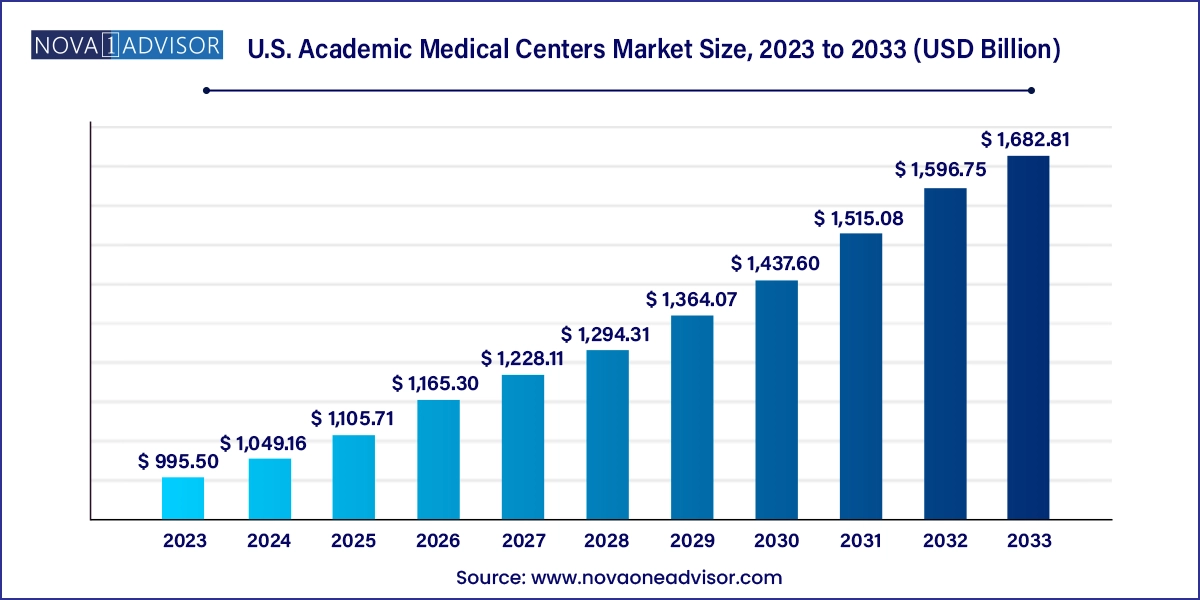

The U.S. academic medical centers market size was exhibited at USD 995.50 billion in 2023 and is projected to hit around USD 1,682.81 billion by 2033, growing at a CAGR of 5.39% during the forecast period 2024 to 2033.

The U.S. academic medical centers (AMCs) market represents a vital segment of the national healthcare system, where the intersection of clinical care, education, and biomedical research takes place. These institutions are affiliated with medical schools and often serve as hubs for cutting-edge treatment, the training of future physicians, and the development of innovative therapies. Their unique positioning enables AMCs to provide comprehensive care to complex and underserved populations while also advancing the frontiers of medicine through translational research.

Academic medical centers, such as Mayo Clinic, Cleveland Clinic, and Johns Hopkins Medicine, function as centers of excellence that often set national standards in specialty care, patient outcomes, and quality benchmarks. The market is driven by the increasing complexity of diseases, rising healthcare demands, and an emphasis on value-based care. At the same time, AMCs are under pressure to balance operational costs with academic missions, maintain accreditation standards, and meet rising expectations in patient experience.

In the post-COVID-19 era, AMCs have expanded their role in pandemic preparedness, telehealth infrastructure, and public health initiatives, reinforcing their strategic importance. Moreover, AMCs continue to be significant economic contributors to their regions, generating employment, partnerships with biotech firms, and acting as anchors for life sciences innovation.

Expansion of telemedicine and virtual care services across academic health systems

Growth in collaborative research networks and industry-academic partnerships

Increasing emphasis on diversity, equity, and inclusion in healthcare delivery and workforce

Implementation of AI and data analytics in clinical decision-making and patient care

Enhanced focus on value-based care and population health management

Investments in precision medicine and genomic research initiatives

Surge in construction and modernization of AMC facilities to improve capacity and experience

Expansion of community-based outreach and rural satellite partnerships

| Report Coverage | Details |

| Market Size in 2024 | USD 1,049.16 Billion |

| Market Size by 2033 | USD 1,682.81 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.39% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Weill Cornell Medicine; Cleveland Clinic; Vanderbilt University Medical Center; University Hospitals; The General Hospital Corporation (Massachusetts General Hospital); Stanford Health Care; UAB Health System; Mayo Foundation for Medical Education and Research (Mayo Clinic); Cedars-Sinai; The Johns Hopkins University; UC San Diego Health; Icahn School of Medicine at Mount Sinai |

A defining driver of the U.S. academic medical centers market is the synergistic integration of research, medical education, and clinical care. This triad model allows AMCs to serve as incubators of innovation while delivering world-class care and training the next generation of healthcare professionals. Unlike conventional hospitals, AMCs have in-house physician-scientists and research infrastructure that enable early adoption of novel therapeutics, clinical trials, and specialized interventions.

