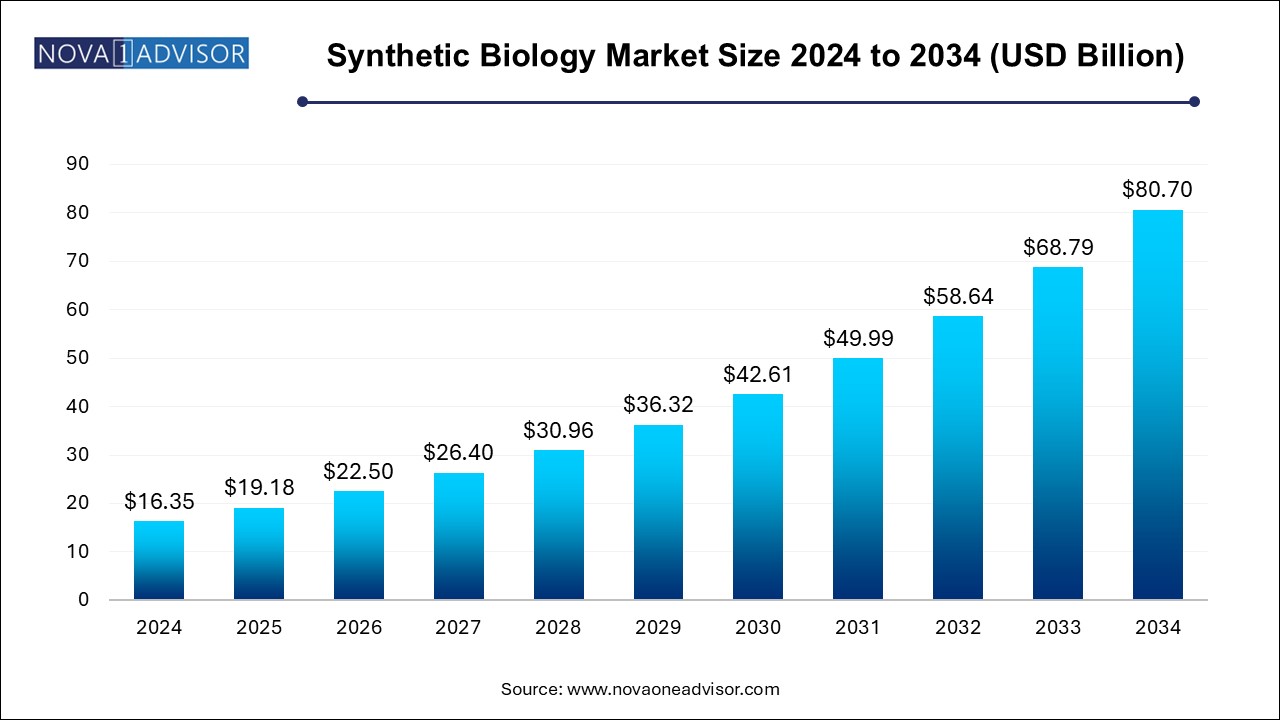

The synthetic biology market size was exhibited at USD 16.35 billion in 2024 and is projected to hit around USD 80.70 billion by 2034, growing at a CAGR of 17.31% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 19.18 Billion |

| Market Size by 2034 | USD 80.70 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 17.31% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Technology, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Bota Biosciences Inc., Codexis, Inc., Creative Biogene, CREATIVE ENZYMES, Enbiotix, Inc., Illumina, Inc., Merck KGaA (Sigma-Aldrich Co. LLC), New England Biolabs, Eurofins Scientific, Novozymes, Pareto Bio, Inc., Scarab Genomics, LLC, Synthego, Synthetic Genomics Inc., Thermo Fisher Scientific, Inc. |

Emerging applications of synthetic biology in areas such as multiplexed diagnostics, cellular recording, and therapeutic genome editing are projected to lead to a substantial rise in demand for synthetic products over the forecast period. Furthermore, the integration of synthetic biology-based products and techniques into sectors such as energy and chemicals are likely to boost the overall market growth. As these applications diversify further, the utility of synthetic biology is expected to increase, promoting further adoption and market growth.

The COVID-19 pandemic has significantly increased the use of synthetic biology products over the past two years. Numerous leading pharmaceutical and biotechnology companies, along with key players in the synthetic biology field, have ramped up their research efforts worldwide, employing innovative techniques to produce test kits, therapies, and vaccines for COVID-19. According to a study by the European Parliament, synthetic biology is recognized as a developing technology with potential applications in combating COVID-19 infections. In addition, the U.S. National Institutes of Health has emphasized synthetic biology as a tool to expedite vaccine development.

