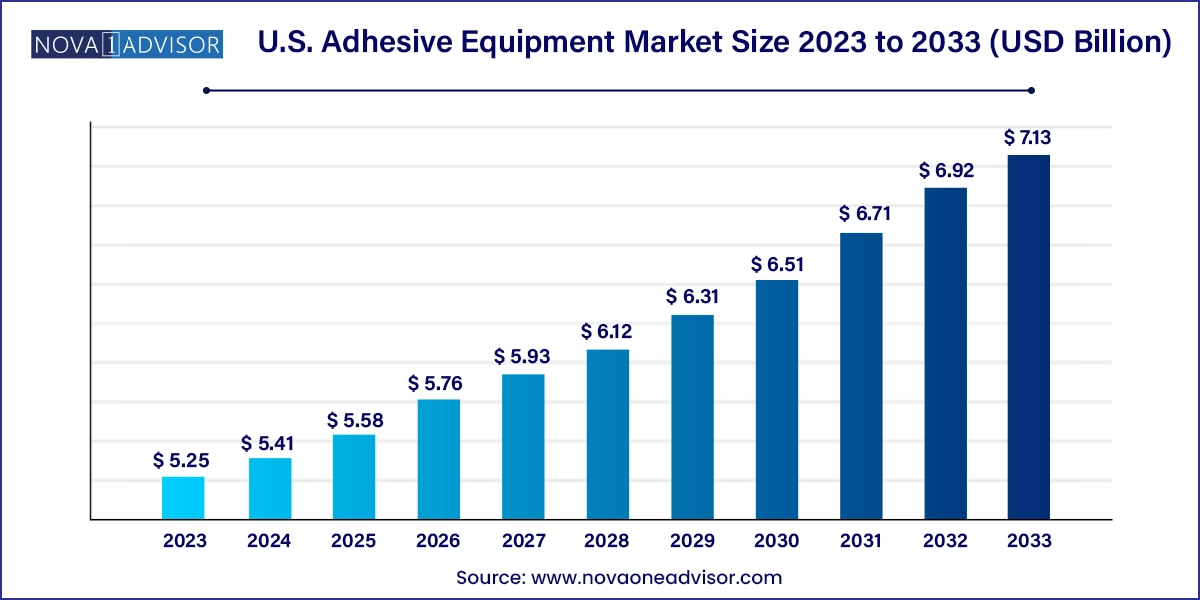

The U.S. adhesive equipment market size was exhibited at USD 5.25 billion in 2023 and is projected to hit around USD 7.13 billion by 2033, growing at a CAGR of 3.11% during the forecast period 2024 to 2033.

The U.S. adhesive equipment market is witnessing a significant transformation driven by evolving industrial applications, technological advancements, and the growing importance of efficient bonding processes across diverse sectors. Adhesive equipment ranging from hot melt systems to advanced robotic applicators plays a critical role in industries like packaging, automotive, electronics, construction, hygiene products, and textiles. As the demand for precision, automation, and sustainable bonding solutions rises, manufacturers are investing in high-performance adhesive application systems to boost productivity, reduce waste, and ensure consistent product quality.

In the U.S., the shift toward lean manufacturing and Industry 4.0 integration is accelerating the adoption of advanced adhesive equipment. The market is benefiting from heightened demand in sectors such as e-commerce packaging, modular construction, and personal hygiene, especially in the wake of increased consumer sensitivity toward product quality and sustainability. The high standards set by U.S. manufacturers have driven a competitive focus on innovation in applicator design, pump efficiency, digital control, and low-VOC adhesives.

Moreover, the ongoing reshoring of manufacturing in the U.S. has further propelled investments in equipment that can optimize labor costs and support automation. Adhesive equipment is not merely a utility tool but a strategic component of modern production lines, offering benefits like high-speed dispensing, minimal material loss, rapid changeovers, and integration with robotic systems. As a result, the U.S. adhesive equipment market is expected to experience sustained growth driven by innovation, regulatory compliance, and cross-industry applications.

Surge in demand for automated adhesive systems: Robotics and automated dispensing solutions are gaining traction, especially in packaging and automotive sectors.

Rise of hot melt systems in sustainable packaging: Hot melt adhesive equipment is favored for energy efficiency and compatibility with recyclable materials.

Integration of IoT and smart sensors: Modern adhesive controllers now come equipped with real-time monitoring and predictive maintenance features.