Patients treated at AMCs often benefit from the latest evidence-based protocols and experimental therapies unavailable elsewhere. This draws referrals for rare and complex cases, boosting AMCs' reputations and volumes. Furthermore, medical students and residents trained in this ecosystem are equipped with practical, research-informed education that fosters lifelong learning and clinical excellence.

Despite their stature, AMCs face significant financial challenges due to high operational costs, complex funding structures, and reduced reimbursement rates. The cost of running large teaching hospitals, maintaining state-of-the-art equipment, and supporting academic missions is significantly higher than community hospitals. This financial strain is exacerbated by the fact that many AMCs serve as safety-net providers for uninsured or underinsured patients.

Government funding through Medicare for graduate medical education (GME) has remained relatively stagnant, even as training needs and patient volumes rise. At the same time, shifts toward value-based reimbursement, competitive pressures from private health systems, and reduced margins in research grants have forced AMCs to streamline operations without compromising care quality. Balancing the academic mission with financial sustainability remains a central challenge.

One of the most promising opportunities in the U.S. academic medical centers market lies in the integration of precision medicine and genomics into clinical practice. AMCs are uniquely positioned to lead this transformation, given their access to large patient datasets, advanced research facilities, and partnerships with biotech and pharmaceutical firms. By leveraging genetic insights, AMCs can personalize treatment plans for cancer, rare diseases, and chronic conditions, improving outcomes and reducing unnecessary interventions.

Several AMCs have already launched precision health initiatives combining biobanks, machine learning, and electronic health records (EHRs). These programs not only benefit individual patients but also support broader population health strategies. With increasing investment from NIH and private sectors in genomic research, AMCs stand at the forefront of delivering next-generation healthcare and setting the standard for data-driven medicine.

The Northeast region dominates the U.S. academic medical centers market, home to many prestigious and long-established institutions such as Harvard Medical School affiliates (Mass General Brigham), Yale-New Haven Health, and Weill Cornell Medicine. These centers boast extensive research portfolios, renowned specialty care programs, and leading NIH grant recipients. Urban density and population diversity in this region support a wide patient base, making these institutions central to both clinical innovation and academic leadership.

The Southeast region is the fastest-growing, with major AMCs like Emory Healthcare, Duke Health, and University of Miami Health expanding their reach. These centers are investing heavily in digital health, cancer research, and cross-state telemedicine networks. The region also benefits from rising demand due to population aging, chronic disease prevalence, and an influx of retirees. Emerging partnerships with rural health systems and medical schools further boost this region's momentum.

Midwest AMCs like the Mayo Clinic and Cleveland Clinic continue to maintain strong reputations for clinical excellence, especially in cardiology and transplant medicine. These centers combine high patient volumes with disciplined clinical research, contributing significantly to medical innovation.

The West region, led by institutions such as Stanford Health Care and UCLA Health, is becoming a powerhouse for biomedical innovation, AI integration, and digital therapeutics. The proximity to Silicon Valley and biotech hubs accelerates collaborations, especially in oncology, neuroscience, and bioinformatics. These centers are increasingly adopting hybrid care models and investing in sustainable hospital infrastructure.

Across the United States, academic medical centers are recognized as integral components of the national health system. With more than 150 AMCs spread across the country, these institutions collectively train the majority of medical professionals and conduct a substantial portion of clinical trials and biomedical research. The U.S. Department of Health and Human Services continues to prioritize AMC involvement in public health strategies, disaster response, and national preparedness initiatives.

The growth of Medicaid expansion, adoption of alternative payment models, and federal investment in AI and digital health infrastructure have positioned AMCs as key players in delivering accessible, equitable, and technologically advanced care. Nationwide, AMCs are leveraging their reputations to form multi-institutional alliances, launch health equity programs, and establish national networks for genomic medicine and clinical data sharing.

March 2025: Cleveland Clinic partnered with IBM Watson to pilot a real-time AI platform for clinical decision support across oncology units.

January 2025: UCSF Health announced a $1.2 billion campus expansion plan focused on sustainability and next-gen research facilities.

November 2024: Mayo Clinic launched a new genomics-based precision cardiology program in partnership with Illumina.

October 2024: NYU Langone Health received $150 million in federal grants for mental health research across underserved communities.

August 2024: Duke Health opened a new virtual hospital system to support chronic care management and remote monitoring for rural populations.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. academic medical centers market

Regional