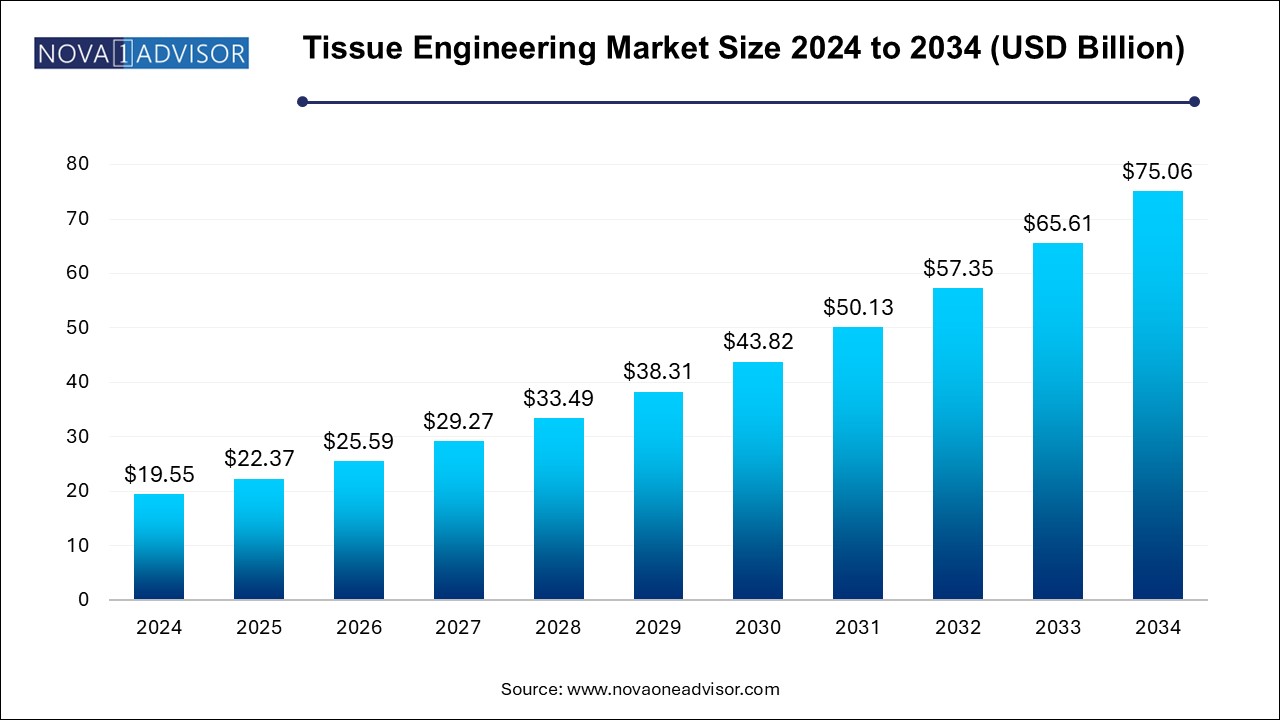

The tissue engineering market size was exhibited at USD 19.55 billion in 2024 and is projected to hit around USD 75.06 billion by 2034, growing at a CAGR of 14.4% during the forecast period 2025 to 2034.

