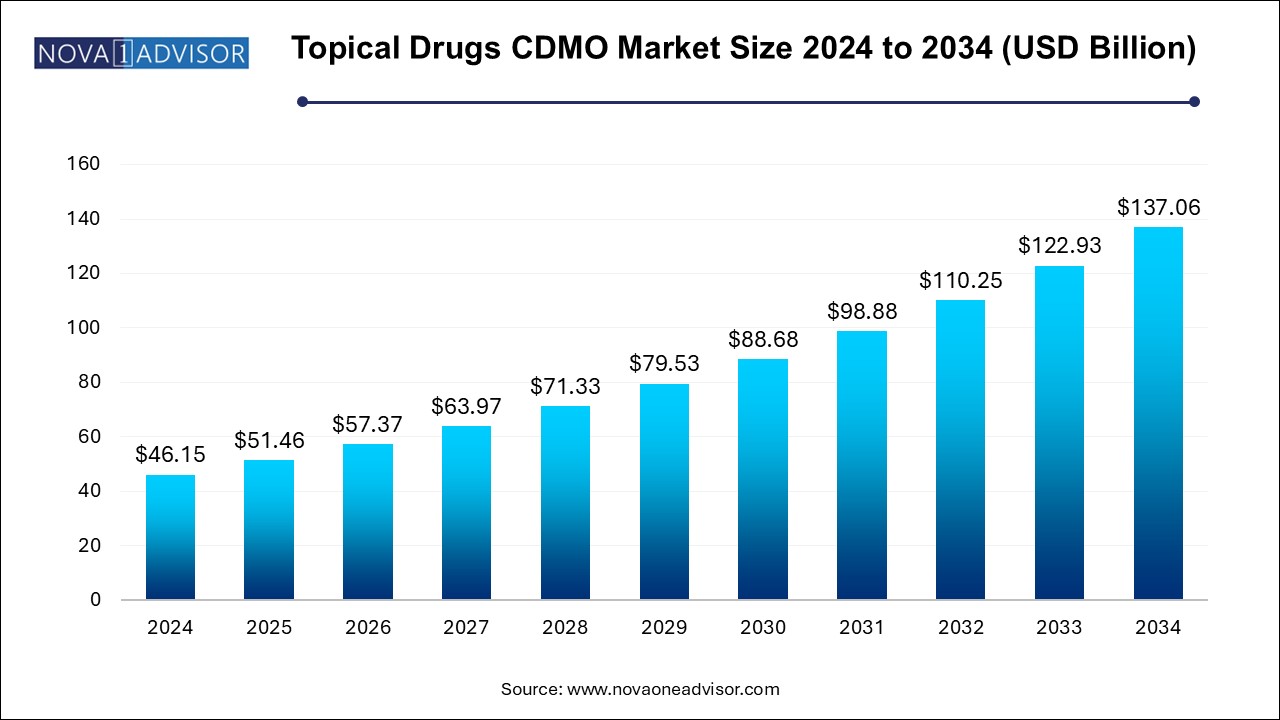

The topical drugs CDMO market size was exhibited at USD 46.15 billion in 2024 and is projected to hit around USD 137.06 billion by 2034, growing at a CAGR of 11.5% during the forecast period 2024 to 2034.

The Topical Drugs CDMO (Contract Development and Manufacturing Organization) market is rapidly evolving into a vital component of the global pharmaceutical outsourcing landscape. Topical drug formulations—administered directly to the skin or mucosal surfaces—offer localized treatment with reduced systemic exposure, making them highly suitable for chronic dermatological, ophthalmic, and musculoskeletal conditions. As demand for topical therapeutics grows, pharmaceutical and biopharmaceutical companies are increasingly relying on specialized CDMOs for formulation development, regulatory support, and scalable manufacturing.

Topical formulations are notably diverse, ranging from semi-solids like creams and gels to liquid sprays, transdermal patches, and solid sticks. Each of these formats presents unique challenges in terms of drug permeation, stability, and sensory characteristics. The technical complexity involved in delivering actives through the skin barrier has prompted companies to outsource to experienced CDMOs with deep formulation know-how, advanced analytical capabilities, and compliant manufacturing infrastructure.

