The UK gummy market size was exhibited at USD 387.15 million in 2023 and is projected to hit around USD 1,214.29 million by 2033, growing at a CAGR of 12.11% during the forecast period 2024 to 2033.

The UK gummy market has experienced a notable transformation over the past decade, transitioning from a confectionery-focused category into a diversified segment encompassing health, wellness, and functional nutrition. Traditionally dominated by sugary gelatin-based sweets targeted at children, the market has now broadened its appeal to adult consumers, particularly those seeking enjoyable alternatives to pills and capsules for nutritional supplementation.

This evolving preference has been fueled by an increased emphasis on preventive health, dietary awareness, and convenience-driven consumption. Today’s consumers are not only interested in flavor but also in the health benefits derived from their daily intake. Consequently, gummies fortified with vitamins, minerals, omega fatty acids, CBD, probiotics, and other bioactive ingredients have gained substantial popularity.

From vegan-friendly formulations to sugar-free variants and clinically validated ingredients, product innovation remains a cornerstone in the UK gummy sector. The country’s mature retail infrastructure, thriving e-commerce ecosystem, and a growing base of health-conscious individuals provide fertile ground for market expansion. With millennials and Gen Z shoppers gravitating towards personalized wellness, the UK's gummy market is set for robust growth over the next decade.

Rise of Functional Gummies: Gummies with active ingredients like vitamins, probiotics, CBD, and even nootropics are gaining traction as consumers seek multifunctional wellness in a palatable form.

Vegan and Plant-Based Formulations: A surge in veganism and flexitarian diets in the UK is driving demand for plant-based gelatin substitutes such as pectin and agar-agar.

Kids & Geriatric Wellness Focus: Specialized formulations for children and elderly populations—featuring immunity boosters, bone health, and cognitive function enhancers—are becoming mainstream.

CBD & CBN Gummy Surge: Legalized cannabidiol (CBD) usage in supplements is supporting a new sub-category of gummies targeted at stress, sleep, and anxiety relief.

Clean Label Movement: UK consumers are increasingly scrutinizing ingredient lists, favoring gummies with natural flavors, colors, and zero synthetic additives or preservatives.

Personalized Nutrition: Subscription-based models offering customized gummy vitamins based on DNA or lifestyle quizzes are disrupting traditional retail models.

Digital and DTC Channels Growing: Brands are increasingly shifting towards online-first or direct-to-consumer channels with engaging, social media-fueled branding strategies.

| Report Coverage | Details |

| Market Size in 2024 | USD 434.03 Million |

| Market Size by 2033 | USD 1,214.29 Million |

| Growth Rate From 2024 to 2033 | CAGR of 12.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use, Ingredient, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | UK |

| Key Companies Profiled | Amway Corp; Bayer AG; Chruch & Dwight Co. Inc.; Ernest Jackson & Co. Ltd.; Ion Labs Inc.; Pfizer Inc.; Reckitt Benckiser Group Plc; UK Gummy Company; Nature’s Bounty Inc.; Perrigo Co. |

One of the most significant drivers of the UK gummy market is the rise in public health consciousness and the subsequent demand for nutritional supplements. The post-pandemic shift in consumer priorities towards proactive wellness and immune support has propelled the market for vitamins, minerals, and botanical ingredients. According to the UK’s Health Food Manufacturers' Association (HFMA), over 70% of adults now regularly consume dietary supplements, with a growing percentage preferring gummies over traditional forms.

Gummies offer a user-friendly and flavorful alternative for populations averse to swallowing tablets—especially children, seniors, and those with medical conditions like dysphagia. Moreover, with the integration of functional benefits—such as stress management, sleep support, and gut health—these products are no longer niche but mainstream. The convenience, taste, and fun format of gummies make them especially attractive to younger demographics, who view wellness through the lens of lifestyle rather than medication.

Despite promising growth, the UK gummy market faces considerable restraints in the form of regulatory and labeling complexities. Gummies, particularly those containing CBD, nootropics, or psilocybin compounds, operate in a gray area within the UK's evolving food and drug legislation. While vitamins and minerals are relatively straightforward to regulate, novel food ingredients must undergo rigorous approval processes under the UK's Food Standards Agency (FSA) guidelines.

Misinformation or exaggerated health claims have also resulted in increased scrutiny. Brands must invest in clinical substantiation and adhere to advertising standards to ensure consumer trust and avoid penalties. Moreover, ensuring the stability and bioavailability of active ingredients in gummy matrices poses technical challenges, especially when dealing with heat-sensitive compounds. These hurdles can increase costs, delay product launches, and deter smaller entrants from participating in the high-growth segments.

