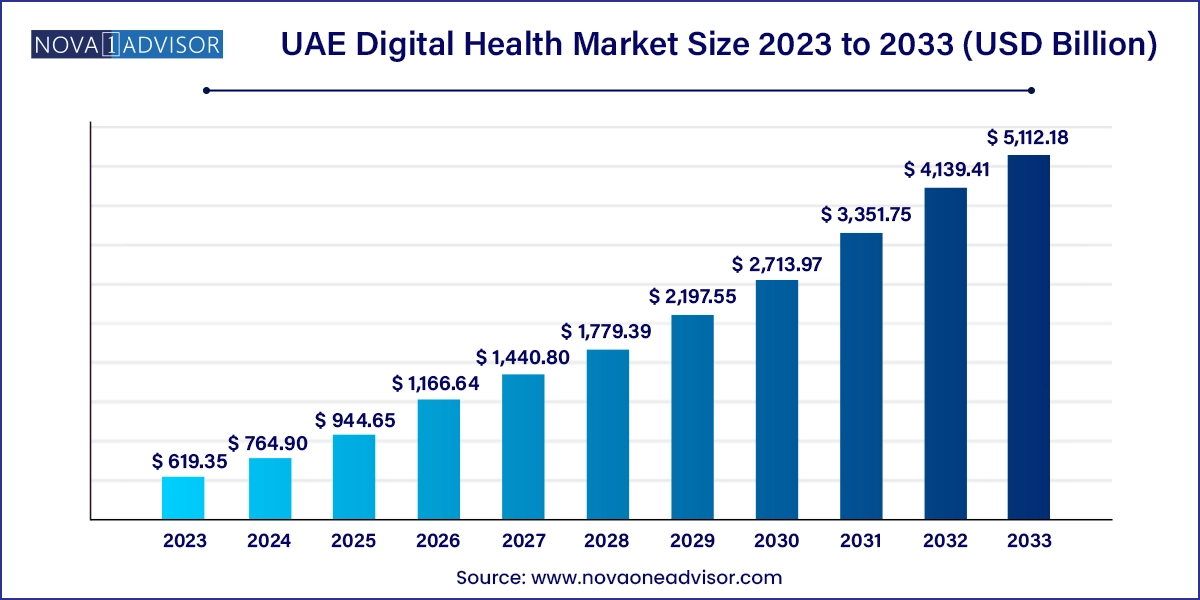

The UAE digital health market size was exhibited at USD 619.35 million in 2023 and is projected to hit around USD 5,112.18 million by 2033, growing at a CAGR of 23.54% during the forecast period 2024 to 2033.

The United Arab Emirates (UAE) digital health market is undergoing a remarkable transformation, driven by technological innovation, government initiatives, and a national agenda focused on smart healthcare. The convergence of information technology, medical science, and consumer-centric solutions is reshaping the UAE’s healthcare delivery system into a digital-first ecosystem. From telemedicine consultations to wearable devices, and from AI-powered diagnostics to integrated electronic health records (EHRs), the UAE has emerged as a regional leader in digital health adoption.

In alignment with the UAE Vision 2031 and the National Strategy for Artificial Intelligence, the nation is focusing on modernizing healthcare infrastructure using digital tools. Public and private healthcare providers are investing heavily in digital platforms that support remote monitoring, chronic disease management, real-time diagnostics, and predictive analytics. Dubai and Abu Dhabi, in particular, have seen rapid digitization in hospitals and clinics, with projects such as NABIDH (National Unified Medical Record) and Malaffi (Abu Dhabi’s HIE platform) setting benchmarks for interoperability and patient data centralization.

The COVID-19 pandemic further accelerated digital health adoption, pushing remote consultations, health apps, and home monitoring systems into mainstream use. Today, digital health solutions in the UAE serve a wide range of purposes, including managing obesity, diabetes, cardiovascular diseases, mental health, and maternal care. The market is characterized by increasing participation from global med-tech companies, local startups, telecom providers, and insurance firms all contributing to an integrated health technology environment.

Government-Led Digital Health Infrastructure Projects: Initiatives like NABIDH and Malaffi are centralizing EHRs and creating national health information exchanges.

Expansion of mHealth Applications: Smartphones are the platform of choice for fitness tracking, remote diagnostics, chronic disease management, and mental health services.

AI and Big Data Integration in Healthcare Analytics: Predictive health modeling and personalized medicine are gaining traction using AI-driven analytics tools.

Telehealth for Expats and Remote Populations: Video consultations, tele-ICUs, and remote prescription refills are helping bridge gaps in access to care.

Wearables and Connected Devices Boom: There is a surge in the adoption of smartwatches, biosensors, and home-use diagnostic tools among fitness-conscious and chronic illness patients.