Beyond dermatology, topical drugs are being developed for pain management, women’s health, wound healing, and even neurological indications using innovative transdermal delivery systems. The growing interest in non-invasive delivery, combined with rising generic drug development and specialty pharma activity, is expanding the scope of topical product outsourcing.

Furthermore, the rise of small and virtual biotech firms, constrained by limited in-house infrastructure, is increasing the outsourcing of R&D and manufacturing tasks. This trend, coupled with a stringent regulatory environment and cost-containment pressures, positions CDMOs as strategic partners across the topical drug lifecycle—from concept to commercial launch.

Increased demand for transdermal drug delivery systems targeting chronic pain, hormonal therapies, and CNS disorders.

Rising outsourcing from specialty pharma and virtual biotech firms, lacking in-house development capabilities.

Adoption of novel formulation technologies such as nanoemulsions, lipid-based carriers, and microneedle systems.

Expansion of CDMO services into early-phase development, including formulation screening, stability studies, and pilot-scale manufacturing.

Heightened regulatory scrutiny on topical generics, driving need for bioequivalence testing, in vitro permeation studies (IVPT), and regulatory consultancy.

Strong growth in dermatological product pipelines, especially for eczema, psoriasis, acne, and fungal infections.

Strategic partnerships and acquisitions as CDMOs enhance topical manufacturing capabilities and geographical reach.

Customization of formulation characteristics (e.g., spreadability, absorption, fragrance) for brand differentiation in OTC products.

Growing interest in topical cannabinoid and cosmeceutical products, creating new demand for niche CDMO expertise.

| Report Coverage | Details |

| Market Size in 2025 | USD 51.46 Billion |

| Market Size by 2034 | USD 137.06 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 11.5% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product Type, Service Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled | Lubrizol Life Science; Cambrex Corporation; Contract Pharmaceuticals Limited; Bora Pharmaceutical CDMO; Ascendia Pharmaceuticals; Pierre Fabre group; Piramal Pharma Solutions; DPT Laboratories, LTD.; MedPharm Ltd.; PCI Pharma Services |

A primary driver fueling the topical drugs CDMO market is the rising complexity of topical drug formulations, which require specialized formulation science, analytical development, and manufacturing techniques. Unlike systemic drugs, topicals must navigate challenges related to skin permeability, drug solubility, rheological properties, and local bioavailability—factors that can significantly influence therapeutic efficacy and consumer acceptance.

For pharmaceutical companies, particularly those lacking internal formulation labs or pilot-scale manufacturing units, outsourcing to CDMOs offers access to domain expertise, equipment, and regulatory support. CDMOs can optimize excipient combinations, enhance drug absorption, and improve the aesthetic qualities of formulations to meet both clinical and commercial goals. With increasingly stringent quality standards and evolving patient expectations, this trend toward strategic CDMO collaboration is expected to grow stronger.

A major restraint in the topical drugs CDMO market is the regulatory and technical complexity involved in establishing bioequivalence for topical generics. Unlike oral generics, where pharmacokinetic endpoints can easily demonstrate similarity, topical drugs often require alternative bioequivalence approaches, such as in vitro release testing (IVRT) and in vitro permeation testing (IVPT), which are not only costly but also methodologically demanding.

Additionally, the lack of global harmonization in regulatory pathways complicates product registration across geographies. CDMOs must invest heavily in compliance, analytical validation, and dossier preparation to support clients through approval processes. These challenges can increase project timelines and raise costs, making the outsourcing model less attractive for some small or cost-sensitive developers.

A compelling opportunity lies in the expansion of transdermal delivery systems for systemic therapies, such as hormonal, analgesic, cardiovascular, and CNS drugs. These patches and gels offer controlled, non-invasive drug delivery, often enhancing compliance and avoiding gastrointestinal or hepatic metabolism.

