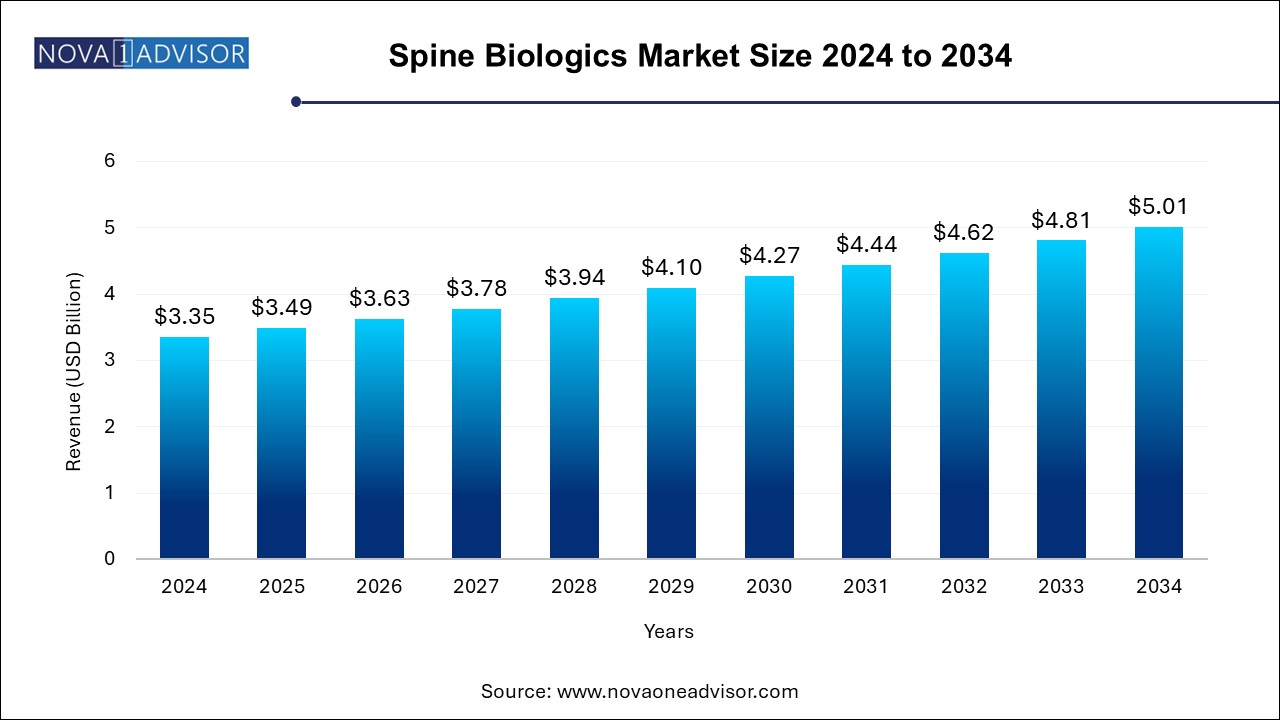

The spine biologics market size was exhibited at USD 3.35 billion in 2024 and is projected to hit around USD 5.01 billion by 2034, growing at a CAGR of 4.11% during the forecast period 2024 to 2034.

The spine biologics market is an integral part of the orthopedic and regenerative medicine industries, focusing on biological substances that facilitate spinal fusion and bone healing. These biologics—ranging from demineralized bone matrices and synthetic grafts to bone morphogenetic proteins (BMPs) and cell-based matrices—play a pivotal role in spinal surgeries, especially those involving degenerative disc disease, deformities, trauma, and spinal tumors. The goal is to stimulate natural bone regeneration, enhance structural stability, and reduce recovery time.

Rising incidences of spinal disorders due to an aging population, sedentary lifestyles, and traumatic injuries are fueling the demand for spine biologics. Surgical interventions such as spinal fusion, which aim to relieve pain and restore mobility, are increasingly relying on advanced biologic products to improve surgical outcomes. Additionally, the growing preference for minimally invasive spinal procedures has amplified the use of biologics that are easy to deliver and integrate within the surgical field.

The development of spine biologics is driven by advancements in biotechnology, molecular biology, and material science. Innovative products are being engineered to mimic the osteoconductive, osteoinductive, and osteogenic properties of natural bone, thus improving spinal fusion rates. Clinical trials continue to explore new applications of stem cell-based therapies and genetically engineered proteins in orthopedic spine care.

Spine biologics are being widely adopted across hospitals, ambulatory surgery centers, and outpatient orthopedic clinics. Reimbursement policy improvements, technological innovation, and rising awareness among both surgeons and patients are enhancing market penetration. However, challenges such as high product costs, regulatory barriers, and variability in efficacy remain areas of concern.

Shift Toward Minimally Invasive Spine Surgeries (MISS): Spine biologics compatible with MISS techniques are in high demand due to faster recovery and reduced complications.

