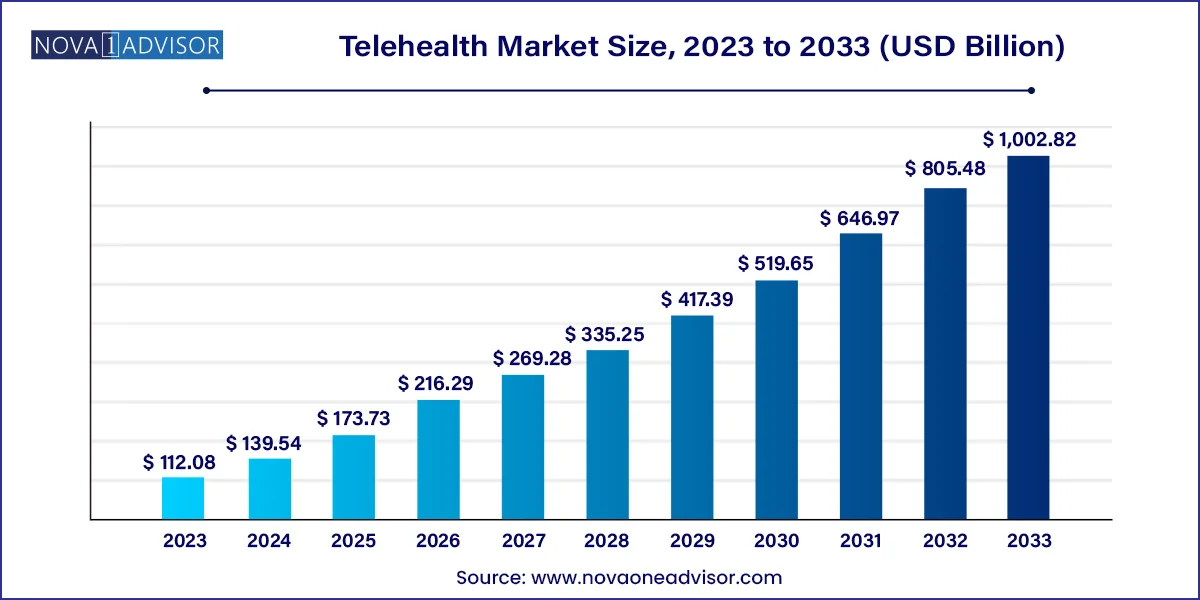

The global telehealth market size was valued at USD 112.08 billion in 2023 and is anticipated to reach around USD 1,002.82 billion by 2033, growing at a CAGR of 24.5% from 2024 to 2033.

Rising penetration of internet and evolution & development of smartphones are factors that have contributed to the market’s growth. COVID-19 pandemic and associated lockdowns & social distancing norms are major factors driving the market growth. As governments globally announced social distancing norms to prevent spread of disease, number of visitors & active members on telehealth platforms rapidly increased between 2019 & 2020.

Advancement of smartphone technology for enhancing disease diagnostics is a key driver for market expansion. According to the GSM Association report, The Mobile Economy 2022, the global number of individuals connected to mobile services was 5.3 billion in 2021, and this figure is projected to reach 5.7 billion by 2025, constituting 70% of the global population as unique mobile subscribers. There is also a notable increase in smartphone penetration, reaching 75% in 2021 and expected to reach 84% by 2025, as highlighted in The Mobile Economy 2022. This growing prevalence of smartphones among consumers is fueling the growth of various mHealth applications in the market. In addition, the continuous enhancement of network infrastructure and expanding network coverage contribute to the rising demand for telehealth services.

Furthermore, the number of health apps has increased significantly in recent years. As per data published by MobiusMD, as of 2021, there were 350,000 health, medical, and fitness apps in the market. Health apps facilitate effective communication between patients living in remote locations and healthcare professionals. Moreover, the usage of mobile devices is rising among physicians. As per a report by BMC Health, around 82% of people use mobile phones for patient engagement. Thus, rising importance of mobile phones and mHealth for improving health outcomes & patient care is driving the market growth.

