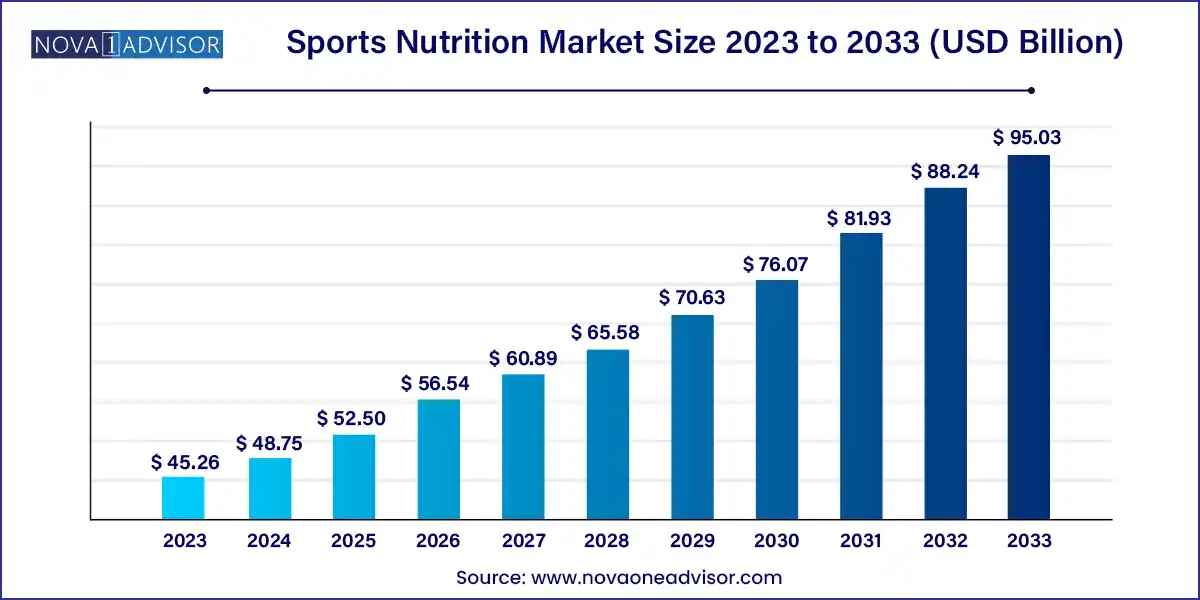

The global sports nutrition market size was exhibited at USD 45.26 billion in 2023 and is projected to hit around USD 95.03 billion by 2033, growing at a CAGR of 7.7% during the forecast period of 2024 to 2033.

Key Takeaways:

Sports Nutrition Market Report Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 48.75 Billion |

| Market Size by 2033 | USD 95.03 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product Type, Formulation, Consumer Group, Sales Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Iovate Health Sciences; Abbott; Quest Nutrition; PepsiCo; Cliff Bar; The Coca-Cola Company; MusclePharm; The Bountiful Company; Post Holdings; BA Sports Nutrition; Cardiff Sports Nutrition; Jacked Factory; Orgain |

Nutrition and diet are essential for maximum performance. Increasing adoption of sedentary lifestyle and growing consumption of unhealthy diets have increased the risk of various diseases, including diabetes, cardiovascular diseases, obesity, and cancer. A large amount of literature data indicates that 30% of cancer cases are related to poor dietary habits. According to the International Diabetes Federation, in 2022, approximately 8.75 million people were living with diabetes across the globe, of which 1.52 million were under the age of 12. With increasing awareness regarding benefits of healthy lifestyles, the demand for sports supplements is likely to grow.

A rising preference for a healthy and active lifestyle is a significant factor propelling the market. Moreover, the increasing inclination of younger consumers towards fitness as a central aspect of their lives and the growing acceptance of protein supplements among consumers are expected to drive market growth. The surging consumer demand for nutritional products containing plant-based ingredients and immunity-boosting advantages is also contributing to this growth. In addition, the expanding use of social media platforms, such as YouTube and Instagram, by manufacturers to promote their products is projected to boost the demand for sports nutrition products. According to a survey conducted by the United Nations Conference on Trade and Development and the Netcomm Suisse eCommerce Association, there has been a 9.0% increase in online purchases of pharmaceutical and health products. This trend, in turn, is propelling the market growth.

