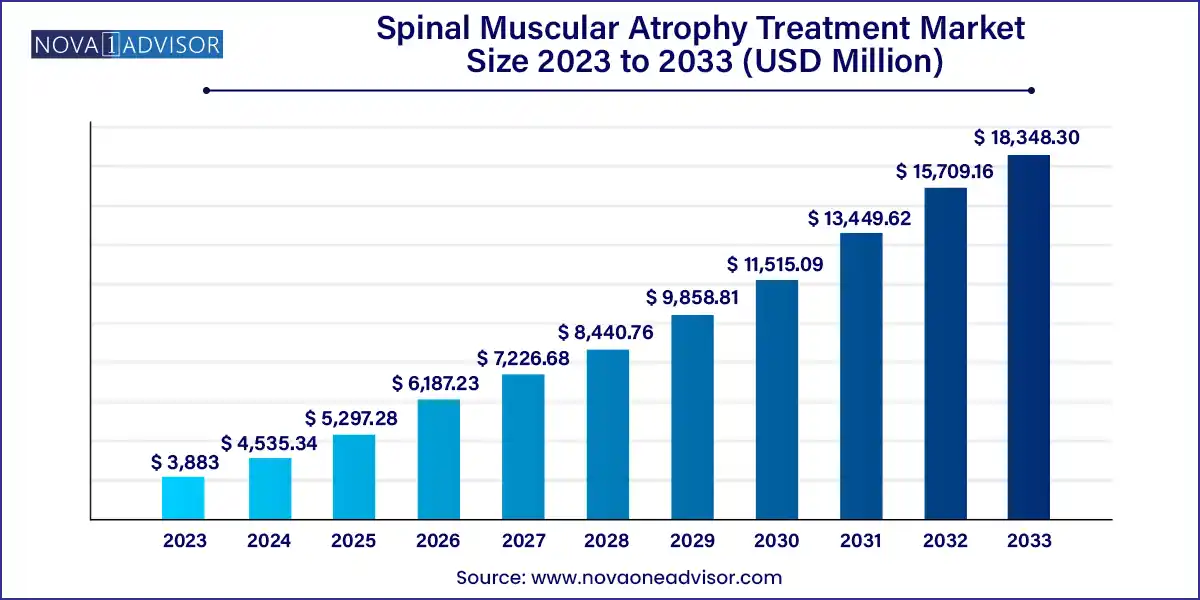

The global spinal muscular atrophy treatment market size was exhibited at USD 3,883.00 million in 2023 and is projected to hit around USD 18,348.30 million by 2033, growing at a CAGR of 16.8% during the forecast period of 2024 to 2033.

Key Takeaways:

Spinal Muscular Atrophy Treatment Market Report Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 4,535.34 Million |

| Market Size by 2033 | USD 18,348.30 Million |

| Growth Rate From 2024 to 2033 | CAGR of 16.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Treatment, Drug, Route Of Administration, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Biogen; Novartis AG; Ionis Pharmaceuticals Inc.; Biohaven Pharmaceuticals; F. Hoffmann-La Roche Ltd; Cytokinetics; Scholar Rock, Inc.; PTC Therapeutics; NMD Pharma A/S |

The market is primarily driven by rising incidence of spinal muscular atrophy (SMA). According to the National Organization for Rare Disorders (NORD), spinal muscular atrophy (SMA) affects almost 1 in 10,000 people globally. Thus, rising prevalence of SMA and the approval for gene therapy for SMA treatment is one of the major factors in generating revenue for the market. A multidisciplinary standard therapy approach is used for the treatment of patients with SMA which includes, symptomatic therapy such as physical, occupational, and respiratory function monitoring and disease-modifying therapies. The U.S. Food and Drug Administration (FDA) approved world’s first disease modifying therapy, Spinraza. It has shown positive promising results with improved survival rates in patients. Thus, approval of new disease-modifying therapies is anticipated to drive market growth.

Moreover, rising awareness regarding novel therapies is a key factor that contributes largely to the market growth. For instance, in May 2023, Cure SMA organized the 2022 Annual SMA Conference in Anaheim to reunite the SMA community including researchers, patients and their caregivers, and clinicians. Under this conference, a wide variety of activities were performed including education workshops, keynote sessions for researchers, and social activities. Such conferences provide opportunities for manufacturers to connect and interact with SMA people and understand their unmet treatment needs.

The development of new products is challenging task for new players due to low success rate in clinical trials. According to the National Library of Medicine, the clinical trial success rate is 10% while developing new SMA drugs. For instance, in December 2020, F. Hoffmann-La Roche Ltd stopped clinical development program for Olesoxim, as the product failed to provide benefits to type 2 & 3 SMA patients. Thus, low success rate in clinical trials create uncertainty among new players to invest in new drug development, thereby, restraining market growth.