CDMOs with capabilities in transdermal formulation, reservoir or matrix design, adhesive technologies, and release kinetics modeling are uniquely positioned to capture this growth. Additionally, interest in transdermal cannabis-based formulations, nicotine replacement patches, and extended-release analgesics presents new frontiers for development.

With aging populations and increased interest in convenient, self-administered therapies, transdermal delivery is gaining traction—creating demand for CDMOs that can offer end-to-end services from prototype design to GMP-scale manufacturing.

Semi-solid formulations currently dominate the topical drugs CDMO market, with creams, gels, and ointments being widely used across dermatology, pain management, and anti-infective applications. These formats are favored for their ease of application, local action, and patient familiarity. CDMOs play a crucial role in optimizing viscosity, spreadability, drug release, and preservative efficacy to meet product performance and shelf-life requirements.

Formulations such as steroid creams for eczema, antifungal ointments, or NSAID gels for joint pain continue to witness robust demand. The ability of CDMOs to customize sensory attributes (e.g., non-greasy feel, fragrance masking) is also key for client differentiation, especially in the consumer health and OTC segments.

Transdermal products represent the fastest growing segment, driven by their ability to provide sustained, systemic drug delivery without the need for injections or oral administration. Innovations in patch technology—such as iontophoresis, microneedles, and multi-day delivery systems—are unlocking new therapeutic categories. CDMOs with expertise in adhesive technology, multilayer lamination, and drug-excipient compatibility are in high demand as pharma companies explore transdermal applications for hormonal, CNS, and pain-related indications.

Contract manufacturing services currently dominate the CDMO landscape, particularly for marketed topical products requiring scalability and GMP compliance. Established CDMOs are relied upon for high-volume production of generic and branded creams, ointments, gels, and patches. These services encompass bulk formulation, filling, packaging, and secondary labeling under strict quality systems.

However, contract development services are expanding rapidly, as clients increasingly seek end-to-end solutions starting from feasibility studies, prototype formulation, analytical method development, and clinical supply manufacturing. Early-stage support is particularly valuable for small pharma, virtual biotechs, and consumer health companies developing differentiated topical products. This segment also includes reformulation projects, lifecycle extensions, and support for regulatory submissions such as ANDAs or 505(b)(2) filings.

