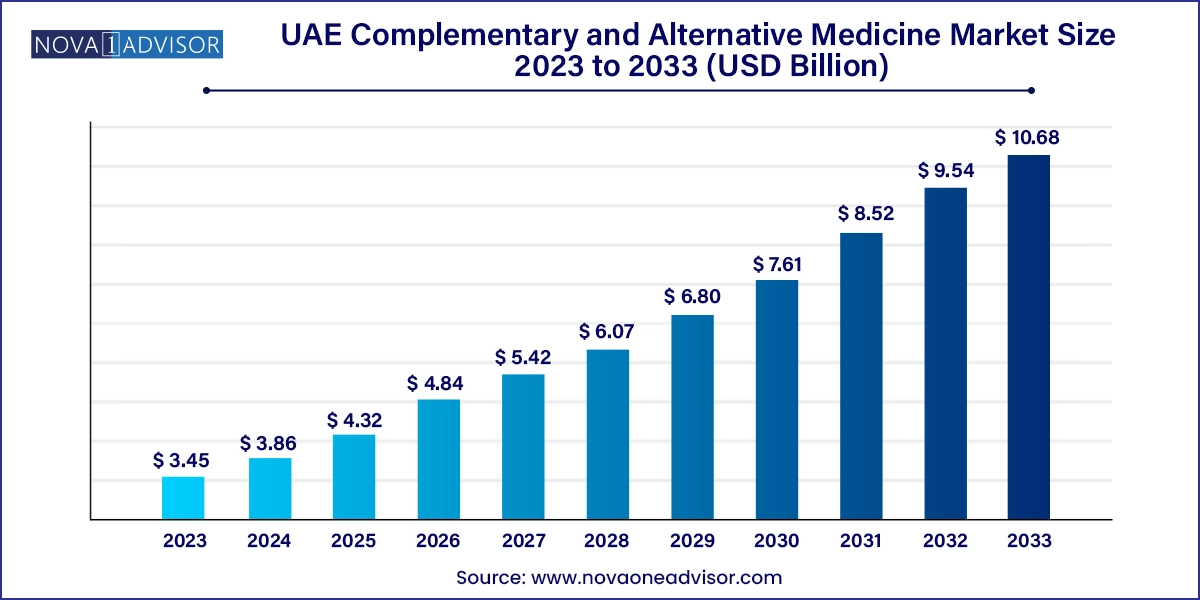

The UAE complementary and alternative medicine market size was exhibited at USD 3.45 billion in 2023 and is projected to hit around USD 10.68 billion by 2033, growing at a CAGR of 11.96% during the forecast period 2024 to 2033.

The UAE Complementary and Alternative Medicine (CAM) market is emerging as a vital component of the nation's wellness and healthcare ecosystem. With its multicultural population, rising awareness of holistic health, and government-backed integrative healthcare initiatives, the UAE is uniquely positioned to foster the growth of CAM practices such as naturopathy, Ayurveda, homeopathy, traditional Arabic medicine, acupuncture, chiropractic care, and mind-body healing techniques.

Traditionally viewed as supplementary to allopathic medicine, CAM has gained ground in the UAE due to a combination of factors. These include rising chronic lifestyle conditions such as obesity, diabetes, and stress-related disorders; growing dissatisfaction with conventional pharmaceutical treatments; and increasing demand for personalized, natural, and preventive health solutions. In response, the UAE Ministry of Health and Prevention (MoHAP) and the Department of Health (DoH) in Abu Dhabi, along with Dubai Health Authority (DHA), have introduced regulations and licensing for CAM professionals and clinics, enabling the practice to flourish within a structured framework.

Dubai and Abu Dhabi have become CAM hubs in the region, with several integrative medical centers, Ayurvedic clinics, and holistic therapy providers expanding their services. Medical tourism, too, plays a significant role in market expansion, as international patients seek CAM treatments for stress relief, chronic pain, infertility, and overall wellness. Simultaneously, CAM is becoming more accessible through luxury spas, wellness retreats, telehealth platforms, and e-commerce channels offering herbal remedies and therapies.

As the line between wellness and healthcare continues to blur, the UAE CAM market is entering a transformative phase. A tech-savvy population, proactive government policies, and a dynamic wellness culture are expected to position the UAE as a regional leader in alternative and integrative medicine by the end of this decade.

Integration of CAM into Mainstream Clinics: Hospitals and licensed health centers in Dubai and Abu Dhabi are increasingly offering CAM alongside conventional medicine, especially for chronic pain and women’s health.

Growing Demand for Traditional Arabic and Asian Therapies: Therapies rooted in Unani, Traditional Chinese Medicine (TCM), and Ayurveda are witnessing renewed interest, especially among the expatriate population.

Tech-Enabled Wellness Platforms: CAM providers are leveraging digital consultations, online bookings, and personalized health plans using mobile apps and AI.

Luxury Wellness Retreats Offering CAM: Five-star resorts and wellness destinations are now offering breathwork, Reiki, sound healing, and holistic detox programs.

