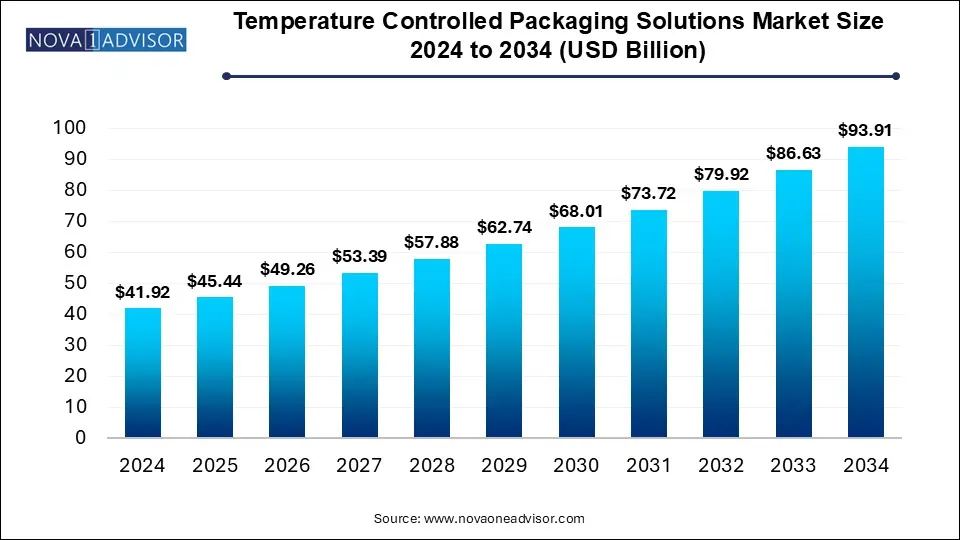

The temperature controlled packaging solutions market size was exhibited at USD 41.92 billion in 2024 and is projected to hit around USD 93.91 billion by 2034, growing at a CAGR of 8.4% during the forecast period 2025 to 2034.

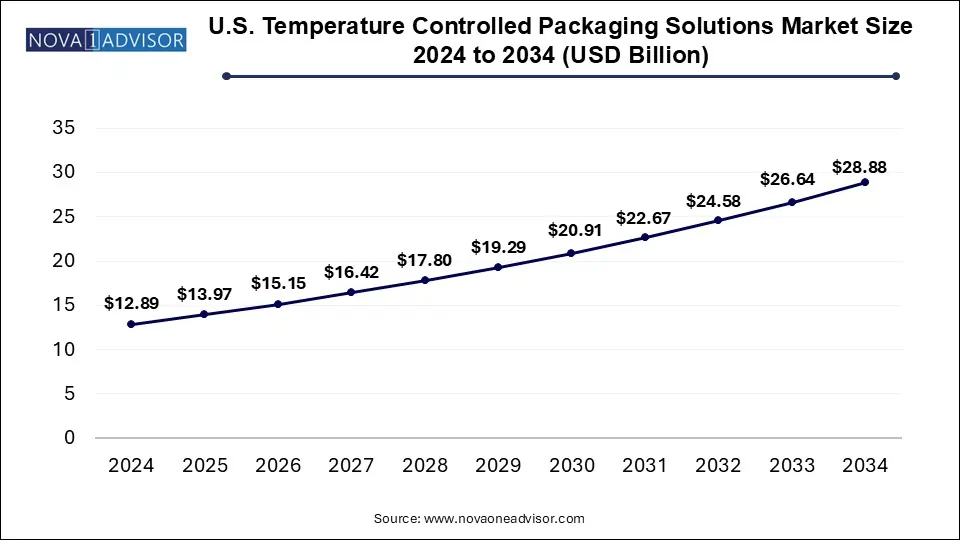

The U.S. temperature controlled packaging solutions market size was valued at USD 12.89 billion in 2024 and is expected to reach around USD 28.88 billion by 2034, growing at a CAGR of 7.6% from 2025 to 2034.

In 2024, North America held the largest revenue share, surpassing 41.0%. This dominance is primarily due to its well-established healthcare industry, which fuels the demand for temperature-controlled packaging solutions essential for storing and transporting temperature-sensitive pharmaceuticals, including vaccines, biologics, and medical devices. Additionally, the rising popularity of online grocery shopping and food delivery services has increased the need for reliable packaging to preserve perishable items like meal kits, fresh produce, and prepared foods. Insulated shippers and containers play a crucial role in ensuring product safety and quality during transportation, further propelling market growth in the region.

Asia Pacific is projected to experience a strong CAGR of 9.2% over the forecast period. This growth is largely driven by the expansion of cross-border trade involving temperature-sensitive agricultural products such as rice, seafood, and vegetable oils. For example, Indonesia and Malaysia lead the global export of palm oil, while Thailand and Vietnam are key rice exporters to Europe. The growing international trade of perishable goods necessitates the use of temperature-controlled packaging solutions to maintain quality, fostering market expansion in the region.

In China, the increasing demand for temperature-controlled packaging solutions is closely tied to its booming electronics sector. As one of the largest exporters of electronic devices, including laptops and smartphones, China requires specialized packaging to protect these products from extreme temperatures that could damage performance and longevity during prolonged transportation and storage.

Europe’s market growth is largely fueled by the surging demand for frozen foods, e-commerce, and home delivery services. The use of temperature-controlled packaging is essential for ensuring the freshness and safety of perishable goods, particularly during last-mile delivery. Insulated shippers and containers help maintain the necessary temperature levels, supporting the rising demand for frozen and fresh food products in the region.