As a result of these intensified research and development activities across various sectors, the global market is poised for substantial growth. Companies are increasingly adopting synthetic biology methods to enhance conventional biofuel production, improving performance and maximizing the use of low-cost inputs such as waste materials. For example, fashion brands like Bolt Threads, Modern Meadow, and VitroLabs are leveraging biotechnology to create sustainable materials, illustrating the versatility and impact of synthetic biology in diverse industries.

The market witnessed an increase in the adoption of synthetic biology for research and development purposes. For instance, in January 2024, Rice University launched the Rice Synthetic Biology Institute to foster collaborative research in synthetic biology and translate it into beneficial technologies for society.

Moreover, advancements in genome editing, the establishment of bio-foundries, and the availability of natural resources and large markets are recognized as key global strengths for fostering a bio-based economy in synthetic biology. However, potential challenges to the long-term development of this field, such as inadequate infrastructure and policy frameworks, must be addressed. Strategies to overcome these obstacles include fostering public-private partnerships, enhancing multilateral cooperation, and implementing a robust governance framework.

The market players are introducing innovative technologies to meet rising demand and explore untapped opportunities. For example, in November 2021, Creative Biogene launched a range of shRNA products designed to accelerate RNA interference (RNAi) research. With extensive expertise in the field, the company aims to provide high-quality RNAi products, including shRNA clones and siRNA libraries, to offer effective, convenient, and reliable tools that expedite RNAi research initiatives.

The enzymes segment dominated the market in 2024 with a share of 36.79%.Enzymes play an essential role in various biotechnological processes, including DNA manipulation, protein engineering, and metabolic pathway construction. Enzymes are crucial for applications in pharmaceuticals, agriculture, and biofuels, driving demand for efficient and specific biocatalysts. Their versatility allows for innovations in gene editing and synthetic pathways, making them indispensable in research and industrial applications. In addition, advancements in enzyme engineering and production technologies have enhanced performance and reduced costs, further solidifying their market position. As synthetic biology continues to expand, the reliance on enzymes for diverse applications is expected to grow.

The cloning technologies kits segment is expected to experience the fastest CAGR of 18.43% over the forecast period. These kits streamline the processes of gene insertion, amplification, and modification, making them accessible to both research and commercial applications. The rise of personalized medicine and synthetic biology-driven innovations fuels the need for efficient cloning solutions. Moreover, the growing interest in synthetic organisms and bioengineering projects accelerates adoption. As researchers and companies seek faster, more reliable methods for gene cloning, this segment is poised for significant growth in the coming years.

The PCR segment accounted for the largest market share of 30.07% in 2024, and this trend is expected to persist in the coming years. Polymerase Chain Reaction (PCR) has become a pivotal technology for the detection and analysis of specific gene sequences. Products such as Real-time PCR assays offer high sensitivity and specificity, making them the preferred choice for numerous genomic studies. This technique finds extensive applications in areas such as DNA cloning, forensic research, and genomics.

The genome editing technology is projected to experience substantial growth at a significant CAGR from 2024 to 2034. The expansion of gene-editing tools can be attributed to various advantages offered by synthetic and genetically modified organisms. The capability of gene editing techniques to create products with specific traits has transformed multiple sectors, including human and animal healthcare as well as agriculture. As these technologies continue to evolve, their impact on research and development is expected to grow even further.

The healthcare segment dominated the market in 2024 due to its critical role in developing innovative therapies and diagnostics. Advances in areas such as gene editing, personalized medicine, and biopharmaceuticals have significantly enhanced treatment options for chronic and rare diseases. The growing demand for targeted therapies and efficient drug development processes has driven investment and research in this field. In addition, synthetic biology enables the creation of customized biologics and improved vaccines, particularly highlighted during the COVID-19 pandemic. This focus on healthcare innovation, coupled with supportive regulatory environments, has solidified the healthcare segment's leadership in the synthetic biology industry.

The non-healthcare segment is projected to grow at a significant CAGR from 2024 to 2034 due to increasing applications in industries like agriculture, energy, and materials. Innovations in synthetic biology enable the development of biofuels, sustainable bioplastics, and crop enhancement solutions, driving demand for eco-friendly alternatives. As companies seek to reduce environmental impact and improve efficiency, investments in synthetic biology techniques are expected to rise. This trend reflects a broader commitment to sustainability and resource optimization across various sectors.

