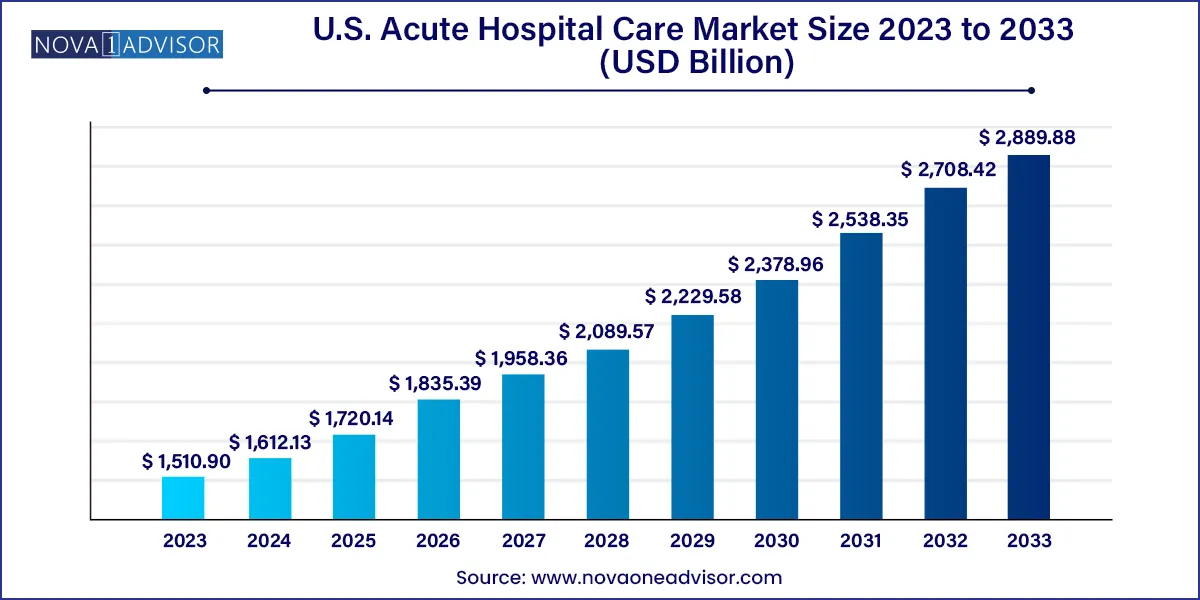

The U.S. acute hospital care market size was exhibited at USD 1,510.90 billion in 2023 and is projected to hit around USD 2,889.88 billion by 2033, growing at a CAGR of 6.7% during the forecast period 2024 to 2033.

The U.S. acute hospital care market represents the backbone of the nation’s healthcare infrastructure, delivering critical, time-sensitive treatment to patients suffering from severe, life-threatening, or sudden-onset conditions. These hospitals serve as essential access points for emergency care, trauma response, surgical intervention, and intensive treatment of acute illnesses. Acute care hospitals are typically equipped with specialized departments such as emergency rooms (ERs), intensive care units (ICUs), coronary care units (CCUs), and neonatal intensive care units (NICUs).

Driven by an aging population, rising incidences of chronic diseases with acute episodes, and increasing rates of trauma-related injuries, the demand for acute hospital care services has remained consistently high. Additionally, the surge in complex surgeries and the prevalence of conditions such as heart attacks, strokes, respiratory distress, and infectious diseases like COVID-19 have emphasized the critical role of acute hospitals. The U.S. government's continuous investment in infrastructure upgrades and emergency preparedness has also contributed to market development.

Acute hospital care in the U.S. is characterized by a blend of public, private, and non-profit institutions, with growing consolidation across hospital networks. This has resulted in improved resource sharing, centralized electronic medical records (EMRs), and standardized treatment protocols. From urban trauma centers to rural general acute hospitals, the market encompasses a wide spectrum of facility types tailored to deliver urgent and intensive care.