In Central and South America, market expansion is driven by the region’s flourishing agricultural sector. As one of the leading global suppliers of fresh produce, meat, and seafood, the region relies on temperature-controlled packaging solutions to preserve product freshness for both international export and domestic distribution. For instance, avocados grown in Central and South America require controlled-atmosphere packaging, where temperature and humidity levels are regulated throughout the shipping process. This technology plays a key role in ensuring product quality, contributing to regional market growth.

In the Middle East & Africa, rising demand for organic food and the growing preference for frozen and ready-to-eat meals are major drivers of market growth. As consumer lifestyles become busier, the demand for convenient food options has increased, requiring effective temperature-controlled packaging to maintain product integrity. Since organic and frozen foods are highly sensitive to temperature fluctuations, specialized packaging solutions are essential for ensuring their quality and freshness, driving demand in the region.

| Report Coverage | Details |

| Market Size in 2025 | USD 45.44 Billion |

| Market Size by 2034 | USD 93.91 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.4% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Product, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Sonoco Products Company; Cryopak Industries Inc.; DGP Intelsius; Cold Chain Technologies, Inc.; Envirotainer AB; Softbox Systems Ltd.; AmerisourceBergen Corporation; DHL International GmbH; Inmark Temperature-Controlled Packaging; APEX Packaging Corporation; TPC Packaging Solutions; PCI Pharma Services; Safe Box; Aeris; DGR PACKAGING & SUPPLY PTE LTD; Valor Industries. |

The temperature-controlled packaging solutions market is categorized into passive systems and active systems based on type. Among these, passive systems secured a dominant revenue share exceeding 65.0% in 2024. Their popularity is attributed to their cost-effectiveness and environmentally sustainable characteristics compared to active systems. Passive systems offer thermal insulation and maintain temperature stability without relying on external power or mechanical components, further driving their market expansion.

Conversely, the active systems segment is projected to witness the highest CAGR of 8.7% throughout the forecast period. Their ability to maintain precise internal temperatures using external power sources or mechanical components makes them essential for industries requiring strict temperature regulation. For example, biopharmaceutical products such as vaccines and specialty drugs demand precise temperature control during storage and transportation, fueling the demand for active system-based packaging solutions.

By product type, the temperature-controlled packaging solutions market is further segmented into insulated containers, insulated shippers, and refrigerants.

The insulated shippers segment captured a higher revenue share of over 48.0% in 2024, owing to their lightweight and portable design, making them ideal for shipping smaller product quantities. These shippers are widely used for packaging individual pharmaceutical vials, small food items, and clinical samples, increasing their demand across various industries.

The insulated container segment is anticipated to grow at a CAGR of 8.1% over the forecast period, driven by increased usage in the food & beverage and healthcare industries. These containers, designed with tight seals, double-walled construction, and advanced insulation materials, help maintain product stability during bulk exports of frozen foods and temperature-sensitive pharmaceuticals. Their ability to minimize temperature variations and ensure compliance with storage requirements further enhances their adoption.

The refrigerants segment is expanding due to the growing demand for gel packs and dry ice refrigerants. Gel packs, which freeze at specific temperatures, absorb heat and sustain a cool environment for short-duration shipments—particularly useful for temperature-sensitive drugs and vaccines requiring refrigeration. Meanwhile, dry ice is widely utilized for deep freezing products like frozen foods and biological samples during extended transportation.

Based on application, the market is segmented into food & beverages, healthcare, and others.

The food & beverage segment accounted for a significant revenue share exceeding 51.0% in 2024. The increased demand for packaging solutions that preserve perishable goods and frozen foods has driven this growth. Products such as fresh produce, dairy items, meats, seafood, and baked goods require refrigeration or controlled-atmosphere packaging to maintain their quality, texture, and taste. Additionally, frozen food items like ready-to-eat meals, ice cream, and frozen desserts necessitate low-temperature packaging to prevent thawing and ensure product longevity, boosting the demand for this segment.

The healthcare segment is anticipated to expand at the fastest CAGR of 9.3% during the forecast period. The rising need for temperature-controlled packaging for biologics and specialty drugs—which are highly sensitive to temperature fluctuations—is a key driver. Insulated shippers and containers ensure that these pharmaceutical products maintain their integrity during storage and transportation.

Additionally, stringent regulatory frameworks and government initiatives are pushing the demand for temperature-controlled packaging in healthcare. In 2024, the World Health Organization (WHO) implemented vaccine waste monitoring programs, emphasizing the necessity of temperature-controlled packaging solutions to maintain vaccine efficacy. Furthermore, regulations such as Good Distribution Practices (GDP) in regions like the U.S. and U.K. mandate strict temperature control for pharmaceutical storage and logistics, driving further market expansion.

The clinical trials segment is experiencing growth due to the increased reliance on temperature-controlled packaging in drug research and stability studies. These packaging solutions are vital for maintaining the desired temperature conditions during storage, ensuring the effectiveness and safety of trial medications throughout their research phases.

The others segment, which includes electronics & semiconductors and chemicals, is also gaining traction. Many electronic components are heat-sensitive and require packaging that maintains a stable, low-temperature environment during shipping and storage. Similarly, chemicals such as enzymes demand specific temperature controls to preserve their stability and functional properties. The necessity for temperature regulation in these industries is driving the demand for temperature-controlled packaging solutions within this segment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the temperature controlled packaging solutions market

By Type

By Product

By Application

By Regional