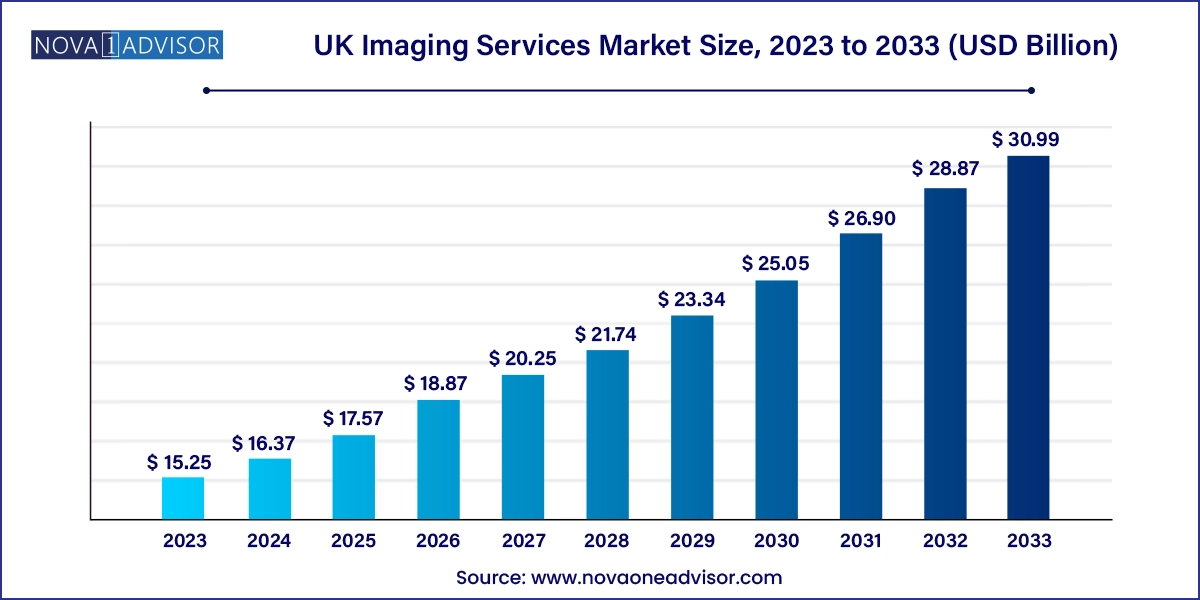

The UK imaging services market size was exhibited at USD 15.25 billion in 2023 and is projected to hit around USD 30.99 billion by 2033, growing at a CAGR of 7.35% during the forecast period 2024 to 2033.

The UK Imaging Services Market stands as a vital pillar in the country’s healthcare delivery system, providing diagnostic, monitoring, and screening solutions essential for clinical decision-making. Imaging services encompass a wide array of modalities, including X-rays, ultrasound, CT scans, MRI scans, and nuclear medicine. These technologies are used in diagnosing diseases ranging from fractures and infections to cancer, cardiovascular anomalies, and neurological disorders. In the UK, imaging services are provided through a mix of National Health Service (NHS) hospitals, private diagnostic centres, mobile imaging units, and increasingly, community-based hubs.

With an aging population, increasing prevalence of chronic diseases, and a greater focus on early disease detection, demand for imaging services across the UK has been on a steady rise. The COVID-19 pandemic, while initially reducing elective imaging procedures, has also underscored the critical importance of diagnostic services in healthcare preparedness. As elective procedures rebound and patient backlogs are addressed, the market has entered a phase of accelerated recovery and innovation.

A key feature of the UK imaging services market is its dual-structure, wherein the NHS provides the majority of services, supplemented by a robust and growing private sector. Public-private partnerships (PPPs) have become increasingly common, especially in addressing service bottlenecks and reducing NHS waiting times. Simultaneously, technological advancements in imaging modalities — such as faster MRI scans, AI-assisted image interpretation, and portable ultrasound devices — are enhancing diagnostic accuracy, reducing scan-to-report turnaround time, and facilitating early intervention.

