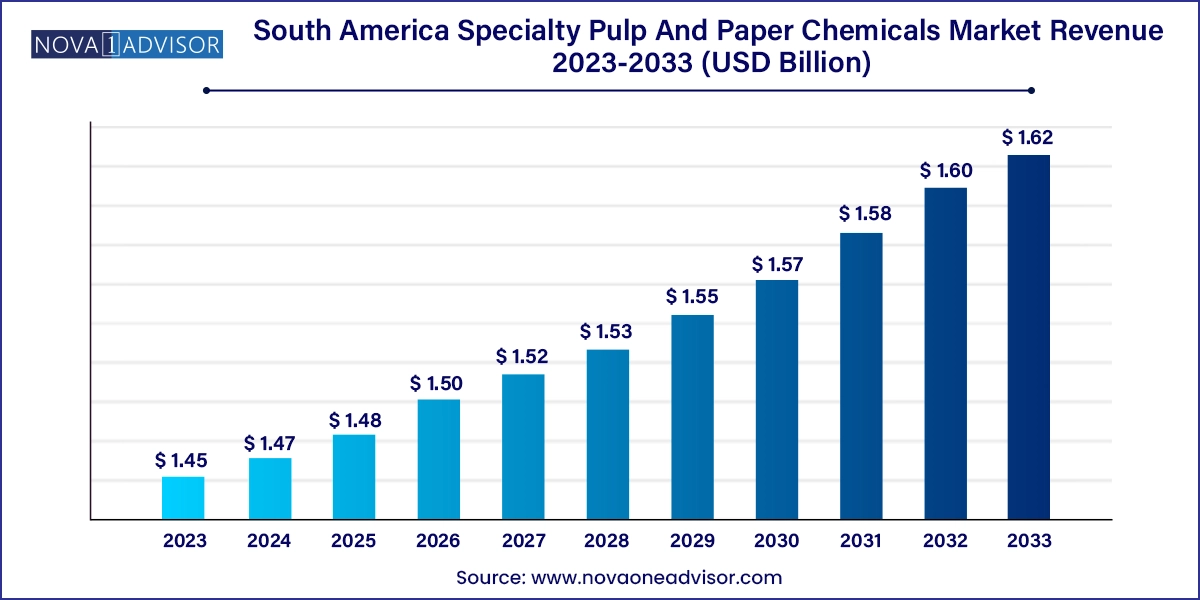

The South America specialty pulp and paper chemicals market size was exhibited at USD 1.45 billion in 2023 and is projected to hit around USD 1.62 billion by 2033, growing at a CAGR of 1.11% during the forecast period 2024 to 2033.

The specialty pulp and paper chemicals market in South America is undergoing a transformative phase, shaped by the convergence of traditional paper production demands and modern sustainable practices. Specialty chemicals used in the pulp and paper industry are designed not only to improve the quality of the end-product but also to enhance processing efficiency, reduce energy and water consumption, and provide functional properties tailored to niche applications such as food-grade packaging, thermal paper, and specialty labeling.

With the region’s rich forest resources and a growing consumer market for sustainable packaging, the South American paper and pulp industry has become increasingly sophisticated. These specialty chemicals play a pivotal role in manufacturing high-performance paper products that meet evolving end-user needs across printing, labeling, and most notably, packaging the fastest-growing application segment driven by e-commerce, food delivery, and exports.

Particularly in countries like Brazil, Argentina, and Venezuela, specialty chemical suppliers are building long-term partnerships with paper mills, investing in regional production facilities, and launching localized solutions. These chemicals including functional agents, process enhancers, bleaching agents, and basic additives are critical to maintaining the competitive edge of South American paper producers in a global market increasingly sensitive to environmental footprints and product performance.

Sustainable Paper Manufacturing

A shift towards eco-friendly chemical formulations, including enzyme-based additives and biodegradable sizing agents, is gaining traction among South American producers aiming to meet global sustainability goals.

Functionalization of Paper

Specialty chemicals that impart water resistance, oil repellency, anti-microbial properties, and enhanced printability are in high demand for packaging and labeling segments.

Digitalization of Production Lines

Mills are integrating chemical dosing systems with AI-based process optimization tools to reduce waste and improve batch consistency in large-scale production.

Growth of Food-grade and E-commerce Packaging

Chemicals that are food-safe, odorless, and improve the barrier properties of paper are rising in demand as food delivery and e-commerce boom in countries like Brazil and Argentina.

Increased Usage of Recycled Fiber

The need for process and functional chemicals tailored to recycled pulp is growing, as mills increasingly depend on post-consumer fiber to reduce raw material costs and environmental impact.