Segments Insights:

Type Insights

The type1 segment dominated the market and accounted for the largest revenue share of 63.1% in 2023 owing to the high prevalence rate. It is one of the most common types of SMA affecting approximately 60.0% of total infants born with SMA. The increasing focus of companies on developing novel drugs for the treatment of patients with SMA is projected to fuel market growth. Several therapies have been approved by FDA for the treatment of type-1 patients including Zolgensma (onasemnogene abeparvovec-xioi) in 2019.

In addition, the type-1 segment is expected to show lucrative growth during the forecast period. This growth is attributed to the presence of a strong product pipeline and increasing research activities. For instance, in March 2022, Novartis AG announced the result of the SPRINT study to assess the effect of pre-symptomatic administration of Zolgensma in patients. The company also published post-hoc data from its STR1VE-EU, START and STR1VE-US studies in SMA type 1 patients, which revealed that the patients could swallow, speak and maintain airway function. This result is anticipated to increase the prescription rate for this drug by encouraging physicians to prescribe this drug to type-1 patients, thereby, driving the segment growth.

Treatment Insights

The drug segment dominated the market and accounted for the largest revenue share of 75.9% in 2023 owing to the wide availability of products. Currently, two drugs are approved by the FDA for the treatment of SMA including Spinraza (nusinersen) and Evrysdi (risdiplam). Low cost associated with research and development of drugs and ease of accessibility compared to gene therapy treatment is driving the segment growth.

Gene therapy segment is anticipated to grow at the fastest CAGR of 33.1% during the forecast period owing to its increasing penetration for spinal muscular atrophy treatment. Launch of a novel gene therapy product for managing symptoms associated with SMA augments market growth. For instance, Zolgensma developed by Novartis AG is the only FDA approved gene therapy product used for controlling disease progression.

Drug Insights

The Spinraza segment dominated the market and accounted for the largest revenue share of 50.0% in 2023. Spinraza is a prescription medicine used to treat pediatric and adult patients. It is administrated through intrathecal injection by experienced healthcare professionals. Spinraza is fully reimbursed worldwide by some countries such as Italy, Norway, Netherlands, Romania, Croatia, and Poland. Thus, the presence of supportive reimbursement policies is propelling the segment growth.

The evrysdi drug segment is expected to witness significant growth over the forecast period. This drug is expected to improve the survival rate in patients with SMA ages 2 months of age and older. It was designated an orphan medicine by the FDA in 2019. Currently, a number of public and private insurance companies offer coverage for Evrysdi for the treatment of patients with SMA including Highmark (Medicare), Aetna, Anthem, BCBS Alabama, Cigna, Florida Blue (BCBS FL), HealthPartners, United Healthcare, Colorado, Connecticut, and HCSC. The availability of insurance coverage encourages practitioners to prescribe this drug patients, thereby, increasing the adoption of Evrysdi.