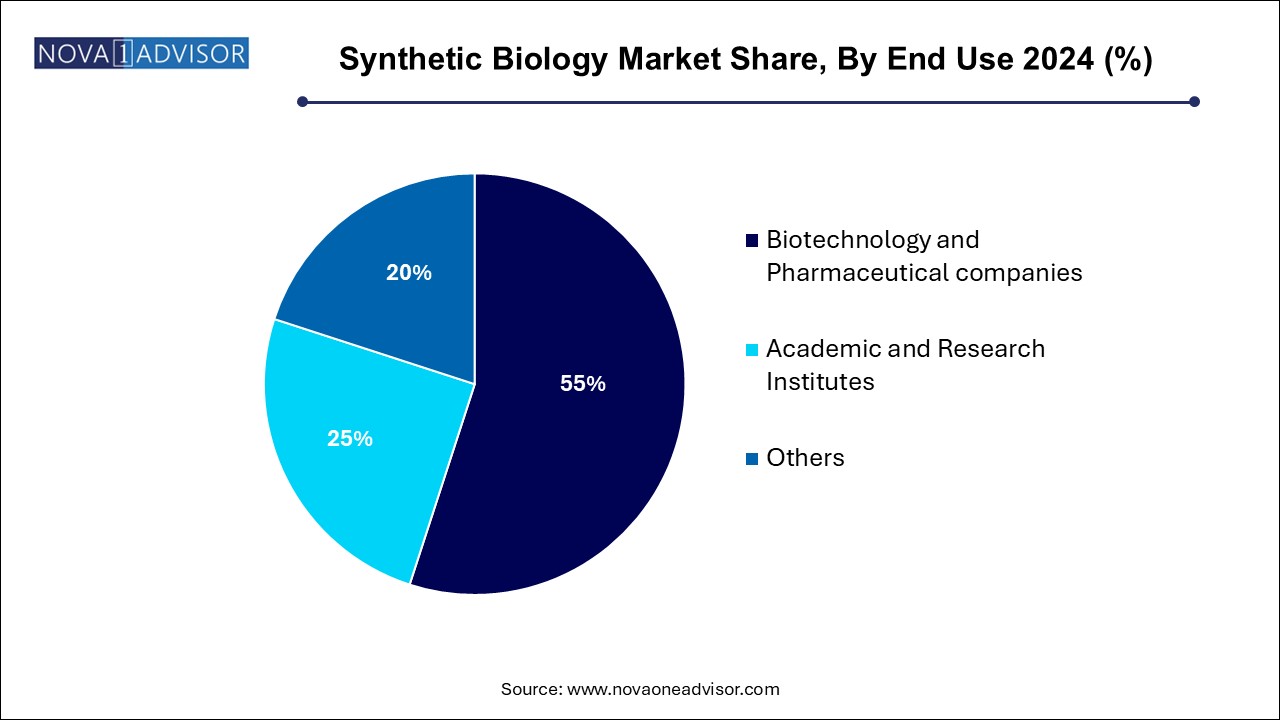

The biotechnology and pharmaceutical companies segment captured the largest revenue share of 55.0% in 2024 due to their pivotal role in advancing medical innovations and therapeutic solutions. These companies leverage synthetic biology to develop cutting-edge treatments, including gene therapies, monoclonal antibodies, and personalized medicine, addressing complex health challenges. Significant investments in research and development have accelerated the creation of novel biologics and improved drug delivery systems. In addition, the increasing demand for efficient vaccine production, particularly evident during the COVID-19 pandemic, has further solidified this segment's leadership. As these companies continue to innovate, their influence on the market is expected to grow.

The academic and research institutes segment is anticipated to grow at a significant CAGR from 2024 to 2034 due to their essential role in driving innovation and discovery. These institutions are at the forefront of research, exploring new applications in gene editing, synthetic genomes, and metabolic engineering. Increased funding and collaboration with industry partners enhance their capabilities, leading to groundbreaking advancements. As the demand for novel biotechnological solutions rises, academic and research institutes will play a crucial role in shaping the future of synthetic biology.

North America synthetic biology market held the largest market share of 41.98% in 2024, driven by strong investment from both public and private sectors, including significant funding from venture capital and government initiatives. The region's robust research infrastructure, with leading universities and research institutions, accelerates technological advancements. In addition, a growing demand for sustainable solutions in agriculture, healthcare, and energy encourages the development of synthetic biology applications.