Cross-sector Collaboration: Partnerships between healthcare providers, technology firms, and telecom companies are enhancing app development and remote health delivery.

Rise of Healthtech Startups in Free Zones: Dubai Science Park and Abu Dhabi Global Market are hubs for innovation, attracting venture capital for digital health startups.

| Report Coverage | Details |

| Market Size in 2024 | USD 764.90 Million |

| Market Size by 2033 | USD 5,112.18 Million |

| Growth Rate From 2024 to 2033 | CAGR of 23.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Component, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.A.E. |

| Key Companies Profiled | Oracle Cerner; Apple Inc.; Epic Systems Corp.; QSI Management, LLC; AT&T; Vodafone Group; Google, Inc.; Samsung Electronics Co. Ltd.; Softserve; Computer Programs and Systems, Inc.; IBM Corp.; CISCO Systems, Inc. |

Software solutions dominate the market, driven by the need for integrated health records, teleconsultation platforms, mobile health applications, and AI-powered analytics engines. EHR systems, in particular, are key infrastructure components across both government and private hospitals. Health apps like Shefaa, Altibbi, and Vezeeta are also expanding functionality through software updates and AI integration.

.webp)

Services, however, are the fastest-growing component, as healthcare delivery moves toward digital-first interaction models. These include remote diagnosis, post-discharge monitoring, chronic disease care coordination, and elderly health support. With the rise of subscription-based digital services, hospitals and clinics are monetizing virtual consultation packages, personalized wellness programs, and real-time nursing services through telemonitoring. The outsourcing of digital health management and analytics services is also fueling this segment’s rapid growth.

mHealth dominated the UAE digital health market, especially through the proliferation of health apps, wearable trackers, and remote monitoring devices. Consumers in the UAE are highly tech-savvy and receptive to mobile-first solutions. mHealth platforms offering fitness tracking, pregnancy monitoring, chronic disease management, and mental health support are widely used, particularly among the millennial population and expatriate community. Devices such as Apple Watch, Fitbit, and Huawei wearables are popular for tracking heart rate, activity, and sleep patterns. Furthermore, mobile apps from public providers like DHA and SEHA are increasingly used for appointment booking, prescription refills, and video consultations.

Telehealthcare is the fastest-growing sub-segment, with exponential growth since the pandemic. The inclusion of video consultations, LTC (long-term care) monitoring, and remote medication adherence solutions has improved access to care, especially for expats with chronic conditions or elderly patients who prefer in-home care. Hospitals and insurance companies now offer 24/7 virtual care platforms, supported by AI-based triage bots. Telehealth expansion is also being driven by strong regulatory backing, and its adoption continues to grow with advancements in 5G connectivity and IoT integration.

Chronic disease management leads the application segment, especially in addressing diabetes, obesity, and cardiovascular conditions, which are prevalent in the UAE. Digital solutions offering blood glucose tracking, remote blood pressure monitoring, lifestyle coaching, and diet management are widely adopted, often integrated with insurance wellness programs.

Mental health and wellness are emerging as high-growth applications. Post-pandemic, there is increased attention to stress, anxiety, burnout, and sleep disorders, and digital platforms offering mindfulness apps, sleep tracking, virtual CBT, and therapist consultations are gaining popularity. Mental health support tailored for women, children, and the elderly has also seen significant traction through both public and private platforms.

Providers are the dominant end-users, including public hospitals like SEHA in Abu Dhabi and DHA-run hospitals in Dubai, which are investing in EHR, tele-ICU, and mobile diagnostics. Private hospital chains such as NMC Healthcare, Mediclinic, and Aster DM are also digitizing patient journeys from appointment booking to discharge planning.

Payers and patients are increasingly becoming active stakeholders in digital health consumption. Insurance firms are partnering with digital platforms to provide preventive wellness, remote screening, and engagement tools for members. Patients, particularly from the younger demographic, are driving demand for DIY health apps, symptom checkers, and online therapy sessions.

The UAE’s digital health readiness varies across its emirates, but Dubai leads the market in terms of technology implementation, public-private collaboration, and consumer engagement. The NABIDH initiative, Smart Dubai’s tech stack, and the presence of healthtech innovation hubs have made Dubai a magnet for global and regional digital health players.

However, Abu Dhabi is the fastest-growing region, especially with the success of the Malaffi HIE platform, and growing investments in AI-powered hospital systems, digital clinical trials, and tele-mental health services. The Abu Dhabi Department of Health (DOH) is actively encouraging startup participation and has signed MoUs with global players for digital innovation pilots, making it the next frontier for smart healthcare delivery in the region.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the UAE digital health market

Technology

Component

Application

End-use