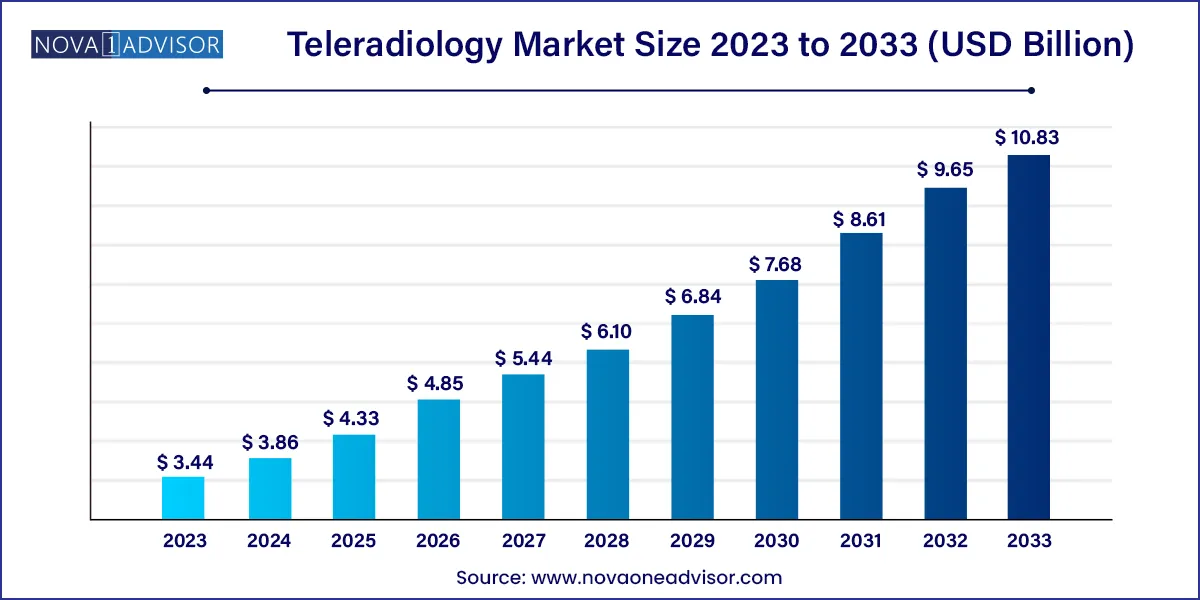

The global teleradiology market size was exhibited at USD 3.44 billion in 2023 and is projected to hit around USD 10.83 billion by 2033, growing at a CAGR of 12.15% during the forecast period of 2024 to 2033.

Key Takeaways:

Teleradiology Market Report Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 3.86 Billion |

| Market Size by 2033 | USD 10.83 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 12.15% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Report, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Virtual Radiologic (vRad); Agfa-Gevaert Group; ONRAD, Inc.; Everlight Radiology; 4ways Healthcare Ltd.; RamSoft, Inc.; USARAD Holdings, Inc.;.Koninklijke Philips N.V., Matrix (Teleradiology Division of Radiology Partners), Medica Group PLC., 5C Network. |

The growth is majorly driven by the increasing prevalence of target diseases, rising demand for teleradiology for second opinion and emergencies. Moreover, the COVID-19 pandemic has emphasized the importance of teleradiology. The shortage of healthcare professionals especially in the sub-specialist segment such as pediatric, neurology, and musculoskeletal radiology is leading to the adoption of teleradiology services. This is because teleradiology helps these healthcare professionals in accessing patient information irrespective of the distance thereby improving diagnostic coverage. Therefore, the growing adoption of teleradiology for early diagnosis is expected to drive market growth during the forecast period.

Teleradiology applications comprise tele-consultation, tele-monitoring, and tele-diagnosis which enable radiologists to effectively perform their daily work. Teleradiology provides effective on-site solutions via cloud network globally and real-time interpretation. Increasing incidence of chronic diseases including breast cancer, cellulitis, & osteomyelitis and growing number of emergency cases in less developed areas are expected to drive the market further.For instance, according to the International Agency for Research on Cancer, breast cancer ranked 1 globally amongst all others cancers with about 2,261,419 new cases in 2020.

Integration of Artificial Intelligence into teleradiology, implementation of picture archiving and communication system (PACS), and growing R&D activities pertaining to eHealth are several other factors expected to boost the demand for teleradiology services over the forecast period. For instance, 5C Network, an Indian teleradiology provider, launched an artificial intelligence-powered platform called Prodigi, that uses advanced technology to ensure that no radiology image is left unreported for more than 2-3 hours. However, data security is a major concern for this market. Healthcare settings capture and store data regarding patients and their radiology images. Security of picture archiving and communication system (PACS) is important to avoid the misuse of a patient’s information. Several complaints have been filed regarding data security of radiology images

Introduction of favorable government initiatives such as Health Insurance Portability and Accountability Act of 1996 of U.S. ensures that all the information related to patient health and personal information are end-to-end protected from cybercrimes. Therefore, every teleradiology service in the U.S. must be compliance with this Act. Such initiatives improve patient and physician’s confidence into teleradiology services increasing its adoption rate during the forecast period. Similarly, the presence of healthcare coverage over the usage of teleradiology services in countries such as U.S. and Australia are also expected to support market development.