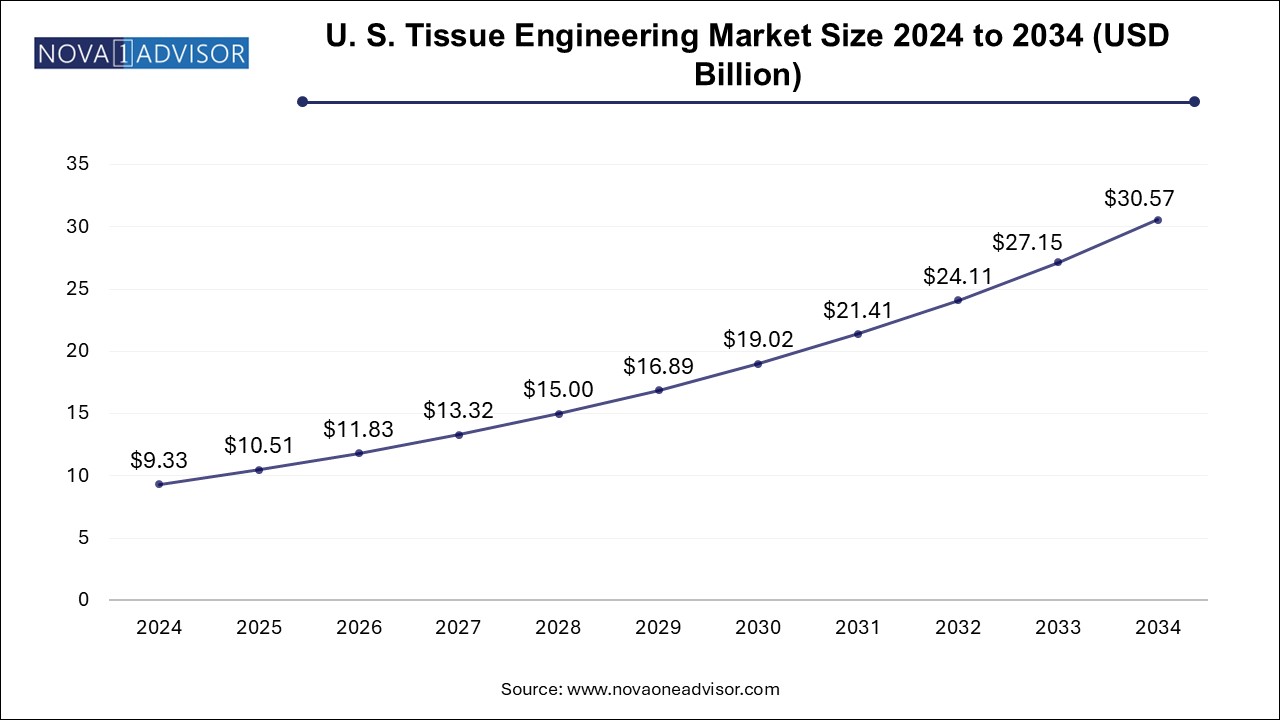

The U.S. tissue engineering market size is evaluated at USD 9.33 billion in 2024 and is projected to be worth around USD 30.57 billion by 2034, growing at a CAGR of 12.6% from 2025 to 2034.

North America dominated the tissue engineering market and accounted for the largest revenue share of 51.0% in 2024, owing to robust healthcare infrastructure, advanced research capabilities, and strong funding mechanisms. The United States, in particular, houses a majority of the world’s leading biotechnology firms, university research hospitals, and venture capital support systems that collectively fuel innovation and commercialization. Regulatory clarity from the FDA, support from agencies like the NIH, and collaborative platforms such as the Armed Forces Institute of Regenerative Medicine (AFIRM) provide the ideal environment for tissue engineering breakthroughs.

Commercial players in the region are well-positioned to scale lab discoveries into marketable therapies. For example, companies like Organogenesis and ACell have launched skin substitutes and wound healing products that are widely used across hospitals. Moreover, the high prevalence of lifestyle diseases, increased awareness of regenerative therapies, and well-established reimbursement systems make North America a mature and dynamic market.

Asia Pacific is the Fastest Growing Region

Asia Pacific is emerging as the fastest growing market, driven by increasing healthcare expenditures, population aging, and the rise of regenerative medicine hubs in countries like Japan, South Korea, India, and China. Governments across the region are promoting stem cell research through policy reforms and funding incentives. For instance, Japan’s accelerated approval pathway for regenerative products under the PMDA has encouraged the commercialization of innovative therapies. Additionally, the region’s large patient base suffering from chronic diseases and trauma-related injuries presents a lucrative demand pool.

Collaborations between local biotech startups and global pharmaceutical companies are on the rise, enhancing technological transfer and access to international markets. The growing medical tourism industry in Asia Pacific, especially in India and Thailand, is another factor contributing to the demand for cost-effective tissue-engineered implants and grafts.

The Tissue Engineering Market is undergoing a paradigm shift, propelled by breakthroughs in regenerative medicine, stem cell science, biomaterials, and bioprinting technologies. At its core, tissue engineering is an interdisciplinary field that combines principles from biology, material science, and engineering to develop biological substitutes capable of restoring, maintaining, or improving tissue function. Once confined to academic labs and pilot clinical programs, tissue engineering has matured into a robust commercial ecosystem with applications spanning orthopedics, cardiology, neurology, urology, dental reconstruction, skin regeneration, and even oncology.

With the aging population worldwide, the need for organ and tissue replacement has surged dramatically. The shortage of organ donors has led researchers and clinicians to seek viable alternatives to transplantation. Tissue engineering offers such promise, with the potential to generate lab-grown tissues and organs using patients' own cells, minimizing rejection risks and surgical complications. Furthermore, the rising prevalence of chronic diseases, traumatic injuries, and congenital abnormalities has amplified the demand for bioengineered tissue implants, scaffolds, and regenerative therapies.

Government support and private investments are playing an instrumental role in scaling research into market-ready solutions. Agencies such as the National Institutes of Health (NIH), European Research Council (ERC), and Japan Agency for Medical Research and Development (AMED) continue to fund multi-million-dollar projects focused on regenerative therapies. Meanwhile, academic-industry collaborations and the proliferation of biotech startups are accelerating innovation cycles and product commercialization.

The global market for tissue engineering is poised for strong, sustained growth over the next decade, characterized by rapid advancements in biomaterial scaffolds, stem cell sourcing techniques, tissue construct vascularization, and 3D bioprinting capabilities.

Integration of 3D bioprinting in tissue engineering pipelines to produce anatomically accurate tissue scaffolds and organoids.

Rising emphasis on personalized tissue constructs utilizing autologous cells and patient-specific biomaterials.