The most promising opportunity lies in the advent of therapeutic and psychotropic gummy supplements. While still a nascent category in the UK due to legal constraints, products featuring ingredients like CBN (cannabinol) and psilocybin microdoses are increasingly being explored for their therapeutic benefits in treating anxiety, sleep disorders, PTSD, and depression. Research institutions and startups are piloting trials for mushroom-based adaptogens and psychedelic-assisted therapy.

In parallel, gummies infused with ingredients such as ashwagandha, L-theanine, melatonin, and magnesium for stress relief and sleep support are gaining commercial viability. As public attitudes soften toward plant-based and psychedelic therapies, the UK's regulatory bodies may soon establish clearer pathways for these products. Forward-looking brands that invest in R&D, legal compliance, and education can capture substantial market share in this high-potential segment.

The vitamins segment dominated the UK gummy market in 2024 and continues to hold a substantial share due to widespread consumer familiarity, efficacy, and demand across age groups. Gummies enriched with multivitamins (especially A, C, D, and E), B-complex, and immunity-focused combinations have become staple supplements in households. Notably, the UK's government initiative recommending daily Vitamin D supplements during the winter months has fueled category adoption. Gummy vitamins are also popular among school-aged children due to their ease of consumption and pleasant flavors, encouraging long-term compliance.

Meanwhile, the CBD/CBN segment is the fastest-growing due to increasing legalization and consumer interest in natural remedies for stress, inflammation, and sleep. Brands like Cannaray and Naturecan are already capitalizing on this demand with flavored, THC-free CBD gummies that appeal to health-conscious adults. While still facing regulatory scrutiny, the segment benefits from growing public trust and favorable media narratives. Innovative offerings combining CBD with melatonin or magnesium further enhance the therapeutic appeal of these gummies, propelling rapid market penetration.

Among adult end-users, women dominate the UK gummy market. Wellness-focused female consumers, particularly in the 25–45 age bracket, have embraced gummy supplements as a lifestyle staple. Products targeting hormonal balance, prenatal health, skin glow, and mental well-being resonate strongly with this group. Brands like Vitabiotics and Nutrafolic offer women-specific lines that include biotin, folate, and iron in gummy formats. The convenience and aesthetic appeal of gummies enhance brand loyalty among female shoppers who seek daily wellness in enjoyable formats.

The geriatric population represents the fastest-growing end-user segment. With an aging population and increased focus on mobility, immunity, and bone health, seniors are turning to supplements to manage chronic conditions. However, due to swallowing difficulties and pill fatigue, gummies offer a highly accessible delivery method. Formulations featuring calcium, Vitamin D3, collagen, and omega-3s are especially relevant. Companies are also developing sugar-free and low-glycemic gummies tailored for older adults with diabetes or dietary restrictions, further expanding this segment's market potential.

