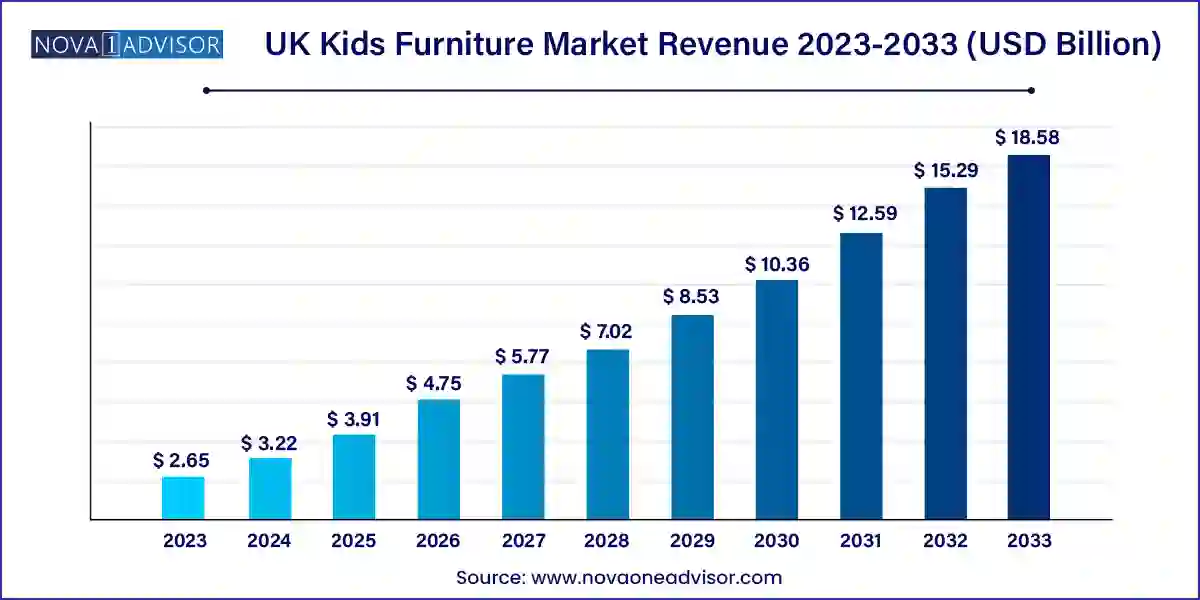

The UK kids furniture market size was exhibited at USD 2.65 billion in 2023 and is projected to hit around USD 18.58 billion by 2033, growing at a CAGR of 21.5% during the forecast period 2024 to 2033.

The UK kids furniture market is witnessing a robust phase of transformation, buoyed by shifting demographics, evolving parenting styles, and the increasing emphasis on child-specific interior design. The market has matured beyond the basic necessity of children’s beds and storage units, transitioning into a segment driven by aesthetics, safety, multi-functionality, and sustainability. With the rising number of nuclear families, dual-income households, and urban dwellings, there’s a visible trend towards the customization of children’s rooms, creating a strong demand for innovative, space-saving, and child-friendly furniture.

A distinct behavioral shift is also evident among millennial parents, who tend to prioritize both functionality and visual appeal in kids' furniture. Social media platforms like Instagram and Pinterest have turned kids’ rooms into creative projects, inspiring parents to invest in designer furniture that reflects their taste and values. Moreover, an increase in disposable income and awareness of ergonomics and child development principles are fueling the adoption of purpose-built furniture designed to support posture, learning, and play.

Prominent players in the UK furniture sector are leveraging this trend by expanding their product portfolios to include educational desks, modular beds, and themed furnishings. The growing inclination towards e-commerce and DIY furniture models is also contributing to market dynamism. As we look toward 2034, the UK kids furniture market is expected to chart a steady growth trajectory, backed by innovation, digital retailing, and a deeper understanding of evolving consumer expectations.

Sustainable and Eco-Friendly Materials: Growing eco-consciousness is pushing brands to adopt FSC-certified wood, recycled polymers, and water-based paints in children's furniture.

Themed and Customizable Furniture: Furniture inspired by themes such as space, jungle, fairy tales, or cartoon characters is increasingly popular among young children and tweens.

Space Optimization: Rising urbanization has driven demand for modular furniture solutions such as bunk beds with built-in desks, or storage beds that maximize floor space.

Ergonomic Designs for Learning: With the growth of homeschooling and homework culture, ergonomic study tables and adjustable chairs designed for correct posture are gaining traction.

Omnichannel Retailing: Integration of physical stores with digital platforms for a seamless shopping experience is a growing strategy among key players.