Segments Insights:

Product Insights

X-ray segment dominated the market in 2023 with a market share of around 30.2% and is expected to grow at a fastest CAGR over the forecast period. Economical pricing, high usage in primary diagnosis, and the introduction of innovative systems, such as filmless x-ray systems, are some of the factors responsible for the segment’s dominance. Moreover, this technique finds wide applications in various healthcare domains, such as orthopedics, cardiovascular diagnostics, chest imaging, cancer screening, and dental imaging.

Computed Tomography (CT) segment is also expected to witness a significant growth over the forecast period. CT provides faster and clearer images of complex body organs, such as brain, cardiac cavities, and lungs, which contributes to its growth. Increasing technological advancements and digitalization in this field are also expected to support the growth of this segment. For instance, in March 2019, Siemens Healthineers, and GE Healthcare, launched a Go platform cardiac CT scanner.

Ultrasound market segment is also expected to grow at a healthy rate during the forecast period. The ability of ultrasound in accessing the critical health parameters quickly without radiation exposure makes it an important technology in limited resource setting. Moreover, teleradiology based ultrasound devices are being extensively used to deliver training and education program to health workers in remote areas. For instance, Philips in collaboration with PURE (non-profit organization) delivers training over the usage of tele-ultrasound technology to healthcare workers in Rwanda, Africa.

Report Type Insights

The preliminary report segment held the largest market share of 64.7% in 2023 and is expected to continue its dominance over the forecast period. Preliminary reports are a general practice in emergency cares, as it is generated at much faster rate than final reports and economical. Providers get improved insurance coverage at hospitals and imaging centers during non-business hours. Thus, it is anticipated to grow at a faster rate.

However, many providers are now inclined towards final reads, due to accurate and in-depth results with reduced errors. Medicare policies are shifting from more reimbursement to final read and preliminary reads with extensive radiologists reports than traditional preliminary reads. Growing competition in teleradiology services, has led to technological advancements that make it simpler for off-site radiologists to communicate with the facilities for which they read, thus encouraging teleradiology providers to deliver more final reads. This contributes to the high CAGR of final report segment, during the forecast period. The time consumed by these reports are more and the cost associated with it eventually rises, accounts for its smaller market size.

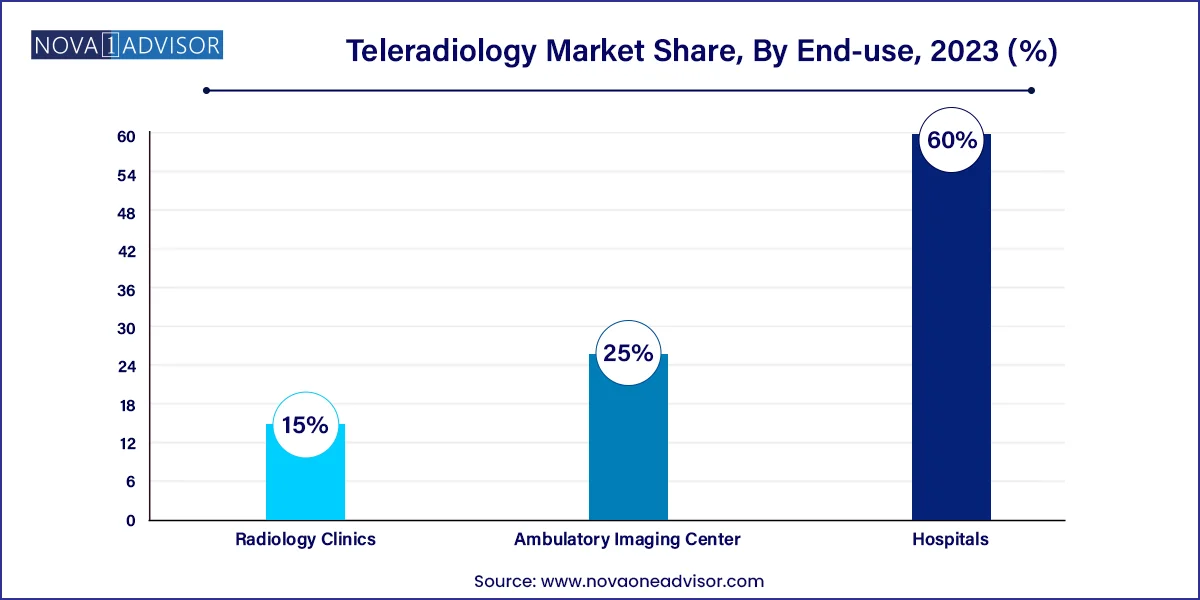

End-use Insights

Hospitals held the largest market share in teleradiology market in 2023, capturing more than 60.0% share. Hospitals use teleradiology services for urgent care, primary diagnosis and secondary opinion. However, teleradiology services are generally preferred in emergency care. For instance, if patient visits to a hospital with severe head trauma during the absence of neuroradiologist, then teleradiology services helps in quicker diagnosis and delivering treatment promptly. Therefore, the rising number of emergency visits in hospitals is expected to drive the market growth over the forecast period. In addition, hospitals save cost of hiring radiologists by adopting teleradiology services. For instance, the Yorkshire Imaging Collaborative, an initiative of hospital trust, collaborated with Agfa Healthcare to launch a diagnostic image sharing platform named, XERO Exchange Network, in 2020. These enabled radiologists make quick diagnosis of around 3 million patients

