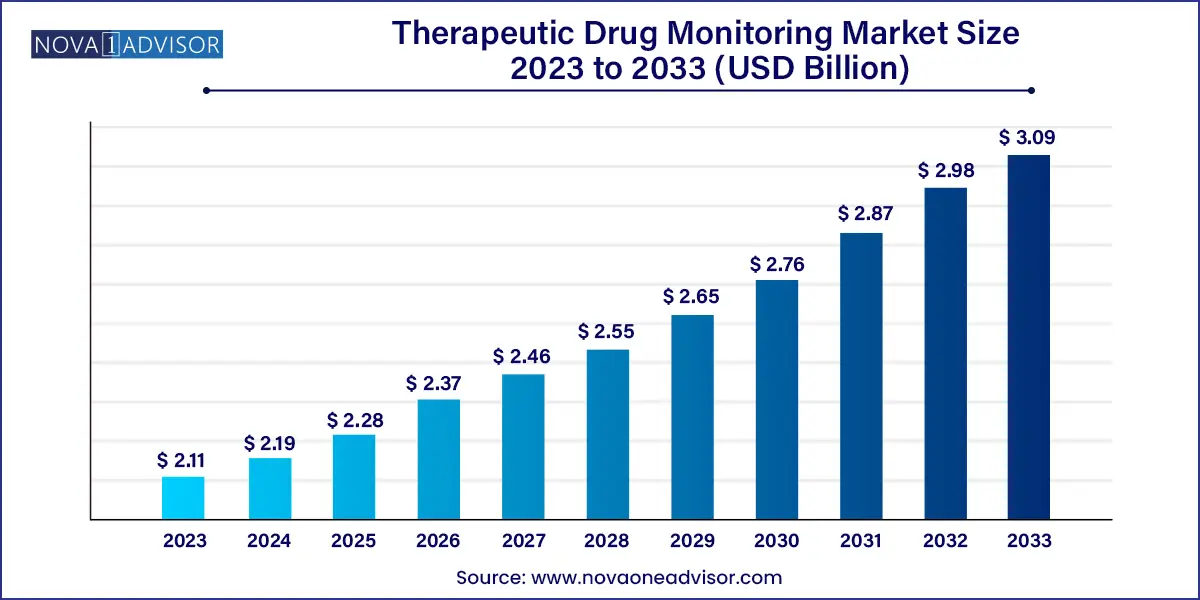

The global therapeutic drug monitoring market size was valued at USD 2.11 billion in 2023 and is anticipated to reach around USD 3.09 billion by 2033, growing at a CAGR of 3.9% from 2024 to 2033.

The increase in demand for genetic testing, technological advancements in diagnosis, research experimentation attributed to therapeutic drug monitoring, the rise in the number of patients, and governments' supportive regulations and policies regarding the usage of drug monitoring. For instance, in August 2019, the U.S. Food and Drug Administration approved linezolid (BPaL) for adults with pulmonary XDR, treatment-intolerant or nonresponsive MDR TB, and pretomanid 200mg combined with bedaquiline.

Based on data reviewed until December 31, 2022, the CDC updated its guidance, reducing the initial linezolid dose in the BPaL regimen from 1200 mg to 600 mg, following the ZeNix trial results. Detailed adverse event information from the ZeNix and Nix-TB trials was added, and safety risks and adverse effects were consolidated for clarity.

The demand for genetic testing is driving growth in the therapeutic drug monitoring market. Genetic testing enables personalized medicine, where treatments are tailored to an individual's genetic profile. This approach enhances drug efficacy and safety, improving patient outcomes and increasing therapeutic drug monitoring services utilization. For instance, in June 2024, Case Western Reserve University (CWRU) researchers developed a DNA testing method called AMPLON, which efficiently amplifies small DNA samples for conventional medical testing. Utilizing a multi-armed DNA primer design, AMPLON enhances amplification efficiency and consistency by leveraging enzyme weaknesses. This method reduces amplification time by 50%, potentially revolutionizing nucleic acid amplification practices.