The rise in obesity rates has led to an increased incidence of chronic diseases worldwide. Factors such as the adoption of sedentary lifestyles and the consumption of unhealthy diets are major contributors to the escalating obesity rates. Currently, approximately 39.0% of the global adult population is affected by obesity, a figure that has nearly tripled between 1975 and 2016. Projections indicate that approximately 1 billion people worldwide will be living with obesity by 2030. Furthermore, it is estimated that 38.2 million children under the age of 5 were either overweight or obese globally in 2019. This rapid surge in obesity prevalence has heightened concerns and spurred greater awareness regarding healthy lifestyles and nutritious dietary choices, which, in turn, are propelling the market for sports nutrition.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The sports nutrition market is characterized by high degree of growth owing to the growing risk of various diseases such as heart diseases, obesity, cancer, hypertension, and diabetes, which is mainly caused due to the rising adoption of sedentary lifestyle. For instance, according to the statistics published by WHO in October 2023, one in every four adults and nearly 80% of adolescents globally has been identified with less than minimal physical activities. Thus, this is anticipated to boost the demand for sports nutrition among individuals over the forecast period.

Key strategies implemented by players in sports nutrition market are new product launches, expansion, acquisitions, partnerships, and other strategies. NutraIngredients, in September 2023, announced the launch of microbiome booster into the sector of sports nutrition, which is projected to provide athletes with prebiotic-based solutions. The company is offering microbiome boosters in powder formulation comprising of collagen, prebiotics, and postbiotics which can be added to any drink or food.

Lack of standard regulations & guidelines regarding the labeling and ingredients is anticipated to limit the growth of the sprots nutrition market. Regulations varied by country with some strict guidelines on ingredients, labeling, and health claims. As a result, the pace of innovation might slow down as some of the ingredients are excluded, thereby limiting the nutrition supplements. Despite these challenges, stringent policies also assure higher data quality and robust results, fostering market confidence in the eventual products developed through several clinical testing. In June 2022, the U.S. launched a new education initiative, Supplement Your Knowledge. This would help in expanding the knowledge and understanding of consumers, educators of high school students, and healthcare professionals about dietary supplements.

Natural alternatives such as whole foods like vegetables, fruits, & cereals and dairy products are external substitutes for sports supplements, hence posing a threat. Moreover, personalized nutrition plans created by nutritionists can also act as substitutes, tailoring dietary recommendations based on an individual’s specific goals. Many companies are introducing personalized nutrition plans to assist individual’s specificity. For instance, in October 2023, Ahara announces the launch of free version of AI driven personalized nutrition plan as per the individual preferences.

The sports nutrition market is experiencing rapid growth, fueled by a surge in health-conscious consumers and a growing awareness of the importance of nutrition in athletic performance. Energy gels, a popular supplement among endurance athletes, have witnessed a significant uptick in demand due to their convenient and efficient delivery of quick energy during intense physical activities. Creatine, known for enhancing strength and muscle mass, has become a staple for athletes engaged in resistance training. Additionally, sports vitamins play a crucial role in supporting overall health and performance optimization. As the market continues to expand, driven by innovation and a focus on personalized nutrition, these key products are at the forefront, meeting the diverse needs of a burgeoning community of fitness enthusiasts.

Segments Insights:

