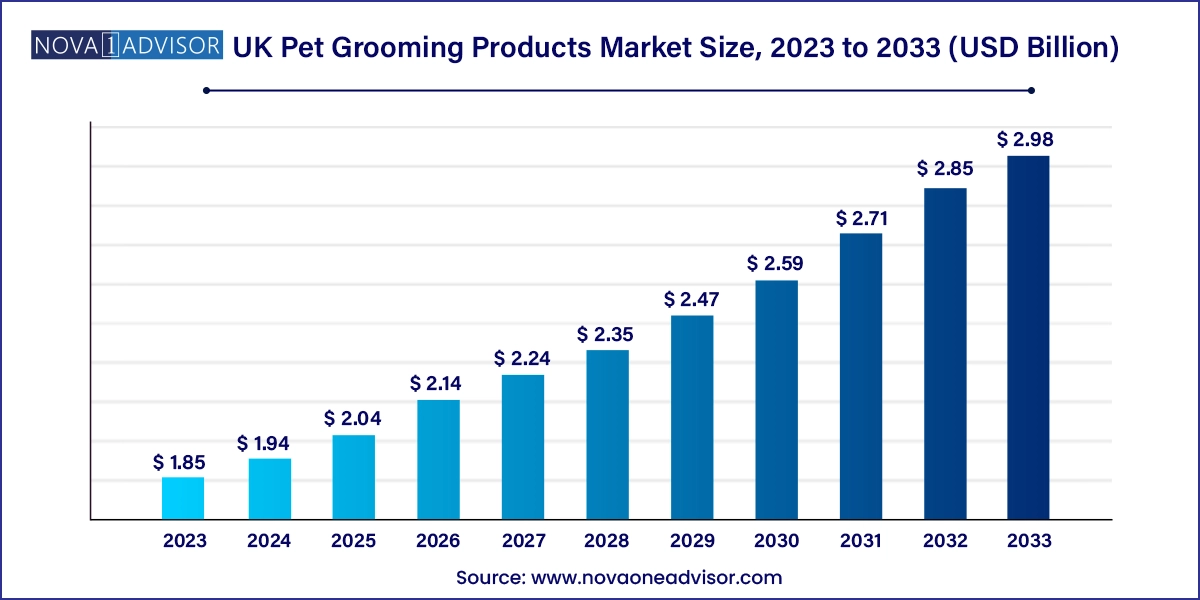

The UK pet grooming products market size was exhibited at USD 1.85 billion in 2023 and is projected to hit around USD 2.98 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.94 Billion |

| Market Size by 2033 | USD 2.98 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | UK |

| Key Companies Profiled | Groomer's Choice; Himalaya Herbal Healthcare; Spectrum Brands; Earthbath; Resco; SynergyLabs; Petco Animal Supplies, Inc.; Coastal Pet Products; Vet's Best; 4-Legger; World For Pets |

In the UK, the number of people who keep pets as house companions is rising. Pets are considered and loved as family members. According to recent trends, couples frequently use pet adoption as a scale for whether they are ready to have children.

The UK pet grooming products market accounted for a share of 8.6% of the global pet grooming products market in 2023. Pet care companies in the UK are putting more of an emphasis on creative marketing campaigns and rebranding initiatives for every facet of their business, including pet grooming supplies and services. These creative marketing initiatives are essential for attracting customers, building brand loyalty, and propelling the nation's sales growth.

The leading pet care company in the UK, dogs at Home, debuted a redesigned brand in April 2023, complete with a new logo and ad campaign that ties together all facets of the company's activities and pays tribute to the nation's love of dogs. The company's continuous goal to position itself as the go-to source for all pet care necessities, from grooming to veterinary treatment, is symbolized by the redesigned brand.

Growing pet hygiene awareness and a spike in the number of cats and dogs, particularly during the shutdown, are the main causes of the UK's rising demand for pet grooming products. Significant potential opportunities for the industry are also presented by the trends of pet humanization and premiumization.

The market for pet grooming products has grown significantly as a result of the increase in pet adoptions throughout the UK. The need for grooming supplies and goods, such as shampoos, conditioners, and other grooming products, is anticipated to rise in the upcoming years as more households welcome pets into their homes, which will support the market for pet grooming products.

It has been observed that pet owners are becoming more emotionally attached to their animals and view them as essential members of the family. To assure their pets' comfort and well-being, people are becoming increasingly ready to spend more on pet care, including grooming supplies.

The UK pet shampoo and conditioner market accounted for a share of 56.0% in 2023. The primary reason companion animals are dominant is because they have basic hygiene needs. The purpose of these grooming products is to clean, condition, and revitalize the skin and hair of companion animals. They are specifically designed with pet care in mind. In addition, manufacturers have developed medicated shampoos with specific components to treat a variety of ailments and skin diseases in animals.

The demand for pet shear & trimming tools in the UK is expected to grow at a CAGR of 4.8% from 2024 to 2033. The growing trend of pet humanization, the increasing number of pet owners, and the growing market for upscale pet products are all having a significant impact on the demand for pet electric trimmers and clippers. Pet owners are willing to spend more on grooming goods and services to keep their animals looking and feeling well because they consider their animals as a member of the family. This entails investing money on high-quality electric trimmers and clippers to maintain their pets' coats at home in between trips to the groomer.

The offline sales of pet grooming products in the UK accounted for a revenue share of 72.8% in 2023. Supermarkets, hypermarkets, retail stores, and convenience stores are crucial offline distribution channels. The ability to physically inspect grooming items and confirm their quality have been the primary drivers of offline distribution's success in the pet grooming goods market.

The online sales of pet grooming products in the UK is expected to grow at a CAGR of 6.3% from 2024 to 2033. The growing population of tech-savvy people and their inclination towards online shopping has resulted in an increase in the distribution popularity of e-commerce platforms. This trend has led to the emergence of independent online distributors as well as e-retailers who offer premium grooming products to a broad customer base.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the UK pet grooming products market

Type

Distribution Channel