Growth in stem cell-based therapies with an increasing number of clinical trials targeting orthopedic, cardiovascular, and neurodegenerative disorders.

Increased collaboration between biotechnology firms and academic institutions to translate bench research into commercial applications.

Development of off-the-shelf allogeneic tissue products with immunomodulatory properties for wider accessibility and rapid deployment.

Expansion of cell banking services such as cord blood storage and induced pluripotent stem cell (iPSC) repositories.

Focus on vascularization techniques to engineer thicker and functional tissues for transplantation and in vitro testing.

| Report Coverage | Details |

| Market Size in 2025 | USD 19.55 Billion |

| Market Size by 2034 | USD 75.06 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 14.4% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Zimmer Biomet Holdings, Inc.; AbbVie (Allergan); Becton Dickinson and Company; B. Braun; Integra LifeSciences Corporation; Organogenesis Holdings Inc.; Medtronic; ACell, Inc.; Athersys, Inc.; Tissue Regenix Group plc; Stryker Corporation; RTI Surgical, Inc.; ReproCell, Inc.; Baxter International, Inc. |

One of the key drivers fueling the tissue engineering market is the escalating demand for regenerative solutions in orthopedic and musculoskeletal healthcare. With an aging global population and increasing incidence of conditions like osteoarthritis, degenerative disc disease, and traumatic skeletal injuries, there is a pressing need for durable, biocompatible replacements for damaged cartilage, ligaments, and bone. Traditional surgical approaches often rely on metallic implants or donor grafts, which come with complications such as immune rejection, wear and tear, and revision surgeries.

Tissue engineering offers a game-changing alternative. For instance, bioengineered cartilage made from biodegradable polymers seeded with mesenchymal stem cells (MSCs) can replicate the native architecture of joint cartilage, promote endogenous regeneration, and integrate seamlessly with the host tissue. Companies like Vericel Corporation and Biotissue Technologies are actively developing and commercializing tissue-based orthopedic implants, which have shown promising results in clinical studies. The expansion of minimally invasive surgical techniques and reimbursement policies supporting regenerative procedures further amplifies the demand in this segment.

Despite the promise tissue engineering holds, regulatory complexity and slow clinical translation remain major restraints for the market. Developing tissue-engineered products involves the integration of living cells, scaffolds, and biologically active factors, which makes the regulatory pathway highly stringent and multifaceted. Products often fall into the hybrid category of biologics and medical devices, requiring comprehensive preclinical data, GMP compliance, and lengthy human trials before market approval.

Additionally, variability in clinical outcomes, difficulties in large-scale manufacturing, and a lack of universally accepted quality standards hinder widespread clinical adoption. For instance, constructs developed in academic labs may not translate well to industrial-scale production due to issues like vascularization or inconsistent cell behavior. These factors discourage investors and delay market entry, particularly for startups or companies operating in emerging economies with less regulatory infrastructure.

Despite the promise tissue engineering holds, regulatory complexity and slow clinical translation remain major restraints for the market. Developing tissue-engineered products involves the integration of living cells, scaffolds, and biologically active factors, which makes the regulatory pathway highly stringent and multifaceted. Products often fall into the hybrid category of biologics and medical devices, requiring comprehensive preclinical data, GMP compliance, and lengthy human trials before market approval.

Additionally, variability in clinical outcomes, difficulties in large-scale manufacturing, and a lack of universally accepted quality standards hinder widespread clinical adoption. For instance, constructs developed in academic labs may not translate well to industrial-scale production due to issues like vascularization or inconsistent cell behavior. These factors discourage investors and delay market entry, particularly for startups or companies operating in emerging economies with less regulatory infrastructure.

The orthopedics, musculoskeletal, & spine segment held the largest revenue of 59.45% market share in 2024, Accounting for a significant share of revenue owing to the high prevalence of bone and cartilage disorders. Bioengineered constructs for bone grafts, intervertebral discs, and articular cartilage have become pivotal in addressing degenerative joint diseases, congenital abnormalities, and injury-related defects. Innovations in scaffold design—such as calcium phosphate-based matrices and collagen-infused hydrogels—have enabled better load-bearing capacity, integration, and healing. Major healthcare systems, including those in the U.S. and Germany, are adopting tissue-engineered orthopedic implants due to their ability to restore function while minimizing rejection and post-operative complications.

Neurology is emerging as the fastest growing application segment due to increasing research on tissue-engineered solutions for spinal cord injuries, stroke recovery, and neurodegenerative diseases. The brain and spinal cord’s limited regenerative capacity makes neurological disorders particularly difficult to treat. Recent breakthroughs involving stem cell-derived neural tissues, bioengineered nerve conduits, and 3D-printed brain organoids offer new hope. Companies and research institutions have initiated clinical trials to evaluate scaffold-assisted nerve regeneration and neuronal integration. The rise in traumatic brain injuries, particularly among military personnel and accident victims, is prompting governments to fund regenerative neurology programs, creating significant growth avenues in the coming years.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the tissue engineering market

By Application

By Regional