Growth in modular and prefabricated construction: Adhesive equipment is essential in assembling modular components using low-VOC adhesives in offsite construction.

High-speed gluing systems for e-commerce packaging: The boom in online shopping has increased the demand for precision and speed in carton sealing and labeling.

Focus on hygiene and clean dispensing in DHP applications: Equipment with closed-loop systems and contamination prevention is in demand for diaper and sanitary product production.

Demand for cold glue technology in print and lamination: Cold glue applicators are being used more in printing and converting industries for low-heat-sensitive materials.

Hybrid equipment for multi-adhesive formats: New systems support both hot melt and water-based adhesives for flexible manufacturing setups.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.41 Billion |

| Market Size by 2033 | USD 7.13 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Glue Machinery Corporation; Gluefast Company; Fisnar Inc.; Adhesive & Equipment, Inc.; ITW Dynatec; Graco Inc.; 3M Company; Dymax Corporation; Valco Melton; Royal Adhesives & Sealants LLC. |

A primary driver of the U.S. adhesive equipment market is the growing push toward manufacturing automation. As labor costs rise and workforce shortages persist, companies are relying more heavily on automated systems to maintain throughput and consistency. Adhesive equipment has evolved beyond basic dispensing systems to include sophisticated, programmable machinery capable of interfacing with entire production lines.

Industries like automotive manufacturing, where precise bonding of lightweight composite materials is essential, heavily rely on adhesive robots and advanced controllers to maintain product integrity at scale. For instance, Ford and General Motors are investing in smart factories that incorporate automated glue dispensers for bonding trims, sensors, and components. Similarly, packaging facilities are deploying automatic carton sealing systems with high-speed glue heads that adapt in real time to box size and material type. This automation not only reduces human error but also improves cycle times and ensures compliance with quality standards.

While adhesive equipment promises long-term cost and productivity benefits, the high upfront capital investment remains a key restraint, particularly for small and medium-sized enterprises (SMEs). Equipment like industrial hot melt systems or pneumatic applicators can be expensive to procure and install, especially when integrated with automated lines or robotic arms.

Moreover, integrating new adhesive systems into existing infrastructure often requires custom retrofitting, staff training, and workflow adjustments. For companies operating with tight margins, the downtime and learning curve associated with advanced adhesive technology adoption can be challenging. In some cases, the lack of technical expertise in configuring controllers or optimizing material flow can result in underperformance or equipment underutilization.

One of the most promising opportunities for the U.S. adhesive equipment market lies in its growing application in the e-commerce packaging and disposable hygiene products (DHP) sectors. As the e-commerce boom continues unabated, fulfillment centers and packaging converters require high-speed, precision adhesive systems for sealing, labeling, and product assembly. Modern equipment capable of variable output, adaptive gluing, and reduced maintenance cycles is in high demand.

In the DHP segment, rising consumer demand for sanitary napkins, baby diapers, and adult incontinence products—driven by lifestyle shifts and demographic trends—is creating a strong growth path for cleanroom-ready, high-efficiency adhesive applicators. Manufacturers in this space demand minimal downtime, edge-to-edge adhesive control, and safety features that prevent contamination. These dynamics create fertile ground for innovation and market entry, especially among players offering modular or mobile adhesive equipment that supports flexible production layouts.