Furthermore, insurance firms and healthcare payers are engaging in partnerships with key market players to offer complimentary consultation services to patients. For instance, the collaboration between AIG and Cigna with Doctor Anywhere in Singapore. This collaboration aims to provide free consultation services to patients in Thailand, Singapore, and Vietnam. In addition, the increasing prevalence of public-private partnerships, advancements in digital infrastructure, government initiatives, and continuous progress in digital health technologies are expected to drive the demand for virtual care applications and services. Several major players such as Siemens Healthineers, Doctor Anywhere, and GlobalMed have reported significant increases in revenue and active users during the pandemic.

| Report Attribute | Details |

| Market Size in 2024 | USD 139.54 Billion |

| Market Size by 2033 | USD 1,002.82 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 24.5% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product type, delivery mode, end-use, disease area, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Koninklijke Philips N.V.; GE Healthcare; Cerner Corporation (Oracle); Siemens Healthineers; Medtronic; Teladoc Health Inc.; American Well; MDLive; Doctor On Demand; Global Med |

Furthermore, integrating artificial intelligence and machine learning algorithms enhances personalization of healthcare services. For instance, Halodoc’s telehealth platform integrated with AI enables physicians to receive patient feedback on consultations and access training programs for performance improvement. In addition, governmental initiatives aimed at promoting telehealth adoption are driving the market growth. For instance, initiatives such as the National Digital Health Mission (NDHM) are expected to increase preference and adoption of the e-healthcare model in India. Similarly, the “Innovation Strategy 2019-2021” implemented in UAE drives digital transformation in the healthcare sector. Federal communications in the U.S. established several programs in March 2020 to help healthcare organizations deploy telemedicine technology.

Global adoption of telehealth services is propelled by increasing funding and government initiatives. For instance, in August 2021, U.S. Administration announced an investment of approximately 19 million to improve healthcare delivery and address gaps in care faced in rural areas with poor access to critical services. Moreover, key players have been focusing on strategies, collaborations, mergers & acquisitions to gain a competitive edge and expand their product portfolio and business footprint. For instance, in June 2022, Oracle acquired a 69.2% stake in Cerner Corporation. Post this acquisition, both companies will develop advanced healthcare analytics solutions and expand their product portfolio & business footprint. This acquisition will enhance patient outcomes, promote patient involvement, and save healthcare costs by leveraging cloud capabilities by making information more secure.

Moreover, increasing prevalence of cancer globally is expected to be a key contributor to growth of market. This growing prevalence is expected to put pressure on healthcare systems, many of which are experiencing a shortage of healthcare professionals, including doctors and nurses. This is projected to stimulate the global adoption of these services. WHO predicts that healthcare facilities will face a 15 million healthcare professionals’ shortage by 2030. This scarcity of healthcare professionals is anticipated to fuel adoption of AI for patient treatment and diagnosis. Telehealth helps to deliver healthcare services digitally and virtually to patients at remote locations.

This technology enables the delivery of patient-centric care to individuals remotely, reducing the need for emergency department visits and lowering the hospitalization rate.

Services segment held the largest revenue share of 48.8% in 2023. The segment is anticipated to grow at a lucrative rate owing to prevailing trend of outsourcing these services. As healthcare facilities lack resources and skill sets required for deployment of digital health solutions, these services are outsourced. Growing need of telehealth application in chronic disease management, real-time monitoring, rapid advancements in digital infrastructure, growing internet & smartphone penetration, development in hardware & software components is driving segment growth. As a result, constantly evolving digital space is expected to support growing need for these services.

Software segment is anticipated to witness the fastest CAGR of 24.8% over the forecast period. High demand for reducing rapidly rising medical costs, growing need for accurate & timely information procurement, and rising patient care costs are among key factors responsible for segment growth. In addition, owing to government reforms and a rise in demand for technologically advanced Healthcare IT solutions, this segment is expected to launch various new products and improved versions of existing software. For instance, in June 2022, GoMeyra launched a telehealth platform, GoVirtual Clinic, a unified cloud-based solution providing a single interface for physicians, nurses, and laboratories to conduct medical tests and engage in secure remote consultations with patients.