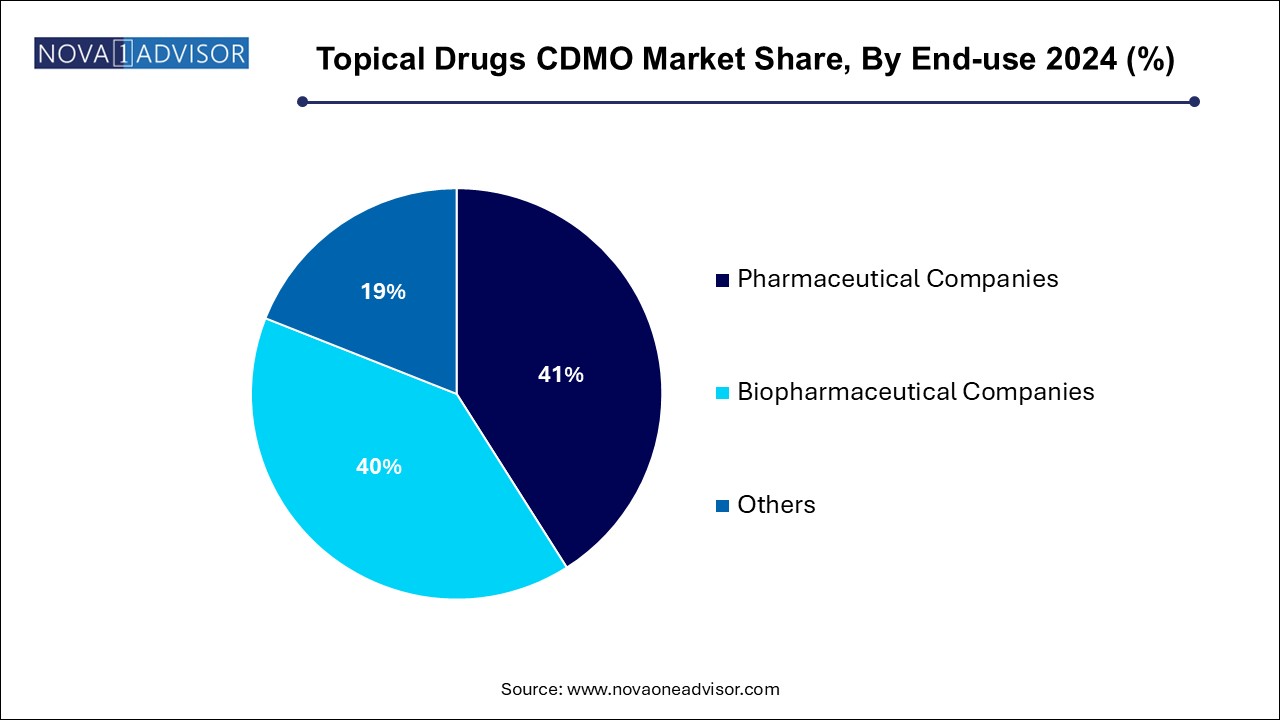

The pharmaceutical companies segment dominated the market with the largest revenue share of 41.0% in 2024. With both large and mid-sized players outsourcing routine manufacturing as well as novel formulation development. Dermatology, analgesics, and anti-infective portfolios are common areas of focus, especially with the increasing availability of off-patent APIs. These companies benefit from CDMOs’ ability to rapidly scale production, ensure regulatory compliance, and support global distribution.

Biopharmaceutical companies represent the fastest growing end-user segment, especially those exploring biologic topical agents, RNAi delivery, or combination products. Topical biologics require highly specialized formulation approaches to maintain molecule stability and skin penetration. CDMOs that can offer aseptic processing, novel excipient screening, and analytical characterization tailored to biologics are becoming key innovation partners.

Asia Pacific held the largest revenue share of 31.5% in 2024, followed by North America. driven by a combination of cost advantages, expanding healthcare access, and a growing generic pharmaceutical sector. Countries like India and China are witnessing increased outsourcing activity due to the presence of GMP-compliant facilities, skilled labor, and growing expertise in semi-solid and transdermal manufacturing.

Additionally, regional demand for dermatological and pain management products—often topical in nature—is rising with increasing disposable income and awareness of personal care. CDMOs in Asia are scaling up operations not just to serve regional clients but also to act as offshore partners for Western pharmaceutical companies looking to reduce costs and diversify supply chains.

North America leads the topical drugs CDMO market, attributed to a mature pharmaceutical ecosystem, strong outsourcing culture, and a large number of dermatological product developers. The U.S. is home to numerous CDMOs offering specialized topical services, including companies with expertise in both Rx and OTC products. Regulatory clarity provided by the FDA—through pathways such as the ANDA and the Product-Specific Guidances (PSGs)—encourages topical generic development and associated CDMO services.

Moreover, the presence of industry leaders and a growing emphasis on lifecycle management strategies among Big Pharma clients supports consistent CDMO demand. CDMOs in the region are expanding capacity, incorporating advanced analytics, and forming strategic partnerships to serve both domestic and global markets.

March 2025 – Recipharm announced the expansion of its topical manufacturing facility in France, adding a new semi-solid formulation line for contract services in dermatology.

December 2024 – MedPharm signed a strategic partnership with a U.S.-based biotech to develop a novel topical delivery system for cannabinoid-based pain relief therapy.

September 2024 – Alcami Corporation acquired a specialist topical CDMO, enhancing its capabilities in transdermal and nasal formulations.

July 2024 – DPT Laboratories launched a new R&D center in San Antonio, focusing on formulation development for topical generics and complex creams.

May 2024 – FormulationRx received FDA approval for its GMP facility upgrade, enabling commercial-scale manufacturing of topical hormone replacement patches for North American clients.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the topical drugs CDMO market

By Product Type

By Service Type

By End-use

By Regional