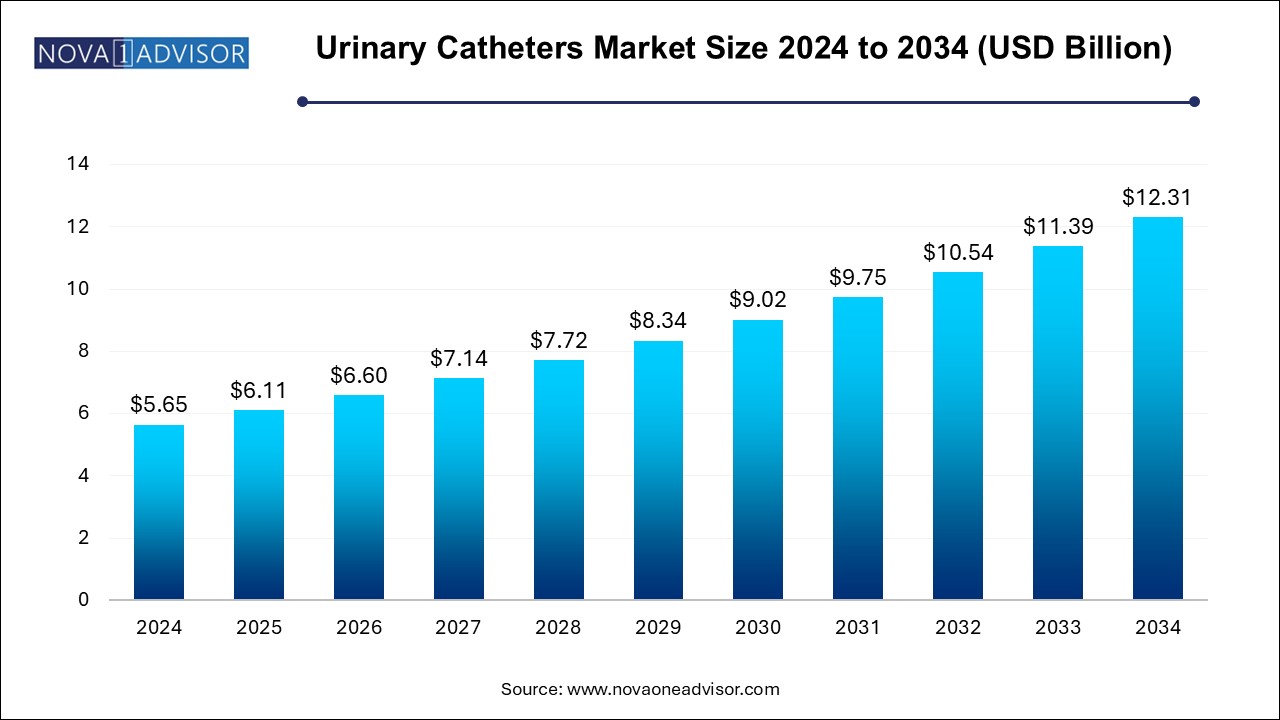

The urinary catheters market size was exhibited at USD 5.65 billion in 2024 and is projected to hit around USD 12.31 billion by 2034, growing at a CAGR of 8.1% during the forecast period 2024 to 2034.

The urinary catheters market is a significant and steadily expanding segment of the global medical devices industry. Urinary catheters are hollow, flexible tubes inserted into the bladder via the urethra to drain urine when patients are unable to urinate naturally. These devices play a critical role in managing various urological and neurological conditions such as urinary incontinence, benign prostatic hyperplasia (BPH), spinal cord injuries, post-operative retention, and other bladder dysfunctions.

Market growth is largely being propelled by the increasing prevalence of urinary tract disorders and chronic diseases, a growing geriatric population, and rising awareness around advanced home care solutions. Additionally, rising surgical volumes, especially in urology and gynecology, further reinforce demand for urinary catheters across hospitals and long-term care facilities.

Modern catheter technologies have also evolved, addressing long-standing challenges such as catheter-associated urinary tract infections (CAUTIs). Antimicrobial and hydrophilic-coated variants are now preferred to improve patient comfort and reduce infection risk. Moreover, the adoption of self-catheterization, particularly intermittent catheterization among patients with spinal cord injuries or neurogenic bladder, is opening new avenues for patient-centric product innovation.