Based on delivery mode, web-based delivery mode held the largest share in 2023, owing to rise of virtual care & web-based applications and an increasing adoption of web-based delivery methods that provide patients with direct access to healthcare services. Web-based solutions are delivered to users through web servers using internet protocol. Web-based solutions comprise four aspects, including internet connection, data administrator, web server, and software coding system. Utilizing internet and web-based services provides access to most remote areas using only one computer or monitoring device.

Cloud-based delivery segment is anticipated to witness the fastest CAGR over the forecast period owing to rising adoption of cloud-based applications by both healthcare providers and patients, along with introduction of technologically advanced solutions. Moreover, seamless data storage & recovery, high bandwidth, enhanced security, easy accessibility provided by cloud-based applications are further contributing to the growth of the segment. Cloud-based solutions enable patient monitoring and teleconsultation for individuals, which require immediate medical assistance in rural and remote locations.

In 2023, radiology segment emerged as the largest segment, owing to rising prevalence of target diseases, such as cancer, cardiovascular diseases, chronic obstructive pulmonary disease (COPD), etc., growing shortage of radiologists, and increasing demand for remote medical imaging is boosting adoption of telehealth services for radiology. COVID-19 has also emphasized importance of teleradiology. Furthermore, integration of AI into teleradiology, implementation of Picture Archiving and Communication System (PACS), and growing R&D activities pertaining to eHealth are a few additional factors expected to boost demand for teleradiology services during the forecast period. For instance, 5C Network, an Indian teleradiology provider, introduced Prodigi, an AI-driven platform that utilizes advanced technology to guarantee that no radiology image remains unreported for more than 2–3 hours.

Psychiatry segment is anticipated to grow at the fastest rate over the forecast period from 2024 to 2033, owing to increase in patient pool of anxiety, stress, and mental illnesses. Several people are adopting services to treat mental health. Also, the eased regulations for telehealth have expanded the access to virtual visits for therapy and other mental health services. In addition, the shortage of psychiatry beds further increases the need for virtual consultation services, thereby boosting segment growth.

Provider segment held the largest share in 2023 due to increasing adoption of teleconsultation, telemedicine, and telehealth among healthcare professionals to reduce burden on healthcare facilities. Moreover, increased convenience offered by these solutions for quick and seamless access to real-time quality reporting, patient health records, improved decision-making, improved data management, and eHealth solutions is expected to increase adoption of these services among the providers. Many healthcare facilities have witnessed considerable improvement in workflow management through adopting these services, which is boosting its adoption.

The payers segment is anticipated to witness fastest CAGR over the forecast period. Payers comprise insurance companies, health plan sponsors (employers and unions), and third-party payers. The payer industry has witnessed a rapid increase in telehealth claims due to the COVID-19 pandemic and providers are adopting telehealth for all in-person and non-urgent care. Payers are turning toward telehealth to provide its members with the right care at the right time in the right place while also saving the member and the employer money owing to major cost-saving opportunities offered by telehealth services, including lower cost per visit in comparison with in-person visits and fewer diagnostics associated with telehealth visits than with in-person visits.