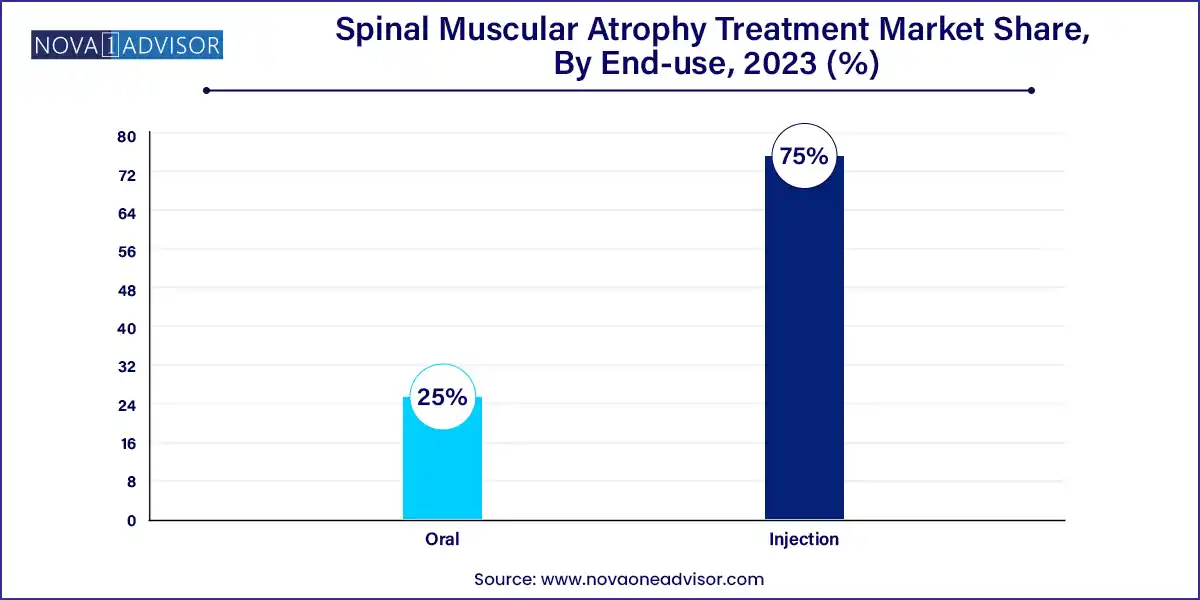

Route Of Administration Insights

The injectable segment dominated the market and accounted for the largest revenue share of 75.0% in 2023. This can be attributed to the owing to high target specificity and efficacy associated with this route of administration. The majority of the approved SMA drugs are administrated intravenously by experienced practitioners. For instance, SPINRAZA is administered intrathecally to patients with recommended dose of 12 mg (5mL) per suspension. Furthermore, Zolgensma is also administered intravenously to the patient dose of 5.5ml.

Oral segment is expected to be the fastest growing segment over the forecast period owing to advantages associated with it such as non-invasiveness, ease of digestion, pain avoidance, versatility, and low side-effects compared to other route of administration methods. Currently, Evrysdi is only the FDA approved orally administrated drug for the treatment of pediatric patients with SMA.

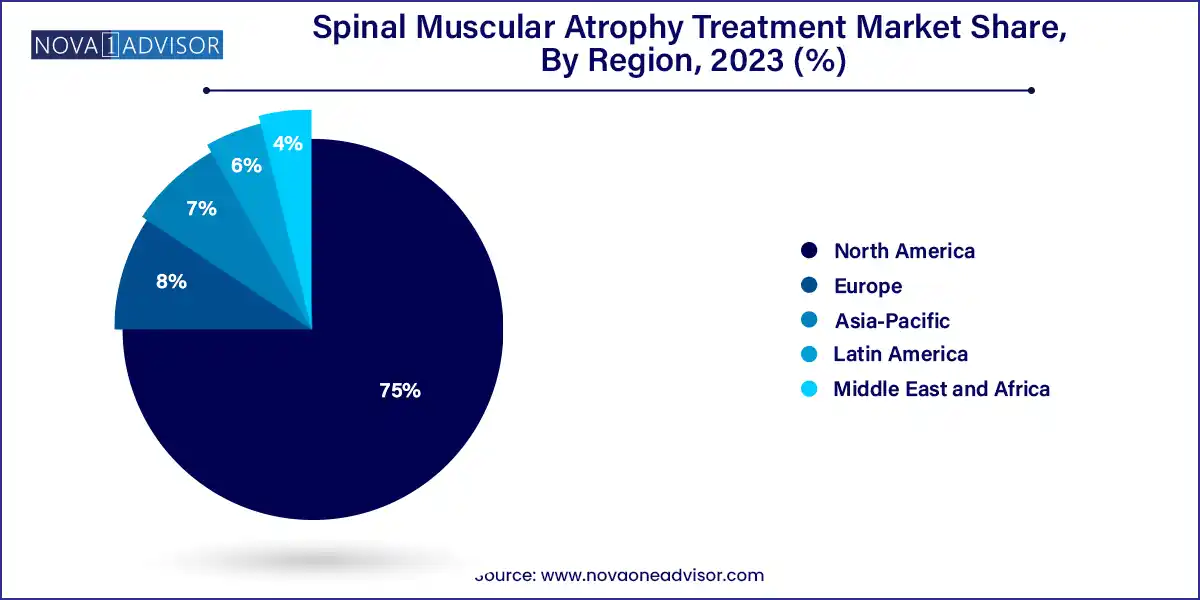

Regional Insights

North America dominated the market and accounted for revenue share of 75.0% in 2023. Mounting prevalence of SMA disorders and increased spending on treatment products are the main factors for the dominance of the region. For instance, around 10,000 to 25,000 children and adults are living with SMA in U.S. In addition, according to SMA Canada, approximately 700 people are living with this condition in Canada as of July 2022 and 30 patients are currently receiving Spinraza.

In Asia Pacific, the market is expected to witness a CAGR of 35.9% during the forecast period. The growth of the region is attributable to the entry of new players in the region. For instance, in March 2020, the Japanese Ministry of Health, Labour and Welfare (MHLW) approved a gene therapy candidate Zolgensma (onasemnogene abeparvovec) developed by Novartis AG for the treatment of the pediatric patients in Japan. This approval is expected to have a positive impact on regions market growth.

Some of the prominent players in the Spinal muscular atrophy treatment market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global spinal muscular atrophy treatment market.

Type

Treatment

Drug

Route of Administration

By Region