Product Type Insights

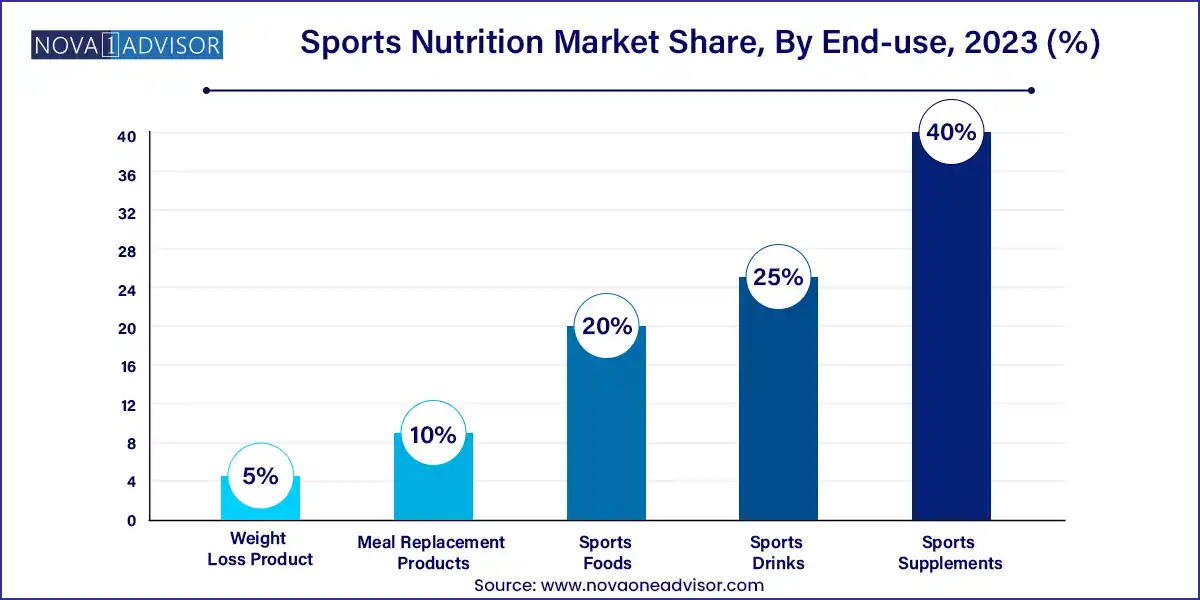

The sports supplements segment accounted for the largest revenue share of 40.0% in 2023, owing to growing awareness about health and fitness and the major commercial availability of sports supplements in the market. An increase in the number of gyms and fitness centers is also one of the significant factors contributing to the segment growth. In addition, the increasing number of new product launches and ongoing research on novel ingredients are likely to boost industry growth in the coming years. For instance, in July 2021, Science in Sports launched a new product range called Beta Fuel-a mix of 1-part fructose and 2 parts maltodextrins-for athletes.

The sports food segment is expected to grow at the fastest CAGR over the forecast period. Growing consumer awareness about health and fitness and the rising number of health and fitness centers in the country are some of the factors expected to drive the market in North America. The increasing number of new product launches in this category is expected to boost the demand for these products in the upcoming years. For instance, in 2018, Bodybuilding.com launched its own private labeled line of protein crunch bars available in two flavors, including chocolate peanut butter and cookies and cream.

Formulation Insights

Based on formulation, the powder segment held the largest market share in 2023. This leading position is due to the increasing number of sporting events and the proliferation of health and fitness centers in the region, which are contributing to market growth. Furthermore, powdered supplements are favored for their ease of consumption, more stable ingredients, and extended shelf-life. In addition, adults focusing on muscle building and physique improvement are significant consumers of protein powders. Innovations within this segment include the development of powders that create thick shakes, which help athletes maintain energy.

The capsule segment is expected to grow at the fastest CAGR owing to ongoing innovation and the launch of products with enhanced bioavailability and outcomes. Also, growing adoption among adolescents is impelling the segment's growth.

Consumer Group Insights

Based on consumer group, the adult segment dominated the market with largest market share in 2023. This can be primarily attributed to the substantial number of consumers within the age group of 18 to 64 years. Furthermore, individuals in this age bracket actively engage in fitness and sports activities, thereby stimulating the growth of this segment. Moreover, the rising population of working women is also a driving factor for the demand for women's sports nutrition within this age group.

The adult segment is expected to emerge as the fastest-growing segment due to the growing spending on health products and supplements and rising awareness regarding well-being. The increasing availability of and demand for sugar-free, vegan, and convenient supplement formats and the growing trend of holistic well-being are driving the segment.

Sales Channel Insights

Based on sales channel, the brick-and-mortar segment dominated the market with largest market share in 2023. The presence of a large number of specialty stores and fitness institutes is a major contributor to the segment's growth. Moreover, retail stores are involved in increasing overall customer engagement and enhancing their experience at stores. For instance, GNC has more than 4,800 retail stores, while The Vitamin Shoppe has around 785 stores across the U.S. Consumer trust is another major factor that contributes to the growth of this channel. Consumers tend to rely more on this channel as compared to online platforms as the latter holds a threat of purchasing substitute or counterfeit products.