Rise of Flat-Pack and DIY Kits: Inspired by brands like IKEA, the demand for easy-to-assemble, space-efficient furniture is increasing, particularly among young urban parents.

Personalized E-commerce Experiences: Online platforms are offering AI-based room configurators and personalized shopping journeys tailored to children’s age, preferences, and room sizes.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.22 Billion |

| Market Size by 2033 | USD 18.58 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 21.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Raw Material, Application, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | UK |

| Key Companies Profiled | Circu Magical Furniture; Williams-Sonoma Inc.; BABYLETTO; Blu Dot; Casa Kids; Crate and Barrel (Crate & Kids); Circu Magical Furniture; Million Dollar Baby Co.; KidKraft; Sorelle Furniture |

One of the primary drivers boosting the UK kids furniture market is the increasing focus on designing dedicated living and learning spaces for children. Modern parenting emphasizes not only functionality but also creating environments that foster creativity, independence, and comfort. As a result, parents are actively investing in furniture that is tailored to children’s physical proportions, developmental needs, and safety requirements.

Furniture brands have responded with collections that align with educational needs (like reading nooks and writing desks), thematic preferences (like castle-themed beds), and health-conscious design (non-toxic materials and rounded edges). Furthermore, social media has become a key influence, where curated children’s spaces are both a trend and a form of digital expression for parents. With many working from home, there’s also increased demand for shared home-office/home-learning furniture that suits both adults and children.

Despite increasing demand, the premium pricing associated with high-quality, customizable, and sustainable children’s furniture acts as a restraint in wider market penetration. UK consumers, particularly in price-sensitive demographics, often view kids' furniture as a temporary necessity due to rapid growth and frequent replacement. This perception limits the appeal of higher-end purchases.

Additionally, fully personalized or bespoke kids' furniture requires significant lead times, specialized manufacturing, and logistics, which may deter budget-conscious consumers or those in urgent need. The challenge for brands is to balance aesthetics, safety, and durability with cost-effectiveness. Without scalable solutions for mid-income families, the market's full growth potential may remain untapped in the foreseeable future.

A compelling opportunity lies in the development of smart and convertible children’s furniture. The modern UK household, often constrained by space and driven by value, is increasingly drawn to furniture that adapts with a child’s growth. For example, cribs that transform into toddler beds or height-adjustable study tables have gained attention for their long-term utility and cost-efficiency.

Moreover, the integration of smart features—such as LED nightlights, charging ports, or interactive touch elements—into kids’ desks, beds, and chairs offers enhanced appeal to digitally-native children and tech-savvy parents. UK startups focusing on multi-purpose, space-saving solutions combined with sustainability and digital convenience are expected to disrupt the conventional kids furniture landscape in the coming years.

Beds, cots, and cribs dominate the UK kids furniture market by revenue share, reflecting their fundamental necessity in every child’s room. From infancy through adolescence, sleeping arrangements form the core of furniture investments for parents. Manufacturers have diversified offerings with designs including convertible cribs, bunk beds with storage, loft beds with play areas, and character-themed toddler beds. Given the emotional and functional importance of safe, high-quality sleeping furniture, consumers show a willingness to invest in this segment, especially in the early years of a child’s life.

Meanwhile, table and chair sets are emerging as the fastest-growing product category. Driven by the increasing focus on home learning and early childhood education, study furniture tailored to kids’ ergonomics is gaining popularity. During and post-pandemic, more parents created dedicated learning corners at home, equipped with appropriately sized desks and chairs to promote correct posture and focus. Play tables for crafts, puzzles, and dining are also gaining traction. The continued trend toward hybrid and remote learning will likely sustain the strong momentum of this category.

Wood continues to lead as the preferred raw material in the UK kids furniture market. Its durability, classic aesthetic, and association with safety and sustainability contribute to its dominance. Solid wood and engineered woods like MDF and plywood are extensively used, especially in beds, wardrobes, and bookshelves. Consumers often prefer wooden furniture due to its longevity and ease of maintenance. Additionally, FSC-certified woods offer eco-conscious options for environmentally aware buyers, aligning well with UK market values.

Polymer-based furniture is the fastest-growing segment due to its affordability, vibrant designs, and lightweight nature. Brightly colored plastic chairs, foldable desks, and modular storage bins are increasingly favored in nurseries, play areas, and preschools. Easy to clean, move, and assemble, polymer furniture is particularly popular among younger age groups and is often designed with rounded edges and soft-touch finishes for enhanced safety. As design innovation makes polymer products more aesthetic and durable, their adoption rate is climbing across budget-conscious and urban households.