Localization of Chemical Manufacturing

Global specialty chemical players are establishing formulation units and warehouses in South America to reduce lead times and customize solutions to local mill conditions.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.47 Billion |

| Market Size by 2033 | USD 1.62 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 1.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Brazil; Argentina; Venezuela |

| Key Companies Profiled | Klabin; MWV Rigesa; CMPC; MASISA; Ashland; BASF SE; Buckman Laboratories International, Inc.; Kemira; Evonik Industries AG |

The most significant growth catalyst for the South American specialty pulp and paper chemicals market is the booming demand for sustainable packaging solutions, especially in the food and beverage sector. With rising environmental awareness, brands are under pressure to replace plastic packaging with recyclable and compostable alternatives. This has elevated paper-based packaging as a preferred medium.

However, conventional paper lacks the barrier properties and durability required for food applications. Specialty chemicals, particularly functional and process chemicals, bridge this gap. For example, water- and grease-resistant coatings, microbial inhibitors, and anti-fog agents allow paper-based trays and wraps to replace plastic without compromising food safety.

Major fast-food chains and beverage brands in South America including regional players are actively collaborating with paper converters to develop high-performance, food-safe packaging. This, in turn, creates a ripple demand for specialty chemicals that impart required functional properties while complying with food-grade regulations. The result is a demand ecosystem fueled by regulatory shifts, consumer preference, and technological innovation in chemical formulations.

One of the most pressing challenges for the specialty pulp and paper chemicals market in South America is the volatility in raw material sourcing. Many of the ingredients required for specialty formulations such as high-grade surfactants, enzymes, optical brighteners, and specialty resins are imported from North America, Europe, or Asia. Geopolitical tensions, currency fluctuations, port disruptions, and logistics bottlenecks often affect the continuity of supply.

This is particularly critical in countries with complex trade environments like Venezuela, where foreign exchange limitations and import restrictions have disrupted supply chains in recent years. Moreover, the high dependency on overseas suppliers increases input costs, limits production planning, and makes it difficult for smaller mills to access advanced formulations at competitive rates.

While some chemical producers have responded by investing in local manufacturing and inventory hubs, the issue remains a significant barrier, particularly for remote or inland mills that lack proximity to port infrastructure or distribution networks. Unless addressed with strategic sourcing and regional innovation, this challenge could impede the market’s long-term scalability.

As South America pivots toward circular economy models, the use of recycled paper is expanding rapidly especially in urban centers and coastal economies where waste segregation and collection systems are improving. This presents a lucrative opportunity for specialty chemical manufacturers to develop solutions optimized for recycled fibers.

Recycled pulp often presents quality challenges, including ink residues, fiber degradation, microbial contamination, and inconsistency in brightness and strength. Specialty chemicals designed for this context such as de-inking agents, microbial control additives, fiber re-strengthening agents, and brightness enhancers are in high demand.

This opportunity is particularly promising in Brazil, where multiple public-private partnerships are emerging to promote sustainable paper usage and increase recycled content in consumer packaging. Chemical companies that can create performance-boosting, cost-effective, and environmentally safe formulations tailored for recycled fibers are well positioned to lead this new wave of innovation.

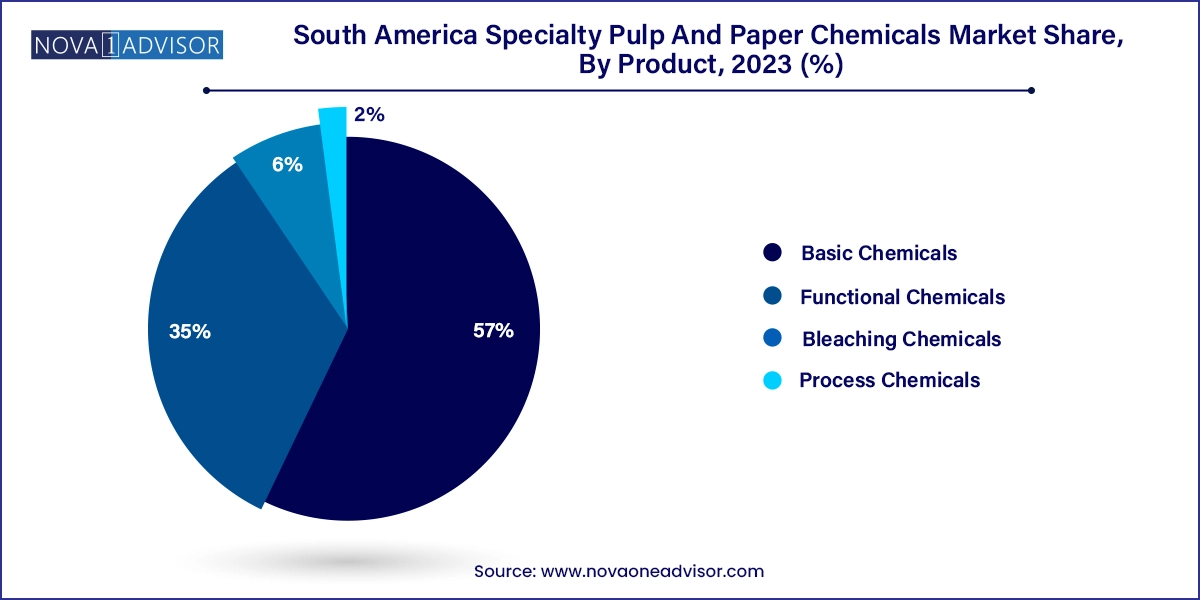

Functional chemicals are currently the largest and most influential segment in the South American specialty pulp and paper chemicals market. Their ability to impart specific traits to the final paper product such as water resistance, print fidelity, tactile smoothness, and oil barrier properties makes them critical for packaging, labeling, and high-end printing. In Brazil, major packaging converters are collaborating with chemical suppliers to enhance the food-grade properties of carton board and kraft paper using functional coatings and additives.