U.S. Synthetic Biology Market Trends

The U.S. synthetic biology market is expected to expand in the near future due to the presence of key market players in this country. Furthermore, the presence of leading universities and research institutions fosters innovation and collaboration. A robust regulatory environment encourages biotechnological advancements while addressing safety and ethical concerns. The growing interest in personalized medicine and bio-based products reflects changing consumer preferences, which can contribute to the market growth in the U.S.

Europe Synthetic Biology Market Trends

The Europe synthetic biology market is experiencing significant growth. Strong public funding and investment from the European Union promote research and innovation. A focus on sustainability and environmental regulations encourages the development of eco-friendly solutions across industries, particularly in agriculture and energy. Europe's well-established academic institutions facilitate collaboration and knowledge sharing. The region's diverse regulatory landscape fosters innovation while ensuring safety, and strategic partnerships among academia, industry, and startups create a vibrant ecosystem for market growth.

The UK synthetic biology market held a significant share in 2024. Strong government support, including funding initiatives like the Biotechnology and Biological Sciences Research Council (BBSRC), is fueling the market. Furthermore, growing scientific awareness and interest in bio-based products in the country is expected to boost the market over the forecast period.

France synthetic biology market is expected to grow remarkably over the forecast period. The French government encourages research and innovation in life sciences through funding initiatives, tax breaks, and infrastructure improvements. This backing boosts investments in areas like biotechnology, genomics, and personalized medicine, leading to a heightened interest in synthetic biology within these sectors.

The synthetic biology market in Germany is anticipated to grow significantly over the forecast period. The nation has significant investments in biotechnology and a solid research infrastructure. Its emphasis on creating innovative therapies, combined with ample public and private funding, is fuelling the demand for synthetic biology products across various biomedical applications.

Asia Pacific Synthetic Biology Market Trends

The Asia Pacific synthetic biology market is projected to grow at the fastest CAGR of 18.91% over the forecast period. Countries in the Asia Pacific region, including India, China, South Korea, and Japan, are witnessing significant industrialization and economic growth, driving demand across various sectors, particularly in pharmaceuticals and biotechnology, both of which increasingly utilize synthetic biology. Major investments from governments and private companies in healthcare infrastructure, pharmaceutical research, and life sciences are boosting the need for synthetic biology solutions.

The synthetic biology market in China is expected to grow over the forecast period. The Chinese government is actively fostering the expansion of its domestic pharmaceutical industry, which includes significant developments in synthetic biology. These initiatives are leading to increased funding for research and development, positively impacting the market as a whole. Furthermore, China's aging population is driving a higher demand for treatments for chronic diseases, creating a greater reliance on innovative solutions. This rising need for effective therapies is expected to significantly enhance the growth of the market as companies focus on developing advanced approaches to meet these healthcare challenges.

Japan synthetic biology market is witnessing significant growth over the forecast period. The market in Japan is experiencing rapid growth, fueled by a rising demand for gene therapies and innovative treatments. Major companies are investing in cutting-edge technologies and facilities to improve production efficiency and scalability. These advancements are establishing Japan as a key center for synthetic biology innovation and the development of biopharmaceuticals.

MEA Synthetic Biology Market Trends

The MEA synthetic biology market is projected to grow significantly over the forecast period. This expansion is driven by advancements in gene therapy and an increasing emphasis on addressing rare diseases. Enhanced funding from both public and private sectors, along with collaborative research initiatives, is creating a robust ecosystem for innovation. As regulatory frameworks continue to evolve, the region is expected to see a rise in companies offering cutting-edge biomanufacturing solutions.

Saudi Arabia synthetic biology market is set to expand in line with Vision 2030, which prioritizes biotechnology as a key sector. Significant investments in research facilities and partnerships with international companies are strengthening local capabilities. In addition, the country's strategic location provides access to emerging markets in the region, further enhancing its manufacturing potential.

The synthetic biology market in Kuwait is also anticipated to grow, driven by increased investments in biotechnology and gene therapy research. Government initiatives aimed at promoting advanced medical technologies, along with collaborations with international research institutions, are bolstering local capabilities and positioning Kuwait as an emerging player in the regional synthetic biology landscape.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the synthetic biology market

By Product

By Technology

By Application

By End Use

By Regional