Increased Use of Cell-based Therapies: Stem cell-derived matrices and autologous biologics are gaining traction as regenerative solutions.

Surge in Demand for Synthetic Grafts: With concerns over disease transmission from allografts, synthetic bone grafts are witnessing increased adoption.

R&D in Bone Morphogenetic Proteins (BMPs): New-generation BMPs with controlled release and improved safety profiles are under development.

Customizable Biologics Through 3D Bioprinting: Emerging technologies are being explored to produce patient-specific graft materials with superior osteoconductivity.

Growing Interest in Nanotechnology: Nanomaterials are enhancing surface interactions to stimulate bone cell proliferation and integration.

Emphasis on Outpatient Spine Procedures: Healthcare providers are transitioning to cost-effective outpatient settings for spinal interventions, driving biologics demand.

Strategic M&A Activity: Consolidation among manufacturers and distributors is expanding product portfolios and global reach.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.49 Billion |

| Market Size by 2034 | USD 5.01 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 4.11% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Surgery, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Stryker; NuVasive, Inc.; Orthofix; DePuy Synthes (Johnson & Johnson); Exactech, Inc.; Zimmer Biomet; Arthrex, Inc.; Medtronic; Organogenesis Inc.; Kuros Biosciences. |

Rising Incidence of Degenerative Disc Diseases and Age-related Spine Conditions

The primary driver of the spine biologics market is the rising prevalence of degenerative disc diseases (DDD), spinal stenosis, and other age-associated spinal disorders. With life expectancy increasing globally, the incidence of spine-related issues such as herniated discs, spondylolisthesis, and osteoarthritis is growing significantly. These conditions often lead to chronic pain, disability, and reduced quality of life, necessitating surgical intervention.

Spinal fusion surgeries, in particular, have become a mainstay in treating such conditions. Spine biologics, when used as grafting materials, eliminate the need for autografts, reducing donor site morbidity and surgical time. This is particularly beneficial for older patients who may not tolerate complex surgeries. As the geriatric population continues to rise—especially in countries like the U.S., Germany, Japan, and China—the demand for effective, minimally invasive, and biologically active spinal solutions is surging.

High Cost of Spine Biologics and Limited Reimbursement Policies

Despite their clinical advantages, spine biologics come with significant cost burdens. BMPs and cell-based matrices, in particular, are priced higher than traditional grafts, which can limit their usage in cost-sensitive settings. Furthermore, not all biologics are consistently covered by health insurance or national reimbursement programs, especially in emerging markets.

Hospitals and outpatient facilities often face budgetary constraints when choosing between advanced biologics and standard options. The lack of universal reimbursement coverage leads to disparities in access to high-quality care. Additionally, variability in outcomes and concerns over adverse events—such as ectopic bone formation with BMPs—can deter adoption by conservative surgeons and insurers.

Advancement in Regenerative and Cell-based Therapies

A major opportunity within the spine biologics market lies in the advancement of regenerative medicine and cell-based therapies. As researchers explore the full potential of mesenchymal stem cells (MSCs), induced pluripotent stem cells (iPSCs), and genetically engineered cellular constructs, the market is poised to benefit from novel biologics that offer true regenerative potential rather than mere bone replacement.

Next-generation biologics that combine scaffolding properties with active cellular components are under development, and many are in preclinical or early clinical phases. These innovations promise faster healing, reduced post-operative pain, and fewer complications. Companies that can demonstrate long-term efficacy and safety while ensuring scalable manufacturing will have significant growth potential. Regulatory agencies are also beginning to establish frameworks to accommodate these biologics, creating fertile ground for innovation.