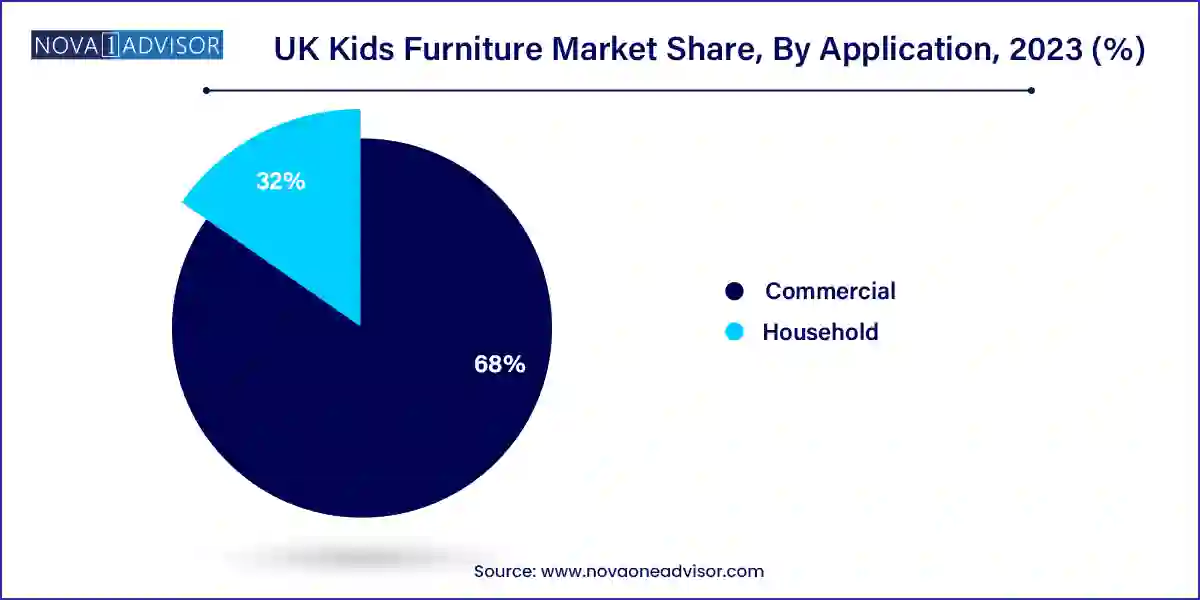

Usage of kids furniture in household sector dominated the market with a revenue share of more than 68.0% in 2023. As early education centers and childcare facilities expand across the UK, especially in urban areas, demand for durable, multifunctional, and regulation-compliant furniture is on the rise. Commercial buyers prioritize stackable, easy-to-clean, and modular units that allow flexible space use and meet stringent health and safety standards. As public and private investment in early childhood infrastructure continues to grow, this segment is expected to expand substantially.

The household application segment dominates the UK kids furniture market, reflecting the essential nature of children’s furniture in residential settings. As parenting styles evolve to place greater importance on dedicated children's spaces, families are increasingly investing in bedroom sets, playroom furniture, and study corners tailored to their children’s age and interests. High personalization, design flexibility, and safety compliance are critical in this space. The increasing practice of setting up personalized nurseries before birth has further propelled demand for domestic children’s furniture.

The UK kids furniture market is uniquely shaped by its diverse population, evolving family structures, and space-conscious urban lifestyles. Cities like London, Birmingham, and Manchester are experiencing increasing demand for multifunctional furniture tailored to compact living environments. With nearly 20% of the UK population under 16, and an increasing number of households prioritizing quality education and home aesthetics, the market has ample room for growth.

Furthermore, the rise in homeownership among young parents and government incentives for early childhood education are pushing demand for both household and institutional children’s furniture. Public awareness of sustainability, child safety standards (such as BS EN 747), and interest in home decor trends also shape purchasing behavior. UK consumers are well-informed and expect a blend of design, practicality, and ethical manufacturing in their purchases—driving innovation and competition in the sector.

IKEA UK (March 2024): IKEA announced the expansion of its Småstad kids’ furniture collection, focusing on modular units that grow with children, including adjustable study desks and stackable storage drawers.

Boori (February 2024): The eco-conscious brand launched a new nursery collection made from sustainable timber, with GREENGUARD Gold certification, appealing to health-conscious and environmentally aware parents.

Cuckooland (January 2024): The online retailer introduced a new line of themed beds for kids featuring safari and outer space designs, capitalizing on the rising popularity of experiential and fantasy-themed room décor.

Mothercare UK (December 2023): Reentering the market through online partnerships, Mothercare rolled out a refreshed line of compact nursery furniture sets designed for UK city apartments.

Wayfair UK (October 2023): Wayfair unveiled an AI-powered room planning tool for children’s furniture, enabling parents to visualize furniture in their own space before purchasing.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the UK kids furniture market

Product

Raw Material

Application

Distribution Channel