As outpatient and home-based care settings expand particularly after the COVID-19 pandemic the demand for easy-to-use, comfortable, and safe urinary catheter devices continues to grow. While regulatory and infection control challenges persist, the outlook for the urinary catheters market remains positive, fueled by both demographic and clinical demand drivers.

Surge in Self-Intermittent Catheterization (SIC): Patient preference for autonomy is driving the uptake of intermittent catheters in home care settings.

Advancement in Coated Catheters: Innovations in hydrophilic and antimicrobial coatings are reducing CAUTIs and improving long-term outcomes.

Growing Demand in Long-Term Care Facilities: With aging populations, more patients require chronic catheterization, especially in nursing homes and rehabilitation centers.

Gender-Specific Catheters and Ergonomic Designs: Companies are developing catheters tailored for male and female anatomy to improve ease of use and reduce trauma.

Disposable and Compact Catheter Kits: Increasing concerns over hygiene and portability are fueling demand for single-use, discreet catheter kits.

Digital Health Integration: Smart catheters with sensors to monitor urine flow, temperature, and signs of infection are in developmental pipelines.

Eco-friendly and Biodegradable Catheter Materials: Regulatory push and sustainability awareness are encouraging R&D into greener alternatives to PVC-based products.

Expansion in Emerging Markets: Rapid urbanization, improved healthcare access, and increasing awareness are driving adoption in countries across Asia-Pacific and Latin America.

| Report Coverage | Details |

| Market Size in 2025 | USD 6.11 Billion |

| Market Size by 2034 | USD 12.31 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 8.1% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Application, Type, Gender, End-user, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Hollister, Inc.; Medtronic PLC; Boston Scientific Corp.; BD (C.R. Bard, Inc.); Cook Medical; ConvaTec, Inc.; Teleflex, Inc.; Coloplast; B. Braun Melsungen AG; Medline Industries, Inc.; J and M Urinary Catheters LLC |

One of the strongest growth drivers of the urinary catheters market is the rising global geriatric population combined with an increasing prevalence of urological conditions. Older adults are more susceptible to benign prostatic hyperplasia (BPH), urinary retention, incontinence, and neurogenic bladder disorders, all of which necessitate urinary catheterization. According to WHO, the population aged 65 years and older is expected to double by 2050, presenting a consistent and growing base of potential users.

In addition, post-operative catheterization is standard practice in surgeries involving the prostate, bladder, uterus, or spinal region. Increased volumes of these surgeries due to better access to healthcare and longer life expectancy further support this trend. Chronic disease conditions such as diabetes, multiple sclerosis, and Parkinson’s disease often result in bladder dysfunction, necessitating either intermittent or indwelling catheter use. These clinical and demographic shifts reinforce the long-term demand for urinary catheters across multiple care settings.

Despite its indispensable role in patient care, the urinary catheters market faces a persistent challenge: the high incidence of catheter-associated urinary tract infections (CAUTIs). CAUTIs are among the most common hospital-acquired infections (HAIs) globally. They not only lead to prolonged hospital stays but also increase treatment costs and raise the risk of complications such as urosepsis and antibiotic resistance.

Healthcare providers are increasingly cautious about catheter usage, preferring minimal and judicious catheterization in hospital settings. This restraint affects the usage duration and frequency of catheters, particularly indwelling ones. Furthermore, regulatory bodies like the CDC and WHO recommend strict catheter management protocols and antimicrobial stewardship to mitigate CAUTI risk. As a result, product adoption is tightly linked to infection control performance, and manufacturers must continually innovate to meet higher safety standards.

A significant opportunity in the urinary catheters market lies in the development of smart, sensor-enabled catheters and novel delivery mechanisms. With the advent of digital health and connected care, there is growing interest in integrating biosensors into catheters to monitor parameters such as urine output, pH, temperature, and infection biomarkers. These features allow for early detection of infections and timely intervention, particularly in critically ill or immobile patients.

Moreover, companies are exploring new materials such as silicone-hydrogel hybrids, antimicrobial silver coatings, and biodegradable polymers to enhance comfort, reduce complications, and align with sustainability goals. Compact, portable catheter kits and discreet packaging solutions for intermittent users further open opportunities in retail and home healthcare segments. Additionally, AI-based algorithms to analyze urinary data, combined with remote patient monitoring platforms, could transform catheterization from a reactive to a proactive care model.