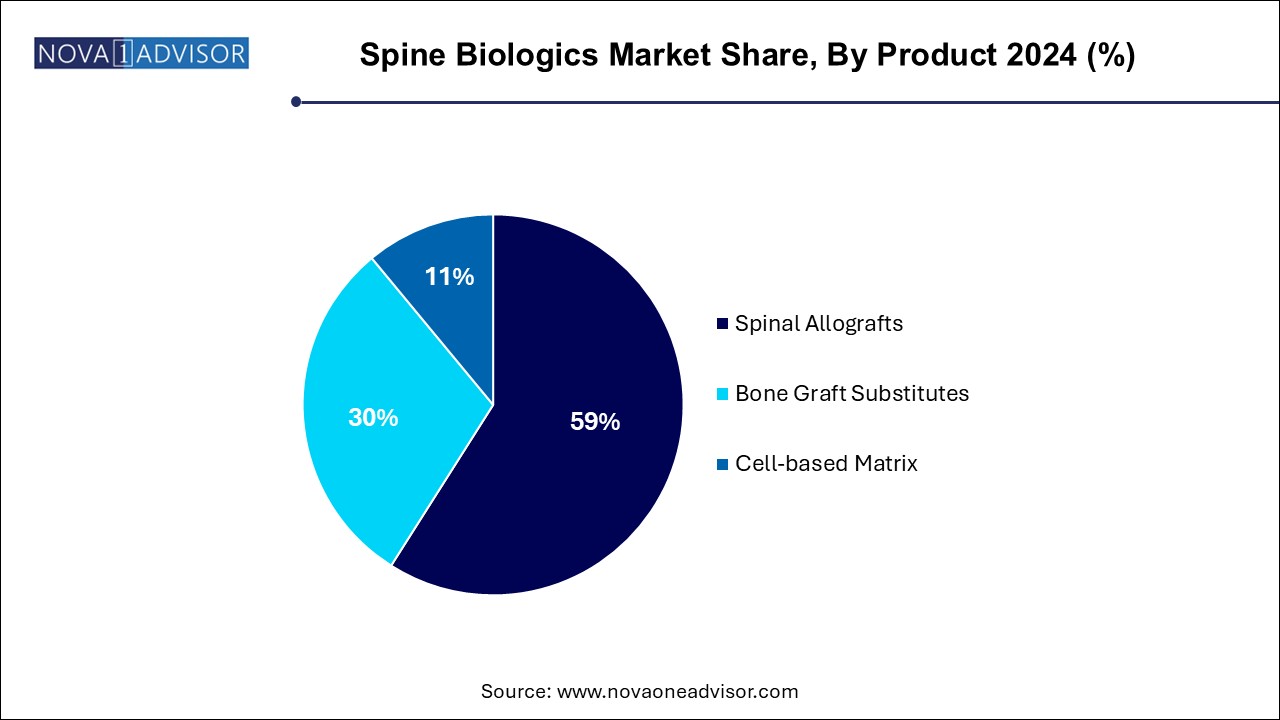

The spinal allografts segment dominated the market, with a revenue share of 59.0% in 2024. primarily due to their established safety profile, osteoconductive properties, and ease of integration into surgical workflows. Within this category, demineralized bone matrices (DBMs) are the most commonly used owing to their versatility and wide availability. DBMs retain native growth factors that promote osteoinduction, making them suitable for a variety of spinal fusion procedures. Machined bone allografts also contribute significantly, especially in reconstructive surgeries requiring structural support.

Cell-based matrices are the fastest-growing product segment, propelled by increasing research in regenerative medicine. These biologics offer osteoinductive and osteogenic potential, differentiating them from passive graft materials. Cell-based matrices containing autologous or donor-derived stem cells are particularly effective in enhancing bone growth in patients with compromised healing abilities. As regulatory clarity improves and clinical data accumulates, this segment is expected to see exponential adoption.

Anterior cervical discectomy and fusion (ACDF) is the most dominant surgical category where spine biologics are utilized. ACDF is a commonly performed procedure for treating cervical spine disorders such as herniated discs and degenerative spondylosis. The use of biologics in ACDF improves fusion rates, reduces the need for hardware revisions, and facilitates faster post-operative recovery. Biologics also reduce complications associated with autograft harvesting, which is critical in delicate cervical spine surgeries.

Lateral lumbar interbody fusion (LLIF) is the fastest-growing surgical category, driven by the adoption of minimally invasive techniques. LLIF offers benefits such as reduced blood loss, quicker recovery, and minimal muscle disruption. The use of biologics in LLIF enhances interbody fusion and stability without the need for anterior or posterior access. As training in LLIF techniques spreads among orthopedic and neurosurgeons, the demand for compatible biologic implants is rising swiftly.

North America remains the largest and most mature spine biologics market, backed by a high volume of spine surgeries, robust reimbursement systems, and a strong presence of leading manufacturers. The U.S. leads global innovation in biologics, with numerous FDA-approved products and a favorable regulatory environment for clinical research. The widespread adoption of minimally invasive spinal techniques and the strong demand for regenerative therapies have made North America a key revenue contributor for global players.

Asia Pacific is the fastest-growing region, owing to rising healthcare investments, a growing elderly population, and increasing incidence of spinal disorders. Countries such as China, India, and South Korea are rapidly adopting modern spine surgery practices, supported by government funding and private sector expansion. As awareness around biologics grows and surgical training improves, Asia Pacific is expected to witness significant growth in the adoption of advanced spinal fusion technologies.

January 2025: Medtronic launched a next-generation cell-based bone graft matrix aimed at improving spinal fusion outcomes in complex lumbar surgeries.

February 2025: Orthofix Medical Inc. announced the FDA clearance of its demineralized bone matrix product with added peptides for enhanced osteoinductivity.

March 2025: NuVasive introduced a minimally invasive bone graft delivery system integrated with synthetic bone grafts tailored for LLIF procedures.

April 2025: SeaSpine Holdings expanded its spinal biologics portfolio with a new cell-based scaffold system for outpatient lumbar fusions.

April 2025: Stryker Corporation finalized a strategic collaboration with a regenerative medicine startup to co-develop bioengineered spinal implants.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the spine biologics market

By Product

By Surgery

By End Use

By Regional