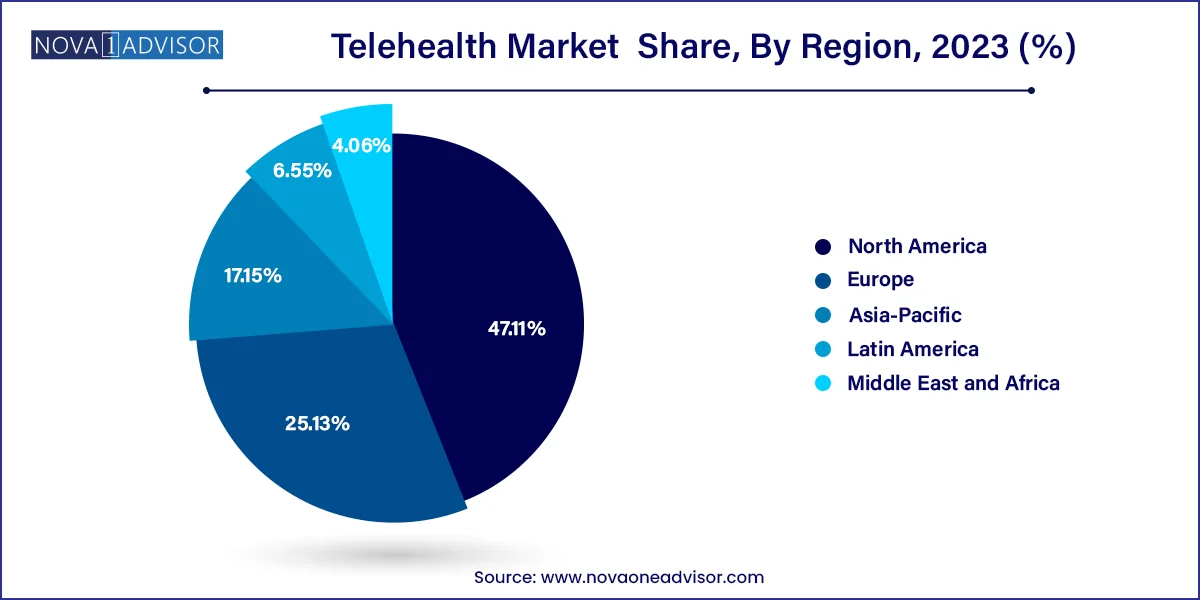

North America dominated the market in 2023 with the largest revenue share of 47.11%. This dominance is attributed to the region's higher healthcare IT expenditure and extensive penetration of internet and smartphone users. North America stands out as one of the earliest adopters of smart healthcare solutions, incorporating technologies such as smart wearables, eHealth services such as HERS telemedicine, and mobile apps. These solutions enable remote access to information on severe and chronic healthcare conditions. Key factors propelling the growth of telehealth services in North America include the rapid adoption of smartphones, advancements in coverage networks, significant shortage of primary caregivers, surge in chronic disease prevalence, growing geriatric population, rising healthcare costs, and an increasing need for enhanced prevention and management of chronic conditions.

The U.S. held largest market share in North American region owing to advanced healthcare management, innovative software development, and presence of several market players operating across segments, such as mobile & network operations. Reports suggest that around 82% of the population aged between 18 and 49 uses smartphones, through which they can access any available digital health technology. In addition, 15% of population owns a smart wearable device connected to a mobile phone. Growing awareness about available digital health solutions, such as telehealth & mHealth, is driving their adoption rate. Advancements in this industry are improving healthcare accessibility & affordability. Telehealth applications enable monitoring & tracking of information related to chronic diseases and help in managing chronic & post-acute care as well as provide cheaper alternatives for healthcare to growing elderly population.

Asia Pacific is projected to witness the fastest growth during the forecast period. Factors such as the rising geriatric population in countries such as India and Japan, combined with advancements in field of digital health and research initiatives undertaken by the key players in the region are anticipated to contribute to the market growth. Favorable government initiatives to strengthen internet connectivity and growing demand for healthcare and medical assistance in rural regions is expected to positively impact the market growth.

China dominated Asia Pacific market in 2023. The Chinese government actively supports telehealth integration into the healthcare system through policies and initiatives, acting as a crucial driver. With a large and aging population, there's a growing demand for healthcare services, especially in remote areas, making telehealth a convenient solution. Ongoing technological advancements, along with widespread internet access and smartphone usage, create a favorable environment for telehealth expansion. The COVID-19 pandemic has accelerated telehealth adoption, underlining its importance during lockdowns and social distancing. Furthermore, addressing the increasing prevalence of chronic diseases due to urbanization and lifestyle changes, telehealth plays a vital role in offering accessible and convenient healthcare solutions across China.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Telehealth market.

By Product Type

By Delivery

By End-use

By Disease Area

By Region