Increasing Hospital Consolidation and Integrated Health Systems

Rising Use of AI and Predictive Analytics in Critical Care Units

Shift Toward Value-Based Reimbursement in Acute Care Settings

Growth in Demand for Emergency and Trauma Services Post-Pandemic

Expansion of Tele-ICU and Remote Monitoring Technologies

Emphasis on Infection Control and Antimicrobial Stewardship

Development of Specialized Centers Within Acute Hospitals (e.g., Stroke Centers, Cardiac Units)

Workforce Shortages and Burnout Among ICU and ER Staff

| Report Coverage | Details |

| Market Size in 2024 | USD 1,612.13 Billion |

| Market Size by 2033 | USD 2,889.88 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Medical Condition, Facility Type, Service Type, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | TH Medical (Tenet Healthcare Corporation); Universal Health Services Inc.; Community Health Systems, Inc.; Ascension; Lifepoint Health, Inc.; Ardent Health Services; Emerus Hospital Partners, Llc; Stanford Health Care, Inc.; NYU Langone Hospitals; and NewYork-Presbyterian Hospital |

A key driver of the U.S. acute hospital care market is the growing prevalence of acute medical events that require immediate intervention. Acute myocardial infarctions (heart attacks), strokes, sepsis, severe infections, trauma from accidents, and complications from chronic conditions often require hospital admissions under acute care protocols. According to the CDC, more than 800,000 Americans experience a stroke annually, with most requiring urgent hospitalization.

Additionally, surgical demand, especially for procedures such as appendectomies, emergency C-sections, and trauma-related surgeries, contributes significantly to the volume of acute care services. The rise in organ transplants, joint replacements, and complex cardiovascular surgeries further underscores the need for advanced acute care facilities equipped with surgical suites and post-operative monitoring units. This driver is compounded by the aging U.S. population, which is more susceptible to sudden health crises.

Despite its critical importance, the U.S. acute hospital care market faces challenges in managing escalating operational costs and workforce shortages. High expenses related to medical equipment, staffing, compliance, and pharmaceuticals burden hospital budgets. Many institutions struggle to balance costs while maintaining quality of care, particularly those in underserved or rural regions.

Moreover, hospitals face acute shortages of specialized personnel including ICU nurses, emergency physicians, respiratory therapists, and critical care surgeons. Staff burnout, exacerbated by the COVID-19 pandemic, has led to higher turnover rates, impacting continuity of care. These workforce constraints not only increase the workload on existing staff but also delay care delivery, potentially compromising patient outcomes.

A promising opportunity in the U.S. acute hospital care market lies in the rapid advancement and deployment of tele-ICU technologies. Tele-ICU enables centralized critical care specialists to monitor and guide patient treatment remotely, thereby extending the reach of high-level care to community hospitals, rural regions, and facilities with limited on-site specialists.

For instance, several major health systems have successfully piloted tele-ICU programs that reduced mortality rates and hospital stays through enhanced monitoring and quicker response times. These platforms integrate real-time vital signs, AI-based alert systems, and two-way audiovisual communication to deliver continuous patient supervision. As broadband access expands and telehealth infrastructure improves, tele-ICU is set to revolutionize how acute care is delivered across geographies.

Emergency care dominated the U.S. acute hospital care market, accounting for the largest share of patient admissions. Emergency departments handle a wide range of urgent medical issues from cardiac arrests and trauma injuries to poisoning and respiratory failure. These departments often serve as the first point of entry into the hospital system. Due to their 24/7 operations and multi-specialty access, ERs are essential for stabilizing patients and initiating life-saving interventions. With the growing incidence of road accidents, drug overdoses, and acute infections, the demand for emergency services has escalated, reinforcing their dominant role.

Acute care surgery is projected to be the fastest-growing segment, as hospitals invest in surgical readiness and response capabilities. Acute surgical services cover appendicitis, gallbladder removal, vascular injuries, and trauma surgery, requiring immediate surgical intervention to prevent morbidity or death. Enhanced surgical techniques, robotic-assisted procedures, and improved anesthesia safety have increased the volume and complexity of acute surgeries performed. Moreover, the creation of dedicated acute care surgical teams has streamlined surgical response time, contributing to segment growth.

General acute care hospitals hold the largest market share, providing a comprehensive range of urgent and inpatient services. These facilities are equipped to manage both medical and surgical emergencies and often include ICUs, operating theaters, diagnostic imaging, and laboratory services. They serve as referral centers for smaller community hospitals and play a vital role in coordinated health networks. Their versatility and broader patient base support their leading position.

Long Term Acute Care (LTAC) hospitals are emerging as the fastest-growing facility type, addressing the needs of patients requiring extended recovery periods post-ICU or post-surgery. These patients often have complex conditions such as respiratory failure, multi-organ dysfunction, or prolonged infections. LTAC facilities provide intensive monitoring and rehabilitative services over weeks or months, bridging the gap between acute hospitalization and outpatient recovery. The aging population and rise in chronic critical illness are key contributors to LTAC expansion.