The e-commerce channel segment is expected to be the fastest-growing segment over the forecast period. Online players offer lucrative discounts on sports supplements, which is driving the demand for products through online channels. In addition, an increase in strategies adopted by online players to compete with their retail counterparts may boost the growth of online channels in the upcoming years. For instance, in 2018, Amazon launched its privately labeled brand-OWN PWR-which consisted of 11 products, including 3 elite pre-workout formulations and 8 general sports nutrition products.

Regional Insights

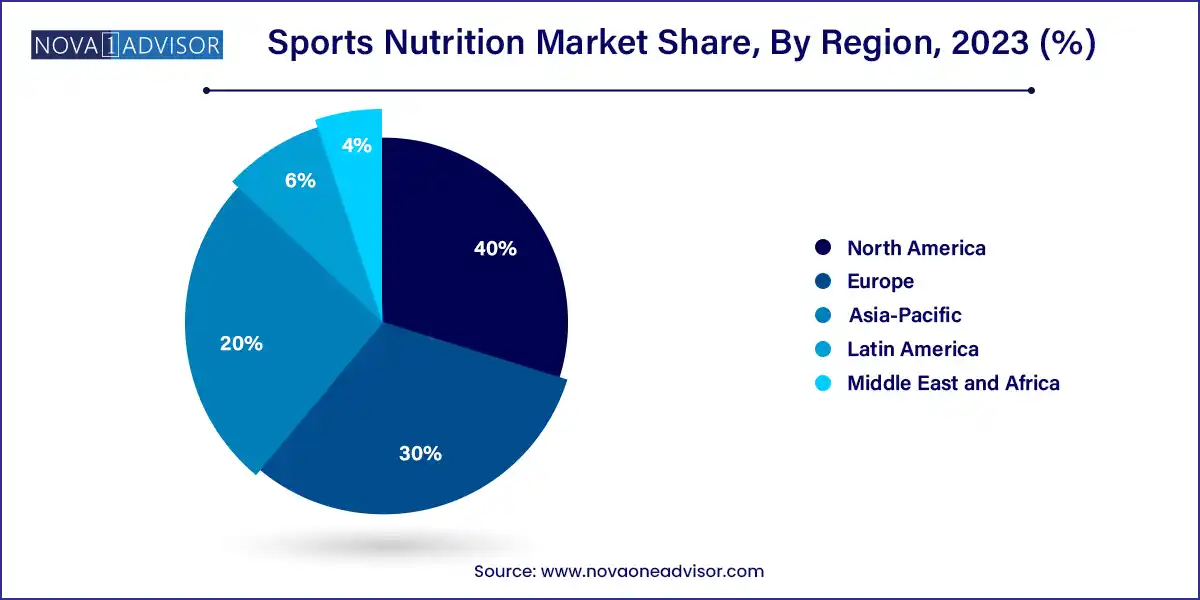

Asia Pacific accounted for the largest revenue share of 40.0% in 2023. India, China, and Australia are notable markets in the Asia Pacific region. The growing awareness regarding health and well-being plays a significant role in driving the increased demand for sports nutrition in this region. In addition, the rising number of new product launches in the sports supplements category, which reflects the high demand for these products in the coming years, and the local presence of key industry players are crucial factors expected to bolster growth. Moreover, an increase in government initiatives that promote sports-related activities serves as another significant driver for the adoption of these products in the Asia Pacific region.

India Sports Nutrition Market

Indian market has noticed a significant growth in the market. This is attributed to the rising consciousness of fitness among young people and the growing popularity of sports as a respectable career. In October 2023, Steadfast Nutrition, a sports and wellness nutrition focused company announced the launch of their campaign ‘Make India Protein Efficient,’ to acknowledge solutions to focus on the nation’s challenge of protein deficit. Furthermore, the campaign is anticipated to create awareness among individuals regarding the importance of proteins. Looking at the opportunities, many companies have launched several products to the Indian market. For instance, in April 2023, PROWL has introduced BUILD to expand the product portfolio to reach wider audience. Similarly, in March 2023, Prorganiq, an Indian-based health supplement company, launched whey protein supplements which is anticipated to improve the levels of proteins, carbohydrates, and healthy fats in gym people as well as athletes.

Recent Developments

Some of the prominent players in the Sports nutrition market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global sports nutrition market.

Product Type

Formulation

Sales Channel

Consumer Group

By Region