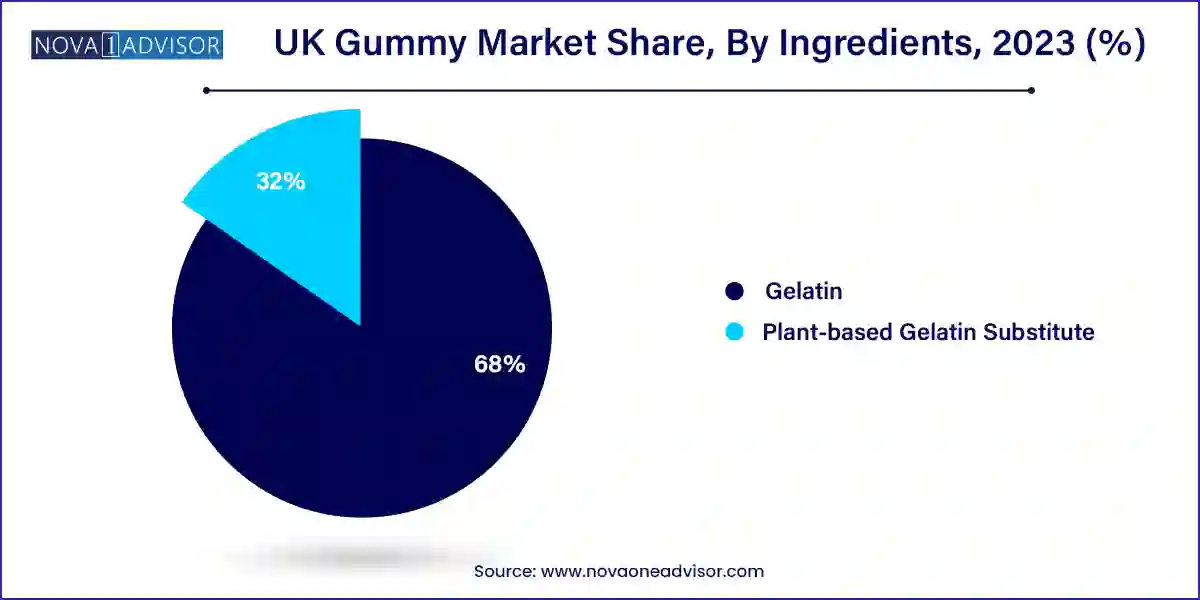

The gelatin-based gummy market in the UK accounted for 68.0% in the year 2023. Derived mainly from animal collagen, gelatin offers desirable texture and elasticity, making it ideal for mass production. Most traditional vitamin and mineral gummies on retail shelves still contain gelatin as the binding agent. However, as ethical concerns around animal products and environmental sustainability rise, brands are reassessing their formulation strategies.

In contrast, plant-based gelatin substitutes are growing rapidly. With veganism gaining momentum in the UK—especially among younger consumers—gummy manufacturers are turning to pectin, agar-agar, and tapioca starch to cater to these preferences. For instance, brands like Nourished and Vegums focus exclusively on vegan gummy products. Although plant-based variants may pose manufacturing challenges such as shelf stability and chewiness, ongoing R&D and consumer demand for cruelty-free products are accelerating this segment's evolution.

The offline channel, particularly through pharmacies and hypermarkets/supermarkets, leads the UK gummy market in terms of sales volume. Pharmacies like Boots and Superdrug play a crucial role in consumer education, while grocery retailers such as Tesco, Sainsbury’s, and Asda offer convenience and visibility for impulse purchases. Brick-and-mortar stores remain trusted sources for health products, especially among older consumers and parents buying for children.

However, the online segment is the fastest expanding due to the growth of e-commerce, direct-to-consumer models, and personalized vitamin subscription services. Websites like Amazon, Holland & Barrett, and brand-owned platforms enable product comparisons, detailed reviews, and convenient auto-replenishment. Moreover, social media influencers and wellness blogs are driving brand discovery and community engagement. Startups are leveraging tech-enabled personalization, offering gummy packs tailored to individual health needs based on online quizzes, further enhancing online channel growth.

The UK gummy market is uniquely positioned at the intersection of tradition and innovation. The country boasts a well-established vitamin and supplement culture, further reinforced by NHS-backed campaigns promoting nutritional well-being. However, the UK’s evolving consumer demographics, such as growing multi-ethnic populations, plant-based adopters, and tech-savvy Gen Z shoppers, are redefining market dynamics.

London remains a hotspot for nutraceutical innovation, with startups and incubators pioneering clean-label, functional, and vegan gummies. Additionally, the post-Brexit regulatory shift has led to more agile product launches as brands now adapt to both UK and EU standards. The high urban population, access to healthcare professionals, and emphasis on preventative wellness continue to support robust market performance across the country. With expanding consumer awareness, evolving delivery formats, and increased personalization, the UK stands as one of the most promising and sophisticated gummy markets in Europe.

Nourished (March 2024): The UK-based brand Nourished announced a partnership with the NHS to pilot personalized gummy vitamin packs for frontline healthcare workers, focusing on stress reduction and immune support.

Cannaray (January 2024): Cannaray launched a new range of CBD-infused gummies targeting sleep support, combining cannabidiol with chamomile and melatonin, positioned for adult urban professionals.

Vitabiotics (December 2023): Vitabiotics expanded its Pregnacare line by introducing vegan prenatal gummies fortified with iron and folate, aiming at conscious expectant mothers.

Holland & Barrett (October 2023): The retailer introduced a new private-label gummy supplement line under its "Live Well" range, focusing on women's health, energy, and beauty from within.

NutraFizz (September 2023): The functional food startup raised £3 million in Series A funding to scale its line of adaptogen-infused gummies with ingredients such as ashwagandha and Rhodiola.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the UK gummy market

Product

End-use

Ingredients

Distribution Channel