Rise in Women-Centric CAM Services: Focused therapies addressing menstrual cycles, menopause, pregnancy support, and hormonal balance are expanding.

Regulatory Professionalization of CAM Practitioners: Increasing standardization of licenses and certifications is enhancing trust and legitimacy in the sector.

CAM for Mental Health: As stress, anxiety, and burnout rise, CAM methods like hypnotherapy, NLP, and meditation are becoming frontline tools in psychological care.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.86 Billion |

| Market Size by 2033 | USD 10.68 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 11.96% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Intervention, Application, Target Audience, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | UAE |

| Key Companies Profiled | Home of Wellness; Emirates European Medical Centre; TCMSH Middle East Ltd. Terms Ltd.; Oasis Care Ayurveda; HeliumDoc; Okadoc Technologies FZ-LLC; Hakkini; ZennMore; Nabta Health; Mediclinic Middle East |

The primary driver of the UAE CAM market is the increasing preference among consumers for natural, holistic, and preventive healthcare approaches. Across the country, there is a noticeable shift in patient behavior—from reactive treatment of diseases to proactive health management and wellness optimization. This shift is deeply rooted in growing awareness about the side effects of long-term pharmaceutical use, increasing stress levels due to urban lifestyles, and the global move toward sustainable and nature-based living.

Consumers are turning to treatments like Ayurveda, homeopathy, and acupuncture not just to cure illness but to prevent disease, reduce mental fatigue, enhance energy levels, and improve overall wellbeing. With social media influencers and wellness experts advocating herbal supplements, detox programs, and energy therapies, consumer interest in CAM has become mainstream. This cultural and behavioral evolution is fueling CAM demand across all age groups, genders, and income levels.

Despite its popularity, the CAM sector in the UAE faces a significant restraint in the form of limited insurance coverage, which can restrict access to a wider population. While the country has made notable progress in regulating and legitimizing CAM practices, most health insurance providers still categorize these treatments as elective or luxury services, resulting in out-of-pocket expenses for consumers.

This lack of coverage can deter lower- and middle-income groups from seeking alternative treatments, especially for chronic conditions requiring ongoing sessions (e.g., physiotherapy, acupuncture, or psychotherapy). Furthermore, many insurers require referrals from conventional doctors or impose limits on CAM visits, adding administrative hurdles. Until insurance reimbursement policies evolve to accommodate proven CAM modalities, the full market potential will remain constrained.

A major opportunity lies in the increasing government support for integrative healthcare models, which combine conventional medical treatment with licensed CAM therapies. Both Dubai and Abu Dhabi authorities have introduced frameworks to regulate and promote CAM as a complementary health option. For example, the DHA offers licensing for Ayurvedic, homeopathy, Chinese medicine, and other practitioners, ensuring quality control and legal legitimacy.

The UAE Vision 2031 also emphasizes preventive health, mental wellness, and alternative health delivery models—creating a strong policy foundation for CAM expansion. If CAM therapies continue to receive support through inclusion in public health campaigns, preventive care programs, and wellness initiatives, they could play a transformative role in shaping the UAE’s future healthcare landscape. This presents vast opportunities for clinics, product manufacturers, app developers, and training institutes operating in the CAM domain.

Traditional Alternative Medicine & Botanicals dominated the UAE CAM market, largely due to the cultural relevance, historical continuity, and increasing professionalization of practices like Ayurveda, homeopathy, and Traditional Arabic Medicine. Expatriate communities from India, Pakistan, China, and Arab nations tend to prefer traditional medicine systems from their native cultures. Ayurvedic wellness clinics in Dubai and Abu Dhabi are seeing a surge in demand for detox treatments, herbal consultations, and lifestyle therapies. Meanwhile, homeopathy is used widely for pediatric, dermatological, and hormonal conditions, often alongside allopathic treatments.

Mind Healing is emerging as the fastest-growing intervention, with rising adoption of hypnotherapy, NLP (Neuro-linguistic Programming), and meditation to address the mental health epidemic. Corporate professionals in particular are seeking non-pharmacological approaches to manage burnout, anxiety, and chronic stress. The pandemic has further heightened awareness of psychological health, leading to the normalization of therapies like psychotherapy, breathwork, and transcendental meditation. This segment is also benefiting from online platforms offering digital mental health coaching, group therapy, and live meditation sessions.

Psychological conditions, particularly stress, anxiety, and depression, represent the dominant application segment, reflecting the cultural and medical recognition of mental health as a critical area of concern in the UAE. In urban hubs like Dubai and Abu Dhabi, the high-paced corporate lifestyle, expat isolation, and academic pressures on youth are contributing to mental fatigue. CAM therapies such as Reiki, sound healing, hypnotherapy, and aromatherapy are increasingly used as complementary interventions to improve emotional regulation, sleep quality, and concentration.

Women’s health is the fastest-growing application, as increasing numbers of female clients seek natural therapies to manage hormonal imbalances, menstrual irregularities, fertility issues, and menopause. Specialized women’s wellness centers offering Ayurvedic massages, hormonal acupuncture, homeopathy, and herbal tonics are expanding across Dubai and Sharjah. Furthermore, prenatal yoga, reflexology, and postnatal support sessions are being adopted widely, indicating a strong female user base for CAM.