Foley or indwelling catheters dominate the urinary catheters market, especially in inpatient hospital settings. These catheters, which remain in the bladder for extended periods, are critical for post-operative care, critical illness, and long-term urinary retention cases. They are widely used in hospitals and nursing homes due to their continuous drainage capability and are often connected to closed drainage systems to minimize infection risk. Foley catheters are commonly manufactured in silicone or latex and can be inserted through urethral or suprapubic routes.

Intermittent catheters are the fastest-growing segment, particularly due to rising demand in home care settings and among patients with neurogenic bladder or spinal cord injuries. These are inserted periodically throughout the day and then removed, minimizing prolonged exposure and the associated risk of CAUTIs. The availability of compact, pre-lubricated, single-use catheters has improved user compliance and convenience. Brands like SpeediCath (Coloplast) and GentleCath (Convatec) are widely used in developed countries, and the shift toward patient self-care is expanding this segment rapidly.

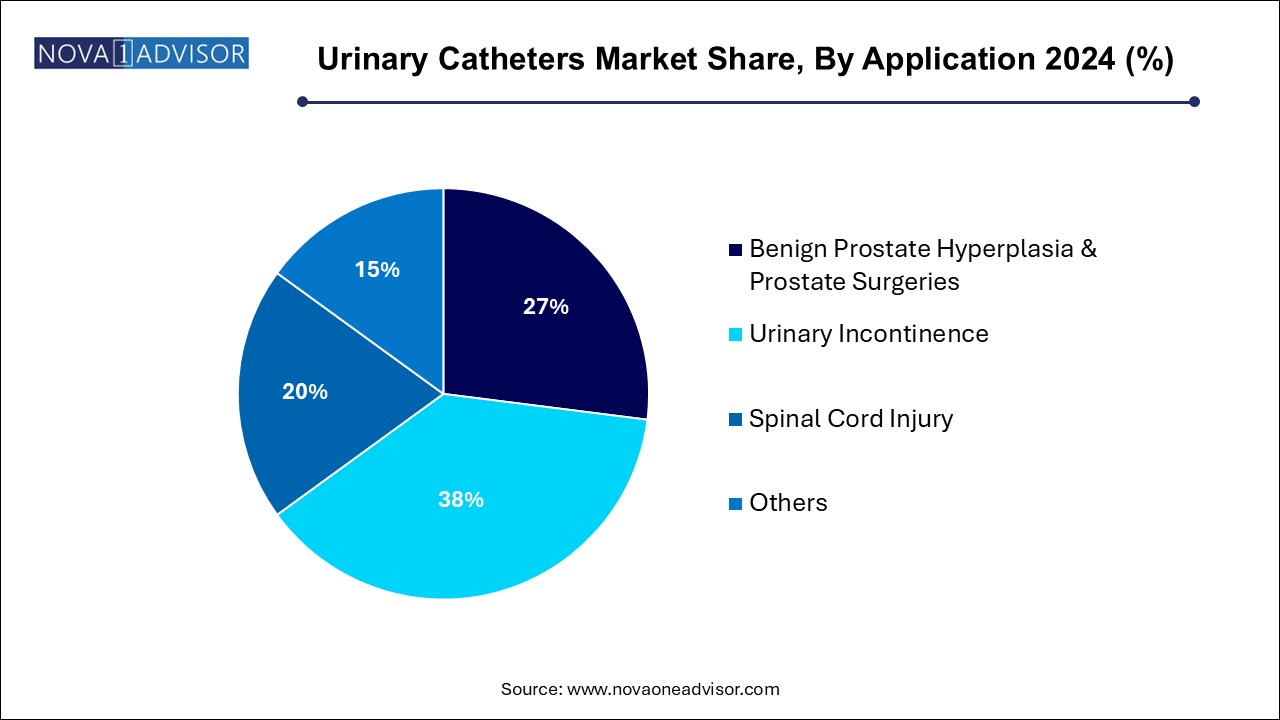

Urinary incontinence leads the application segment, accounting for a substantial share of total catheter usage. This condition is especially common among elderly individuals and women post-childbirth or post-surgery. With millions affected globally, catheters are often required for both acute and chronic management of urinary leakage. Incontinence care is increasingly integrated into broader continence care programs in hospitals and long-term care centers, driving demand for both indwelling and external catheters.