Government efforts to digitize healthcare, investments in AI-based radiology platforms, and an increased focus on patient-centric care are reshaping the imaging services landscape in the UK. With strong policy support, infrastructure upgrades, and rising awareness of preventive healthcare, the imaging services market in the UK is expected to expand significantly over the next decade.

Integration of Artificial Intelligence (AI): AI tools are being integrated into diagnostic workflows for faster image interpretation, automated reporting, and triaging of high-risk cases.

Shift Toward Community Diagnostic Centres (CDCs): The NHS is establishing decentralized imaging hubs to reduce pressure on hospital imaging departments and improve patient access.

Growing Private Sector Involvement: Private diagnostic providers are partnering with NHS trusts and expanding standalone centres to meet increasing imaging demand.

Portable and Point-of-Care Imaging Devices: The rise of mobile and handheld ultrasound machines is enabling bedside diagnostics, particularly in emergency and rural settings.

Digital Imaging and Teleradiology: Cloud-based PACS (Picture Archiving and Communication Systems) and remote reporting services are gaining traction to manage high scan volumes.

Cancer Screening Initiatives: National programs for breast, colorectal, and lung cancer screening are driving demand for high-resolution and high-volume imaging.

Staffing and Radiologist Shortages: Skill shortages are prompting increased reliance on AI, automation, and international recruitment to support diagnostic capacity.

Equipment Modernization Programs: NHS and private providers are investing in newer-generation CT and MRI machines to replace aging infrastructure and improve image quality.

| Report Coverage | Details |

| Market Size in 2024 | USD 16.37 Billion |

| Market Size by 2033 | USD 30.99 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.35% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Modality, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Alliance Medical; InHealth Group; Neuromed Diagnostic Imaging Center; UNILAB; Medica Group; TIC Health; The Clinic; Affidea Group; Vista Health; Medical Imaging Partnership |

The primary growth driver for the UK imaging services market is the rising burden of chronic and age-related diseases that necessitate early diagnosis and continuous monitoring. According to the UK Office for National Statistics (ONS), over 18% of the UK population is aged 65 and above — a figure projected to increase steadily through the forecast period. This demographic shift is associated with higher incidences of musculoskeletal disorders, cardiovascular diseases, neurodegenerative conditions, and cancers — all of which rely heavily on imaging diagnostics for accurate diagnosis, treatment planning, and follow-up.

Imaging modalities such as MRI for neurological assessment, CT for cardiac imaging, and ultrasound for vascular conditions are becoming essential tools for managing the aging population’s health needs. The increasing complexity of medical conditions also calls for multi-modality diagnostic approaches, boosting the demand for integrated imaging service providers. As the UK transitions toward more personalized and preventive models of care, imaging will remain a central pillar, contributing not only to diagnosis but also to treatment monitoring and outcome evaluation.

Despite growing demand, the UK imaging services market faces a critical constraint in the form of radiologist and imaging technician shortages. According to the Royal College of Radiologists (RCR), the NHS in England faces a shortfall of thousands of radiologists, with many departments under significant operational stress. This workforce gap results in delayed reporting times, longer patient waiting lists, and suboptimal utilization of installed imaging equipment.

The shortage is exacerbated by increasing scan complexity, growing scan volumes, and a high attrition rate due to burnout and retirement. While AI and teleradiology solutions are helping mitigate the impact to some extent, the need for skilled professionals remains central to service delivery. Recruitment from overseas, expanded training capacity, and better workforce retention strategies are urgently required. Until these systemic workforce challenges are addressed, service scalability and quality assurance may remain constrained across various modalities.

One of the most promising opportunities in the UK imaging services market is the government-backed expansion of Community Diagnostic Centres (CDCs). In response to long NHS waiting lists and limited hospital imaging capacity, the Department of Health and Social Care launched a national plan to establish over 160 CDCs across England by 2025. These centres are designed to provide MRI, CT, ultrasound, and X-ray services outside of hospital settings, making diagnostic services more accessible and patient-centric.

This decentralization strategy offers tremendous opportunities for both public and private imaging service providers. NHS trusts can reduce hospital congestion and improve care coordination, while private providers can bid for service contracts, offer equipment leasing, or operate centres under public-private partnership models. With CDCs being equipped with advanced, high-throughput machines and digital infrastructure, they also open avenues for remote diagnostics, AI implementation, and integrated chronic disease management. This shift is expected to reshape how imaging services are accessed and delivered across the UK.