As the region witnesses an uptick in online commerce and premium packaging formats, demand for functional chemicals continues to grow. Additionally, applications such as thermal receipt paper, security printing, and glossy magazine paper rely heavily on functional coatings to ensure performance under varied conditions. This entrenches functional chemicals as both indispensable and strategically valuable in a market where product differentiation is key.

While functional chemicals dominate in terms of overall demand, process chemicals are emerging as the fastest-growing product segment. These include retention aids, sizing agents, anti-pitch agents, and defoamers all aimed at enhancing the efficiency of the paper production process. In Argentina, where energy and water costs are significant concerns, mills are increasingly deploying process chemicals to reduce downtime, energy consumption, and waste generation.

Advanced process chemicals not only streamline production but also reduce the environmental burden by minimizing effluents and extending machine lifespans. Many South American mills are upgrading to closed-loop water systems and automated control platforms, where these chemicals play an essential role in maintaining system balance. Their rising importance in sustainable manufacturing makes this segment a focal point for innovation and growth.

Packaging remains the dominant application for specialty pulp and paper chemicals across South America. The combination of retail expansion, growing middle-class consumption, and the rise of e-commerce has dramatically increased the demand for paper-based packaging materials. Brazil, in particular, has become a hotspot for packaging innovation, with local converters adopting functional and process chemicals to meet international food safety and performance standards.

The packaging sector is also benefiting from global and regional sustainability mandates. As brands phase out plastics, they are turning to paperboard, molded pulp, and kraft paper. Specialty chemicals are vital in ensuring these substrates meet strength, barrier, and durability requirements. This has led to increased collaboration between chemical suppliers and end-user brands to co-develop customized packaging solutions.

Among the application segments, labeling is growing at the fastest pace. With global supply chains becoming increasingly complex, labeling plays a pivotal role in product identification, regulatory compliance, and brand visibility. Specialty chemicals used in labeling including adhesives, optical brighteners, ink-receptive coatings, and wet-strength agents are seeing heightened demand, particularly in Argentina’s wine, meat, and dairy industries.

Labeling substrates need to withstand refrigeration, moisture exposure, and handling, requiring high-performance chemical formulations. Moreover, as brands invest in tamper-evident, QR-coded, and premium-looking labels, the functional requirements have become more sophisticated. Specialty chemicals that enable such performance are thus finding increased traction across the South American market.

Brazil stands as the epicenter of the specialty pulp and paper chemicals market in South America. With its vast eucalyptus plantations, advanced pulp mills, and growing export demand for packaging-grade paper, Brazil has attracted both regional and international chemical companies. Local mills are increasingly adopting enzyme-based and low-VOC (volatile organic compound) chemicals to comply with global sustainability benchmarks. Innovation hubs in São Paulo and Rio Grande do Sul are driving collaborative R&D between chemical engineers and packaging developers.

In Argentina, the focus has shifted toward efficiency and cost optimization, given the economic pressures and supply chain challenges. Many paper mills in Buenos Aires and Córdoba are investing in chemical automation and customized blends that improve paper strength while reducing energy use. There is also a notable rise in demand for functional chemicals in the labeling segment, especially for export-oriented food and beverage products.

Venezuela, while facing economic instability, still maintains a paper production base that caters to domestic demand. Specialty chemicals are primarily used in packaging paper production, especially for essential consumer goods. With limited access to imports, there’s growing interest in low-cost, multifunctional chemical solutions that can replace multiple traditional additives. As conditions stabilize, the market could see renewed investment in higher-grade chemical formulations.

March 2025 – Solenis Expands Its Brazilian Footprint

Solenis, a global leader in pulp and paper chemicals, announced the opening of a new application lab in São Paulo to accelerate the development of customized solutions for Latin American mills focusing on sustainable packaging and water treatment.

February 2025 – Local Collaboration for Circular Paper Chemistry in Argentina

A partnership between a regional university and a pulp and paper producer in Argentina resulted in the launch of a pilot facility for enzyme-based deinking agents aimed at improving recycled fiber utilization.

December 2024 – Start-Up Launches Bio-based Sizing Agents in Brazil

A green chemistry start-up based in Curitiba launched its first line of plant-based internal sizing agents, aimed at food packaging paper, as part of Brazil’s national push toward biobased industrial inputs.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the South America specialty pulp and paper chemicals market

Product

Application

Country