2020; this represented an increase of 2% and 1% over the procedures conducted in 2017, respectively. In addition, 5.8 million reconstructive procedures were performed in the US during the same period.

Accident and trauma cases and sports injuries are among the major factors increasing the volume of surgeries performed across the globe. According to the WHO global status report (2020), there is a growth in the global number of accidents and trauma cases. About 1.35 million people die each year due to accidents, and about 20 to 50 million sustain non-fatal injuries due to road crashes.

Hands, upper extremities, and legs are the most vulnerable body parts to sports injuries. According to the facts and statistics for sports injuries provided by the National Safety Council (NSC, US), in 2020, the incidence of sports injuries across sports activities such as martial arts, boxing, and skateboarding increased by 3.7% from 2007 to 2020 in the US. The rising incidence of sports injuries is increasing the number of orthopaedic and reconstructive surgeries performed across the globe. This is expected to drive the growth of dependent markets, including the markets for tissue patches and mesh.

Restraint: unfavourable reimbursement scenario

The unfavourable reimbursement scenario in most countries across the globe is a major factor restricting the growth of the soft tissue repair market. According to the Centers for Medicare & Medicaid Services (CMS), there have been a number of changes in payment policies and rates for physicians and non-physician practitioners with regard to services paid under the Medicare Physician Fee Schedule in 2020. CMS has issued a five-year review of work relative value units (RVUs) for orthopaedic procedures. The total RVU includes the following three components: the work RVU, which captures the time and effort required by the physician to perform the procedure; the practise expense RVU, which captures the cost in terms of staff labor, equipment, supplies, and rent; and the malpractice RVU, which captures a portion of the malpractice cost.

As a result of the CMS review, overall procedural reimbursements from Medicare have decreased. In 2019, RVUs for orthopaedic surgery decreased by about 1%. Any further decrease in Medicare reimbursements is expected to have a negative impact on the growth of the soft tissue repair market in the coming years.

In addition to this, from 2011 to 2021, the national inflation rate was 16.3%. Unadjusted reimbursement rates for open and laparoscopic inguinal hernia repairs increased by 6.5% and 7.2%, respectively. There was an increase in unadjusted reimbursement for open appendectomies of 5.1% and 6.1% for laparoscopic procedures. Unadjusted reimbursement for open cholecystectomies increased by 4.4% but decreased by 6.8% for laparoscopic. When adjusted to 2021 values, reimbursement for all six operations decreased. Laparoscopic and open cholecystectomies experienced the largest decreases (19.8% and 10.2%, respectively).

The high price of soft tissue repair products and the rising cost of surgical procedures

The high cost, coupled with the unfavourable reimbursement scenario for these products in several countries, makes them unaffordable for a large section of the target patient population. Currently, the soft tissue market is extremely competitive in terms of pricing, owing to the high level of competition among existing players. Most of the products available in this market are priced at a premium. To reduce the growing costs of healthcare, governments in several countries across the globe have undertaken efforts to redesign their respective healthcare reimbursement systems. For instance, the US government has planned to reduce Medicare spending by USD 716 billion from 2012 to 2022. This is being achieved by bringing about a 2% cut in the Critical Access Hospitals (CAH) Medicare payments. The reduction in such expenditures has negatively affected the overall quality of healthcare provided to patients. In addition, in 2018, the CMS cut payments by 0.4% (USD 80 million) for home healthcare agencies over the 2017 budget.

Due to the high cost, this further restricts the adoption of many soft tissue repair products. Also, the products currently available on the market are made of complicated reconstitutions with a poor shelf life. Hence, there is a growing need for low-priced products that are easy to handle and have a better shelf life.

Opportunity: Increasing adoption of soft tissue repair products in emerging markets

The penetration of soft tissue repair products is increasing across emerging countries in the Asia Pacific, Latin America, the Middle East, and Africa. In the coming years, countries such as China, India, and Brazil are expected to offer significant growth opportunities for players operating in the soft tissue repair market. This is because the markets in these countries are characterised by a large patient base for target indications (such as cardiovascular, orthopedic, general/abdominal, and gynaecological disorders), rising health awareness, growing healthcare expenditure, rising medical tourism, and rapidly developing healthcare infrastructure. For instance, cardiovascular diseases are currently the leading cause of mortality in India. Heart disease and stroke will account for approximately 25% of deaths in India by 2020, accounting for approximately 80% of the healthcare burden.

Over the last few decades, countries such as India and Malaysia have emerged as hubs for medical tourism. This is because the cost of medical procedures in these emerging countries is significantly lower in comparison to developed countries such as the US, Germany, France, and the UK. Also, the presence of skilled surgeons and the availability of well-equipped surgical care facilities across private hospital chains are driving the number of medical tourists travelling to these countries for treatment.