The 15- to 64-year-old age group dominates the CAM target demographic, encompassing the working population, parents, and fitness enthusiasts. This group is highly proactive about wellness, interested in self-optimization, and willing to invest in integrative care options. From gym-goers using chiropractic care and breathwork to working professionals using acupuncture for migraine or NLP for anxiety, the engagement level is consistently high.

The 65 and above age group is the fastest-growing, particularly due to its interest in non-invasive, drug-free pain relief and chronic disease support. Elderly patients are turning to acupuncture for arthritis, homeopathy for digestion, and Ayurvedic massage for muscle relaxation. Moreover, family caregivers are exploring CAM options as complementary therapies to reduce pharmaceutical load and improve life quality in older adults.

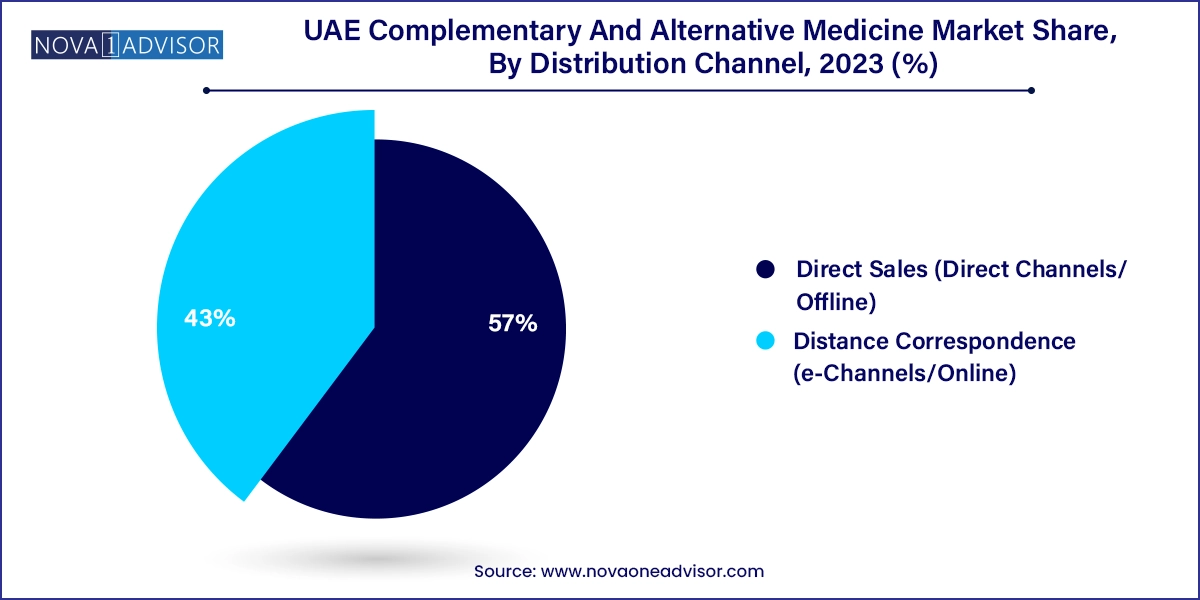

Direct Sales (offline channels) dominate the market, with CAM services primarily delivered through clinics, wellness centers, hospitals, and licensed therapy providers. Physical consultations remain the preferred method for personalized diagnoses and treatments, particularly in hands-on therapies like acupuncture, reflexology, and osteopathy. Luxury wellness resorts, spas, and traditional medicine centers are central to this distribution model, offering both preventive and therapeutic services.

Distance correspondence (e-Channels) is the fastest-growing distribution channel, particularly post-COVID-19. Online bookings, teleconsultations with homeopaths or mind therapists, and the e-commerce purchase of herbal remedies, supplements, and essential oils are gaining popularity. Platforms offering virtual yoga sessions, audio meditation, and personalized therapy plans are capturing the tech-savvy younger demographic, and subscription models are on the rise.

Within the United Arab Emirates, the CAM market is led by Dubai and Abu Dhabi, where progressive healthcare policies, affluent consumers, and a robust wellness tourism sector provide fertile ground for CAM growth. Dubai's status as a global city brings together practitioners from Ayurveda, Chinese medicine, Arabic medicine, and integrative psychotherapy under regulated medical frameworks. The Dubai Health Authority’s active licensing of CAM professionals has created trust and credibility in the market.

Abu Dhabi has also prioritized integrative healthcare through the Department of Health’s CAM regulations, enabling medical centers to include licensed acupuncture, osteopathy, and mind-body therapists on staff. Sharjah and Ras Al Khaimah are seeing growth in community clinics offering traditional Arabic healing and massage therapies, especially in residential areas. The CAM sector across the UAE is becoming a core component of the country’s strategy to balance modern and traditional approaches to healthcare and wellness.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the UAE complementary and alternative medicine market

Intervention

Application

Target Audience

Distribution Channel