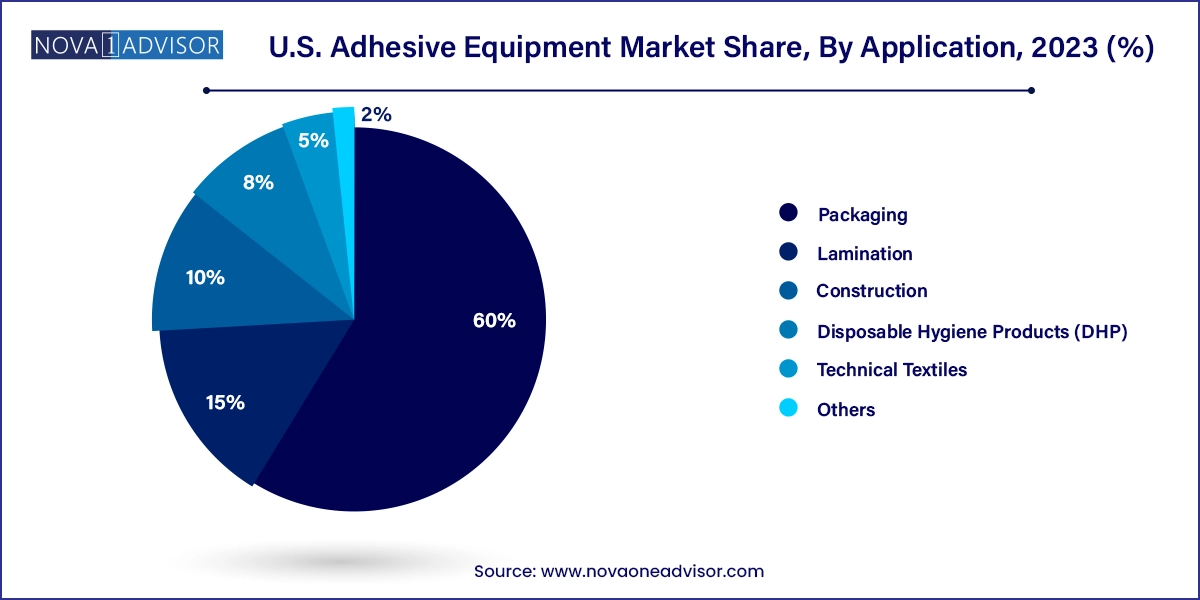

Packaging applications lead the market due to the massive scale of the U.S. consumer goods, food, and beverage industries. From carton sealing and tray assembly to shrink sleeve labeling and specialty pouch formation, adhesive equipment is critical to efficient and secure packaging. Hot melt systems, cold glue applicators, and programmable guns are used across multiple packaging lines to meet throughput demands. With the rise of automation and custom packaging sizes (especially in subscription services and meal kits), demand for adaptive adhesive application systems has surged.

Disposable Hygiene Products (DHP) represent the fastest-growing application segment, driven by innovations in personal care products and increasing hygiene awareness across the U.S. market. Equipment used in this sector must operate at high speeds while delivering exact glue placement for core attachment, backsheet bonding, and side seams. Leading manufacturers like Kimberly-Clark and Procter & Gamble are upgrading their DHP production lines with adhesive systems that offer both flexibility and reduced material waste. Additionally, eco-conscious consumers are driving the need for cleaner, non-toxic adhesives, which in turn demands precise and contamination-free application equipment.

Industrial hot melt adhesive equipment dominates the U.S. market due to its widespread usage across high-volume applications such as packaging, labeling, textiles, and automotive assembly. These systems are preferred for their fast bonding speeds, reduced drying times, and energy efficiency. For example, packaging manufacturers favor hot melt for its immediate adhesion in corrugated box sealing and for bonding multilayer laminates in snack food bags. The technology has also gained traction in automotive interiors and footwear manufacturing where high-strength, non-toxic adhesion is required without volatile organic compounds (VOCs).

Adhesive controllers are emerging as the fastest-growing product category, driven by the industry’s shift toward precision, traceability, and real-time performance optimization. These controllers are equipped with touchscreen interfaces, programmable glue patterns, and IoT connectivity that allow operators to monitor usage, temperature, flow rate, and system faults remotely. The ability to integrate these controllers with smart factory systems enhances their appeal, particularly in highly regulated sectors such as pharmaceuticals and food packaging. As quality assurance becomes non-negotiable, adhesive controllers will see exponential demand across verticals.

The U.S. adhesive equipment market is shaped by industrial decentralization, stringent environmental policies, and the diversity of end-user industries. States like Michigan, Ohio, and Tennessee are focal points for automotive assembly and component manufacturing, driving demand for precision bonding systems. Meanwhile, California and New York represent high-value markets for packaging and electronics applications, where innovation and regulatory compliance go hand-in-hand.

Government incentives promoting domestic manufacturing, such as the CHIPS and Science Act, are encouraging localized production of electronics and medical devices—industries that rely heavily on micro-adhesive dispensing technologies. Additionally, the rise in U.S.-based fulfillment centers due to reshoring and e-commerce has led to regional investments in automated gluing lines and robotic adhesive arms. The country’s emphasis on energy efficiency, sustainability, and smart manufacturing ecosystems makes it a fertile ground for adhesive equipment providers focusing on digital innovation and reduced emissions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. adhesive equipment market

Product

Application