Rising chronic illnesses are propelling the therapeutic drug monitoring market as precise medication management becomes crucial for optimal drug effectiveness and safety. According to the IDF Diabetes Atlas (2021), over 10% of adults (20-79 years) had diabetes with many undiagnosed patients. This number was expected to rise significantly by 2045, reaching 783 million, with type 2 diabetes being the main culprit.

| Report Attribute | Details |

| Market Size in 2024 | USD 2.19 Billion |

| Market Size by 2033 | USD 3.09 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, drug class, end use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Abbott; ALPCO; Beckman Coulter, Inc; Bio-Rad Laboratories, Inc; Thermo Fisher Scientific Inc.; Chromsystems Instruments & Chemicals GmbH; F.Hoffmann-La Roche Ltd.; Randox laboratories Ltd; Siemens Healthineers AG.; biomérieux, Inc. |

The consumables segment dominated the market share with 65.14% in 2023. Chronic disease burden from conditions such as heart disease, diabetes, and neurological disorders is expected to solidify the therapeutic drug monitoring market's leading position. According to the World Health Organization (WHO), cardiovascular diseases (CVDs) are the world's leading cause of death, claiming approximately 17.9 million lives annually. CVDs encompass a range of heart and blood vessel disorders, including coronary heart disease, cerebrovascular disease, and rheumatic heart disease, among others.

The equipment segment is expected to grow significantly over the forecast period. The rise of infectious and non-infectious diseases such as diabetes, cancer, and heart disease fuels the dominance of immunoassay analyzers used in treating both. In the U.S., 2 million new cancer cases were projected in 2024, with colorectal, lung, breast, and prostate being the most common. Men were more likely to be diagnosed with prostate, lung, and colorectal cancers, while women faced a higher risk of colorectal, lung, and breast cancers.

The antiarrhythmic segment dominated the market in 2023. Rising heart disease with arrhythmias, personalized medicine for better drug response, improved diagnostics, and growing awareness of therapeutic drug monitoring are propelling the antiarrhythmic drug market. Affecting 1.5% to 5% of the population, arrhythmias, especially atrial fibrillation, can be asymptomatic and are linked to serious health complications (according to the National Center for Biotechnology Information).

The immunosuppressants segment is expected to grow fastest, with a compounded annual growth rate of 5.13% over the forecast period. Rising obesity due to lifestyle changes fuels the growth of drugs for rheumatoid arthritis, multiple sclerosis, and psoriasis. According to the WHO, adult and adolescent obesity rates have increased globally since 1990, with the number of obese adults more than doubling and obese adolescents quadrupling. This trend is reflected in 2022 statistics, where 43% of adults worldwide were overweight, with an additional 16% classified as obese, translating to a concerning 2.5 billion overweight and 890 million obese adults globally.

The hospital segment dominated the market share in 2023. The major factor contributing to the growth and dominance of the segment is the rising importance of therapeutics drugs monitoring (TDM) in organ transplant procedures and the increase in the preference for precision medications and treatments. According to the National Center for Biotechnology Information (NCBI), to prevent organ rejection, solid organ transplant recipients rely on lifelong immunosuppressant medication. Therapeutic drug monitoring (TDM) tailors drug doses for optimal effect and is commonly used for calcineurin and mTOR inhibitors, with some use for mycophenolate.

The diagnostics segment is expected to grow at the fastest CAGR over the forecast period. The segment's growth is attributed to the increase in the number of diagnostics centers and improved quality and infrastructure of treatment centers. For instance, in September 2023, a Cornell-led interdisciplinary team received a five-year grant to establish the Point of Care Technologies for Nutrition, Infection, and Cancer for Global Health (PORTENT) center. PORTENT was funded by three National Institutes of Health (NIH) branches: NIBIB, Fogarty International Center, and the National Center for Complementary and Integrative Health. This initiative aims to develop, test, and bring to market diagnostic tools that can be used anywhere for global health applications.

North America dominated the global therapeutics drugs monitoring market in 2023 with a revenue share of 42.17%. The major factors contributing to the dominance are the population's awareness and government regulations that support the market. For instance, in October 2023, the FDA approved ProciseDx's TDM tests (Procise IFX and Procise ADL) for monitoring infliximab and adalimumab, medications used to treat inflammatory bowel disease (IBD). This is significant for the millions of IBD patients, as these tests help doctors optimize treatment for the 15% who rely on these drugs. The tests are designed for use in hospitals and similar lab settings.