Radiology Clinics segment is expected to grow at a fastest rate during the forecast period. Fatty pays of radiologist coupled with rising imaging cost is the factor expected to drive the segment growth over the forecast period. According to NCBI report, the average monthly pay of an Indian radiologist (5 year experienced) is approximately USD 5000, and around 10-15% of salary is added to the total bill of each scan. Therefore, rising demand to reduce the healthcare cost is expected to aid to the market growth in long run.

Ambulatory Imaging Center (AIC) market is also expected to grow at a healthy rate during the forecast period. Rising demand of imaging procedures, cost-effectiveness, and shortage of radiologist are the major factors contributing to the growth of the Segment. The major problem faced during an imaging procedure is the time taken for its diagnosis. For instance, as per the NCBI report, in the UK the average time taken by a radiologist in a normal setting to report MRI is, 21 days. AICs helps reduce this diagnosis time thereby leading to its adoption for various imaging procedures.

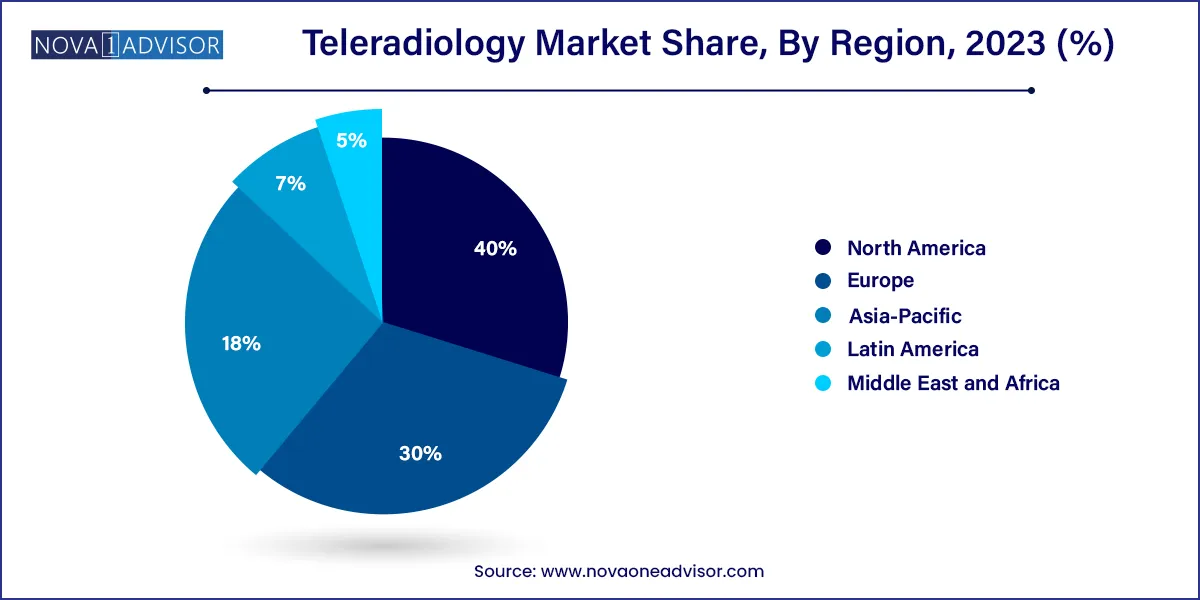

Region insights

North America held the largest market share of 40.0% in 2023 and is projected to maintain its dominance over the forecast period. Growing target population base, increasing prevalence of chronic disorders and presence of major market players in the region are the major factors contributing to the market growth. In addition, developed infrastructure, supportive government initiatives, and increasing demand for efficient radiology solutions are likely to drive the regional market further.

Asia Pacific is expected to witness the fastest CAGR over the forecast period. This can be attributed to the large unmet healthcare needs coupled with rapidly expanding healthcare infrastructure in the region. In developing economies such as India and China a major proportion of the population resides in rural areas where they have limited access to healthcare, as most of the advanced care facilities being established in urban areas. Therefore, hospitals and organizations are looking to tap this unexploited market considering the benefit at the bottom of the pyramid. This is expected to increase the demand of cost-effective diagnostic intervention such as teleradiology services especially in countries with inefficient coverage policies.

Some of the prominent players in the Teleradiology market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global teleradiology market.

Product

Report

End-use

By Region