The MRI segment held the largest market share of 32.8% in 2023. driven by increasing demand for non-invasive, high-resolution imaging of soft tissues, brain structures, spinal injuries, and musculoskeletal disorders. MRI’s ability to diagnose complex conditions such as multiple sclerosis, tumors, and joint abnormalities has expanded its use in neurology, orthopedics, and oncology. Recent technological advancements, including 3T MRI, silent MRI, and cardiac MRI, have further broadened clinical applications. The NHS's ongoing MRI fleet modernization programs, coupled with growing private sector investment, are accelerating the installation of next-generation MRI scanners across UK facilities.

X-rays dominated the modality segment due to their wide application, affordability, and rapid image acquisition. X-ray imaging remains the first-line diagnostic tool for a broad range of clinical conditions, including fractures, infections, and respiratory issues. It is used across emergency departments, outpatient clinics, and dental settings, making it the most commonly performed diagnostic imaging procedure in the UK. The availability of digital radiography systems has further enhanced the efficiency and throughput of X-ray services, particularly within NHS community settings and mobile diagnostic units.

Hospitals hold the dominant position in the end-use segment, given their role as primary healthcare providers across the UK. NHS hospitals account for the bulk of imaging procedures, serving both emergency and elective care patients. These facilities house comprehensive imaging departments capable of multi-modality scanning, supported by specialist radiologists and interventional teams. Hospital-based imaging also benefits from direct integration with surgical and therapeutic services, enabling seamless care delivery. Moreover, hospitals are central to medical education and research, making them ideal for piloting AI and machine learning applications in radiology.

Diagnostic Imaging Centres are the fastest-growing segment, as the UK healthcare system seeks to expand capacity beyond traditional hospital settings. Private and independent imaging providers are increasingly setting up standalone facilities in urban, suburban, and even rural areas. These centres often operate extended hours, offer fast turnaround times, and serve both NHS-referred and self-paying patients. Their agility in adopting new technologies, delivering high-quality imaging, and partnering with insurers and corporates is driving growth. The integration of these centres within the NHS CDC program further amplifies their role in modernizing diagnostic services in the UK.

As a single-country focus market, the United Kingdom offers a unique landscape shaped by its publicly funded National Health Service (NHS), a growing private healthcare sector, and strong policy backing for diagnostic modernization. England accounts for the majority of imaging service utilization, followed by Scotland, Wales, and Northern Ireland. NHS England’s push for diagnostics transformation — through investments in digital infrastructure, AI, and mobile scanning units — is central to market dynamics. Simultaneously, Scotland has launched initiatives to improve rural diagnostic access through mobile MRI vans and teleradiology partnerships.

Urban centers like London, Manchester, and Birmingham serve as diagnostic hubs, with a concentration of teaching hospitals, specialist clinics, and private imaging chains. Meanwhile, rural and underserved regions are benefiting from community imaging programs and mobile diagnostics. With aging infrastructure and workforce limitations posing persistent challenges, the UK government is incentivizing innovation, outsourcing, and private partnerships to bridge the diagnostic care gap. These strategies, coupled with a well-regulated but innovation-driven market environment, position the UK as one of the most active imaging services markets in Europe.

March 2024: The UK Department of Health announced a £350 million investment to expand and equip 30 new Community Diagnostic Centres, aiming to reduce imaging backlogs across the NHS.

February 2024: Alliance Medical partnered with University Hospitals Birmingham to install a 3T MRI scanner and establish a mobile diagnostic unit for underserved communities.

January 2024: Everlight Radiology, a UK-based teleradiology provider, launched a new AI-powered triage system to prioritize high-risk CT and X-ray scans for rapid reporting.

December 2023: InHealth Group secured a contract to operate diagnostic imaging services within three major London NHS trusts, including mobile CT and MRI facilities.

November 2023: Siemens Healthineers completed the installation of next-gen AI-enhanced MRI and CT systems in over 40 NHS sites as part of the government's diagnostic technology modernization plan.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the UK imaging services market

Modality

End-use