U.S. Therapeutic Drug Monitoring Market Trends

The U.S. dominated the market in the region with a market share of market share of 88.17% in 2023. The dominance can be attributed to the large awareness among the population, the increasing number of drug developments, research, and launches, and the well-established major pharmaceutical players. For instance, in March 2024, Cognizant leveraged generative AI (gen AI) technology through the NVIDIA BioNeMo platform to address intricate drug discovery challenges in the life sciences sector. This initiative aimed to enhance productivity during development and accelerate the introduction of new life-saving treatments to the market.

Europe Therapeutic Drug Monitoring Market Trends

Europe held a significant market share in 2023; this can be attributed to the increasing demand for personalized medicines, and increasing awareness of the benefits of personalized medicine has made the increase in adoption in recent years. For instance, in 2024, Capitainer secured approximately SEK 2 million in funding to expand production capabilities and enhance sales efforts in Europe and the U.S. This investment, led by Sciety and the Sciety Venture Partners network, highlights the strong confidence in Capitainer's innovative technology and its potential to drive advancements in healthcare.

The UK therapeutic drug monitoring market is expected to grow rapidly in the coming years due to advancements in drug monitoring tools. Advancements in therapeutic drug monitoring tools allow for precise monitoring and personalized treatment plans, propelling market growth.

For instance, in July 2023, University College London (UCL) researchers showcased a new drug-monitoring device at the Royal Society Summer Science Exhibition. Developed by a consortium that includes UCL researchers, the ChromaDose device measures cancer medicine levels in a patient's blood to mitigate side effects such as heart problems during chemotherapy for children in the UK. This innovation aims to reduce the occurrence of treatment-related complications, which affect up to 65% of the 10,000 children receiving anti-cancer medications in the UK and will aid doctors in determining personalized treatment doses for future patients.

Germany therapeutics drugs monitoring market is expected to grow rapidly in the coming years due to the awareness is increasing among the people and the participation of major healthcare organization in improving the systems quality and infrastructure

Asia Pacific Therapeutic Drug Monitoring Market Trends

Asia Pacific therapeutics drugs monitoring market is expected to grow at the fastest CAGR of 4.1% over the forecast period. The increasing number of chronic diseases and the increase in the senior population are the major factors contributing to the market growth in the region. According to the WHO, non-communicable diseases (NCDs), Southeast Asia faces a growing threat from non-communicable diseases such as heart disease, cancer, diabetes, and lung issues. These illnesses account for a staggering 62% of deaths in the region, impacting an estimated 9 million people.

China's aging population, rising chronic diseases, and government support are expected to grow its therapeutic drug monitoring market significantly. According to the WHO, China's aging population is exploding, with projections showing that nearly a third (28%) of the population will be over 60 by 2040 due to rising life expectancy and fewer births. This demographic shift brings hurdles and opportunities for public health and economic growth.

India's therapeutics drugs monitoring market is expected to grow significantly over the forecast period due to increasing awareness among the people and the preference for a better healthcare system, which are the major driving factors.

The following are the leading companies in the therapeutic drug monitoring market. These companies collectively hold the largest market share and dictate industry trends.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Therapeutic Drug Monitoring market.

By Product

By Drug Class

By End Use

By Region

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Therapeutic Drug Monitoring Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Million)

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.4. Therapeutic Drug Monitoring Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Therapeutic Drug Monitoring Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Therapeutic Drug Monitoring Market: Product Movement Analysis, 2024 & 2033 (USD Million)

4.3. Equipment

4.3.1. Equipment Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.2. Immunoassay Analyzers

4.3.2.1. Immunoassay Analyzers Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.3. Clinical Chemistry Analyzers

4.3.3.1. Clinical Chemistry Analyzers Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.4. Chromatography & MS detectors

4.3.4.1. Chromatography & MS detectors Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4. Consumables

4.4.1. Consumables Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 5. Therapeutic Drug Monitoring Market: Drug Class Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Therapeutic Drug Monitoring Market: Drug Class Movement Analysis, 2024 & 2033 (USD Million)

5.3. Antiarrhythmic Drugs

5.3.1. Antiarrhythmic Drugs Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.4. Immunosuppressants

5.4.1. Immunosuppressants Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.5. Antiepileptic Drugs

5.5.1. Antiepileptic Drugs Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.6. Others

5.6.1. Others Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 6. Therapeutic Drug Monitoring Market: End Use Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Therapeutic Drug Monitoring Market: End Use Movement Analysis, 2024 & 2033 (USD Million)