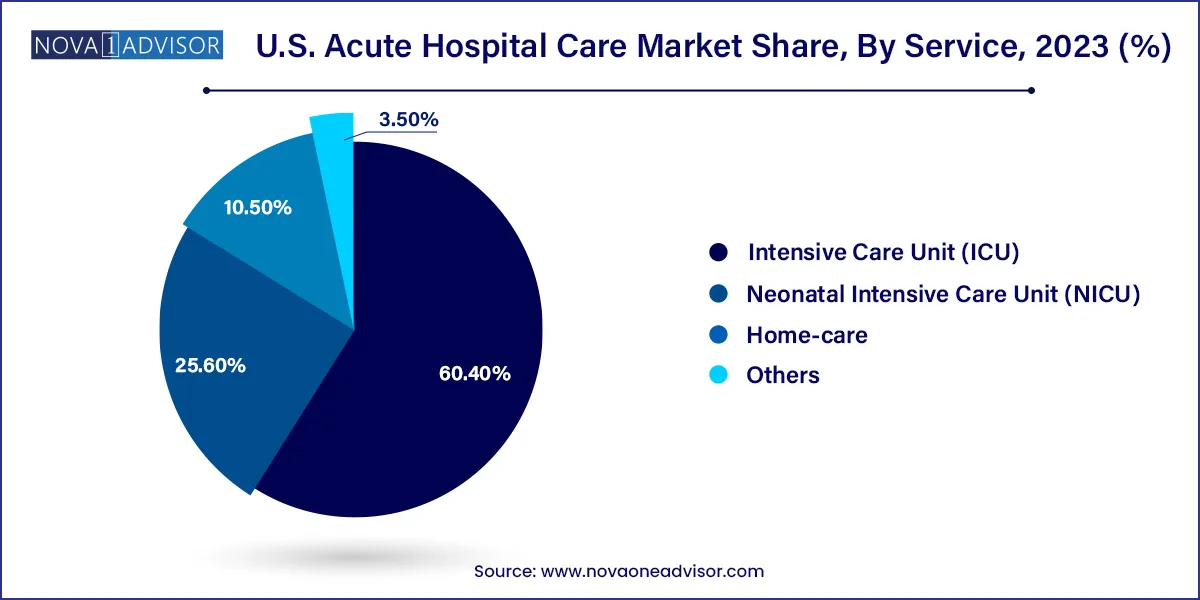

Intensive Care Units (ICUs) dominate the service segment, serving critically ill patients with life-threatening conditions. ICUs provide continuous monitoring, advanced ventilation, and life-support systems for patients experiencing severe infections, cardiac dysfunction, neurological crises, and major surgeries. Given their central role in modern hospitals and the necessity for high staff-to-patient ratios, ICUs represent a significant share of operational resources and patient care volume.

Neonatal Intensive Care Units (NICUs) are expected to grow fastest, as improvements in neonatal survival rates and advancements in maternal-fetal medicine increase the demand for specialized care. NICUs manage premature infants and newborns with congenital anomalies, respiratory distress, and low birth weight. U.S. birth data indicates a rise in premature deliveries, necessitating expanded NICU capacity and specialized personnel. Innovations such as non-invasive respiratory support and neonatal telehealth consultations further accelerate NICU development.

In the U.S., acute hospital care is shaped by a mix of federal policies, state regulations, and private investment. States such as California, Texas, Florida, and New York lead in terms of acute hospital bed capacity and service volumes. Large academic medical centers like Mayo Clinic, Cleveland Clinic, and Massachusetts General Hospital are benchmarks of acute care excellence, offering tertiary and quaternary care across numerous specialties.

However, rural states face significant disparities in access to acute hospital care. Many community hospitals struggle to maintain surgical teams and intensive care capabilities. Federal programs like the Critical Access Hospital (CAH) initiative and grants from the Health Resources and Services Administration (HRSA) aim to address these inequities. Additionally, public-private collaborations are enhancing emergency preparedness, especially in disaster-prone regions, ensuring readiness for mass casualty events, pandemics, and weather-related crises.

HCA Healthcare (March 2025): Announced a $1 billion expansion plan including new acute care facilities and ICU units across four states.

CommonSpirit Health (January 2025): Launched a nationwide tele-ICU network to connect rural hospitals with centralized critical care specialists.

Mayo Clinic (February 2025): Partnered with Google Cloud to integrate AI-driven predictive models into ICU monitoring systems.

Ascension Health (December 2024): Opened a new LTAC facility in Indiana to support long-term recovery for ventilator-dependent patients.

Tenet Healthcare (November 2024): Invested in upgrading trauma care infrastructure across its network of acute hospitals.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global U.S. acute hospital care market.

Medical Condition

Facility Type

Service

Region