Government agencies in several Asia-Pacific countries are undertaking initiatives to support their respective healthcare systems. Owing to the healthcare reforms in China and the 13th Five-year Plan, about 1.35 billion people participated in the basic medical insurance program, and about 95% of Chinese citizens were insured. Similarly, according to 2020 statistics from the World Bank, healthcare spending in Latin America increased to about 7.93% of total GDP in 2019 from about 6.53% of total GDP in 2002. Such developments have further opened up the soft tissue repair market across emerging countries. As a result, a number of players operating in the global market are focusing on capturing a greater share in emerging markets. With the growing market potential in the APAC region, many leading players in the biosurgery market are making significant investments in emerging APAC countries.

Similarly, countries such as Saudi Arabia and the UAE are focusing on building healthcare facilities for primary care, the secondary hospital segment, and preventive and diagnostic care for their populations. Authorities in the UAE are also undertaking initiatives to convert the country into a medical tourism hub. This is expected to create various growth opportunities for stakeholders operating in the healthcare market in the Middle East.

The rising use of grouping materials for enhancing product efficacy

The performance of soft tissue repair products significantly depends on the type of biologics and materials used in their manufacturing. The use of new materials and agents is helping vendors overcome the limitations (related to biocompatibility, infection, and inflammation) of conventional products and launch products that outperform popular products in terms of biological response and effectiveness.

Several vendors are using the combination approach, which makes use of the best traits of two different materials in an attempt to provide better care. For instance, many vendors are offering polyester- and polytetrafluoroethylene-based combined meshes for use in hernia repair procedures. With the increasing success rate of combination materials and the benefits offered by the unique combination of materials, several companies are focusing on the development and launch of these products. For example, the Fibrin-PTH (KUR-113) product candidate is about to enter Phase 2a clinical trials in the US. The product is a drug-biological combination for use in spinal interbody fusion.

Such innovative approaches to material use have assisted vendors in improving product performance and reducing the length of patient stays across healthcare settings (following surgical procedures). As a result, soft tissue products made using combined biocompatible materials are gaining rapid adoption, thereby providing lucrative growth opportunities to market players.

Challenges: Stringent regulatory framework

The development of new soft tissue repair products requires significant investments, and new products generally take more than 7–8 years to gain marketing approval. For instance, in the US, the FDA has made it mandatory for soft tissue repair product manufacturers to obtain premarket approval (PMA) for their products before they are introduced in the market. For this, the product has to demonstrate proper clinical trial data, which has to be submitted along with the application for PMA. The cost and time required for a product to enter the clinical trial stage and then clear the clinical trials are very high, with very low chances of the product gaining approval. Also, the possibility of obtaining clinically significant data showing clinical trial clearance has been low for soft tissue repair products such as adhesion barriers, semi-synthetic sealants, and hemostatic agents. Soft tissue repair products are considered Class III products, owing to which they require strict adherence to regulatory guidelines. Hence, despite huge investments in research and development, the risk of failure is very high in the case of soft tissue repair products. This is a major factor limiting the development of novel soft tissue repair products on the market.

In the US, for specific applications such as in ophthalmology, urology, and neurology, approval requires preclinical and clinical data demonstrating safety and efficacy during surgical use. Thus, stringent regulations, the requirement of significant investments for clinical studies, and the uncertainty of approval during studies make the development and commercialization of soft tissue products a challenging task for vendors.

requirement of skilled personnel for the effective use of soft tissue repair products

Conventional products used in wound closure, such as sutures and staples, are increasingly being replaced by advanced biosurgery products. Though these products offer improved outcomes, they need skilled surgeons and physicians for their effective utilization. As the use of soft tissue repair products has different effects and contradictions, the application of these products is very complex. For instance, improper application of these products can lead to complications such as anastomotic leaks in patients.

Currently, the lack of skilled surgeons, both in developed and developing economies, is one of the major factors limiting the adoption of these products. For instance, the Association of American Medical Colleges (AAMC) projects a shortage of about 122,000 physicians by 2032 in the US. Of these, a shortage of 67,000 specialists and 23,000 surgeons is expected to occur by 2032. Similarly, the Health Resource and Services Administration (HRSA) projects a shortage of 5,080 orthopedic surgeons in the US by 2025.

The technology landscape and application areas of soft tissue repair products are changing rapidly, owing to technological advancements in this field. This necessitates physicians and other healthcare providers to acquire the necessary skills to apply advanced soft tissue repair products such as allograft, xenograft, and synthetic mesh. Therefore, surgeons and physicians in hospitals and clinics are reluctant to use advanced surgical products for wound closure.

The North America segment accounted for the largest share in the soft tissue repair market by region.

On the basis of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2022, North America accounted for the largest share of 44.9% of the market, followed by Europe, the Asia Pacific, Latin America, and the Middle East and Africa. The large share of the North American market is attributed to the presence of an advanced healthcare system in the region, the high and growing number of surgical procedures, the higher adoption of advanced products, and the presence of several leading market players in the US.

Recent Developments:

Some of the prominent players in the Soft Tissue Repair Market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Soft Tissue Repair market.

by Product

By Application

By End user

By Region