6.3. Hospitals

6.3.1. Hospitals Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4. Diagnostic Centers

6.4.1. Diagnostics Centers Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5. Others

6.5.1. Others Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 7. Therapeutic Drug Monitoring Market: Regional Estimates & Trend Analysis

7.1. Therapeutic Drug Monitoring Market Share, By Region, 2024 & 2033 (USD Million)

7.2. North America

7.2.1. North America Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.2.2. U.S.

7.2.2.1. U.S. Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.2.3. Canada

7.2.3.1. Canada Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.2.4. Mexico

7.2.4.1. Mexico Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3. Europe

7.3.1. Europe Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.2. UK

7.3.2.1. UK Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.3. Germany

7.3.3.1. Germany Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.4. France

7.3.4.1. France Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.5. Italy

7.3.5.1. Italy Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.6. Spain

7.3.6.1. Spain Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.7. Denmark

7.3.7.1. Denmark Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.8. Sweden

7.3.8.1. Sweden Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.9. Norway

7.3.9.1. Norway Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.4.2. Japan

7.4.2.1. Japan Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.4.3. China

7.4.3.1. China Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.4.4. India

7.4.4.1. India Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.4.5. Australia

7.4.5.1. Australia Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.4.6. South Korea

7.4.6.1. South Korea Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.4.7. Thailand

7.4.7.1. Thailand Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.5. Latin America

7.5.1. Latin America Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.5.2. Brazil

7.5.2.1. Brazil Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.5.3. Argentina

7.5.3.1. Argentina Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.6. Middle East and Africa

7.6.1. Middle East and Africa Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.6.2. South Africa

7.6.2.1. South Africa Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.6.3. Saudi Arabia

7.6.3.1. Saudi Arabia Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.6.4. UAE

7.6.4.1. UAE Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.6.5. Kuwait

7.6.5.1. Kuwait Therapeutic Drug Monitoring Market Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis by Key Market Participants

8.2. Company Categorization

8.3. Company Heat Map Analysis

8.4. Company Profiles

8.4.1. Abbott

8.4.1.1. Participant’s Overview

8.4.1.2. Financial Performance

8.4.1.3. Product Benchmarking

8.4.1.4. Recent Developments/ Strategic Initiatives

8.4.2. ALPCO

8.4.2.1. Participant’s Overview

8.4.2.2. Financial Performance

8.4.2.3. Product Benchmarking

8.4.2.4. Recent Developments/ Strategic Initiatives

8.4.3. Beckman Coulter, Inc

8.4.3.1. Participant’s Overview

8.4.3.2. Financial Performance

8.4.3.3. Product Benchmarking

8.4.3.4. Recent Developments/ Strategic Initiatives

8.4.4. Bio-Rad Laboratories, Inc.

8.4.4.1. Participant’s Overview

8.4.4.2. Financial Performance

8.4.4.3. Product Benchmarking

8.4.4.4. Recent Developments/ Strategic Initiatives

8.4.5. Thermo Fisher Scientific Inc.

8.4.5.1. Participant’s Overview

8.4.5.2. Financial Performance

8.4.5.3. Product Benchmarking

8.4.5.4. Recent Developments/ Strategic Initiatives

8.4.6. Chromsystems Instruments & Chemicals GmbH

8.4.6.1. Participant’s Overview

8.4.6.2. Financial Performance

8.4.6.3. Product Benchmarking

8.4.6.4. Recent Developments/ Strategic Initiatives

8.4.7. F.Hoffmann-La Roche Ltd.

8.4.7.1. Participant’s Overview

8.4.7.2. Financial Performance

8.4.7.3. Product Benchmarking

8.4.7.4. Recent Developments/ Strategic Initiatives

8.4.8. Randox laboratories Ltd

8.4.8.1. Participant’s Overview

8.4.8.2. Financial Performance

8.4.8.3. Product Benchmarking

8.4.8.4. Recent Developments/ Strategic Initiatives

8.4.9. Siemens Healthineers AG.

8.4.9.1. Participant’s Overview

8.4.9.2. Financial Performance

8.4.9.3. Product Benchmarking

8.4.9.4. Recent Developments/ Strategic Initiatives

8.4.10. biomérieux, Inc.

8.4.10.1. Participant’s Overview

8.4.10.2. Financial Performance

8.4.10.3. Product Benchmarking

8.4.10.4. Recent Developments/ Strategic Initiatives