Benign Prostatic Hyperplasia (BPH) and prostate surgeries are the fastest-growing application area, particularly in aging male populations. BPH is nearly ubiquitous among men over 60, and when urinary retention ensues, catheterization becomes necessary either temporarily or as part of surgical management. Transurethral resection of the prostate (TURP), prostatectomy, and minimally invasive procedures often require catheter support post-surgery. This has driven increased use of Foley catheters, particularly those with balloon retention features and large drainage channels.

Coated catheters dominate the market by type, particularly hydrophilic and antimicrobial-coated variants. These are designed to reduce friction during insertion and withdrawal, lowering the risk of urethral trauma and infection. Coated catheters also demonstrate better patient comfort and improved adherence among long-term users. Hydrophilic coatings, in particular, are preferred in intermittent catheterization and are often chosen by patients who self-catheterize multiple times a day.

Uncoated catheters, while traditional, are declining in share but still widely used in resource-constrained settings. However, their lower cost keeps them relevant, especially in developing regions where advanced coating technologies may be financially inaccessible. Over time, educational initiatives and reimbursement improvements may shift preference toward coated versions as infection control becomes a greater priority.

Male patients dominate the gender-based segmentation, largely due to the anatomical need for longer catheters and higher prevalence of BPH, prostate cancer, and related surgeries. Male catheters typically range from 16–18 inches in length and are designed with ergonomic features for ease of insertion. Manufacturers often design gender-specific lines to ensure anatomical compatibility and reduce discomfort.

Female catheter use is growing steadily, especially in the context of urinary incontinence and post-partum care. Female catheters are shorter (usually 6–8 inches) and are becoming more discreet and easier to self-insert, especially in home settings. Growth in this segment is being driven by improved product education and women-centric urinary care programs, including those targeting aging and post-menopausal populations.

Hospitals remain the largest end-user of urinary catheters, accounting for routine and surgical usage across multiple departments. From intensive care units (ICUs) to surgical recovery and emergency care, catheterization is a vital part of fluid and bladder management. Hospitals favor long-lasting Foley catheters and use closed systems to minimize infection risks, ensuring the availability of a range of catheter sizes and types.

Long-term care facilities are the fastest-growing end-user segment, reflecting the increasing population of elderly patients requiring chronic urinary support. These facilities use a mix of indwelling and intermittent catheters depending on patient mobility and condition. The growing trend of decentralizing healthcare and increasing funding toward eldercare infrastructure in developed countries is a key factor driving growth in this segment.

North America leads the urinary catheters market, driven by strong healthcare infrastructure, high disease awareness, and robust reimbursement systems. The U.S., in particular, has widespread access to advanced urological care, and catheter usage is high both in hospitals and long-term care settings. The region benefits from early adoption of coated and antimicrobial catheter technologies and has seen a rapid shift toward patient-directed intermittent catheterization.

Additionally, companies headquartered in the U.S. and Canada, such as Becton, Dickinson & Co. and Hollister, Inc., are at the forefront of product innovation. Favorable reimbursement for chronic conditions such as neurogenic bladder and the availability of customized catheter kits have further cemented North America’s leadership position.

Asia-Pacific is the fastest-growing regional market, fueled by rising healthcare investment, increasing urological disease burden, and improving access to surgical care. Rapid urbanization and expanding insurance coverage in countries like India, China, and Southeast Asia have brought more patients into the healthcare system, resulting in higher demand for catheters.

The prevalence of diabetes, stroke, and spinal injuries—common precursors to bladder dysfunction—is rising across APAC, necessitating catheter support. Government efforts to improve hospital infrastructure, along with the rising adoption of home-based care, are also contributing to market growth. Local manufacturers are increasingly entering the market, making products more affordable and accessible to middle- and lower-income populations.

March 2025: B. Braun launched a new line of closed system intermittent catheters under its Actreen® brand, featuring hydrophilic coating and pre-lubricated designs for enhanced infection prevention.

January 2025: Hollister Incorporated expanded its Onli™ intermittent catheter line to include female-specific models, with ergonomic packaging and compact designs for discreet use.

October 2024: Teleflex Medical received CE marking for its sensor-integrated Foley catheter designed to detect early signs of infection through urine temperature and turbidity analysis.

August 2024: Convatec PLC announced the opening of a new manufacturing facility in Malaysia to increase global production of its GentleCath™ catheter range, targeting growth in Asia-Pacific.

June 2024: Coloplast entered a strategic collaboration with a European telehealth company to explore remote monitoring of urinary health via smart catheter-connected devices.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the urinary catheters market

By Product

By Application

By Type

By Gender

By End-user

By Regional